Saudi Arabia Air Freshener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Air Freshener Market Summary:

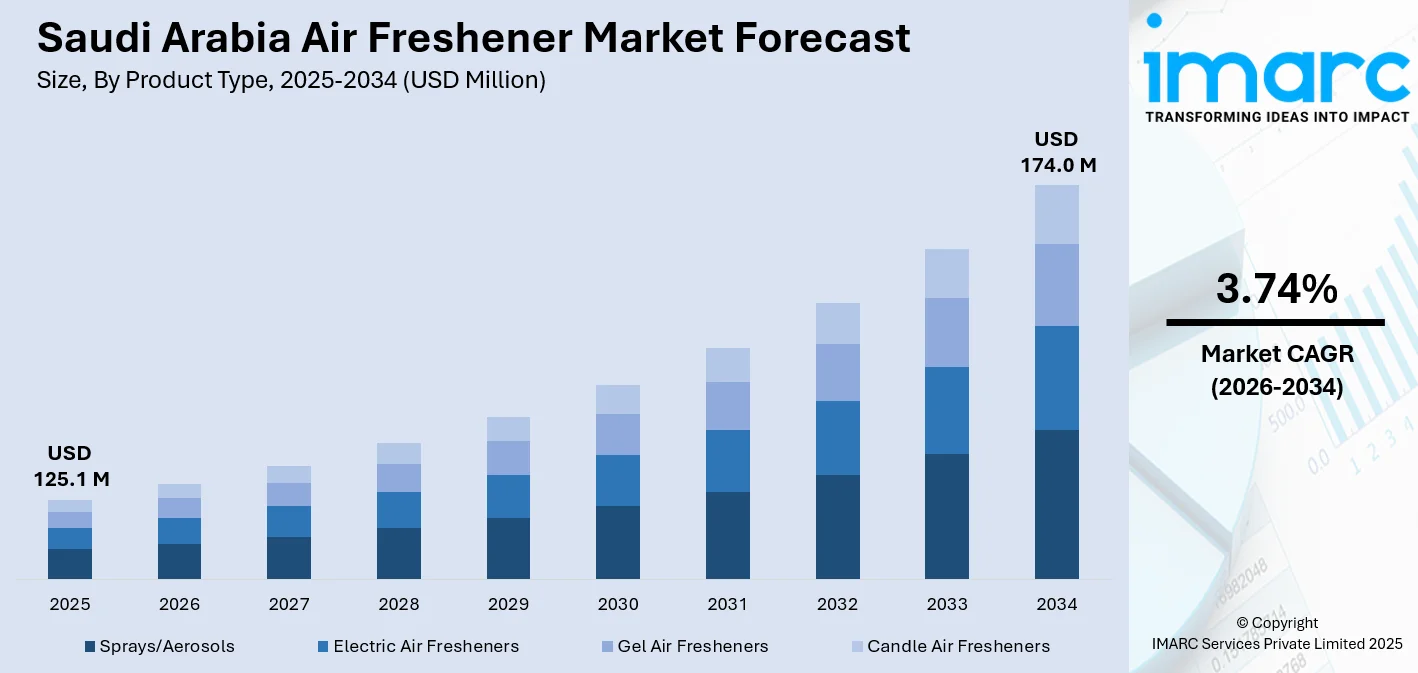

The Saudi Arabia air freshener market size was valued at USD 125.1 Million in 2025 and is projected to reach USD 174.0 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

The Saudi Arabian market demonstrates steady growth driven by heightened urban development patterns, rising household income levels, and evolving user preferences toward ambient home environments. Apart from this, the cultural emphasis on hospitality and cleanliness drives sustained demand for air fresheners across residential and commercial applications, while retail modernization enhances product accessibility nationwide, thereby expanding the Saudi Arabia air freshener market share.

Key Takeaways and Insights:

- By Product Type: Sprays/aerosols dominate the market with a share of 31% in 2025, owing to their rapid scent release, convenience, and adaptable use in various settings and events.

