Saudi Arabia Artificial Insemination Market Size, Share, Trends and Forecast by Type, Source Type, End Use, and Region, 2026-2034

Saudi Arabia Artificial Insemination Market Overview:

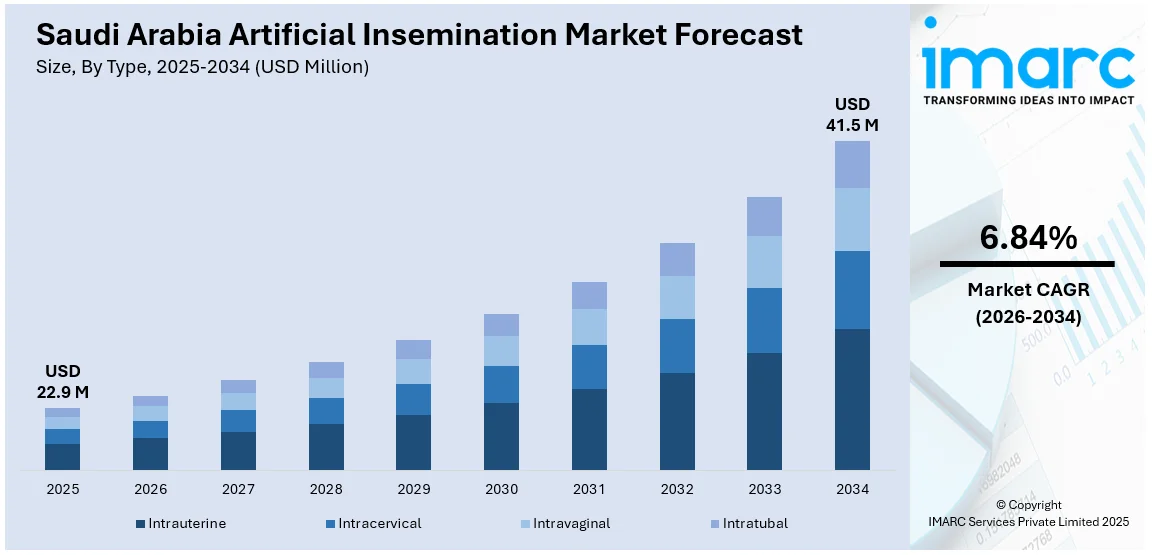

The Saudi Arabia artificial insemination market size reached USD 22.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 41.5 Million by 2034, exhibiting a growth rate (CAGR) of 6.84% during 2026-2034. The market is being driven by improved awareness of fertility treatments, advancements in reproductive technologies, escalating demand for assisted reproduction services, government support for healthcare innovations, and the expanding medical tourism sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 22.9 Million |

| Market Forecast in 2034 | USD 41.5 Million |

| Market Growth Rate 2026-2034 | 6.84% |

Saudi Arabia Artificial Insemination Market Trends:

Government-Led Livestock Development and Food Security Initiatives

The Kingdom of Saudi Arabia has been making substantial investments in agriculture and animal development as part of its broader Vision 2030 initiative, which aims to diversify the national economy and strengthen food security. A critical element of this strategy is the enhancement of animal breeding programs, with artificial insemination (AI) playing a key role. The Ministry of Environment, Water, and Agriculture (MEWA) is at the forefront of initiatives that encourage the adoption of innovative reproductive technologies designed to enhance livestock productivity, genetic quality, and disease resistance. AI enables the rapid distribution of superior genetic material, helping farmers overcome the challenges posed by the Kingdom's harsh climate, including extreme temperatures and limited water resources. By breeding animals with improved heat resistance and higher production capabilities, such as in milk, meat, or wool, AI facilitates the development of more resilient and productive herds. Moreover, given that Saudi Arabia relies heavily on imports of dairy and red meat, the expanded use of AI contributes to reducing this dependency and bolstering the country's self-sufficiency, a key component of national policy.

To get more information on this market Request Sample

Rising Demand for Advanced Fertility Solutions in Human Reproductive Health

Another driver of growth in the Saudi artificial insemination market is within the human healthcare sector, particularly in the realm of assisted reproductive technologies (ART). There is a notable increase in the demand for infertility treatments, driven by a combination of social and demographic factors, including delayed marriages, a rising incidence of infertility (especially male infertility), and greater societal acceptance of medical interventions in reproduction. Changing cultural and religious attitudes toward infertility have led to the widespread legitimacy of artificial insemination among married couples seeking solutions. Many couples facing male-factor infertility view intrauterine insemination (IUI) as a less invasive and more cost-effective alternative to in vitro fertilization (IVF). As a result, numerous public and private infertility clinics across Saudi Arabia are now offering AI services supported by well-trained medical personnel, leading to improved clinical outcomes. Additionally, the influx of fertility tourists, including individuals seeking medical services from neighboring countries, further contributes to the growing demand for such services.

