Saudi Arabia Aviation Fuel Market Size, Share, Trends and Forecast by Fuel Type, Aircraft Type, End Use, and Region, 2026-2034

Saudi Arabia Aviation Fuel Market Summary:

The Saudi Arabia aviation fuel market size was valued at USD 3,461.09 Million in 2025 and is projected to reach USD 9,746.99 Million by 2034, growing at a compound annual growth rate of 12.19% from 2026-2034.

The Saudi Arabia aviation fuel market is experiencing robust expansion, driven by the Kingdom's ambitious Vision 2030 aviation strategy, which aims to transform the country into a global aviation hub. Increasing air passenger traffic, rapid expansion of domestic and international airline networks, and substantial infrastructure investments in airport development are propelling fuel consumption. The growing religious tourism sector, fleet modernization initiatives by national carriers, and the strategic geographic positioning of Saudi Arabia as a transit point between Asia, Europe, and Africa are collectively strengthening the market share.

Key Takeaways and Insights:

-

By Fuel Type: Aviation turbine fuel (ATF) dominates the market with a share of 83% in 2025, owing to its widespread utilization by commercial airlines and cargo carriers operating across the Kingdom's extensive airport network. The fuel's compliance with international aviation standards and reliable performance under diverse operating conditions reinforce its market leadership.

-

By Aircraft Type: Fixed wing leads the market with a share of 79% in 2025, driven by the dominance of commercial passenger jets and cargo aircraft in Saudi Arabia's aviation ecosystem. Fleet expansion by national carriers and increasing international route connectivity sustain strong demand for conventional turbine-powered aircraft.

-

By End Use: Commercial represents the largest segment with a market share of 72% in 2025, reflecting the substantial volume of passenger and freight operations by Saudi airlines. Religious tourism traffic, growing leisure travel, and expanding business aviation services drive consistent fuel consumption across commercial applications.

-

By Region: Eastern Region comprises the largest region with 35% share in 2025, driven by the concentration of industrial and oil sector activities around Dammam and the strategic importance of King Fahd International Airport as a key logistics and aviation hub serving the petroleum industry cluster.

-

Key Players: Key players drive the Saudi Arabia aviation fuel market by expanding refining capacities, investing in sustainable fuel technologies, and strengthening strategic partnerships with airlines. Their focus on operational efficiency, fuel quality standards, and distribution network optimization ensures reliable supply across the Kingdom's expanding airport infrastructure.

The Saudi Arabia aviation fuel market is propelled by transformative developments in the Kingdom's aviation sector, underpinned by significant government investments and strategic policy frameworks. The aviation industry contributes substantially to national gross domestic product (GDP) while supporting extensive employment across related sectors, including logistics, tourism, and hospitality. Increasing air passenger volumes, driven by both domestic travel growth and expanding international connectivity, generate sustained demand for aviation fuel supplies. According to the General Authority of Civil Aviation, Saudi airports received 103.1 Million travelers from January to September 2025, reflecting a 9% rise in comparison to the same timeframe in 2024. The ambitious target of handling 330 Million passengers annually by 2030 necessitates proportional growth in fuel infrastructure and supply capabilities, positioning the aviation fuel market for continued expansion aligned with broader national development objectives.

Saudi Arabia Aviation Fuel Market Trends:

Accelerating Adoption of Sustainable Aviation Fuels (SAFs)

The Saudi Arabia aviation fuel market is witnessing growing momentum towards SAF integration as part of broader decarbonization strategies aligned with Vision 2030. Airlines and airports are gradually integrating SAF blends to reduce lifecycle carbon emissions while maintaining operational performance. This shift encourages investments in alternative fuel production, blending infrastructure, and supply chains within the Kingdom. Growing emphasis on sustainability strengthens long-term fuel demand, supports innovations in refining capabilities, and positions Saudi Arabia as an emerging hub for next-generation aviation fuels.

Digital Transformation in Fuel Management Systems

The market is experiencing a significant shift towards digitalization and advanced fuel management technologies to optimize consumption and enhance operational efficiency. Airlines and airport operators are implementing smart monitoring systems, predictive analytics, and automated fuel planning solutions to reduce costs and minimize wastage. As per IMARC Group, the Saudi Arabia predictive analytics market size reached USD 216.2 Million in 2025. These technological innovations enable real-time tracking of fuel inventories, automated procurement processes, and data-driven decision-making that improves overall fuel supply chain efficiency across Saudi Arabia's expanding network of aviation facilities.

