Satellite Amplifier Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Satellite Amplifier Market Size and Share:

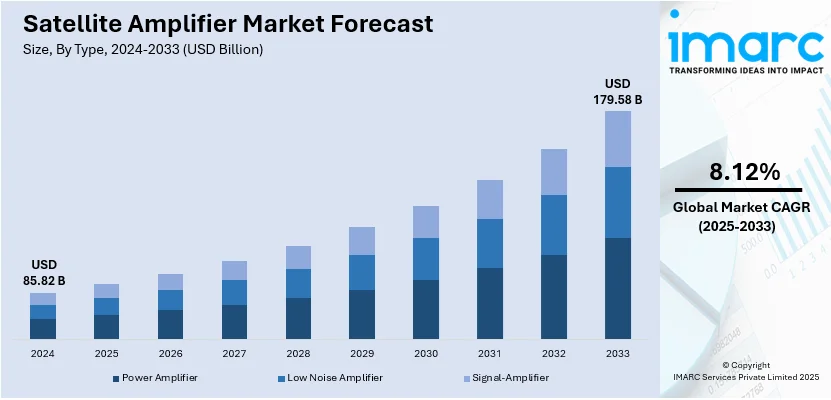

The global satellite amplifier market size was valued at USD 85.82 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 179.58 Billion by 2033, exhibiting a CAGR of 8.12% from 2025-2033. North America currently dominates the market, holding a market share of over 37.7% in 2024. The market is driven by strong defense investments, growing satellite broadband adoption, advancements in space technology, and increasing demand for high-speed connectivity in remote areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 85.82 Billion |

|

Market Forecast in 2033

|

USD 179.58 Billion |

| Market Growth Rate (2025-2033) | 8.12% |

The increasing need for high-speed internet connectivity in far-flung and underserved areas is a dominant worldwide driver of the satellite amplifier market growth. Public and private sector investment in satellite communication infrastructure to offer uninterrupted connectivity where terrestrial network coverage is restricted is driving demand. Sophisticated satellite networks are being established to enable broadband growth, shipping and aviation communication, and disaster response. Emerging markets are increasingly turning towards satellite-based internet solutions, leading to the demand for effective amplifiers that strengthen signals and lower latency. New developments in amplifier technology, including increased frequency of operation and low-power designs, are also enhancing satellite transmission capability. For example, in June 2024, Qorvo launched three high-power Ku-Band MMIC amplifiers for SATCOM, offering 8W to 55W output, enhanced efficiency, and thermal management, improving satellite communication in defense and aerospace. Furthermore, with more industries, such as healthcare, education, and logistics depending on unbroken communication, the satellite amplifier market is set to expand. The need for smaller, high-power amplifiers capable of supporting higher frequency bands is also on the rise, further bolstering the market as global reliance on satellite connectivity continues to grow.

The United States hold a total of 87.7% of satellite amplifier market share which is propelled by growing government and military investment in space technology. Defense and aerospace organizations are expanding satellite communication networks to boost security, surveillance, and worldwide connectivity. Demand for secure, high-bandwidth communication in high-stakes operations has spurred satellite amplifier technology improvements, especially in high-frequency bands. For instance, In March 2023, Wavestream launched the Endurance 500W Ka-Wideband Block Upconverter, an “always-on” SSPA designed to replace TWT amplifiers with high power, redundancy, and hot-swappable components for continuous satellite communication. Moreover, investment in future communication infrastructure is boosting demand for high-speed data transmission-efficient amplifiers with minimal signal loss. Growth in satellite networks for military and civilian use, such as deep-space missions and Earth observation, is further stimulating the market. Government authorities are still granting approvals for new satellite deployments, boosting amplifier design innovation to cater to higher data demands. With continued development in space technology and national security programs, the U.S. demand for high-performance satellite amplifiers will continue to be robust in the next few years.

