Saudi Arabia Artisanal Bread Market Size, Share, Trends and Forecast by Type, Ingredients, Distribution Channel, and Region, 2026-2034

Saudi Arabia Artisanal Bread Market Overview:

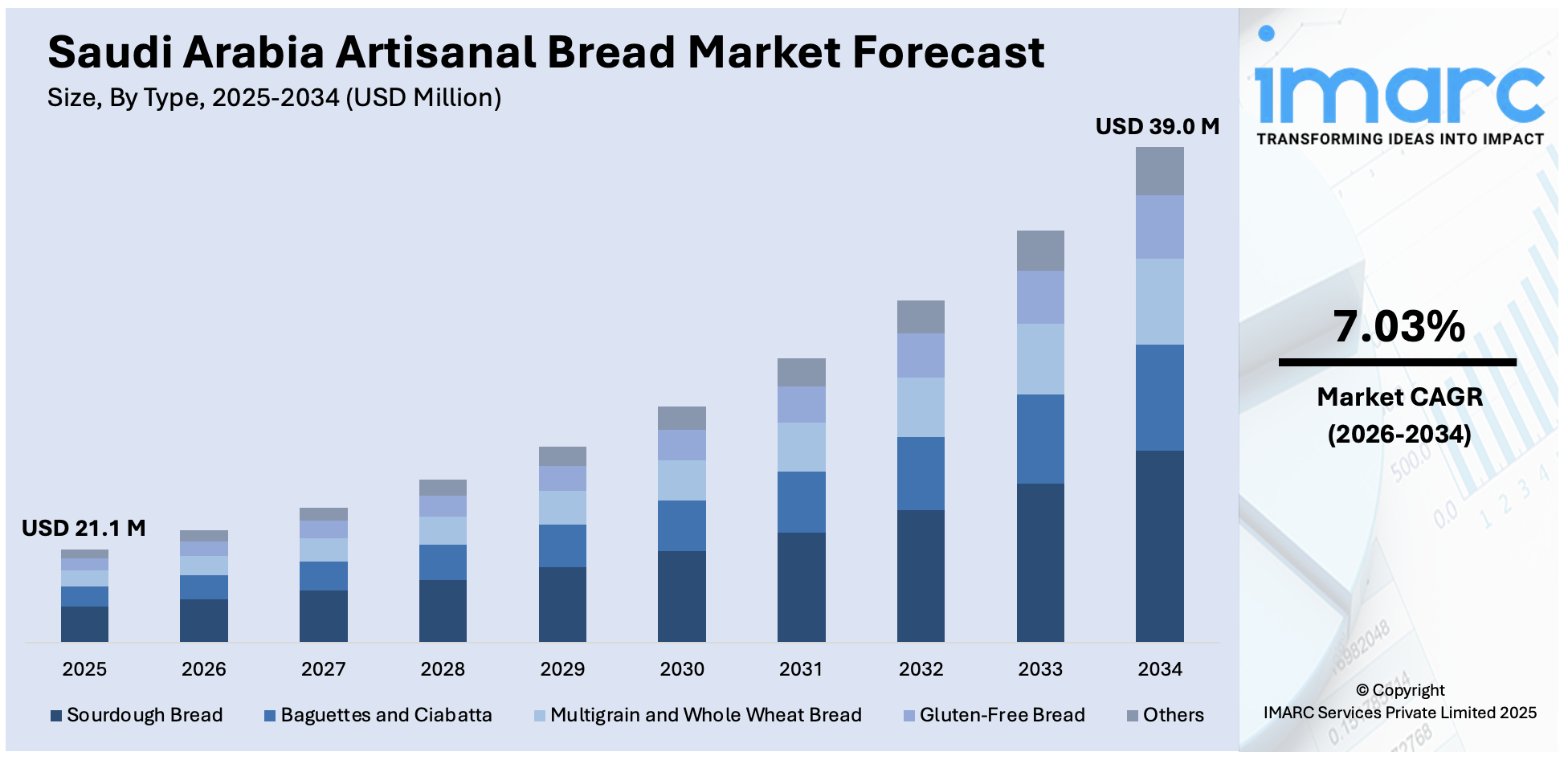

The Saudi Arabia artisanal bread market size reached USD 21.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 39.0 Million by 2034, exhibiting a growth rate (CAGR) of 7.03% during 2026-2034. The market is driven by increasing health consciousness, with consumers shifting from conventional bread to nutrient-rich artisanal alternatives, such as multigrain and sourdough, due to rising lifestyle-related health concerns. Growing disposable incomes and urbanization are fueling demand for premium, gourmet varieties, as consumers seek authentic, high-quality breads such as ciabatta and za’atar-infused loaves. Additionally, expanding e-commerce and foodservice channels enhance accessibility, further augmenting the Saudi Arabia artisanal bread market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 21.1 Million |

