Saudi Arabia Animal Husbandry Market Size, Share, Trends and Forecast by Segment and Region, 2025-2033

Saudi Arabia Animal Husbandry Market Overview:

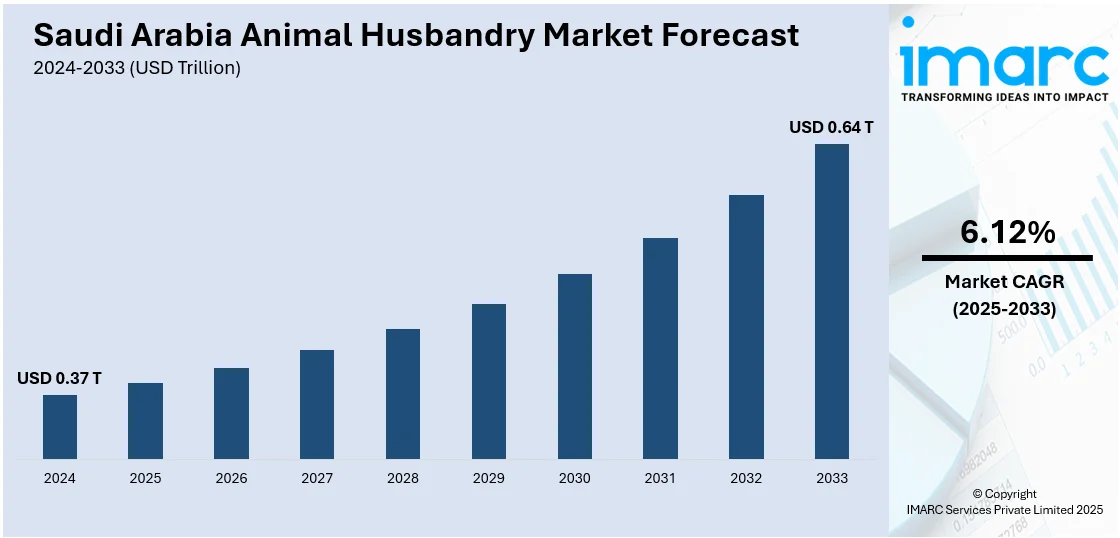

The Saudi Arabia animal husbandry market size reached USD 0.37 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.64 Trillion by 2033, exhibiting a growth rate (CAGR) of 6.12% during 2025-2033. Rising demand for meat and dairy, government support for food security, technological advancements in breeding and animal health, increased investments in farm infrastructure, and growing awareness of animal nutrition and productivity among commercial livestock producers are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.37 Trillion |

| Market Forecast in 2033 | USD 0.64 Trillion |

| Market Growth Rate 2025-2033 | 6.12% |

Saudi Arabia Animal Husbandry Market Trends:

Accelerated Growth in Livestock Production

Saudi Arabia's animal husbandry industry is undergoing a substantial transition, fueled by greater productivity and innovation. The joint efforts of the government and the business sector are key to this change, which aims to improve local food security and reduce reliance on imports. Key programs have aimed to modernize farming operations, use innovative technologies, and improve breeding and supply chain management. These improvements are helping to build a more resilient and sustainable cattle business, preparing it for long-term growth. Furthermore, the sector's growth is aided by enhanced infrastructure, which increases production capacity and ensures more efficient distribution. As a result, the industry is becoming more important to the nation's agricultural environment. With a continuous emphasis on sustainability and food security, the livestock industry is projected to play an important role in satisfying expanding demand for animal products while also supporting larger economic goals, positioning it as a vital area of growth in Saudi Arabia's changing agricultural policy. For example, Saudi Arabia's poultry industry recorded a milestone in March 2024, reporting a record-breaking production of 100 million kilograms achieved in February, owing to collaborative efforts between the government and the private sector.

Partnership Boosting Livestock Farming and Food Security

The animal husbandry industry in Saudi Arabia is changing, with a greater emphasis on improving food security and reaching self-sufficiency in meat production. Key advancements revolve around the rise of intensive livestock farming, which uses new technology to increase efficiency and sustainability. Partnerships between public and commercial organizations are playing an important role in modernizing farming processes, while large-scale investments are fostering the creation of cutting-edge farms. These measures aim to boost local production capacity, minimize reliance on imports, and assure the meat supply's long-term stability. The sector's expansion is consistent with the Kingdom's overall aims of strengthening its agricultural industry, increasing food security, and promoting sustainable development. As a result, the animal husbandry market is experiencing greater innovation and structural improvements to meet rising demand while advancing the country’s food production capabilities. For instance, in March 2024, the National Agricultural Development Co. (NADEC) and United Feed Co., a subsidiary of Al Muhaidib Group, established a joint venture in Saudi Arabia's animal husbandry sector, focusing on intensive livestock farming for red meat production. With NADEC holding a 51% stake, the initiative aims to enhance food security, achieve self-sufficiency in red meat, and develop high-tech farms to support sustainable development in the Kingdom's livestock sector.