Strategic Infrastructure Expansion Across Airport Network

The Kingdom is undertaking massive infrastructure development to support its aviation sector growth, with substantial investments in fuel storage, distribution networks, and airport refueling facilities. New airports at NEOM and the Red Sea region are being constructed with integrated fuel infrastructure designed for both conventional and SAFs. King Salman International Airport will feature advanced fuel storage and supply systems capable of supporting 100-120 Million passengers annually upon its completion by 2030, significantly expanding the Kingdom's fuel distribution capabilities.

Market Outlook 2026-2034:

The Saudi Arabia aviation fuel market outlook remains strongly positive, underpinned by the Kingdom's commitment to establishing itself as a premier global aviation hub. Continued expansion of airline fleets, new route development, and increasing tourist arrivals will sustain fuel demand growth throughout the forecast period. The market generated a revenue of USD 3,461.09 Million in 2025 and is projected to reach a revenue of USD 9,746.99 Million by 2034, growing at a compound annual growth rate of 12.19% from 2026-2034. Major sporting events, including the 2034 FIFA World Cup, and sustained religious tourism will create additional demand peaks requiring robust fuel supply infrastructure.

Saudi Arabia Aviation Fuel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Fuel Type |

Aviation Turbine Fuel (ATF) |

83% |

|

Aircraft Type |

Fixed Wing |

79% |

|

End Use |

Commercial |

72% |

|

Region |

Eastern Region |

35% |

Fuel Type Insights:

- Aviation Turbine Fuel (ATF)

- Avgas

- Sustainable Aviation Fuel (SAF)

Aviation turbine fuel (ATF) dominates with a market share of 83% of the total Saudi Arabia aviation fuel market in 2025.

Aviation turbine fuel serves as the primary energy source powering commercial aviation operations across Saudi Arabia's extensive airport network. The fuel's standardized specifications ensure compatibility with diverse aircraft types while meeting stringent international safety and performance requirements. Major airports, including King Khalid International Airport in Riyadh, King Abdulaziz International Airport in Jeddah, and King Fahd International Airport in Dammam, maintain substantial ATF reserves to support continuous flight operations.

The dominance of aviation turbine fuel is reinforced by the operational requirements of Saudi Arabia's expanding fleet of commercial aircraft. In May 2024, Saudia Group announced an order for 105 A320neo family aircraft, with deliveries commencing from first quarter of 2026. These modern aircraft are designed for optimal performance with conventional jet fuel, ensuring sustained ATF demand, as airlines expand their capacity to meet growing passenger volumes across domestic and international routes.

Aircraft Type Insights:

- Fixed Wing

- Rotary Wing

Fixed wing leads with a share of 79% of the total Saudi Arabia aviation fuel market in 2025.

Fixed wing aircraft constitute the backbone of Saudi Arabia's aviation sector, encompassing commercial passenger jets, cargo freighters, and business aviation platforms. These aircraft consume the majority of aviation fuel due to their larger fuel tank capacities and extended operational ranges compared to rotary-wing alternatives. The Kingdom's strategic position as a connecting hub between continents drives substantial demand for wide-body and narrow-body jet aircraft capable of serving long-haul international routes.

Fleet modernization programs and continuous route expansion are further strengthening fuel consumption from fixed wing aircraft. Airlines are increasing flight frequencies and adding new international and regional destinations to meet rising passenger and cargo demand. Fixed wing platforms also support the growing air cargo sector, operating longer flight hours and higher payload capacities. Additionally, expansion of business and private aviation for corporate travel contributes to consistent fuel usage. Together, these operational dynamics reinforce fixed wing aircraft as the primary driver of aviation fuel demand across Saudi Arabia’s aviation ecosystem.

End Use Insights:

- Commercial

- Military

- Others

Commercial exhibits a clear dominance with a 72% share of the total Saudi Arabia aviation fuel market in 2025.

Commercial aviation encompasses passenger airlines, charter services, and cargo operations that collectively drive the majority of fuel consumption in Saudi Arabia. The sector benefits from rising domestic travel demand, expanding international route networks, and the Kingdom's growing prominence as a tourism destination. Religious tourism remains a cornerstone of commercial aviation activity, with Hajj and Umrah pilgrimage traffic generating significant seasonal demand spikes requiring robust fuel supply capabilities. In 2024, over 1.83 Million pilgrims completed Hajj, according to Saudi Arabia’s General Authority for Statistics.

Commercial aviation fuel demand is supported by year-round business travel, leisure tourism, and expanding cargo operations. Airlines are increasing fleet sizes and aircraft utilization rates to serve growing passenger volumes and time-sensitive freight. Development of airport hubs and improved connectivity encourages higher flight frequencies and longer routes, increasing fuel uplift volumes. In addition, growth of low-cost carriers is stimulating air travel accessibility, further expanding overall commercial flight activities and reinforcing the sector’s dominant contribution to aviation fuel consumption.