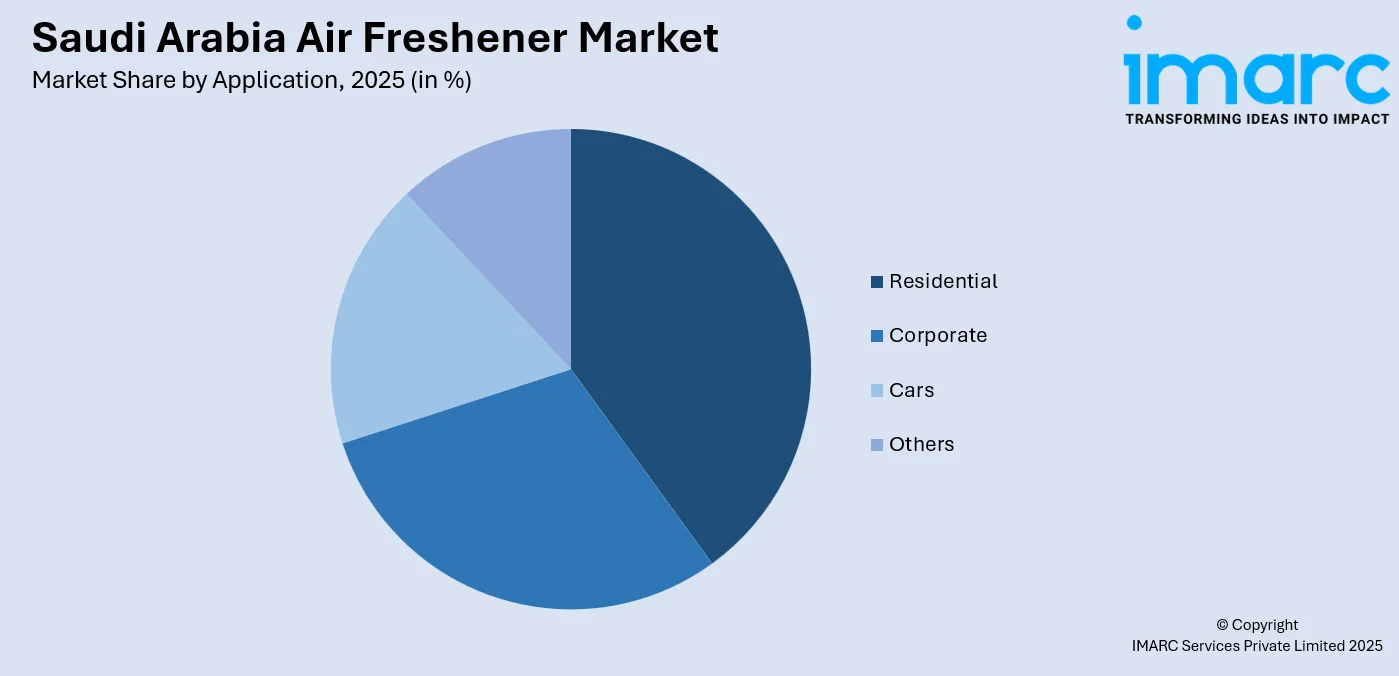

- By Application: Residential leads the market with a share of 40% in 2025, driven by growing homeownership rates, nuclear family structures, and heightened awareness of indoor air quality.

- By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 35% in 2025, benefiting from extensive product variety, promotional activities, and one-stop shopping convenience.

- By Region: Northern and Central Region accounts for the largest share of 29% in 2025, reflecting concentrated population density in Riyadh metropolitan area and higher purchasing power among urban households.

- Key Players: The competitive landscape features established multinational fragrance corporations alongside regional manufacturers competing through product innovation, pricing strategies, and distribution network expansion. Market players focus on localized scent preferences, premium product lines, and sustainability initiatives to capture diverse consumer segments.

