Russia Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Russia Meat Market Overview:

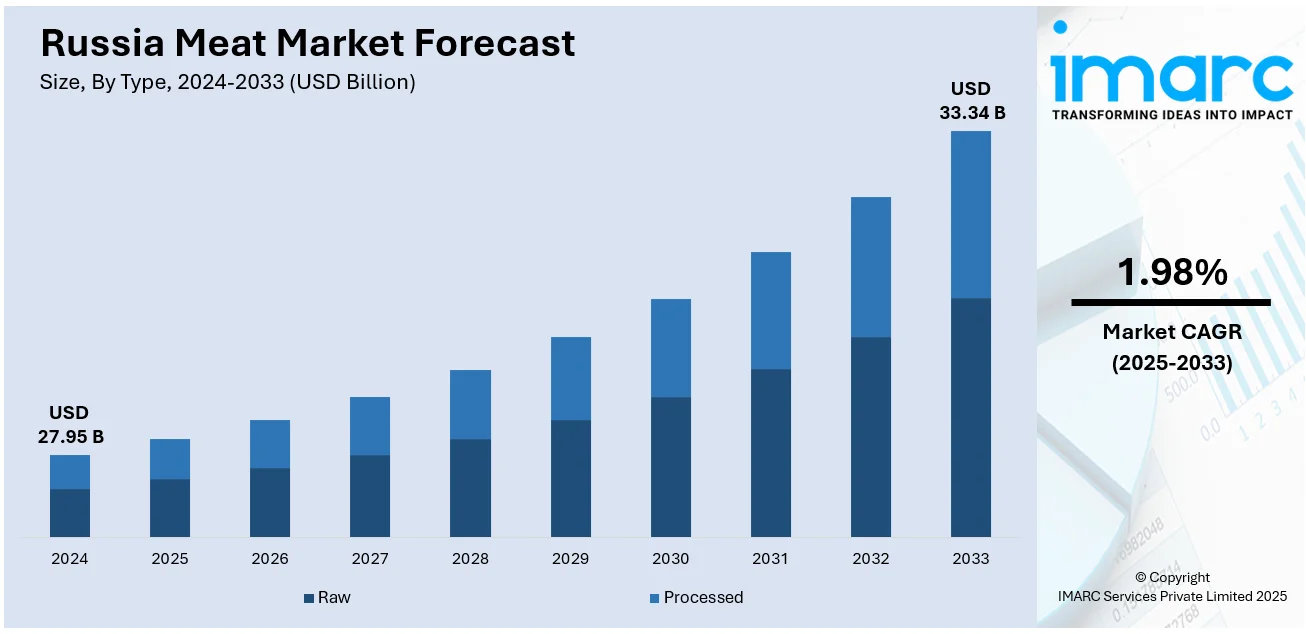

The Russia meat market size reached USD 27.95 Billion in 2024. The market is projected to reach USD 33.34 Billion by 2033, exhibiting a growth rate (CAGR) of 1.98% during 2025-2033. The market is driven by the rising consumer demand for convenience foods, which boosts processed and ready-to-cook segments, and the pursuit of export opportunities in Asia, especially amid shifting global supply chains. Government support, such as subsidies and trade agreements, encourages production growth and modernization. Additionally, evolving consumer awareness around sustainability and animal welfare pressures producers to adopt cleaner, ethical practices. Technological advancements in farming, packaging, and logistics also enable efficiency and product diversification, further bolstering the Russia meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.95 Billion |

| Market Forecast in 2033 | USD 33.34 Billion |

| Market Growth Rate 2025-2033 | 1.98% |

Russia Meat Market Trends:

Expansion of Meat Exports to Asia

Russian meat producers are increasingly turning to global markets, with a strong emphasis on Asia, where demand for pork and poultry continues to rise. China and Vietnam are among the most important targets, as Russian exporters attempt to cover niches abandoned by long-term suppliers. Enhanced production facilities and compliance with international quality standards have allowed Russian companies to supply competitive, high-quality products. The exportation of meat not only increases revenue possibility but also enables producers to obtain improved margins, particularly on better cuts. In spite of being challenged by geopolitical tensions as well as constraints on overseas payments, firms are responding by creating alternate trade lanes and payment channels. This international orientation is reconfiguring the local meat industry, promoting modernization, quality enhancement, and realignment of priorities towards global competitiveness. It also stimulates diversification, enabling Russian meat manufacturers to minimize dependence on domestic demand and cope more effectively with global market forces.

To get more information on this market, Request Sample

Rise of Processed and Ready-to-Cook Products

Consumer preferences in Russia are increasingly shifting toward convenience, driving Russia meat market growth in processed and ready-to-cook (RTC) meat products. As modern lifestyles leave less time for cooking, demand is rising for semi-finished options like marinated cuts, meatballs, and quick-frozen meals. This shift is reflected in changing consumption patterns—while raw chicken and pork sales declined in 2024, demand for beef and turkey rose by 7% and 2% respectively, signaling growing interest in healthier and easier-to-prepare meats. In response, producers are investing in advanced packaging and processing technologies that extend shelf life, preserve flavor, and improve product appeal. The market is also seeing greater product variety, including leaner cuts and reduced-additive options tailored to health-conscious consumers. These developments not only cater to domestic demand but also support export potential in convenience-driven global markets. Overall, the trend highlights a broader consumer focus on quality, efficiency, and practical meal solutions.