Saudi Arabia Animal Husbandry Market Segmentation:

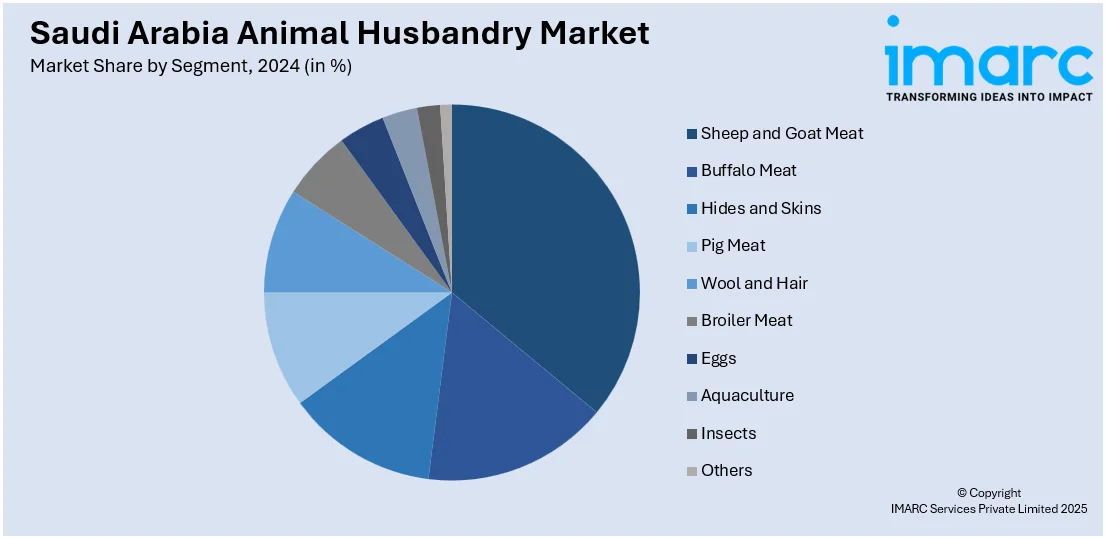

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on segment.

Segment Insights:

- Sheep and Goat Meat

- Buffalo Meat

- Hides and Skins

- Pig Meat

- Wool and Hair

- Broiler Meat

- Eggs

- Aquaculture

- Insects

- Others

The report has provided a detailed breakup and analysis of the market based on the segment. This includes sheep and goat meat, buffalo meat, hides and skins, pig meat, wool and hair, broiler meat, eggs, aquaculture, insects, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Animal Husbandry Market News:

- In December 2024, the Prince Mohammed bin Salman Royal Reserve identified five species new to global science, i.e., a gecko (Hemidactylus sp.), the Hejaz black-collared snake (Rhynchocalamus hejazicus), and three plants, globe thistle (Echinops sp. aff. glaberrimus), mignonette (Reseda sp. aff. muricata), and hogbean (Hyoscyamus sp.). These discoveries enhance Saudi Arabia's biodiversity, supporting ecological health and sustainable practices within the animal husbandry sector.

- In August 2024, Saudi Aramco launched Olfa Animal Welfare, a non-profit company dedicated to improving the lives of stray animals in Saudi Arabia, focusing on sheltering animals, providing veterinary care, and promoting community awareness.

Saudi Arabia Animal Husbandry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Sheep and Goat Meat, Buffalo Meat, Hides and Skins, Pig Meat, Wool and Hair, Broiler Meat, Eggs, Aquaculture, Insects, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia animal husbandry market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia animal husbandry market on the basis of segment?

- What is the breakup of the Saudi Arabia animal husbandry market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia animal husbandry market?

- What are the key driving factors and challenges in the Saudi Arabia animal husbandry?

- What is the structure of the Saudi Arabia animal husbandry market and who are the key players?

- What is the degree of competition in the Saudi Arabia animal husbandry market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia animal husbandry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia animal husbandry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia animal husbandry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)