|

Market Forecast in 2034

|

USD 39.0 Million |

| Market Growth Rate 2026-2034 | 7.03% |

Saudi Arabia Artisanal Bread Market Trends:

Rising Demand for Health-Conscious Artisanal Bread

The market is experiencing a rise in demand for healthier bread options, driven by increasing health awareness among consumers. With rising concerns over obesity, diabetes, and gluten intolerance, many consumers are shifting from traditional white bread to artisanal varieties made with whole grains, organic flour, and natural ingredients. The Saudi adult obesity rate has increased to 23.1%, and 14.6% of children aged 2-14 years fall under the obese category. Additionally, only 10.2% of adults meet the recommended daily allowance of fruits and vegetables. As many as 45.1% of adults are overweight, and 33.5% are exposed to passive smoking, with a rising trend towards healthy consumption. These changes highlight an increased need for healthier artisanal bread options supporting public health aims. Bakeries are responding by introducing multigrain, sourdough, and low-carb bread, often free from artificial additives and preservatives. Additionally, the popularity of keto and high-protein diets has led to the emergence of specialty breads catering to fitness enthusiasts. Social media and influencer marketing have further amplified this trend, with consumers seeking premium, nutrient-dense bread options. As health-conscious eating continues to grow, artisanal bakeries are expected to expand their product lines to include functional breads fortified with seeds, nuts, and superfoods, positioning themselves in both retail and online markets.

To get more information on this market Request Sample

Growth of Premium and Gourmet Artisanal Bread Offerings

The increasing preference for premium and gourmet bread varieties, particularly among affluent and expatriate consumers, is propelling the Saudi Arabia artisanal bread market growth. Urbanization, rising disposable incomes, and exposure to global food trends have fueled demand for high-quality, handcrafted bread such as ciabatta, baguettes, and brioche. Upscale cafes, hotels, and restaurants are incorporating artisanal bread into their menus, further driving market growth. Additionally, specialty bakeries are leveraging unique flavors, such as za’atar-infused or date-sweetened bread, to cater to local tastes while maintaining an artisanal appeal. The trend is also supported by the growing foodservice sector and e-commerce platforms, which allow consumers to order freshly baked artisanal bread online. As consumers increasingly associate artisanal bread with sophistication and authenticity, bakeries are expected to focus on premium branding, artisanal storytelling, and sustainable packaging to differentiate themselves in a competitive market.

Saudi Arabia Artisanal Bread Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, ingredients, and distribution channel.

Type Insights:

- Sourdough Bread

- Baguettes and Ciabatta

- Multigrain and Whole Wheat Bread

- Gluten-Free Bread

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes sourdough bread, baguettes and ciabatta, multigrain and whole wheat bread, gluten-free bread, and others.

Ingredients Insights:

- Organic Flour-Based Breads

- Grain and Seed Mix Breads

- Dairy-Free and Vegan Options

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes organic flour-based breads, grain and seed mix breads, and dairy-free and vegan options.