To get more information on this market Request Sample

The Saudi Arabian air freshener market benefits from several converging factors that position it for sustained growth. The Kingdom's Vision 2030 transformation agenda accelerates urban development projects, creating expanded residential and commercial real estate that requires ambient scenting solutions. Rising female workforce participation correlates with increased household expenditure on convenience products, while social media influence shapes aspirational lifestyle choices that prioritize home aesthetics. The hospitality sector's recovery and expansion, particularly in major cities like Riyadh, Jeddah, and Dammam, generates substantial commercial demand. Retail sector modernization through hypermarket proliferation and e-commerce platforms enhances product accessibility across geographic regions. For instance, the expansion of Carrefour and Panda stores into secondary cities has democratized access to international air freshener brands, while local manufacturers leverage traditional souq networks to maintain market presence in conservative communities where oud and musk-based fragrances remain culturally preferred. In 2025, to align with the objectives of Saudi Vision 2030 aimed at improving services for the “Guests of God” during Hajj, Majid Al Futtaim Retail, the sole operator of Carrefour in the Kingdom of Saudi Arabia, reveals the launch of four new pop-up stores in Mina - strategically positioned to assist Pilgrims throughout the Hajj season 1446 AH.

Saudi Arabia Air Freshener Market Trends:

Premiumization and Artisanal Fragrance Adoption

User preferences are shifting toward premium and artisanal air freshener products featuring sophisticated fragrance compositions, luxury packaging, and natural ingredient formulations. Affluent Saudi households increasingly seek differentiated scenting experiences through niche brands offering complex fragrance profiles inspired by international perfumery traditions. This trend manifests in growing demand for reed diffusers, scented candles with multiple wick configurations, and electric diffusers with customizable intensity settings. The premiumization movement aligns with broader lifestyle aspirations promoted through social media platforms, where influencers showcase home aesthetics incorporating high-end fragrance products as essential design elements. Fragrances are developing as vibrant links to cultural heritage at the Jazan Festival 2026. Scents drifting through the area evoke visions of local ecosystems, aromatic plants grown in mountainous and flat regions, gathered at ideal times, then enduring lengthy drying and distillation methods before emerging as fragrances and extracts that reflect the essence of their origin.

Smart Home Integration and Technology-Enabled Solutions

Technological advancement drives adoption of smart air freshener systems featuring app-based controls, programmable schedules, and integration with home automation ecosystems. Modern Saudi consumers, particularly millennials and Gen Z demographics, demonstrate strong affinity for IoT-enabled devices that offer convenience and personalization. Electric air fresheners with Bluetooth connectivity allow users to adjust fragrance intensity, set automatic dispensing intervals, and monitor refill requirements through smartphone applications. This technological integration appeals to tech-savvy households in major urban centers where smart home penetration accelerates, creating opportunities for manufacturers to differentiate products through digital innovation and enhanced user experiences. IMARC Group predicts that the Saudi Arabia smart homes market is projected to attain USD 3.2 Billion by 2033.

Sustainability Consciousness and Eco-Friendly Formulations

Environmental awareness influences purchasing decisions as Saudi consumers increasingly scrutinize product ingredients, packaging materials, and manufacturing practices. Growing concern about indoor air quality and chemical exposure drives demand for air fresheners formulated with natural essential oils, plant-based compounds, and VOC-free propellants. Manufacturers respond by developing eco-friendly product lines featuring biodegradable packaging, refillable containers, and transparent ingredient labeling. The sustainability trend gains momentum among educated urban populations exposed to global environmental movements through digital media, though traditional synthetic fragrances maintain dominance in price-sensitive segments. Retailers enhance visibility of sustainable options through dedicated shelf space and promotional campaigns emphasizing health and environmental benefits. The rapid development of Saudi Arabia's residential sector significantly contributes to market growth, with the number of planned residential units surging, reaching approximately 26,000 housing units under off-plan sales projects via “Sakani” platform during the first half of 2025, creating expanded opportunities for eco-friendly air freshener positioning as new homeowners increasingly value sustainable home care products aligned with Vision 2030's environmental objectives.