Satellite Amplifier Market Trends:

Expanding Use of SATCOM Across Industries

Increasing dependency on satellite communication (SATCOM) in defense, entertainment, telecommunications, and transportation sectors is a primary factor in the market's growth. With more applications demanding stable and high-speed connectivity, SATCOM systems are highly being implemented for real-time data transmission, secure communication, and remote access. India's total number of telephone subscribers stood at 1,203.69 million in May 2024, as stated by India Brand Equity Foundation, depicting the amplified requirement for sound satellite communication infrastructure. The boom in satellite launches along with greater Ku- and Ka-band satellites use for broadband service is driving up demand for satellite amplifiers in advanced technologies further. Moreover, governments and private entities are actively investing in satellite networks to improve global connectivity, enable smart city projects, and enhance rural communications. With industries intensely incorporating satellite technology for smooth operations, the demand for effective amplifiers that can handle higher frequencies and enhance signal quality will fuel market growth.

Growing Role of Satellite Amplifiers in Broadcasting and Remote Sensing

The extensive usage of satellite amplifiers in broadcasting is generating impressive growth prospects, especially in the case of markets where signal strength is poor. As media viewership keeps progressing towards high-definition (HD) and ultra-high-definition (UHD) viewing, broadcasters bank on sophisticated amplifiers to enable uninterrupted transmission as well as signal strength improvement. Further, growth in government financing of space missions and Earth observation projects is continuing to drive satellite amplifier demand even further. The propelling demand for weather forecasting and remote sensing services based on satellites for use in agriculture, forestry, and environment monitoring is favorably influencing the market. The Indian agricultural sector is anticipated to reach USD 24 billion by 2025, as per India Brand Equity Foundation, highlighting the significance of satellite-based solutions to precision farming. While high-demanding broadcasting and satellite-monitoring raise need for greater-efficiency amplifiers, manufacturers develop the ones of improved reliability with low power requirement.

Advancements in Satellite Amplifier Technology and Infrastructure Investments

Satellite amplifier technology enhancements in terms of efficiency, longivity, and reliability are having a major influence on market development. Companies are launching new-generation amplifier solutions with greater signal levels, lower power consumption, and lower heat production, which find better applications for longer-duration space missions and satellite commercial applications. Further, high-level investments in satellite communication network infrastructure are driving next-generation amplifiers for higher frequency bands to become mainstream. Governments and non-state actors are placing high importance on SATCOM for emergency response and disaster management to guarantee sound communication in natural disasters and crises. The availability of networked devices, like IoT-enabled equipment and smart sensors, further calls for satellite-based networks, creating further demand for high-end amplifiers. With connectivity needs ever-changing, manufacturers of satellite amplifiers are putting efforts into developing higher performance levels to enable next-generation applications, such as 5G backhaul, autonomous transportation, and global broadband rollout, setting the market up for sustained growth.

Satellite Amplifier Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global satellite amplifier market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Power Amplifier

- Low Noise Amplifier

- Signal-Amplifier

Power amplifiers constitute the biggest share in the market for satellite amplifiers at 64.1% in 2024 because of their key contribution to signal transmission for most applications of satellite communication. Power amplifiers are used to amplify the strength of a signal so that communication is long distance and trustworthy, especially at high frequency like Ku- and Ka-band. Power amplifiers are on demand as satellite deployment increases for broadband, defense, and commercial usage. Technological innovation, such as the use of Gallium Nitride (GaN)-based amplifiers, has enhanced efficiency and longevity, making them suitable for use in space. With satellite networks stimulating to accommodate rising connectivity demands, the interest in small, energy-efficient, and high-power amplifiers is growing. As satellite investments continue worldwide, the power amplifier market is bound to stay in the driver's seat based on demand from growing adoption in military communications, deep space exploration, and next-generation satellite broadband services, fueling strong market growth in the years to come.

