Russia Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and Region, 2025-2033

Russia Online Education Market Overview:

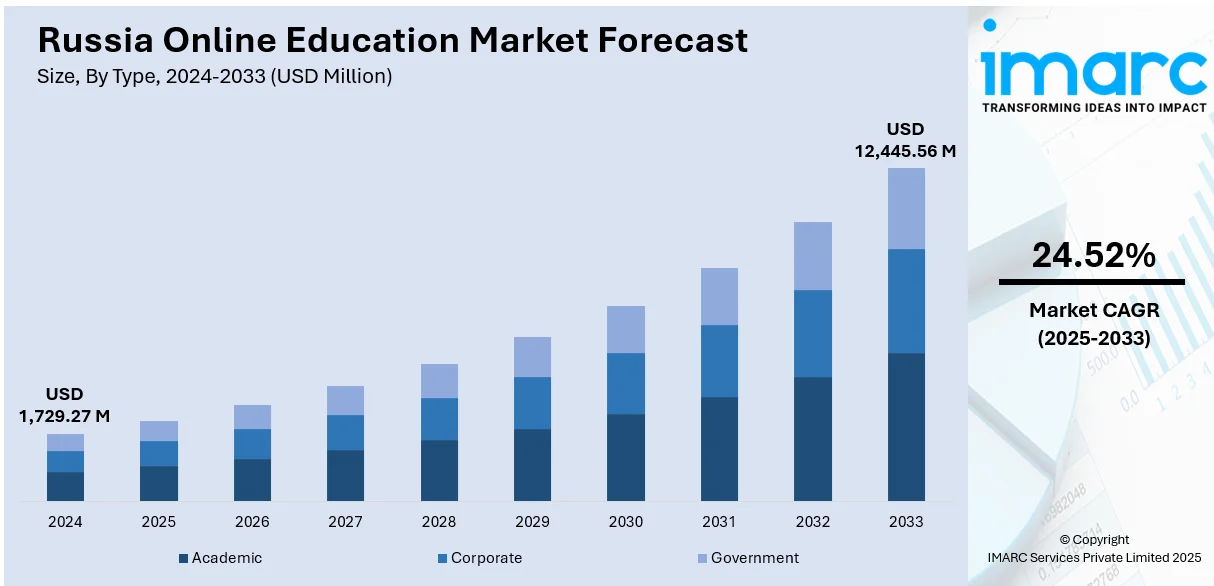

The Russia online education market size reached USD 1,729.27 Million in 2024. The market is projected to reach USD 12,445.56 Million by 2033, exhibiting a growth rate (CAGR) of 24.52% during 2025-2033. The market is fueled by growing digital adoption, adaptive learning models, and heightened demand for skill-based programs. Government support, technological interlinkages, and growing access across urban and rural areas are fueling the pace of change in the sector. Prioritizing personalized, career-focused learning and hybrid formats is redefining learning dynamics. As institutions and learners increasingly transition to digital platforms, there is notable competition among providers, influencing the overall Russia online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,729.27 Million |

| Market Forecast in 2033 | USD 12,445.56 Million |

| Market Growth Rate 2025-2033 | 24.52% |

Russia Online Education Market Trends:

Expansion of Hybrid Learning Models

Russia is experiencing significant growth in hybrid learning models that merge traditional classroom instruction with online education technologies. This blended approach is becoming increasingly common in universities, technical institutes, and corporate training programs. Students are given the freedom to learn course materials online while being able to leverage organized classroom interactions. Use of video lectures, cloud-based tasks, and virtual exams has enhanced learning outcomes by making students more autonomous and motivated. At the same time, the development of digital infrastructure in and around cities is providing instant access to interactive platforms and live classes. Teachers are also modifying their pedagogies to accommodate hybrid models by employing the help of analytics for making learning more personalized. Trends in the Russia online education market suggest that hybrid education is at the core of future growth models in the market. According to the reports, in November 2023, Russia officially initiated the Online Higher Education Association, which includes leading universities and EdTech firms, with the goal of developing standards for quality and opening access to online educational programs. Furthermore, Russia online education market growth is being highly propelled by scalability and accessibility of hybrid models.

