Russia Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

Russia Medical Tourism Market Overview:

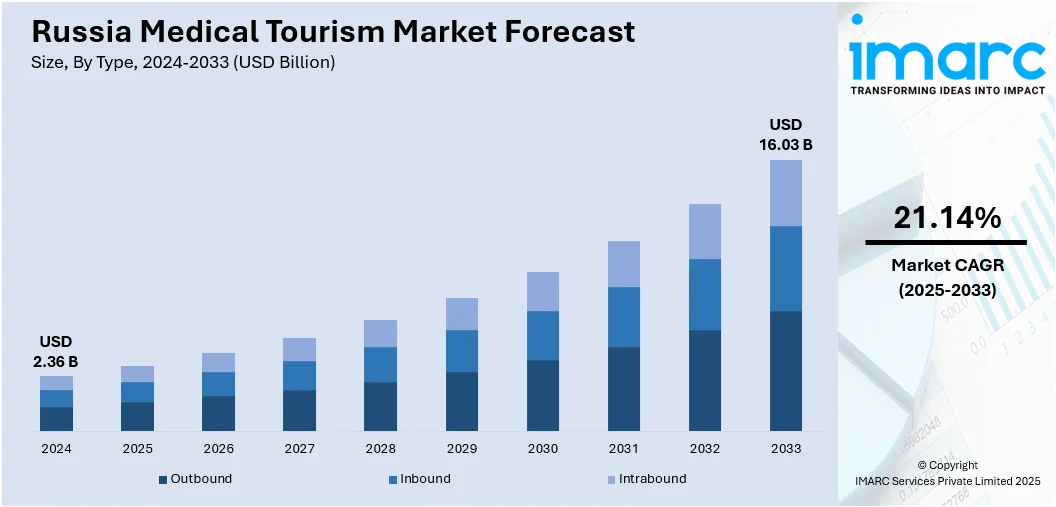

The Russia medical tourism market size reached USD 2.36 Billion in 2024. Looking forward, the market is projected to reach USD 16.03 Billion by 2033, exhibiting a growth rate (CAGR) of 21.14% during 2025-2033. The market is driven by Russia’s respected expertise in oncology, neurosurgery, and cardiovascular care, drawing patients from Eastern Europe and Asia. Competitive pricing and modern facilities for dental and cosmetic procedures attract medical tourists seeking value and results. Additionally, regional ties and simplified access for CIS patients are further augmenting the Russia medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.36 Billion |

| Market Forecast in 2033 | USD 16.03 Billion |

| Market Growth Rate 2025-2033 | 21.14% |

Russia Medical Tourism Market Trends:

Affordable Pricing for High-Quality Cosmetic and Dental Procedures

Russia has developed a reputation in cosmetic surgery and dental care, offering advanced techniques at significantly lower costs than Western Europe and North America. Clinics in cities like Moscow, St. Petersburg, and Kazan cater to patients from Germany, Scandinavia, Israel, and neighboring CIS countries seeking affordable, high-end procedures. Services such as rhinoplasty, facelifts, body contouring, hair transplantation, and full-mouth dental reconstruction are provided in accredited clinics equipped with European-manufactured tools and materials. Many Russian cosmetic surgeons are internationally certified and participate in global medical congresses, adopting current aesthetic trends and technologies. Packages often include consultations, post-operative recovery stays, and digital follow-ups, ensuring continuity of care. Dental clinics, in particular, attract health-conscious tourists with the promise of same-day implants, ceramic veneers, and orthodontic services, all priced substantially lower than EU counterparts. Russian clinics promote their services through multilingual online platforms and international patient coordinators, facilitating appointment scheduling and logistics. As medical aesthetics become increasingly normalized, especially among middle-income global travelers, Russia’s price-performance advantage remains a key differentiator making cosmetic and dental care a significant segment augmenting the Russia medical tourism market growth. A recent research report highlighted that Russia's medical tourism market has significant potential, especially from BRICS+ nations like China and India, which together represent over USD 207.7 Billion in outbound medical spending. Experts noted that Russia currently ranks 41st globally for medical tourism, with the sector contributing less than 0.01% to GDP, far behind countries like Turkey and Malaysia. Projections suggest the Russian medical tourism market could grow to between USD 2.2 Billion and USD 7.6 Billion by 2030 if national strategies improve.

