Russia Toys Market Report by Product Type (Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, and Others), Age Group (Up to 5 Years, 5 to 10 Years, Above 10 Years), Sales Channel (Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, and Others), and Region 2025-2033

Russia Toys Market Overview:

The Russia toys market size reached USD 2,009 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,986 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is propelled by the rising disposable income among Russian households, increasing popularity of educational and developmental toys, expansion of e-commerce and digital retail channels, rapid urbanization, and declining infant mortality rate.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,009 Million |

| Market Forecast in 2033 | USD 2,986 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Russia Toys Market Trends:

Rising Disposable Income Among Russian Households

The increasing disposable income of Russian households is a significant factor driving the growth of the toys market of the nation. According to OECD Better Life Index, the average disposable income per capita of the country is USD 19546 per year. Over the past decade, Russia has seen a gradual increase in household income levels, which has allowed parents to allocate more funds toward non-essential goods, including toys. This trend is particularly noticeable in urban areas where families have greater access to higher-paying jobs and a more diverse retail landscape. A key aspect of this factor is the growing middle class, which is a primary consumer base for branded and higher-quality toys. As Russian families experience improved financial stability, there is a tendency to spend on products that enhance the development and entertainment. This shift is evident in the increasing demand for educational toys, which cater to the aspirations of parents who want to provide their children with the best possible resources.

Expansion of E-Commerce and Digital Retail Channels

The expansion of e-commerce and digital retail channels is another crucial factor driving the growth of the toys market in Russia. The country has witnessed significant growth in online shopping, fueled by increased internet penetration, the proliferation of smartphones, and a growing preference for convenient shopping experiences. According to Data Reportal, by the start of 2024, 130.4 million internet users were recorded in Russia. This trend is particularly evident in the toys market, where consumers are increasingly turning to online platforms to purchase toys for their children. The COVID-19 pandemic accelerated the shift toward online shopping, as lockdowns and social distancing measures limited access to physical stores. In response, many toy retailers in Russia expanded their online presence, offering a wider selection of products, competitive pricing, and convenient delivery options. The convenience of browsing a vast array of products from the comfort of home, combined with the ability to compare prices and read reviews, has made online shopping an attractive option for Russian parents.

Declining Infant Mortality Rate and Growing Child Population

The declining infant mortality rate in Russia, coupled with a growing child population, is significantly influencing the toys market. According to the World Bank, the infant mortality rate in Russia has dropped to 4 deaths per 1,000 live births in 2022. Over the past decade, Russia has made substantial improvements in healthcare, leading to a decrease in infant mortality and an increase in the overall number of children. This demographic shift is driving demand for products of children, including toys, as more families are raising children who require various forms of entertainment and educational tools. Improved prenatal care, better access to healthcare services, and government initiatives aimed at supporting maternal and child health have all contributed to this positive trend. This reduction is a clear indicator of the progress of the country in improving child health outcomes, which in turn has led to an increase in the number of healthy children who grow up requiring toys for their development and enjoyment. As a result of the declining infant mortality rate, the population of young children has been on the rise, creating a larger market for toys. This has led to increased demand for a wide range of toys, from those designed for infants and toddlers to products aimed at older children. The toys market is particularly benefiting from the growing segment of parents who are keen to invest in quality products that support the cognitive and physical development of their children.

Russia Toys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, age group, and sales channel.

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes action figures, building sets, dolls, games and puzzles, sports and outdoor toys, plush, and others.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes up to 5 years, 5 to 10 years, and above 10 years.

Sales Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes supermarkets and hypermarkets, specialty stores, department stores, online stores, and others.

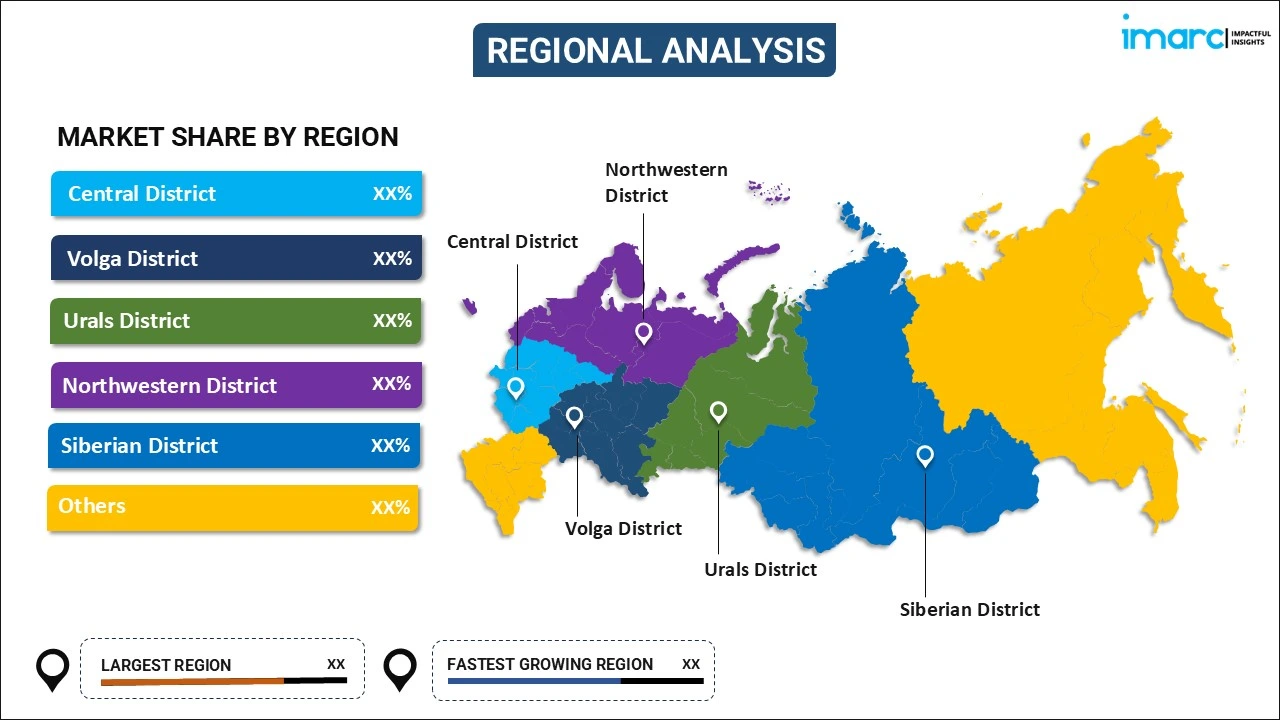

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia toys market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Russia toys market?

- What is the breakup of the Russia toys market on the basis of product type?

- What is the breakup of the Russia toys market on the basis of age group?

- What is the breakup of the Russia toys market on the basis of sales channel?

- What are the various stages in the value chain of the Russia toys market?

- What are the key driving factors and challenges in the Russia toys?

- What is the structure of the Russia toys market and who are the key players?

- What is the degree of competition in the Russia toys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia toys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia toys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)