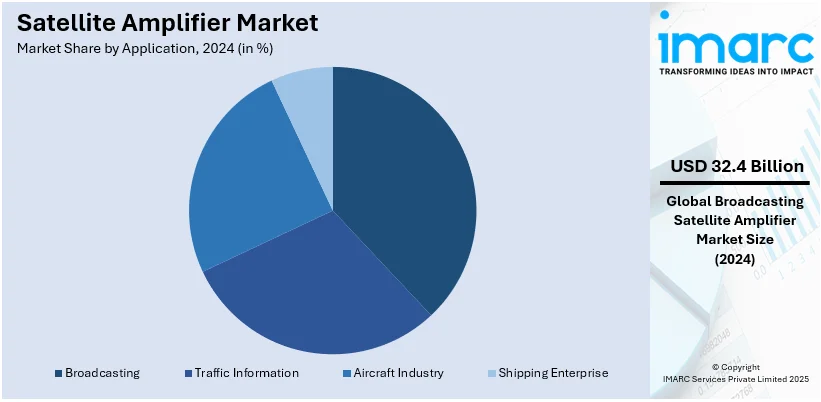

Analysis by Application:

- Traffic Information

- Aircraft Industry

- Shipping Enterprise

- Broadcasting

Broadcasting is the dominant use for satellite amplifiers, accounting for 37.8% market share in 2024 due to rising interest in high-definition (HD) and ultra-high-definition (UHD) programming. Satellite amplifiers are dependent on satellite broadcasters to deliver stable signal delivery, particularly to geographically dispersed zones with limited coverage of the terrestrial network. Escalated demand has come from expanding use in direct-to-home (DTH) TV, satellite radio, and broadcasting of live events. Moreover, the shift from conventional broadcasting to digital and satellite-based media demands amplifiers that can handle high-frequency bands to provide quality signals. Private organizations and government agencies are setting up satellite broadcasting networks to enhance media availability in remote areas. As technology in amplifiers improves in terms of efficiency and power consumption reduction, the sector is growing further. As consumption of content moves towards streaming and satellite-based platforms, the need for dependable, high-power amplifiers will continue to drive robust market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the satellite amplifier market with a 37.7% share in 2024 due to robust defense spending, space exploration programs, and commercial satellite launches. Advanced satellite communication for military, aerospace, and telecommunication purposes drives demand for high-frequency amplifiers in the region. Government institutions and private companies are increasing satellite networks for broadband coverage, deep-space exploration, and Earth observation, boosting demand for efficient amplifiers. High utilization of satellite-internet services in rural and outlying areas enhances market expansion even more. Moreover, North America leads the efforts in the establishment of high-power amplifiers of better efficiency supporting new satellite communications technologies. Amplified investments into satellite infrastructure, approval for the establishment of new satellite constellations, as well as boosted efficiency in design for amplifiers, solidifies leadership within the region. With ongoing innovation and growing satellite applications, North America is likely to continue leading the satellite amplifier market.

Key Regional Takeaways:

United States Satellite Amplifier Market Analysis

The United States is witnessing a surge in satellite amplifier adoption driven by substantial investments in military and defense. For example, defense expenditure has raised by 62% since 1980, from USD 506 Billion to USD 820 Billion as of 2023. Contemporary military operations depend significantly on secure and reliable communications networks, in which satellite communication is important. This calls for high-performance satellite amplifiers to provide clear and unbroken signal transmission for numerous applications, such as command and control, surveillance, and data transfer. Furthermore, the increasing demand for advanced communication technologies within the defense sector, such as satellite-based internet and secure voice communication, fuels the need for robust and efficient satellite amplifiers. The ongoing modernization efforts of the US military, coupled with the growing emphasis on space-based assets, further propel the growth of the satellite amplifier market in this region.