To get more information on this market, Request Sample

Increase in Language and Skill-Based Learning Platforms

There is a significant rise in demand for Russian-language platforms for learning languages and developing skills. They are addressed to academic as well as professional students and provide flexible, autonomous modules in areas like coding, digital marketing, foreign languages, and soft skills. Certification courses are also popular, and numerous students utilize them for improving employability or career progression. Mobile-optimized interfaces and gamified learning structures have made these platforms well-liked among younger generations. Moreover, inclusion of AI-based recommendations and individualized learning pathways boosts the engagement of users. Numerous platforms are aligned with international competency frameworks, making them relevant and standard. Students in metropolitan and semi-rural areas are now using these platforms as alternatives to conventional training. Russia online education market trends indicate a decisive movement towards competency-based learning suited to personal purposes.

Government-Approved Digital Education Initiatives

State-approved digital education initiatives are leading the process of transforming the educational scene in Russia. Government policies are geared towards amplified internet connectivity, providing centralized online teaching resources, and developing digital pedagogies among teachers. All these are aimed at minimizing the educational gap between urban and rural areas as well as improving academic achievement overall. With national platforms and region-specific digital classrooms, students can now access science, technology, engineering, and math subjects, foreign languages, and career guidance modules irrespective of where they are. As per the sources, in August 2023, Russia introduced the Akademika platform in place of Coursera, providing more than 200 online courses from leading universities, with the goal to boost the nation's independent digital education system. Moreover, these platforms commonly use AI-driven tools for adaptive learning and real-time performance tracking. Teacher capacity building through e-learning certification and content development workshops are also a part of the national plan. Russia online education market trends are a clear mirror to the impact of public investment in defining digital learning ecosystems.

Russia Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

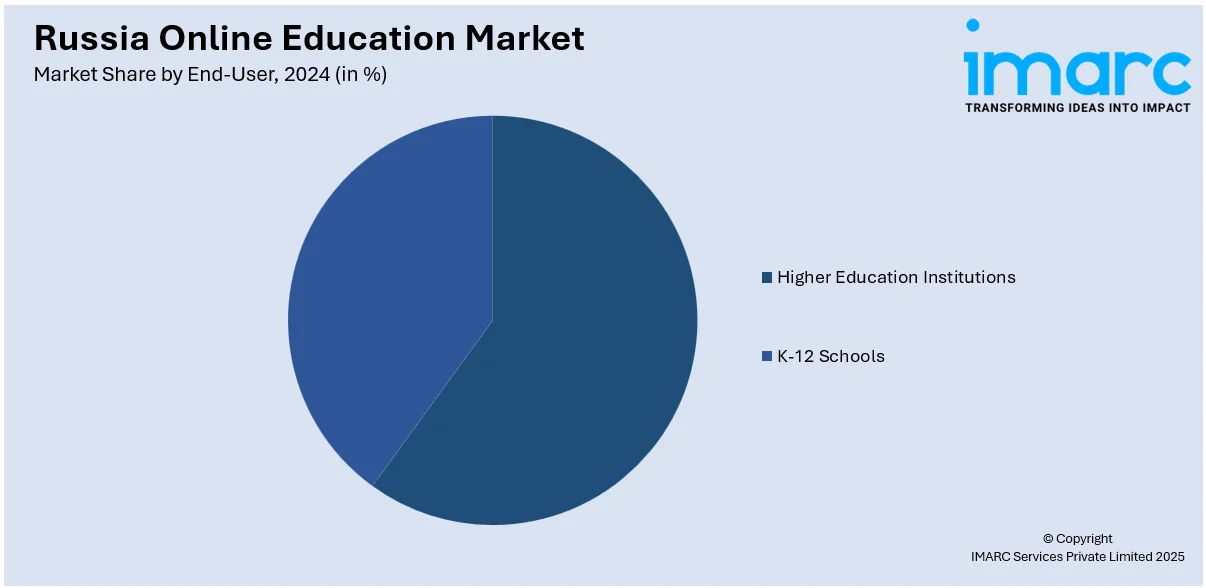

End-User Insights:

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes higher education institutions, and K-12 schools.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia online education market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia online education market on the basis of type?

- What is the breakup of the Russia online education market on the basis of provider?

- What is the breakup of the Russia online education market on the basis of technology?

- What is the breakup of the Russia online education market on the basis of end user?

- What is the breakup of the Russia online education market on the basis of region?

- What are the various stages in the value chain of the Russia online education market?

- What are the key driving factors and challenges in the Russia online education?

- What is the structure of the Russia online education market and who are the key players?

- What is the degree of competition in the Russia online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)