Russia Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

Russia Logistics Market Overview:

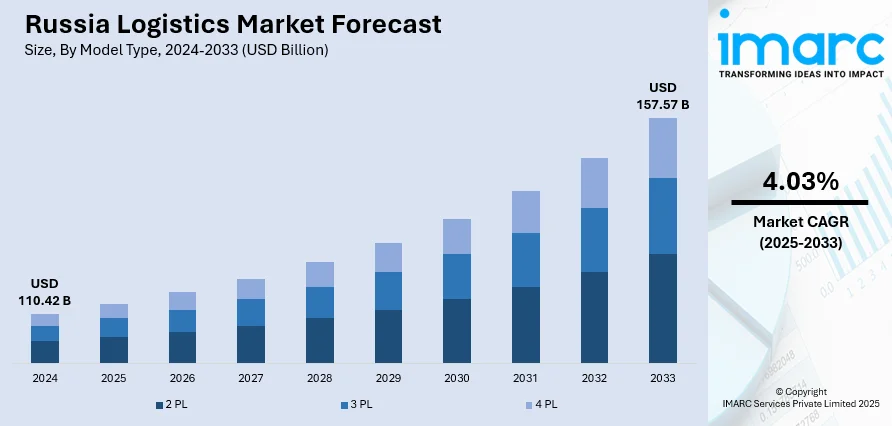

The Russia logistics market size reached USD 110.42 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 157.57 Billion by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The logistics market is driven by rapid e-commerce growth, which demands faster delivery, smart warehousing, and last-mile optimization, encouraging providers to adopt automation and expand urban and rural logistics networks to meet evolving user expectations. Additionally, government-led infrastructure modernization, digitalization, and capacity expansion to overcome geographic challenges are contributing to the expansion of the Russia logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 110.42 Billion |

| Market Forecast in 2033 | USD 157.57 Billion |

| Market Growth Rate 2025-2033 | 4.03% |

Russia Logistics Market Trends:

Domestic Infrastructure Modernization

The governing authority is making logistics and transportation a core focus of its national development strategy, viewing infrastructure modernization as a key driver of economic growth. Significant investments are being directed towards upgrading highways, rail networks, and port facilities to increase capacity, improve efficiency, and reduce transit times and logistics costs. These efforts are critical for overcoming Russia’s vast geographic challenges and harsh climate, which have historically hindered reliable and scalable logistics operations. A notable example is the 2024 announcement by Russia’s Transport Ministry to invest 541.1 billion rubles in port infrastructure between 2025 and 2030, with the majority of funding coming from private investors. This ambitious plan aimed to increase port capacity by 232 million tons, targeting expansions in strategic regions such as the Far East, North-West, and Azov-Black Sea basins. Alongside this, an additional 946.2 billion rubles was allocated for the development of the Northern Sea Route, enhancing Russia’s Arctic shipping capabilities. Moreover, the expansion of digital infrastructure, including e-documentation, cargo tracking, and automated customs processing, is enhancing overall logistics performance, allowing for greater transparency and speed across the supply chain. As modernization advances, private logistics companies are increasingly integrated into a more unified national network, extending service coverage to previously underserved regions. This coordinated development is supporting the Russia logistics market growth, creating a more efficient, interconnected logistics ecosystem that supports both domestic and international trade expansion.

To get more information of this market, Request Sample

Growth in E-commerce and Retail Demand

The rapid growth of online retail and omnichannel commerce is profoundly transforming Russia’s logistics market, catalyzing the demand for faster delivery, broader product ranges, and real-time order tracking. Individuals increasingly expect seamless, efficient shopping experiences, encouraging logistics providers to develop advanced fulfillment centers, implement smart warehousing technologies, and optimize last-mile delivery solutions. In response, companies are investing heavily in automation, expanding urban distribution hubs, and forming partnerships with technology platforms to boost operational efficiency and meet rising user expectations. The e-commerce boom also highlights the challenge of rural connectivity, motivating logistics networks to become more agile and adaptive to serve remote areas effectively. Reflecting this trend, the Russian e-commerce market was valued at USD 63.80 billion in 2024, with projections from IMARC Group estimating growth to USD 142.62 billion by 2033. This represents a robust compound annual growth rate (CAGR) of 8.88% from 2025 to 2033, underscoring the sector’s rapid expansion and its critical role in shaping logistics demand. The increasing volume and complexity of e-commerce shipments are not only driving infrastructure upgrades but also spurring innovations in delivery models, such as contactless drop-offs and real-time route optimization.

Russia Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

A detailed breakup and analysis of the market based on the model type have also been provided in the report. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, seaways, railways, and airways.

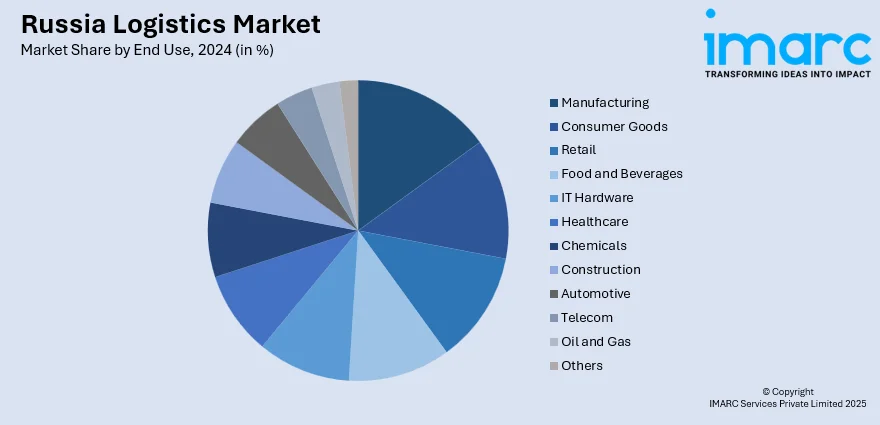

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Logistics Market News:

- In April 2025, Russian Railways Logistics announced the launch of a permanent cargo delivery route to China via Iran, using the International North-South Transport Corridor (INSTC). The route includes transshipment at Iran’s Bandar Abbas port and aims to ease congestion on the Eastern rail network. This move supports Russia’s pivot to Asia amid shifting global trade dynamics.

- In July 2024, Russia launched the "Arctic Express No. 1" logistics service connecting Moscow to Chinese ports via Arkhangelsk and the Arctic Ocean. This 13,000-km rail-sea intermodal route reduced delivery time to 20–25 days—at least 20 days faster than the traditional Suez Canal route.

Russia Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia logistics market on the basis of model type?

- What is the breakup of the Russia logistics market on the basis of transportation mode?

- What is the breakup of the Russia logistics market on the basis of end use?

- What is the breakup of the Russia logistics market on the basis of region?

- What are the various stages in the value chain of the Russia logistics market?

- What are the key driving factors and challenges in the Russia logistics market?

- What is the structure of the Russia logistics market and who are the key players?

- What is the degree of competition in the Russia logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)