Russia Shrimp Market Size, Share, Trends and Forecast by Environment, Species, Shrimp Size, Distribution Channel, and Region, 2025-2033

Russia Shrimp Market Overview:

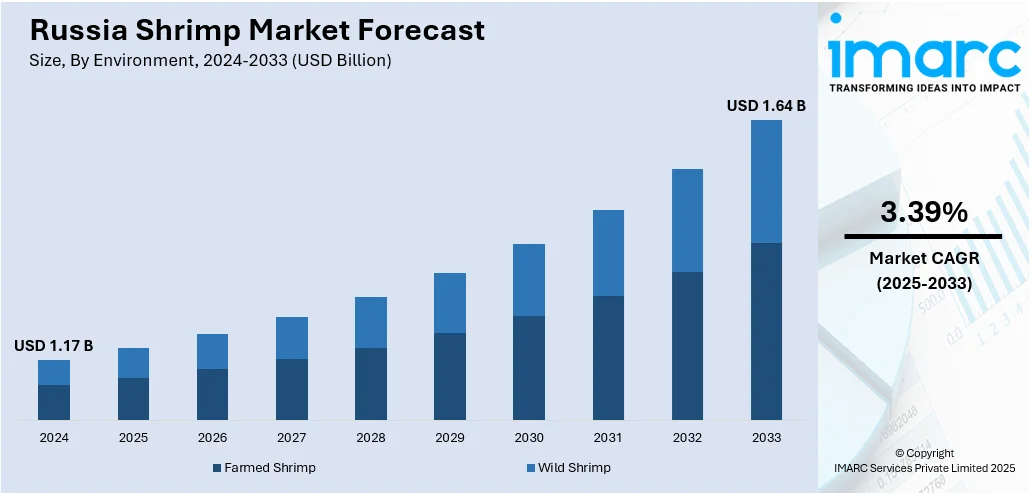

The Russia shrimp market size reached USD 1.17 Billion in 2024. The market is projected to reach USD 1.64 Billion by 2033, exhibiting a growth rate (CAGR) of 3.39% during 2025-2033. The market is expanding as local farms boost supply with modern systems and better storage. Added investment in indoor production and clean practices continues to strengthen Russia shrimp market share by reducing imports and meeting steady demand from households, restaurants, and regional distributors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.17 Billion |

| Market Forecast in 2033 | USD 1.64 Billion |

| Market Growth Rate 2025-2033 | 3.39% |

Russia Shrimp Market Trends:

Local Supply and Growing Interest

Russia shrimp market growth has picked up as domestic producers increase output to meet changing eating habits and reduce the country’s reliance on imported seafood. Higher household incomes have led more people to include shrimp in home meals and restaurant orders. Shoppers now expect shrimp to be fresh and responsibly farmed, encouraging farms to improve water systems and upgrade hatchery conditions. Small businesses have gained local government help to set up better storage and expand deliveries. Some big supermarket chains have started stocking locally farmed shrimp to meet demand for Russian produce. Over the past year, larger seafood groups launched indoor shrimp farms near city centres, aiming to get fresh shrimp into stores on the same day it is harvested. These modern farms use closed-loop systems to keep water clean and reuse resources. A few sites tested new equipment like heat recovery units and rooftop solar to save energy. Wholesale suppliers have agreed supply deals with food service companies to make sales more stable. This steady link between producers and buyers helps farms plan stock better and keeps supply consistent. Better coordination from pond to shelf has made the local shrimp supply more reliable and cost effective for buyers.

To get more information on this market, Request Sample

New Methods Support Steady Output

Russia’s shrimp industry is seeing fresh funding and modern ideas as companies switch to efficient farming practices. Investors are backing indoor farms with closed systems that protect shrimp from harsh weather and seasonal risks. Some sites now run automated feeders and sensors that track water levels and feed rates to cut waste and keep shrimp healthy. Feed makers are trying local protein blends to depend less on imported fish ingredients. Small producer groups in coastal regions have joined up to build shared processing units to handle cleaning, packing, and storage. These sites help save transport costs and keep shrimp fresher for store delivery. In the last year, several farms added solar units and improved filters to cut energy bills and follow local green rules. Local councils work with producers to watch water use and keep discharge within safe limits. New cold trucks mean shrimp reaches markets faster without losing quality. Seafood expos now feature these updates to attract buyers from nearby regions and overseas. These combined efforts make it easier for Russia’s shrimp farmers to supply better products, compete on quality, and secure stable sales for the years ahead.