How Vision 2030 is Transforming the Saudi Arabia Air Freshener Market:

Saudi Vision 2030 is quietly reshaping the air freshener market by changing how people live, shop, and spend. Urban housing projects, mixed-use developments, hotels, malls, and entertainment hubs have expanded rapidly, lifting demand for home care and ambient fragrance products. As more households move into modern apartments and gated communities, everyday hygiene and indoor aesthetics receive greater attention. New hotels, resorts, cinemas, and offices use air fresheners to maintain a consistent indoor experience, catalyzing bulk and commercial demand. Retail transformation is also bringing changes in the market in the country. Organized retail, e-commerce platforms, and lifestyle stores make branded air fresheners easier to access, encouraging product trials beyond basic sprays. Sustainability goals under Vision 2030 influence product choices as well. Consumers show growing interest in safer formulations, recyclable packaging, and locally manufactured goods. This opens space for private labels and domestic producers alongside international brands. Overall, the market benefits from lifestyle upgrades, stronger retail channels, and steady institutional demand shaped by Vision 2030’s urban and economic priorities.

Market Outlook 2026-2034:

The Saudi Arabian air freshener market trajectory reflects ongoing economic diversification, demographic transformation, and retail sector modernization that collectively enhance market fundamentals. Continued urbanization concentrates populations in metropolitan areas with higher consumption capacity, while megaprojects under Vision 2030 generate commercial real estate demand requiring ambient scenting solutions. E-commerce channel expansion democratizes access to international brands previously unavailable in physical retail, though traditional distribution maintains significance in cultural preference segments. The market generated a revenue of USD 125.1 Million in 2025 and is projected to reach a revenue of USD 174.0 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034. Continued urbanization concentrates populations in metropolitan areas with higher consumption capacity, while megaprojects under Vision 2030 including NEOM, Qiddiya entertainment city, and Riyadh metro infrastructure generate construction activity and population influx that expand market fundamentals through new residential units, commercial establishments, and transportation facilities requiring ambient scenting applications.

Saudi Arabia Air Freshener Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Sprays/Aerosols |

31% |

|

Application |

Residential |

40% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

35% |

|

Region |

Northern and Central Region |

29% |

Product Type Insights:

- Sprays/Aerosols

- Electric Air Fresheners

- Gel Air Fresheners

- Candle Air Fresheners

- Others

Sprays/aerosols dominate with a market share of 31% of the total Saudi Arabia air freshener market in 2025.

Sprays and aerosol air fresheners maintain market leadership through unmatched convenience, immediate odor neutralization capabilities, and versatile application scenarios across residential and commercial environments. The format's portability enables targeted fragrance deployment in specific rooms, vehicles, and office spaces without requiring electrical infrastructure or installation procedures. Aerosol technology delivers consistent fragrance dispersion through pressurized propellant systems that atomize liquid formulations into fine mist particles, ensuring rapid ambient scenting across enclosed spaces. Consumer familiarity with spray formats established over decades reinforces purchasing habits, while competitive pricing relative to electric alternatives broadens accessibility across income segments.

Product innovation within the sprays/aerosols category addresses evolving consumer preferences through specialized formulations targeting specific applications and demographics. Manufacturers develop variants featuring odor-eliminating enzymes for bathroom and kitchen applications, antibacterial compounds for healthcare settings, and hypoallergenic formulas for sensitive households. Premium aerosol lines incorporate sophisticated fragrance compositions mimicking luxury perfumes, natural essential oil blends, and culturally resonant scents like oud, amber, and rose that resonate with Saudi preferences. Packaging evolution includes ergonomic designs, decorative finishes, and travel-sized formats that enhance user experience and enable lifestyle integration. For example, automotive-specific aerosol fresheners with compact dimensions and specialized mounting clips have gained traction among Saudi Arabia's substantial vehicle-owning population, particularly in regions experiencing extreme temperatures that amplify odor concerns.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Corporate

- Cars

- Others

Residential leads with a share of 40% of the total Saudi Arabia air freshener market in 2025.

Residential applications dominate market consumption as households prioritize ambient home environments reflecting cultural values of hospitality, cleanliness, and aesthetic refinement. Saudi families allocate significant household budgets toward home care products that enhance living spaces for family gatherings and guest reception, where pleasant fragrances contribute to perceived hospitality standards. Nuclear family structures emerging from urbanization patterns increase individual household numbers, multiplying aggregate residential demand even as average household sizes decline. Rising homeownership rates supported by government housing initiatives and mortgage financing programs expand the permanent resident population more likely to invest in home ambiance products compared to transient rental demographics.