Focus on Sustainability and Animal Welfare

Environmental and ethical concerns are transforming meat production in Russia, with domestic and international pressures compelling producers towards sustainable production methods. Firms are investing in technologies that minimize pollution, enhance waste disposal, and provide better animal welfare. Such a transformation is not only a consequence of increasing consumer demands for ethically sourced food but also a prerequisite for gaining access to environmentally friendly export markets. Market leaders are modernizing housing systems, reducing the use of antibiotics, and improving animal welfare standards throughout the supply chain. These improvements, as difficult as they are for old facilities, are pushing modernization and positioning Russian meat production in line with international sustainable norms. As much as it is a regulatory requirement, this change enhances brand trust and enhances long-term business sustainability by lowering environmental risks. Therefore, sustainability is starting to become a fundamental basis of competitiveness in Russia's developing meat sector.

Russia Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

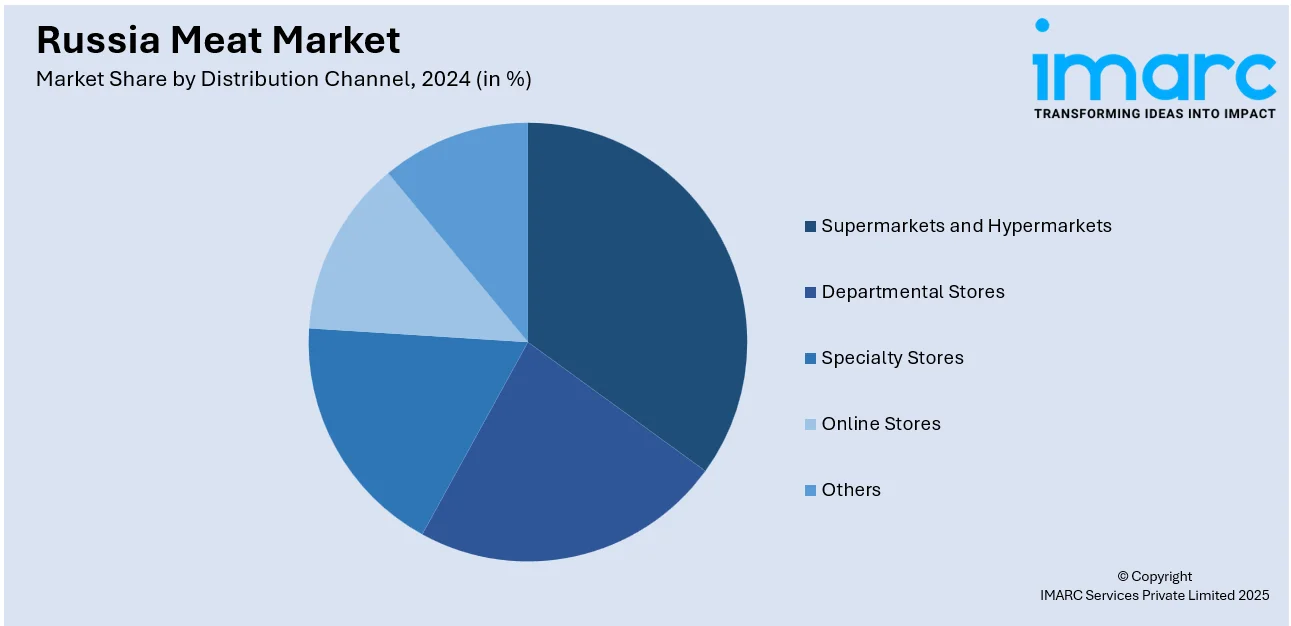

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Meat Market News:

- In November 2024, Rusagro Group finalized its acquisition of LLC GK Agro-Belogorie, gaining 20 pig farms, three feed mills, a meat processing plant, and extensive land holdings in Belgorod. This strategic move makes Rusagro Russia’s second-largest pork producer, strengthening its vertical integration and operational efficiency. The consolidation enhances Rusagro’s position in the domestic pork market and supports growth across its agriculture and meat divisions.

- In July 2024, Cherkizovo Group signed a preliminary agreement to acquire Cargill’s chicken processing plant in Efremov, Tula region, pending regulatory approval. CEO Sergey Mikhailov highlighted the deal's alignment with Cherkizovo’s strategy to expand value-added product offerings and strengthen its foodservice presence. The vertically integrated producer plans to boost the plant’s capacity, leveraging supply chain synergies. This marks Cherkizovo’s first acquisition since buying Altaisky Broiler in 2019.

Russia Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia meat market on the basis of type?

- What is the breakup of the Russia meat market on the basis of product?

- What is the breakup of the Russia meat market on the basis of distribution channel?

- What is the breakup of the Russia meat market on the basis of region?

- What are the various stages in the value chain of the Russia meat market?

- What are the key driving factors and challenges in the Russia meat market?

- What is the structure of the Russia meat market and who are the key players?

- What is the degree of competition in the Russia meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)