Saudi Arabia Automated Assembly Line Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Automated Assembly Line Market Overview:

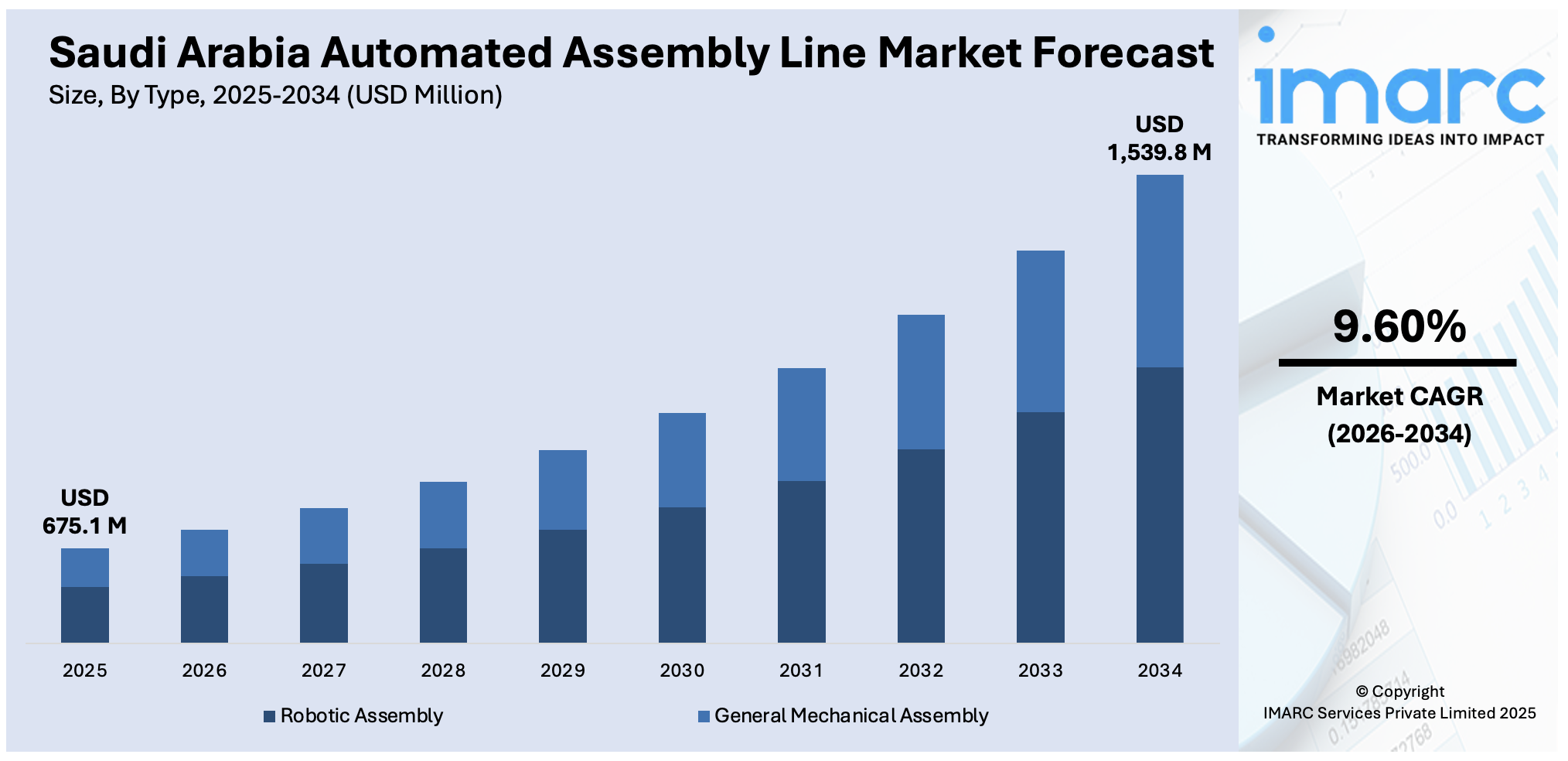

The Saudi Arabia automated assembly line market size reached USD 675.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,539.8 Million by 2034, exhibiting a growth rate (CAGR) of 9.60% during 2026-2034. Governmental support for industrial diversification is driving the market, with tremendous investments being made in the modernization of the manufacturing sector. In addition, labor market inefficiencies and the requirement for a skilled workforce are driving the use of automated assembly lines to enhance productivity. Further, the increasing requirement for high-quality, low-cost production in different industries is driving automation further. These factors together are jointly augmenting the Saudi Arabia automated assembly line market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 675.1 Million |

| Market Forecast in 2034 | USD 1,539.8 Million |

| Market Growth Rate 2026-2034 | 9.60% |

Saudi Arabia Automated Assembly Line Market Trends:

Government Support for Industrial Diversification

Saudi Arabia’s Vision 2030 initiative aims to diversify the economy and reduce its reliance on oil exports by promoting non-oil sectors such as manufacturing, technology, and automation. The government’s commitment to fostering a modern, high-tech manufacturing base has led to significant investments in automation technologies, including automated assembly lines. As part of Vision 2030, there are ongoing efforts to modernize industrial facilities, enhance productivity, and introduce advanced manufacturing techniques across various sectors, such as automotive, electronics, and consumer goods. On September 27, 2023, Lucid Group made history by opening Saudi Arabia's first-ever car manufacturing facility in King Abdullah Economic City (KAEC), Jeddah. The AMP-2 facility will initially automate the assembly of 5,000 Lucid Air electric vehicles annually, with plans to increase production to 155,000 vehicles per year. This strategic move supports Saudi Arabia's Vision 2030 goals by creating jobs for local talent, expanding the domestic supply chain. This support from the government, in the form of incentives and investment, is a key factor driving the expansion of automated assembly lines in the region. Furthermore, Saudi Arabia’s government has been pushing for the development of smart manufacturing hubs and industrial parks to attract foreign direct investment (FDI). These initiatives aim to position Saudi Arabia as a regional leader in advanced manufacturing, with automated assembly lines playing a central role. This policy-driven emphasis on technological advancement and industrial diversification is contributing significantly to Saudi Arabia automated assembly line market growth.

To get more information on this market Request Sample

Growing Demand for High-Quality, Cost-Effective Production

Saudi Arabia’s manufacturing sector has been evolving to meet the increasing demand for high-quality products at competitive prices. In industries such as automotive, electronics, and consumer goods, there is growing pressure to meet global quality standards while reducing production costs. Automated assembly lines offer an efficient solution by streamlining production processes, reducing the chances of human error, and ensuring consistent product quality. Furthermore, automation reduces labor costs, minimizes waste, and enhances overall production speed, making it an attractive option for manufacturers looking to stay competitive in the global market. The rise of e-commerce and consumer demand for quick turnaround times has further driven the need for automated production. The ability to scale production without compromising on quality or increasing operational costs has become a priority for many manufacturers. As businesses in Saudi Arabia strive to meet these demands while maintaining cost-effectiveness, automated assembly lines have become a critical component in the country’s manufacturing landscape. The integration of automation into production processes is a crucial factor in the expansion of the market. On February 20, 2024, Alat, a company established by the Saudi Crown Prince, formed a strategic partnership with SoftBank Group to create a next-generation industrial automation business in Saudi Arabia. The joint venture will manufacture industrial robots designed for various industrial assembly processes, with an investment of up to USD 150 million to build an automated manufacturing hub in Riyadh, scheduled to open in December 2024. This collaboration aims to transform assembly lines in the Kingdom and globally, enhancing manufacturing capabilities and supply chains.

Saudi Arabia Automated Assembly Line Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Robotic Assembly

- General Mechanical Assembly

The report has provided a detailed breakup and analysis of the market based on the type. This includes robotic assembly and general mechanical assembly.