The residential segment exhibits diverse consumption patterns influenced by dwelling characteristics, household composition, and lifestyle preferences that manufacturers target through specialized products. Large villas and apartments with multiple rooms generate demand for varied fragrance profiles across different functional spaces, with living areas featuring welcoming scents, bedrooms utilizing calming aromatherapy formulations, and kitchens employing odor-neutralizing variants. Premium residential developments incorporating modern amenities attract affluent households seeking sophisticated home fragrance solutions including reed diffusers, automatic spray dispensers, and decorative candles that complement interior design aesthetics. Working professionals in urban centers demonstrate strong affinity for convenient electric air fresheners with programmable features that maintain ambient fragrance during absence, while traditional households in conservative regions maintain preference for bakhoor burners and oud-based products reflecting cultural heritage. The COVID-19 pandemic's legacy effect continues influencing residential consumption as remote work arrangements and increased time spent at home elevate awareness of indoor environment quality and drive sustained demand for air quality enhancement products.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Pharmacies

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 35% share of the total Saudi Arabia air freshener market in 2025.

Supermarkets and hypermarkets command the largest distribution channel share through unparalleled product assortment breadth, competitive pricing structures, and integrated shopping experiences that position air fresheners as routine household purchases alongside grocery staples. Modern retail formats operated by chains offer dedicated home care aisles featuring comprehensive air freshener selections spanning multiple brands, formats, and price points that enable comparison shopping and informed purchase decisions. Promotional activities including bundle offers, loyalty program rewards, and seasonal discounts incentivize trial of new products and brand switching behaviors that benefit established retailers with sophisticated marketing capabilities and supplier relationships.

The channel's infrastructure advantages facilitate effective market penetration across Saudi Arabia's diverse geographic landscape through strategic store placement in high-traffic commercial districts, residential neighborhoods, and regional cities beyond major metropolitan centers. Hypermarkets' expansive floor space accommodates extensive product displays, end-cap promotions, and cross-merchandising opportunities that enhance air freshener visibility and stimulate impulse purchases among shoppers focused primarily on grocery procurement. Store environments featuring climate control, organized layouts, and professional merchandising contrast favorably with traditional retail formats, appealing to younger consumers and female shoppers who comprise primary household purchasing agents for home care categories. For instance, hypermarkets in Riyadh's modern shopping districts attract affluent families during evening hours and weekends, creating concentrated shopping occasions where air freshener purchases occur alongside weekly grocery replenishment. Regional expansion of hypermarket chains into cities like Khobar, Jubail, and Tabuk extends organized retail penetration into markets previously dominated by independent grocery stores and traditional souqs, gradually shifting distribution patterns toward modern trade channels while creating growth opportunities for premium and international brands requiring sophisticated retail environments to effectively communicate brand positioning and product differentiation.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads with a share of 29% of the total Saudi Arabia air freshener market in 2025.

The Northern and Central Region's market leadership stems from Riyadh's position as the national capital and largest metropolitan area, concentrating population density, economic activity, and retail infrastructure that collectively drive disproportionate consumption levels. Riyadh houses government institutions, corporate headquarters, and industrial facilities that generate substantial commercial real estate demand for air freshening solutions across office complexes, hospitality venues, and public facilities. The region's affluent residential neighborhoods featuring luxury villas and high-end apartment complexes attract households with elevated purchasing power and sophisticated preferences for premium home care products, creating favorable demographics for market growth and premiumization trends.

