Russia Power Market Size, Share, Trends and Forecast by Generation Source and Region, 2025-2033

Russia Power Market Size and Share:

The Russia power market size reached USD 41.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 54.20 Billion by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. Strong regional energy regulations, international cooperation, government investments in infrastructure, novel technological breakthroughs, diversification of energy sources, and a surging emphasis on improving energy efficiency and security are the main factors influencing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 41.30 Billion |

| Market Forecast in 2033 | USD 54.20 Billion |

| Market Growth Rate (2025-2033) | 2.80% |

Russia Power Market Trends:

Expansion of Renewable Energy Sources

Russia is increasingly focused on incorporating renewable energy sources to diversify its energy portfolio. The nation, which was formerly dependent on fossil fuels, is currently making significant investments in hydroelectric, solar, and wind energy. Motivated by the need to protect the environment and update the country's energy infrastructure, the Russian government has set high goals to boost the shares of renewable energy in the energy mix. For instance, in February 2025, the Russian government announced its plans to accelerate domestic lithium production, President Putin stated on February 2. With one million tons in reserves, lithium is essential for high-capacity batteries and critical minerals, including rare earths. Investments in solar parks and wind farms are gaining traction, supported by favorable policies such as financial incentives and tax breaks for renewable energy projects. Furthermore, advancements in technology and the decreasing costs of renewable energy are enhancing its viability, further fueling market growth.

Modernization of Energy Infrastructure

Russia is modernizing its energy infrastructure to boost efficiency, reliability, and capacity. The modernization efforts involve utilizing advanced technology to upgrade outdated power plants and grid systems. This includes implementing smart grid technology, which enables more efficient energy distribution and better management of consumption. Significant investments are being made in automation, real-time monitoring, and advanced control systems to reduce operating costs and improve grid stability. Additionally, new power generation facilities, such as nuclear reactors and combined-cycle gas turbine plants are being constructed. For instance, in September 2024, Russia's draft energy plan proposed 34 new nuclear reactors by 2042, increasing nuclear power’s share from 18.9% to 23.5%. The plan includes reactor replacements, new sites, and Rosatom's proposal for 37 units. These improvements aim to meet the increasing energy demands of the residential and commercial sectors, reduce energy loss concerns, and enhance service dependability.

Focus on Energy Efficiency and Conservation

Russia's power market is gradually shifting towards the focus on energy conservation and efficiency. Currently, the nation is implementing various programs aimed to lower energy usage and enhancing overall energy use efficiency. This entails encouraging the use of energy-saving technology in both residential and commercial buildings, such as highly efficient lighting, heating, and cooling systems. For instance, in December 2024, Rosatom announced the launch of wind turbine blade production in Ulyanovsk, repurposing a former Vestas site. The factory will supply Russia’s largest 300-MW wind farm in Dagestan, with full operations expected by 2026. Moreover, government regulations and incentives are encouraging industries to embrace energy-efficient practices and technologies. Additionally, initiatives are being undertaken to educate businesses and consumers about the benefits of reducing energy usage. These initiatives include minimizing the effects of energy production and usage on the environment, reducing energy cost and overall energy usage. As a result, integrating energy-efficient solutions into both new and existing infrastructure is becoming crucial, further strengthening the market growth.

Russia Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on generation source.

Generation Source Insights:

.webp)

- Thermal

- Hydro

- Renewable

- Others

The report has provided a detailed breakup and analysis of the market based on the generation source. This includes thermal, hydro, renewable, and others.

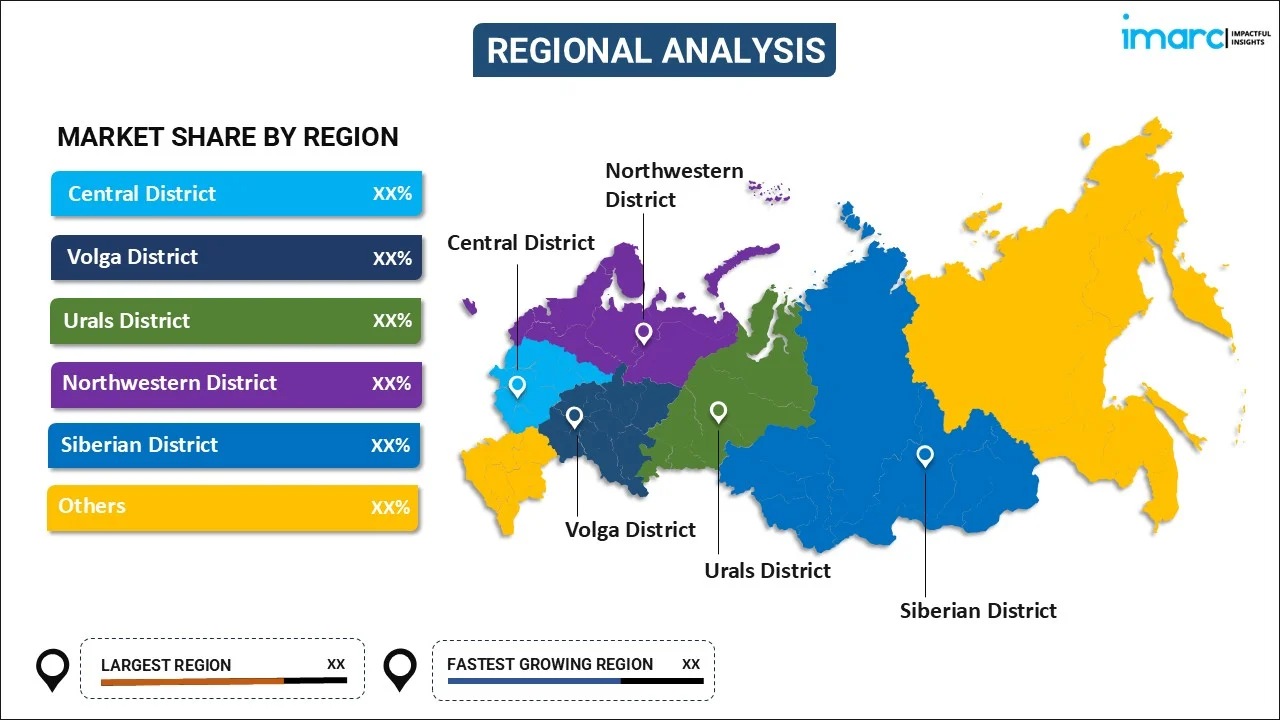

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central district, Volga district, Urals district, Northwestern district, Siberian district, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Power Market News:

- In August 2024, India and Russia announced plans to sign a deal worth Rs 10,500 crore for the supply of nuclear fuel and core components for the Kudankulam nuclear power plant's two new units. TVEL JSC, the Russian nuclear fuel company, will supply initial loads as well as five reloads for units 3 and 4 of the Kudankulam N-power project, along with control rods and fuel assembly inspection tools from 2025 to 2033.

- In February 2023, Japanese multinational Hitachi conglomerate Hitachi Energy sold its Russian business unit to local management for an undisclosed amount. The business will now be operated independently in several locations in Russia, by the local management team. Further, Hitachi Energy intends to leverage the expertise of the local staff in the power grid industry to run the business.

Russia Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Generation Sources Covered | Thermal, Hydro, Renewable, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia power market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia power market on the basis of generation source?

- What is the breakup of the Russia power market on the basis of region?

- What are the various stages in the value chain of the Russia power market?

- What are the key driving factors and challenges in the Russia power?

- What is the structure of the Russia power market and who are the key players?

- What is the degree of competition in the Russia power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)