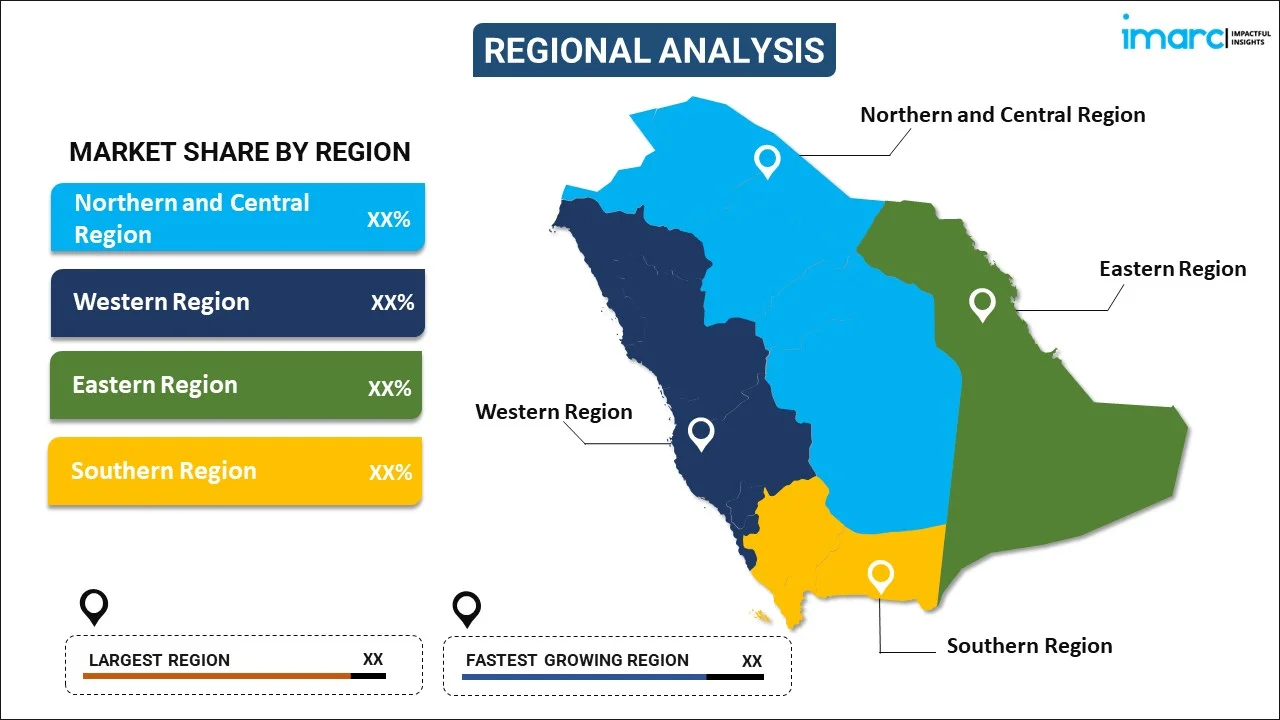

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Eastern Region represents the leading segment with a 35% share of the total Saudi Arabia aviation fuel market in 2025.

The Eastern Region leads the Saudi Arabia aviation fuel market due to its strong concentration of refining capacity, energy infrastructure, and major fuel storage facilities. The region hosts key petroleum processing and distribution hubs that ensure reliable production and supply of aviation fuel to domestic and international markets. Proximity to crude oil resources enables efficient refining operations, cost advantages, and consistent fuel availability, supporting high-volume aviation fuel distribution across the Kingdom.

Additionally, the Eastern Region benefits from high air traffic, well-developed logistics networks, and access to major ports along the Arabian Gulf. In 2024, King Fahd International Airport handled 12 million passengers, representing a 15% increase from 2023. Its established pipeline systems and storage terminals support seamless delivery to airports and military aviation facilities. The presence of industrial cities and strong linkages with the broader energy value chain further reinforce the Eastern Region’s leadership in the Saudi Arabia aviation fuel market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Aviation Fuel Market Growing?

Expansion of Air Passenger Traffic and Tourism Activities

The expansion of air passenger traffic is a primary driver of the Saudi Arabia aviation fuel market as domestic and international travel demand continues to rise. Air Transport Statistics 2024 indicated a notable rise in passenger traffic at Saudi Arabia's airports, with total passengers surpassing 128 Million, marking a 15% growth from 2023. International flight travelers at the Kingdom’s airports totaled 69 Million, reflecting a 14% rise from 2023. Growth in leisure, religious, and business travel is increasing flight frequencies across major airports. Airlines are expanding routes and increasing aircraft utilization to accommodate rising passenger volumes, directly boosting aviation fuel consumption. Seasonal peaks linked to pilgrimage travel further intensify demand, requiring sustained fuel supply readiness. Low-cost carriers and fleet expansion strategies are also increasing overall flight movements within the Kingdom. Improved airport infrastructure and passenger handling capacity support higher aircraft turnaround rates, reinforcing fuel usage. As air connectivity improves between Saudi Arabia and global destinations, long-haul flights contribute to higher fuel burn per trip. This sustained increase in passenger traffic positions aviation fuel as a critical enabler of the Kingdom’s growing aviation ecosystem.