Urban development projects under Vision 2030 including NEOM, Qiddiya entertainment city, and Riyadh metro infrastructure generate construction activity and population influx that expand market fundamentals through new residential units, commercial establishments, and transportation facilities requiring ambient scenting applications. The region's climate characteristics featuring extreme summer temperatures and arid conditions create specific air freshener demand patterns, with consumers seeking products that withstand heat exposure without fragrance degradation while providing long-lasting performance in air-conditioned indoor environments. Retail concentration in the Northern and Central Region includes extensive hypermarket networks, modern shopping malls, and specialty stores that provide superior product accessibility compared to other regions, while e-commerce logistics infrastructure centered on Riyadh enables efficient last-mile delivery that supports online channel growth. For example, expatriate communities concentrated in Riyadh compounds demonstrate distinct consumption patterns favoring international air freshener brands and formats familiar from home countries, creating niche market opportunities that retailers address through specialized product assortments and targeted marketing communications that resonate with diverse demographic segments within the region's cosmopolitan population composition.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Air Freshener Market Growing?

Urban Developmets and Household Formation Acceleration

Rapid urbanization transforms Saudi Arabia's demographic landscape as populations concentrate in major metropolitan areas including Riyadh, Jeddah, and Dammam, creating dense residential clusters with elevated household goods consumption. Government housing initiatives provide mortgage financing and direct construction programs that accelerate homeownership among Saudi nationals, particularly younger demographics forming independent households earlier than previous generations. Nuclear family structures replace traditional extended family arrangements, multiplying total household numbers even as average household sizes decline, thereby expanding aggregate market demand. Urban apartment living in modern residential developments emphasizes compact interior design and multi-functional spaces where air fresheners serve practical odor control alongside aesthetic ambiance creation. For instance, youth housing programs targeting first-time buyers in Riyadh's emerging suburbs have created concentrated demand pockets for affordable air freshener products as newly independent households establish purchasing patterns across home care categories. The National Developmental Housing Foundation, referred to as Sakan, and the Social Development Bank have collaborated to offer 4,000 housing units to qualified families throughout Saudi Arabia as part of the second phase of the Joud Regions initiative. This collaboration expands on an earlier agreement that provided housing for 1,000 families. The initiative directly aids in achieving the Vision 2030 objective of raising homeownership levels among citizens.

Rising Disposable Income and Middle-Class Expansion

Economic diversification under Vision 2030 generates employment opportunities beyond traditional oil sector careers, expanding the middle-income demographic with discretionary spending capacity for lifestyle enhancement products including air fresheners. Moreover, in Saudi Arabia, the GDP is expected to increase by 3.7% annually in 2025, maintaining its lead over global GDP growth. Dual-income households emerging from increasing female workforce participation significantly boost household purchasing power, enabling allocation toward home environment quality improvement. Salary growth in technology, finance, healthcare, and tourism sectors creates upwardly mobile consumer segments demonstrating willingness to trade up from basic products to premium alternatives offering superior fragrance quality, longer duration, and sophisticated packaging. Consumer financing availability through installment payment options and credit cards reduces purchase barriers for higher-priced electric air freshener systems and premium candle sets that previously exceeded budget constraints for middle-income households, expanding accessible market segments for premium positioning strategies.

Cultural Emphasis on Hospitality and Home Presentation

Deep-rooted cultural values regarding hospitality, cleanliness, and home presentation as reflections of family honor drive sustained investment in home environment quality including ambient fragrance. Saudi social customs involving frequent family gatherings, guest reception, and ceremonial occasions create regular hosting requirements where pleasant home fragrances contribute to perceived hospitality standards and guest comfort. Cultural preferences for specific scent profiles including oud, amber, musk, and rose establish distinctive demand patterns that manufacturers address through localized product development and traditional format adaptations. Religious observances and prayer practices emphasizing cleanliness and purification reinforce broader cultural attitudes toward home hygiene that extend to air quality management through fragrance products. The tradition of bakhoor burning during special occasions has evolved to incorporate modern air freshener formats that deliver similar cultural scent experiences through convenient application methods appealing to younger generations maintaining cultural heritage while adopting contemporary lifestyles in urban environments. In 2025, Bahrain celebrated the launch of Scent Arabia, its top exhibition focused on exquisite fragrances, perfumes, oud, and bakhoor. Scheduled for 25–29 November 2025 over an area of 9,000 sqm, the exhibition draws affluent fragrance enthusiasts from Bahrain and Saudi Arabia, in search of unique and exclusive aromas for everyday use, blending, and special events. Uniting small houses, traditional brands, and modern perfumers, the exhibition showcases the richness of Gulf fragrance culture and its lasting artistry.

