Russia Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Russia Steel Market Overview:

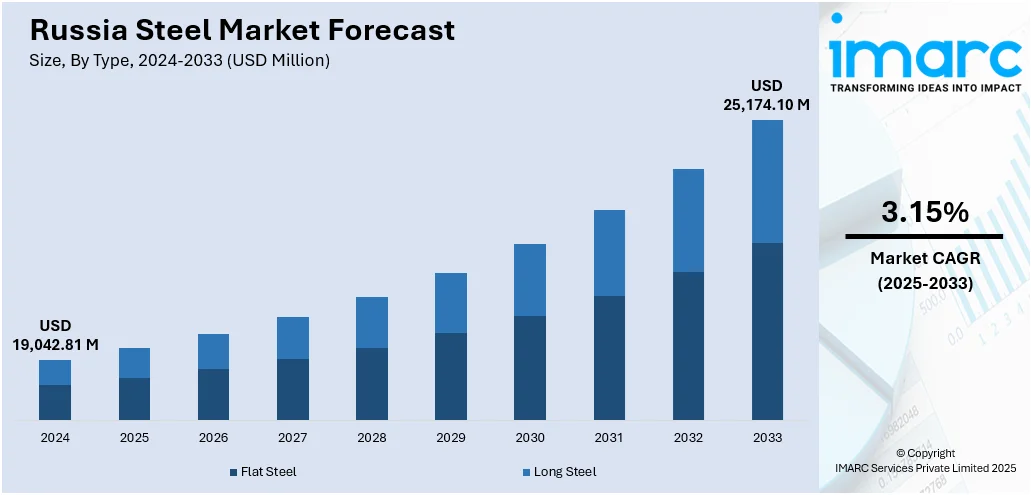

The Russia steel market size reached USD 19,042.81 Million in 2024. The market is projected to reach USD 25,174.10 Million by 2033, exhibiting a growth rate (CAGR) of 3.15% during 2025-2033. The market is expanding due to increased infrastructure projects and modernization efforts in the mining and production sectors. The adoption of advanced technologies and eco-friendly practices is helping to improve efficiency and sustainability, which supports Russia steel market share in both the industrial and construction sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19,042.81 Million |

| Market Forecast in 2033 | USD 25,174.10 Million |

| Market Growth Rate 2025-2033 | 3.15% |

Russia Steel Market Trends:

Shift Toward Domestic Infrastructure Projects

A strategic pivot toward domestic infrastructure development is driving the Russia steel market growth. As the government prioritizes self-reliance and national construction efforts, there is rising demand for steel in transportation, energy, and residential projects. This focus helps mitigate the decline in exports resulting from shifting global trade dynamics and restrictions. Investments in roads, bridges, and large-scale housing initiatives have further boosted steel consumption within the country. In particular, the expansion of Russia’s railways and metro systems in major cities has led to steady demand for long and flat steel products. Additionally, the push to modernize utilities and industrial zones is prompting increased use of high-grade steel. In recent developments, major steel producers are ramping up output for infrastructure-focused segments while also upgrading equipment to meet domestic specifications. These internal market adjustments are expected to continue shaping steel production and supply chains in the coming years.

To get more information on this market, Request Sample

Industrial Expansion Fuels Steel Demand

Industrial diversification in Russia is emerging as a key factor influencing the national steel market. Sectors such as energy, heavy machinery, and shipbuilding are generating consistent demand for steel, particularly in regions focused on oil and gas exploration like Siberia and the Arctic. As the government increases investment in domestic industrial projects, the need for structural and pipeline steel has seen notable growth. This rising consumption is driven by ongoing efforts to localize production and reduce reliance on imported materials. Recent months have seen the development of new manufacturing hubs and energy infrastructure, which require specialized steel grades, prompting producers to expand and tailor their output. Steelmakers are now aligning their operations with the technical demands of equipment manufacturing and large-scale energy transport systems. Additionally, innovations in steel processing and collaboration with industrial firms are helping to optimize supply efficiency. These shifts point to a strong interconnection between Russia’s industrial policy and steel market dynamics, laying the foundation for continued growth in production and domestic utilization.

Russia Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

The report has provided a detailed breakup and analysis of the market based on the product. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

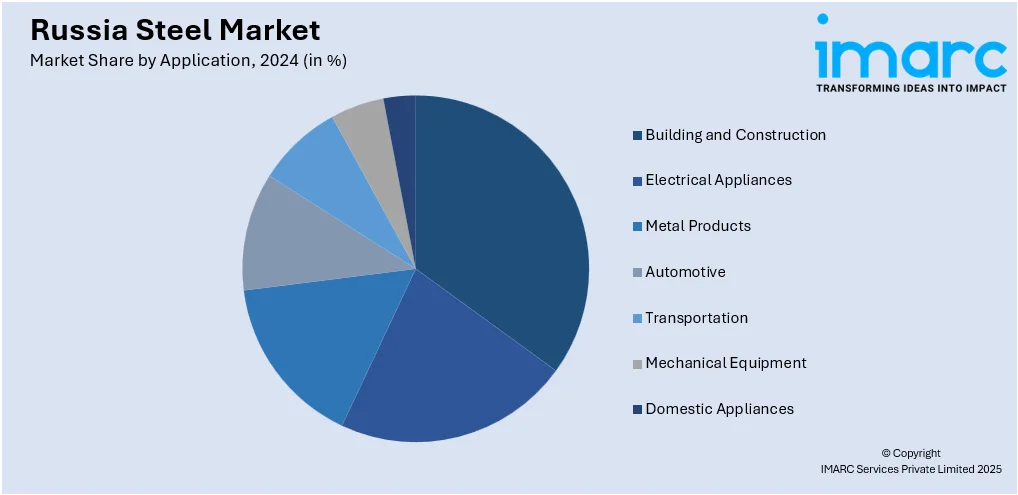

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Steel Market News:

- December 2024: Metalloinvest launched its second crushing and conveyor system at Mikhailovsky GOK, boosting iron ore transport capacity to 50 Million tonnes annually. This advancement enhanced steel production efficiency in Russia by lowering costs and environmental impact, strengthening the country’s steel market competitiveness.

Russia Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia steel market on the basis of type?

- What is the breakup of the Russia steel market on the basis of product?

- What is the breakup of the Russia steel market on the basis of application?

- What is the breakup of the Russia steel market on the basis of region?

- What are the various stages in the value chain of the Russia steel market?

- What are the key driving factors and challenges in the Russia steel market?

- What is the structure of the Russia steel market and who are the key players?

- What is the degree of competition in the Russia steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia steel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)