Saudi Arabia Artificial Insemination Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, source type, and end use.

Type Insights:

- Intrauterine

- Intracervical

- Intravaginal

- Intratubal

The report has provided a detailed breakup and analysis of the market based on the type. This includes intrauterine, intracervical, intravaginal, and intratubal.

Source Type Insights:

- AIH-Husband

- AID-Donor

A detailed breakup and analysis of the market based on the source type have also been provided in the report. This includes AIH-husband and AID-donor.

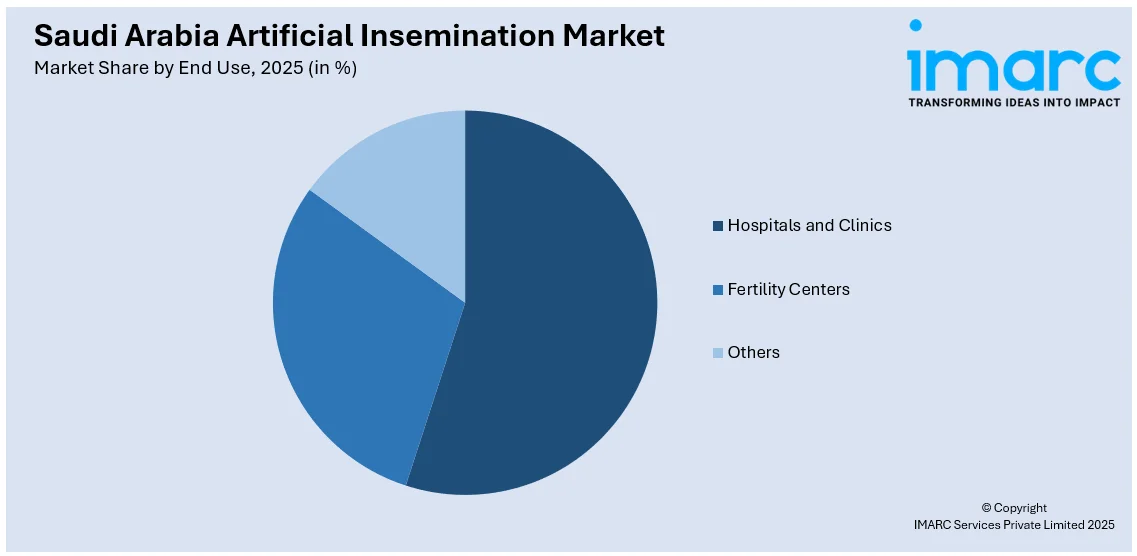

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals and Clinics

- Fertility Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals and clinics, fertility centers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Artificial Insemination Market News:

- May 2025: Saudi Arabia's Ministry of Environment, Water and Agriculture announced the establishment of seven new bee breeding stations across regions including Jazan, Asir, Madinah, Makkah, Hail, Tabuk, and Najran. These facilities aim to preserve and strengthen local bee strains, reducing reliance on imported colonies. The stations will implement programs encompassing training in queen rearing and artificial insemination, alongside promoting practical breeding techniques.

- March 2025: Inspire IVF, a Bangkok-based fertility center, announced that it would be expanding into the Middle East, targeting Saudi Arabia and the UAE through strategic joint ventures. This move leverages rising demand for fertility treatments like IVF, driven by delayed parenthood and supportive healthcare policies. Inspire IVF aims to collaborate with regional healthcare providers and regulatory bodies to establish IVF centers.

Saudi Arabia Artificial Insemination Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Intrauterine, Intracervical, Intravaginal, Intratubal |

| Source Types Covered | AIH-Husband, AID-Donor |

| End Uses Covered | Hospitals and Clinics, Fertility Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia artificial insemination market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia artificial insemination market on the basis of type?

- What is the breakup of the Saudi Arabia artificial insemination market on the basis of source type?

- What is the breakup of the Saudi Arabia artificial insemination market on the basis of end use?

- What is the breakup of the Saudi Arabia artificial insemination market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia artificial insemination market?

- What are the key driving factors and challenges in the Saudi Arabia artificial insemination market?

- What is the structure of the Saudi Arabia artificial insemination market and who are the key players?

- What is the degree of competition in the Saudi Arabia artificial insemination market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia artificial insemination market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia artificial insemination market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia artificial insemination industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)