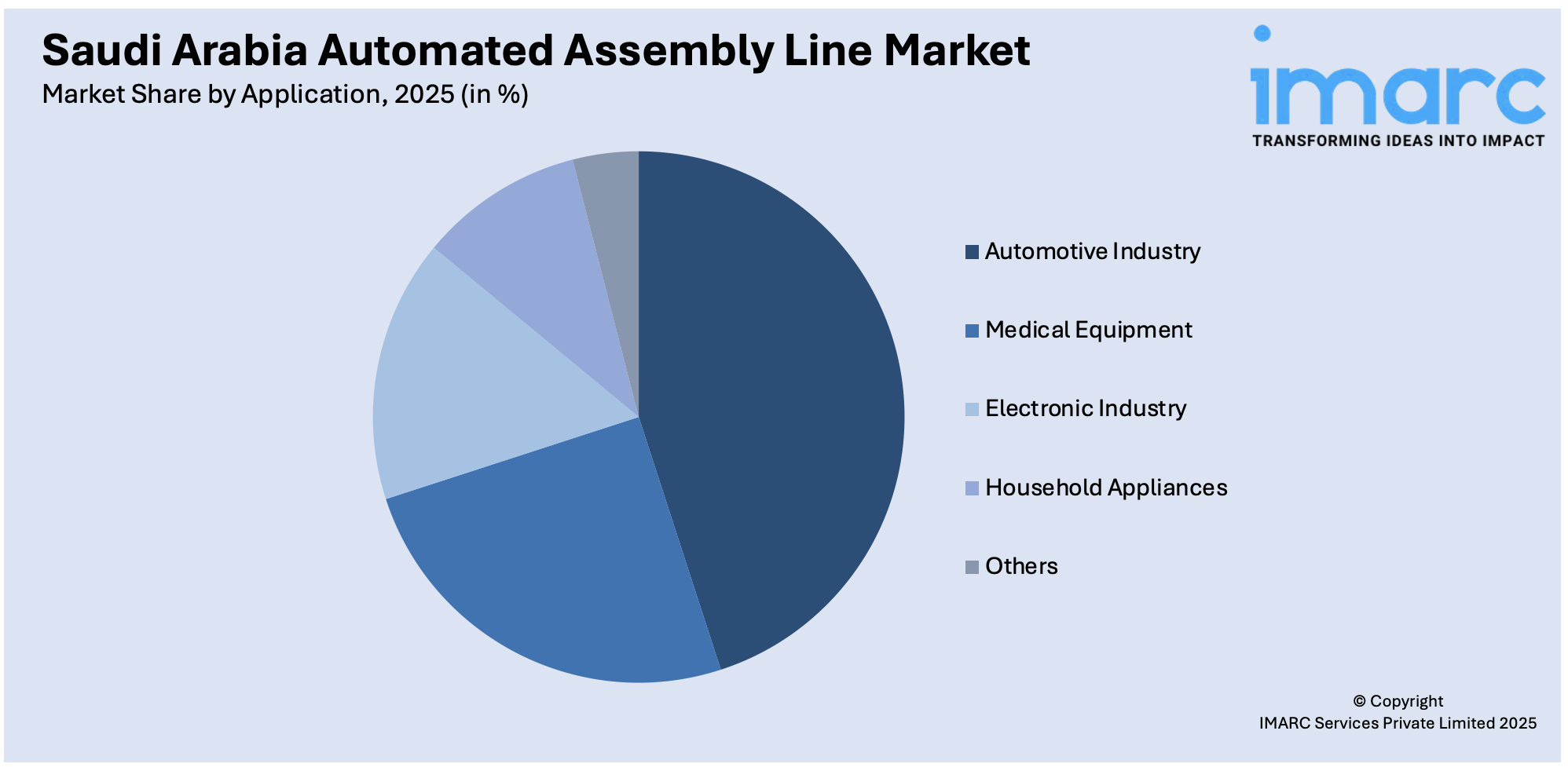

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive Industry

- Medical Equipment

- Electronic Industry

- Household Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive industry, medical equipment, electronic industry, household appliances, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Automated Assembly Line Market News:

- On May 12, 2025, Honeywell unveiled a new gas detector assembly line at the Masdar Innovation Centre in Abu Dhabi, reinforcing its global manufacturing footprint and advancing automation in industrial sectors. This new line strengthens Honeywell’s commitment to localizing production, building long-term capabilities, and accelerating the transfer of advanced manufacturing technologies, aligning with the UAE’s industrial objectives.

Saudi Arabia Automated Assembly Line Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Robotic Assembly, General Mechanical Assembly |

| Applications Covered | Automotive Industry, Medical Equipment, Electronic Industry, Household Appliances, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia automated assembly line market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia automated assembly line market on the basis of type?

- What is the breakup of the Saudi Arabia automated assembly line market on the basis of application?

- What is the breakup of the Saudi Arabia automated assembly line market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia automated assembly line market?

- What are the key driving factors and challenges in the Saudi Arabia automated assembly line market?

- What is the structure of the Saudi Arabia automated assembly line market and who are the key players?

- What is the degree of competition in the Saudi Arabia automated assembly line market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia automated assembly line market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia automated assembly line market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia automated assembly line industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)