Russia Shrimp Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on environment, species, shrimp size, and distribution channel.

Environment Insights:

- Farmed Shrimp

- Wild Shrimp

The report has provided a detailed breakup and analysis of the market based on the environment. This includes farmed shrimp and wild shrimp.

Species Insights:

- Penaeus Vannamei

- Penaeus Monodon

- Macrobrachium Rosenbergii

- Others

The report has provided a detailed breakup and analysis of the market based on the species. This includes penaeus vannamei, penaeus monodon, macrobrachium rosenbergii, and others.

Shrimp Size Insights:

- <21

- 21-25

- 26-30

- 31-40

- 41-50

- 51-60

- 61-70

- >70

The report has provided a detailed breakup and analysis of the market based on the shrimp size. This includes <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, and >70.

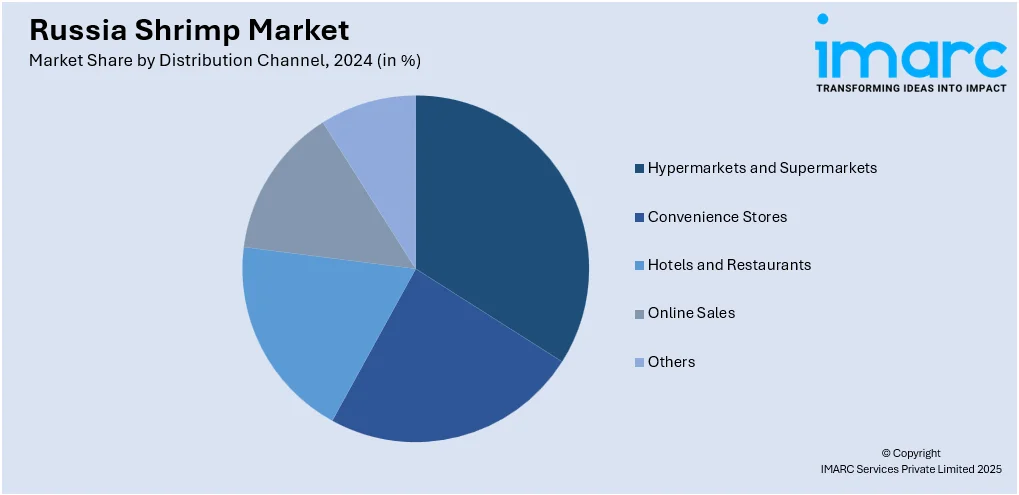

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Hotels and Restaurants

- Online Sales

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, hotels and restaurants, online sales, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Shrimp Market News:

- March 2025: Russia raised its shrimp catch to 5,400 Tons for January to March, marking a 29% rise over last year. This growth strengthened Russia’s shrimp market by boosting domestic supply, meeting higher demand, and supporting local producers alongside stable imports.

Russia Shrimp Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Farmed Shrimp, Wild Shrimp |

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, Others |

| Shrimp Sizes Covered | <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, >70 |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Sales, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia shrimp market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia shrimp market on the basis of environment?

- What is the breakup of the Russia shrimp market on the basis of species?

- What is the breakup of the Russia shrimp market on the basis of shrimp size?

- What is the breakup of the Russia shrimp market on the basis of distribution channel?

- What is the breakup of the Russia shrimp market on the basis of region?

- What are the various stages in the value chain of the Russia shrimp market?

- What are the key driving factors and challenges in the Russia shrimp market?

- What is the structure of the Russia shrimp market and who are the key players?

- What is the degree of competition in the Russia shrimp market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia shrimp market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia shrimp market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia shrimp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)