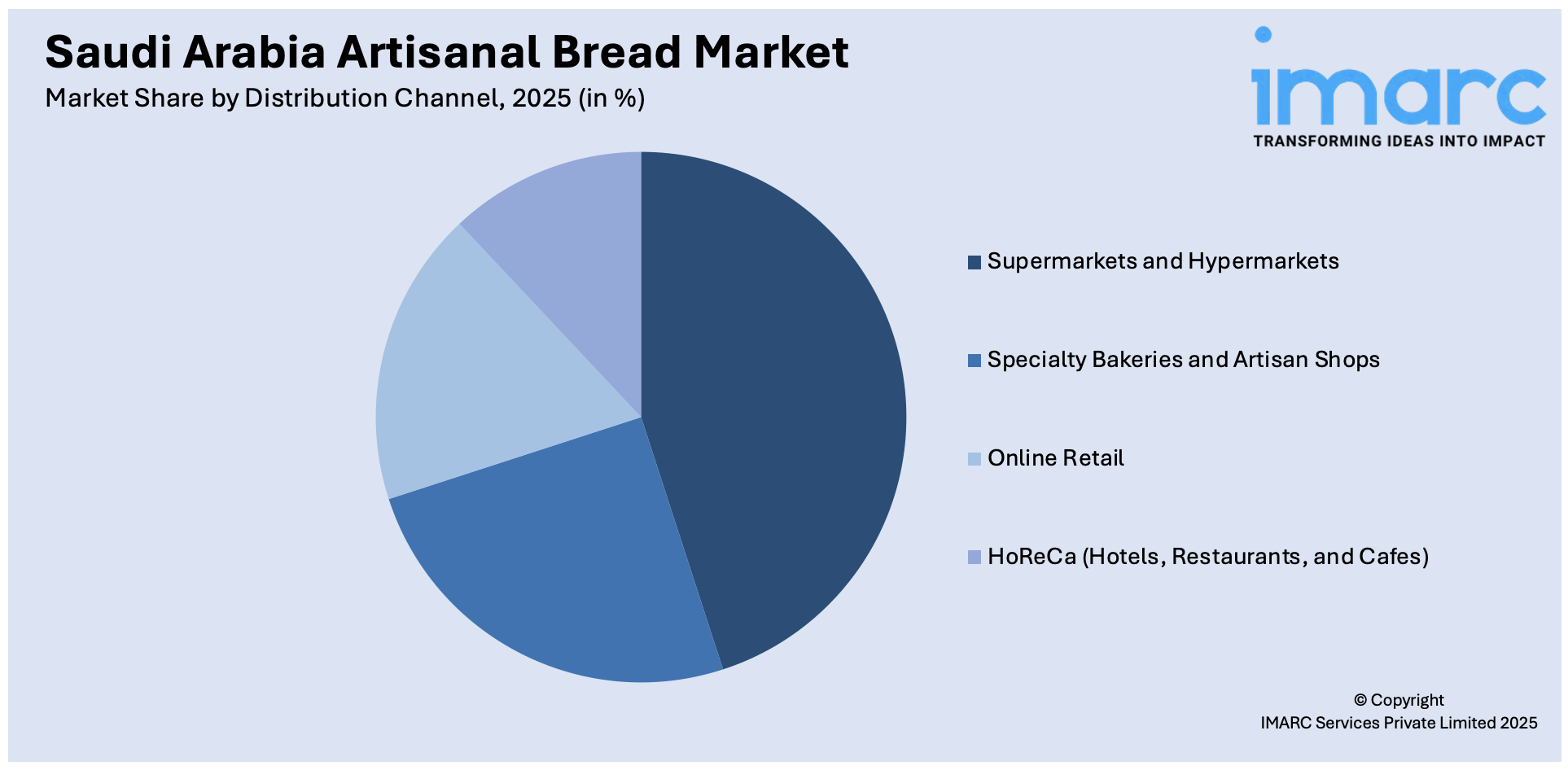

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Bakeries and Artisan Shops

- Online Retail

- HoReCa (Hotels, Restaurants, and Cafes)

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty bakeries and artisan shops, online retail, and HoReCa (hotels, restaurants, and cafes).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Artisanal Bread Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sourdough Bread, Baguettes and Ciabatta, Multigrain and Whole Wheat Bread, Gluten-Free Bread, Others |

| Ingredients Covered | Organic Flour-Based Breads, Grain and Seed Mix Breads, Dairy-Free and Vegan Options |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Bakeries and Artisan Shops, Online Retail, HoReCa (Hotels, Restaurants, and Cafes) |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia artisanal bread market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia artisanal bread market on the basis of type?

- What is the breakup of the Saudi Arabia artisanal bread market on the basis of ingredients?

- What is the breakup of the Saudi Arabia artisanal bread market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia artisanal bread market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia artisanal bread market?

- What are the key driving factors and challenges in the Saudi Arabia artisanal bread market?

- What is the structure of the Saudi Arabia artisanal bread market and who are the key players?

- What is the degree of competition in the Saudi Arabia artisanal bread market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia artisanal bread market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia artisanal bread market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia artisanal bread industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)