Russia Poultry Market Size, Share, Trends, and Forecast by Product Type, Nature, Distribution Channel, and Region, 2025-2033

Russia Poultry Market Size and Share:

The Russia poultry market size reached 6,243.20 Kilotons in 2024. Looking forward, IMARC Group expects the market to reach 16,822.50 Kilotons by 2033, exhibiting a growth rate (CAGR) of 10.40% during 2025-2033. The growing use of new farming methods like automated feeding systems, climate-controlled housing, and advanced breeding practices, rising focus on improving production capacity, and increasing number of retail chains and supermarkets are some of the key factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 6,243.20 Kilotons |

| Market Forecast in 2033 | 16,822.50 Kilotons |

| Market Growth Rate (2025-2033) | 10.40% |

Russia Poultry Market Trends:

Increasing Production Capacity

Rising investments in modernizing and expanding poultry farms across Russia are bolstering the market growth. These investments involve building new, large-scale production facilities and upgrading existing ones with advanced technologies. The expansions enable producers to scale up their operations by improving farm management practices, enhancing feed efficiency, and increasing automation. Moreover, the implementation of vertically integrated production systems, in which companies oversee all aspects, ranging from feed production to distribution, is enhancing efficiency and output. This higher capacity not only meets the growing demand for poultry products in Russia but also helps the country become a leading poultry exporter, enhancing its position in the international market. In 2023, Cherkizovo Group announced an investment of $4.3 million to expand regional chicken meat production by 10% with the opening of a new broiler chicken facility in the Lebedyansky District. Thirty-two buildings covering an area of 355,000 square feet were transformed to increase broiler production by 12,000 tons annually.

Growing Number of Retail Chains and Supermarkets

Major retail chains and supermarkets are broadening their product offerings to encompass a range of cuts, processed goods, and value-added choices, making them more accessible to a broader consumer base in Russia. For example, as of December 31, 2023, Magnit, a noted food retail chain in Russia, operated 29,165 stores across 67 regions in the country. The variety of products available in convenient locations makes purchasing poultry easier for consumers, whether for everyday meals or special events. Furthermore, these stores frequently offer competitive prices, special offers, and loyalty schemes to attract buyers. Retail chains are not just meeting the increasing demand but also promoting greater consumption by enhancing the visibility and accessibility of poultry products.

Technological Advancements in Poultry Farming

The growing use of new farming methods like automated feeding systems, climate-controlled housing, and advanced breeding practices is improving productivity and efficiency. These advancements are decreasing expenses related to labor, cutting down on losses caused by illnesses, and enhancing the general well-being of animals, ultimately resulting in better-quality poultry items. Furthermore, by combining data analytics with precision farming tools, farmers can effectively oversee and enhance different stages of production, ranging from feed consumption to growth rates. Russian chicken farms are increasing their competitiveness by producing greater amounts of poultry at reduced expenses, benefiting both local consumption and potential exports. As per industry reports, in 2024, Russian scientists and poultry breeders created the 'Smena 9' meat chicken crossbreed, which demonstrated high productivity. The breed plays a crucial role in Russia's aim to enhance its local poultry sector. The recently opened breeding and genetic center 'Smena' in the Moscow Russia will continue to enhance the expansion of poultry meat production using local hybrids.

Russia Poultry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, nature, and distribution channel.

Product Type Insights:

- Broiler

- Eggs

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes broiler, eggs, and others.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic and conventional.

Distribution Channel Insights:

- On-Trade

- Off-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade.

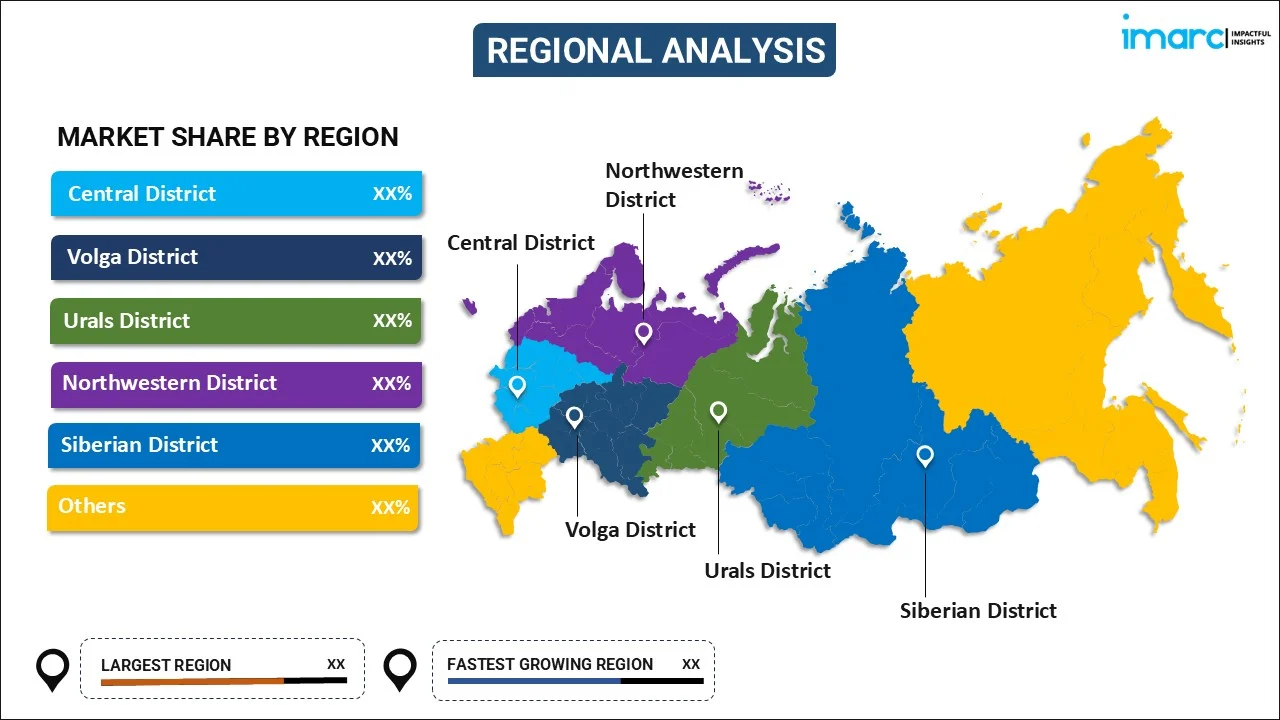

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central district, Volga district, Urals district, Northwestern district, Siberian district, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Poultry Market News:

- March 2024: Cherkizovo Group announced plans to increase broiler meat production in Bashkortostan by 30,000 metric tons over the next two years. The company is investing RUB10.3 billion ($112 million) to upgrade its poultry farms in the Russia, aiming to increase production capacity and expand both domestic sales and exports.

- October 2023: Hungarian firm Babolna Tetra increased its stock of breeding laying hens in Russia by sending shipments to two of the nation's biggest poultry farms. This strategic maneuver strives to improve genetic diversity and production efficiency in the Russian poultry sector.

Russia Poultry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilotons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Broiler, Eggs, Others |

| Natures Covered | Organic, Conventional |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia poultry market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia poultry market on the basis of product type?

- What is the breakup of the Russia poultry market on the basis of nature?

- What is the breakup of the Russia poultry market on the basis of distribution channel?

- What is the breakup of the Russia poultry market on the basis of region?

- What are the various stages in the value chain of the Russia poultry market?

- What are the key driving factors and challenges in the Russia poultry?

- What is the structure of the Russia poultry market and who are the key players?

- What is the degree of competition in the Russia poultry market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia poultry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia poultry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia poultry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)