Asia Pacific Satellite Amplifier Market Analysis

The burgeoning entertainment sector in the Asia-Pacific region is a significant driver of satellite amplifier adoption. According to India Brand Equity Foundation, the entertainment and media sector of the country is predicted to experience growth of 9.7% per annum in revenues to become USD 73.6 Billion by 2027. With the growing demand for direct-to-home (DTH) TV services and demand for high-definition and ultra-high-definition content, there is a need for powerful satellite signal amplification. Satellite amplifiers play a crucial role in delivering high-quality audio and video signals to households across the region, including remote and underserved areas. Furthermore, the growing adoption of over-the-top (OTT) platforms and streaming services, which often rely on satellite connectivity for content delivery, contributes to the demand for advanced satellite amplifiers. The expanding middle class, coupled with increasing disposable incomes, further fuels the growth of the entertainment sector and, consequently, the satellite amplifier market in Asia-Pacific.

Europe Satellite Amplifier Market Analysis

In Europe, the growing transportation sector, fuelled by spurring vehicle ownership, is a key driver of satellite amplifier adoption. According to International Council on Clean Transportation, approximately 10.6 Million new vehicles were registered across the 27 Member States in 2023, 14% more than in 2022. New cars are becoming more and more equipped with satellite-based navigation systems, telematics, and connectivity. Satellite amplifiers provide a constant signal reception for use in such applications, providing accurate positioning, real-time traffic information, and effortless communication. Furthermore, the growing adoption of connected car technologies and autonomous driving systems, which rely heavily on satellite connectivity, further propels the demand for high-performance satellite amplifiers. The increasing focus on road safety and efficient logistics, coupled with the growing demand for in-vehicle entertainment and information systems, contributes to the growth of the satellite amplifier market in Europe.

Latin America Satellite Amplifier Market Analysis

The expanding telecommunication sector in Latin America, marked by growing connections, is boosting the adoption of satellite amplifiers. According to GSMA, smartphone subscriptions in Latin America will total 500 Million as of the end of 2021, at an adoption rate of 74%. This increase, in turn, underlines the rising demand for services such as Dietary Supplements, which tend to depend on strong communication infrastructure for distribution and promotion. As telecommunication infrastructure expands, satellite amplifiers become essential for bridging connectivity gaps, particularly in remote and underserved areas. This improved connectivity facilitates access to information, healthcare, and education, further driving the demand for satellite-based services and the associated amplification technology.

Middle East and Africa Satellite Amplifier Market Analysis

The rapidly expanding IT sector in the Middle East and Africa is a significant driver for the satellite amplifier market. For example, total investment in information and communications technology (ICT) in the Middle East, Türkiye, and Africa (META) region will exceed USD 238 Billion this year, up by 4.5% from 2023. The growing demand for cloud computing, data centers, and enterprise communication solutions creates a need for high-bandwidth and reliable connectivity. Satellite communication is essential for ensuring connectivity in remote areas and reducing the digital divide. Satellite amplifiers are essential for ensuring strong and stable signal reception, enabling seamless data transfer and communication. The growing investments in IT infrastructure and the increasing demand for digital services across the region contribute to the growth of the satellite amplifier market.

Competitive Landscape:

The satellite amplifier market is highly competitive with some of the prominent players concentrating on product innovation, technological developments, and strategic collaborations to improve their position in the market. Players are making investments in developing high-frequency amplifiers like Ku-, Ka-, and Q-band amplifiers to respond to the intensifying need for high-speed satellite communications. The market also sees growing uses of Gallium Nitride (GaN) technology, augmenting amplifier efficacy, longevity, and power generation. Additionally, North America drives innovation and spending with robust defense and aerospace initiatives, while Asia-Pacific is set to become the major region by virtue of a growing number of satellite deployments aimed at broadband as well as telecommunications services. Amplifying government spending in space exploration, satellite internet, and broadcasting influences the market, too. With accelerating usage in military, broadcasting, and commercial applications, competition is high with companies turning towards miniaturization, efficiency, and affordability-based amplifier solutions to outgrow competitors.