To get more information on this market, Request Sample

Regional Diplomacy and Patient Inflow from Post-Soviet States

Russia continues to benefit from longstanding diplomatic, linguistic, and cultural ties with countries in Central Asia, the Caucasus, and Eastern Europe, which directly support inbound medical tourism. Citizens from countries like Kazakhstan, Uzbekistan, Kyrgyzstan, Belarus, and Armenia frequently travel to Russian cities for both primary and follow-up treatments, attracted by shared medical protocols, visa agreements, and familiar care models. Many of these patients view Russian care as more trustworthy and advanced compared to local offerings but more affordable and culturally aligned than Western alternatives. On May 21, 2025, Russia's Deputy Health Minister Yevgenia Kotova reported that over the past five years, more than 21.5 Million foreigners traveled to Russia for medical treatment. The number of foreign patients rose more than fivefold, with key demand areas including oncology, orthopedics, neurosurgery, and cardiovascular care. This surge underscores Russia’s growing appeal as a regional hub in the global medical tourism market. Russia also offers medical education to thousands of students from these countries, many of whom return home and refer patients to their alma maters. Specialized government programs simplify visa procedures for patients from Commonwealth of Independent States (CIS) countries, while public and private hospitals maintain referral partnerships with foreign clinics. Hospitals in border cities like Kaliningrad and Vladivostok also cater to European and East Asian patients, respectively, using proximity and pricing as leverage. These geopolitical and cultural alignments support a steady, regionalized stream of medical tourists. Also, Russia’s clinical strength in complex and research-driven care continues to attract patients whose primary concern is medical efficacy rather than tourism.

Russia Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

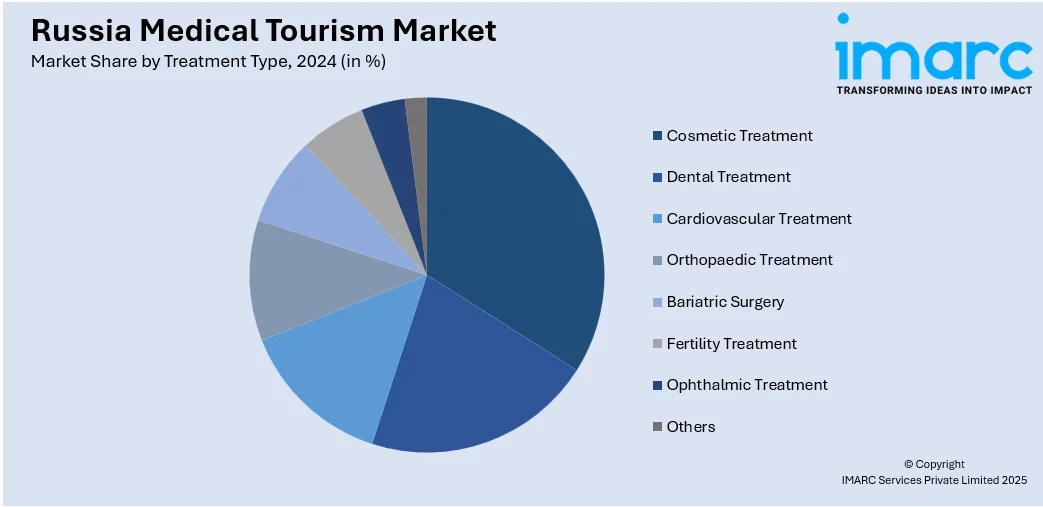

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Medical Tourism Market News:

- On December 19, 2024, Russia announced the development of a groundbreaking AI-powered mRNA cancer vaccine that customizes treatment per patient, with production times ranging from 30 minutes to 1 hour. The vaccine, scheduled for public release in early 2025, is intended to be distributed free of charge and is expected to elevate Russia’s appeal as a global medical tourism destination. This advancement is set to attract foreign patients seeking cutting-edge oncology care, especially from regions with limited access to such technology.

Russia Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia medical tourism market on the basis of type?

- What is the breakup of the Russia medical tourism market on the basis of treatment type?

- What is the breakup of the Russia medical tourism market on the basis of region?

- What are the various stages in the value chain of the Russia medical tourism market?

- What are the key driving factors and challenges in the Russia medical tourism market?

- What is the structure of the Russia medical tourism market and who are the key players?

- What is the degree of competition in the Russia medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)