Market Restraints:

What Challenges the Saudi Arabia Air Freshener Market is Facing?

Price Sensitivity Among Budget-Conscious Segments

Economic pressures from subsidy reforms, VAT implementation, and inflation impact household budgets, particularly among lower-income segments and expatriate populations, creating heightened price sensitivity that constrains premium product adoption. Generic and private label alternatives offered by retailers at significantly reduced prices attract cost-conscious consumers prioritizing functional benefits over brand reputation or sophisticated fragrances. Price competition pressures margins across distribution channels, potentially limiting manufacturer investment in product innovation, marketing support, and retail expansion that would otherwise accelerate market development.

Limited Consumer Awareness of Product Differentiation

Many consumers lack awareness of technical differences between air freshener formats, fragrance quality variations, and specialized features that justify premium pricing, viewing products as largely commoditized based primarily on scent preference and price. Educational gaps regarding health impacts of synthetic fragrances, VOC emissions, and allergen risks limit demand for eco-friendly alternatives despite growing global sustainability trends. Manufacturers face challenges communicating value propositions for innovative products including smart dispensers, natural formulations, and long-duration technologies that command premium positioning without clear performance differentiation visible to average consumers during purchase evaluation.

Cultural Preferences for Traditional Fragrance Methods

Traditional incense burning practices including bakhoor, oud wood chips, and frankincense remain deeply embedded in Saudi cultural heritage, particularly among older demographics and conservative regions, creating competition for modern air freshener formats. Ceremonial and religious contexts favor traditional methods perceived as more authentic expressions of cultural identity and spiritual practice compared to commercial air freshener products. The sensory experience of smoke-based fragrance diffusion and associated rituals provides emotional connections that modern alternatives struggle to replicate, limiting market penetration among demographic segments maintaining strong cultural traditions despite exposure to contemporary product offerings through retail modernization and digital media influence.

Competitive Landscape:

The Saudi Arabian air freshener market exhibits moderate competitive intensity with multinational consumer goods corporations competing alongside regional manufacturers and private label brands across differentiated price-performance segments. Established international players leverage brand equity, research capabilities, and distribution partnerships to maintain premium positioning, while regional manufacturers capitalize on cost advantages, localized scent preferences, and traditional retail relationships to defend market share in value segments. Competition dynamics increasingly incorporate innovation dimensions including smart home integration, sustainable formulations, and premium fragrance development that elevate entry barriers and favor well-capitalized players. Market consolidation pressures emerge from retail concentration as hypermarket chains exercise procurement leverage, though fragmented traditional retail channels provide alternative routes for smaller manufacturers.

Saudi Arabia Air Freshener Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays/Aerosols, Electric Air Fresheners, Gel Air Fresheners, Candle Air Fresheners, Others |

| Applications Covered | Residential, Corporate, Cars, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Pharmacies, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia air freshener market size was valued at USD 125.1 Million in 2025.

The Saudi Arabia air freshener market is expected to grow at a compound annual growth rate of 3.74% from 2026-2034 to reach USD 174.0 Million by 2034.

Sprays/aerosols dominated the market with a share of 31% in 2025, attributed to their instant fragrance dispersion capabilities, portability advantages, versatile application across diverse settings, and competitive pricing that appeals to broad consumer segments seeking convenient odor control solutions.

Key factors driving the Saudi Arabia air freshener market include accelerating urbanization creating concentrated residential demand, rising disposable incomes enabling premium product adoption, cultural emphasis on hospitality and home presentation standards, and retail modernization improving product accessibility across geographic regions.

Major challenges include heightened price sensitivity among budget-conscious consumer segments limiting premium adoption, limited awareness of product differentiation constraining value-based purchasing decisions, and persistent cultural preferences for traditional incense-based fragrance methods competing with modern air freshener formats particularly among conservative demographics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)