Saudi Arabia Automotive Software Market Size, Share, Trends and Forecast by Product, Vehicle Type, Application, and Region, 2026-2034

Saudi Arabia Automotive Software Market Overview:

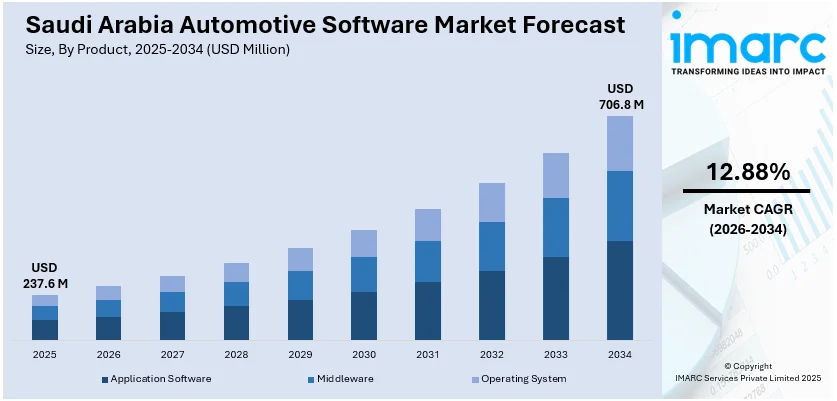

The Saudi Arabia automotive software market size reached USD 237.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 706.8 Million by 2034, exhibiting a growth rate (CAGR) of 12.88% during 2026-2034. The growing adoption of advanced driver assistance systems (ADAS) in cars, rising demand for connected vehicles and sophisticated in-vehicle infotainment systems, and increasing focus on diversification away from oil and prioritizing technological development, such as digital infrastructure and smart transport networks are expanding the Saudi Arabia automotive software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 237.6 Million |

| Market Forecast in 2034 | USD 706.8 Million |

| Market Growth Rate 2026-2034 | 12.88% |

Saudi Arabia Automotive Software Market Trends:

Increasing Integration of Advanced Driver Assistance Systems (ADAS)

The heightened adoption of advanced driver assistance systems (ADAS) in cars is positively influencing the market. Car manufacturers and technology companies are increasingly implementing ADAS features like adaptive cruise control, lane departure warning, automatic emergency braking, and parking aid systems to enhance driving safety and convenience. This is in line with the Vision 2030 ambitions of the Kingdom, where road safety is prioritized, and smart mobility solutions are embraced. Car manufacturers are also reacting to increasing user demand for smart and semi-autonomous vehicles, which is facilitating the development of embedded software. Regulatory agencies are also increasingly urging the integration of safety aspects through favorable policies and standards. Moreover, vehicle manufacturers are integrating automotive sensors to improve the vehicle’s performance. The IMARC Group predicts that the Saudi Arabia automotive sensors market size is expected to reach USD 446.4 Million by 2033.

To get more information on this market Request Sample

High Requirement for Connected Vehicles and Infotainment Solutions

The market is experiencing robust growth due to the rising need for connected vehicles and sophisticated in-vehicle infotainment systems. Individuals in Saudi Arabia are increasingly valuing digital experiences, prompting automakers to enhance connectivity features like over-the-air (OTA) updates, real-time navigation, voice recognition, smartphone integration, and internet-enabled services. This demand is driving continuous investment in software platforms that support seamless communication between the vehicle, driver, and cloud-based services. Automakers are partnering with telecom providers and software vendors to develop robust ecosystems capable of handling vast data flows and ensuring cybersecurity. The shift toward 5G infrastructure and Internet of Things (IoT)-enabled mobility is further accelerating the adoption of advanced infotainment systems. These technologies are also used to collect telematics data, enhancing fleet management capabilities in commercial sectors. Thus, the growing expectation for connected services is motivating the automotive sector to evolve into a software-centric environment across the Kingdom. In 2024, General Motors launched OnStar in Saudi Arabia, providing the kingdom a push towards a connected future of mobility.

Government Support for Automotive Digitalization and Smart Mobility

The government of Saudi Arabia is playing an essential role in driving the market by supporting digital transformation and smart mobility programs. In its Vision 2030 vision, the government is urging diversification from oil and prioritizing technological development, such as digital infrastructure and smart transport networks. Regulators are investing in building intelligent transport systems (ITS), autonomous testing grounds, and electric vehicle (EVs) networks, all of which call for sophisticated software platforms to implement and operate. Public-private partnerships and incentives are being established to spur research and development (R&D) in automotive electronics and software solutions. Moreover, national projects, such as NEOM and The Line are serving as innovation centers that are drawing international tech companies to work together on future mobility solutions, thereby propelling the Saudi Arabia automotive software market growth. In 2024, Saudi Arabia's Ministry of Transport and Logistics made a major leap in its digital transformation with the opening of a new Digitalization and Technical Processing Center, along with the launch of the Unified Documents and Records Platform.

Saudi Arabia Automotive Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, vehicle type, and application.

Product Insights:

- Application Software

- Middleware

- Operating System

The report has provided a detailed breakup and analysis of the market based on the product. This includes application software, middleware, and operating system.

Vehicle Type Insights:

- ICE Passenger Vehicle

- ICE Light Commercial Vehicle

- ICE Heavy Commercial Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Autonomous Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes ICE passenger vehicle, ICE light commercial vehicle, ICE heavy commercial vehicle, battery electric vehicle, hybrid electric vehicle, plug-in hybrid electric vehicle, and autonomous vehicles.

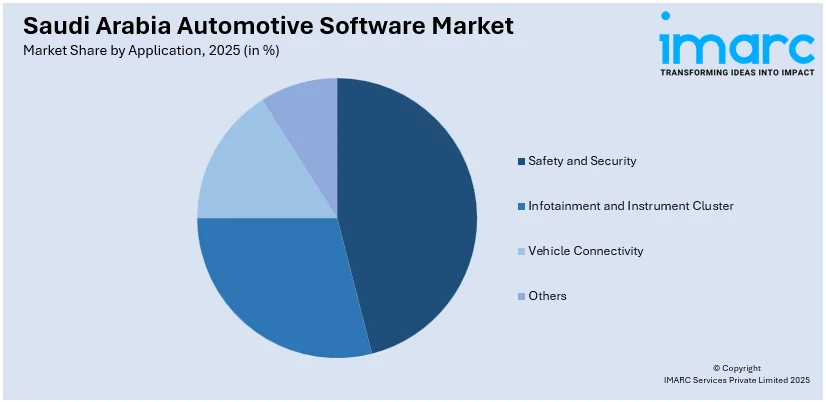

Application Insights:

Access the comprehensive market breakdown Request Sample

- Safety and Security

- Infotainment and Instrument Cluster

- Vehicle Connectivity

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes safety and security, infotainment and instrument cluster, vehicle connectivity, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Automotive Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Application Software, Middleware, Operating System |

| Vehicle Types Covered | ICE Passenger Vehicle, ICE Light Commercial Vehicle, ICE Heavy Commercial Vehicle, Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Autonomous Vehicles |

| Applications Covered | Safety and Security, Infotainment and Instrument Cluster, Vehicle Connectivity, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia automotive software market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia automotive software market on the basis of product?

- What is the breakup of the Saudi Arabia automotive software market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia automotive software market on the basis of application?

- What is the breakup of the Saudi Arabia automotive software market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia automotive software market?

- What are the key driving factors and challenges in the Saudi Arabia automotive software?

- What is the structure of the Saudi Arabia automotive software market and who are the key players?

- What is the degree of competition in the Saudi Arabia automotive software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia automotive software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia automotive software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia automotive software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)