The report provides a comprehensive analysis of the competitive landscape in the satellite amplifier market with detailed profiles of all major companies, including:

- Advantech Wireless Technologies Inc. (Baylin Technologies Inc.)

- Amplus Communication Pte Ltd

- Comtech PST Corporation (Comtech Telecommunications Corp.)

- Kratos Defense & Security Solutions Inc.

- ND SatCom GmbH

- Norsat International Inc. (Hytera Communications Corporation Limited)

Latest News and Developments:

- December 2024: AmpliTech Group has shipped prototype Ultra Low Noise Amplifiers (ULNAs) at high frequency to a Fortune 50 satellite provider for constellations in LEO. The ULNAs have leading industry noise performance at high frequencies and are tailored for the unforgiving space environment. Projected demand for the amplifiers is tens of thousands of units over the next few years as LEO satellite deployments continue to grow.

- October 2024: G&H's optical amplifier technology was instrumental in JAXA's high-speed inter-satellite communication success. Their amplifiers, which are part of the LUCAS system, provided a 1.8 Gbps link between two Japanese satellites. A high-power amplifier amplified the transmitted signal, and a low-noise pre-amplifier amplified the received signal. G&H's experience in space photonics and undersea fiber optics helped develop these vital amplifier systems.

- October 2024: ISRO Chief Somanath made the announcement in December of the launch of India's first electric propulsion satellite, TDS-01. The technology will enhance satellites to be lighter and more efficient. TDS-01 will be used to test native electric thrusters for orbit maneuvering. The satellite will also operate indigenously developed traveling wave tube amplifiers (TWTAs), which are essential for communication and remote sensing.

- October 2024: ETL Systems, a UK market leader in RF solutions, has purchased SpacePath Communications, a UK satellite amplifier supplier. The move enhances ETL's satellite communications market position through the addition of SpacePath's high power amplifier (HPA) product line to its offerings. The transaction unites the UK's strength in satellite amplifier technology.

- March 2024: MACOM will exhibit its new space and high-reliability products at SATELLITE 2024. These products include RF, microwave, millimeter wave, and optical devices for satellite communications. Exhibited products include solid state amplifier ("SSPA") and traveling wave tube amplifier ("TWT") linearizer modules and free space optic components. MACOM also provides GaN MMICs and small signal components for satellite and ground station electronics.

Satellite Amplifier Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Amplifier, Low Noise Amplifier, Signal-Amplifier |

| Applications Covered | Traffic Information, Aircraft Industry, Shipping Enterprise, Broadcasting |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advantech Wireless Technologies Inc. (Baylin Technologies Inc.), Amplus Communication Pte Ltd, Comtech PST Corporation (Comtech Telecommunications Corp.), Kratos Defense & Security Solutions Inc., ND SatCom GmbH, Norsat International Inc. (Hytera Communications Corporation Limited), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the satellite amplifier market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global satellite amplifier market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the satellite amplifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The satellite amplifier market was valued at USD 85.82 Billion in 2024.

The satellite amplifier market is projected to exhibit a CAGR of 8.12% during 2025-2033, reaching a value of USD 179.58 Billion by 2033.

The satellite amplifier market is driven by increasing demand for high-speed internet, rising adoption of satellite communication in defense and commercial sectors, advancements in satellite technology, and growing investments in space exploration. Expanding broadband services in remote areas and the rise of 5G backhaul further boost market growth.

North America currently dominates the satellite amplifier market, accounting for a share of 37.7%. The market is driven by strong defense investments, growing satellite internet adoption, advanced space exploration programs, and amplifying demand for high-frequency communication systems.

Some of the major players in the satellite amplifier market include Advantech Wireless Technologies Inc. (Baylin Technologies Inc.), Amplus Communication Pte Ltd, Comtech PST Corporation (Comtech Telecommunications Corp.), Kratos Defense & Security Solutions Inc., ND SatCom GmbH, Norsat International Inc. (Hytera Communications Corporation Limited), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)