Growth of Airport Infrastructure and Airline Fleet Expansion

Significant investments in airport infrastructure and airline fleet expansion are driving steady growth in the Saudi Arabia aviation fuel market. New terminals, expanded runways, and upgraded ground handling facilities are enabling higher aircraft movements and larger aircraft operations. National and regional airlines are adding new aircraft to modernize fleets and support network expansion. Larger and more fuel-intensive widebody aircraft increase overall fuel demand, even as efficiency improves per seat. Expansion of cargo handling facilities also contributes to higher jet fuel consumption from dedicated freighter operations. Improved airport capacity reduces congestion, allowing more flights and optimized schedules. As airlines scale operations to meet rising demand, consistent and reliable aviation fuel supply becomes essential. These infrastructure and fleet investments collectively support long-term growth in aviation activity, directly strengthening demand for aviation fuel across Saudi Arabia.

Rising Air Cargo and Logistics Activities

The growth of air cargo and logistics activities is an important factor fueling the market expansion in Saudi Arabia. Increasing demand for fast, reliable transportation of high-value and time-sensitive goods is supporting growth in dedicated cargo flights. Expansion of e-commerce, pharmaceuticals, and industrial supply chains is increasing reliance on air freight services. As per IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024. Saudi Arabia’s strategic geographic position supports its role as a regional logistics hub, encouraging higher cargo aircraft movements. Cargo flights typically operate longer hours and higher payloads, contributing to substantial fuel consumption. Development of specialized cargo terminals and free zones further supports this trend. As global and regional trade flows expand, air cargo volumes continue to rise, reinforcing demand for aviation fuel. This growing logistics role strengthens the aviation fuel market beyond passenger travel dependency.

Market Restraints:

What Challenges the Saudi Arabia Aviation Fuel Market is Facing?

Crude Oil Price Volatility

The aviation fuel market faces challenges from fluctuating crude oil prices that directly impact jet fuel production costs and airline operating expenses. Price volatility creates uncertainty for long-term fuel procurement contracts and infrastructure investment planning. Airlines must manage fuel hedging strategies while maintaining competitive ticket pricing, creating operational complexities that can constrain market growth during periods of price instability.

Limited SAF Infrastructure

The development of SAF production and distribution infrastructure remains in nascent stages within Saudi Arabia. High production costs compared to conventional jet fuels, limited feedstock availability, and the absence of dedicated SAF blending facilities at most airports constrain adoption rates. Airlines face challenges sourcing sufficient SAF volumes to meet emerging environmental commitments while maintaining operational economics.

Supply Chain Vulnerabilities

The aviation fuel supply chain remains susceptible to disruptions arising from geopolitical tensions, refinery maintenance requirements, and logistics constraints. Regional instabilities affecting maritime shipping routes or overland transportation can impact fuel availability at airports. Maintaining adequate inventory levels across the Kingdom's dispersed airport network requires substantial coordination between refiners, distributors, and airport operators.

Competitive Landscape:

The Saudi Arabia aviation fuel market features a competitive landscape, characterized by the presence of major integrated energy companies, specialized aviation fuel distributors, and refinery operators serving the Kingdom's airport network. Key market participants leverage extensive refining infrastructure, established distribution networks, and long-term supply agreements with airlines to maintain competitive positions. Strategic partnerships between international oil majors and domestic entities are driving investments in fuel quality enhancement, SAF development, and digital supply chain optimization. Market leaders focus on expanding storage capacities, upgrading airport refueling systems, and ensuring compliance with international aviation fuel specifications to serve the Kingdom's rapidly growing aviation sector.

Recent Developments:

-

In February 2025, Red Sea Global (RSG) and daa International, which manages the Red Sea International Airport (RSI), reached an agreement with Arabian Petroleum Supply Company (APSCO) to introduce SAF at the airport, established in Saudi Arabia. To enhance sustainability in aviation, SAF and lower-carbon aviation fuel (LCAF) were two fuels, specifically designed to decrease greenhouse gas lifecycle emissions related to aviation.

Saudi Arabia Aviation Fuel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Aviation Turbine Fuel (ATF), Avgas, Sustainable Aviation Fuel (SAF) |

| Aircraft Types Covered | Fixed Wings, Rotary Wing |

| End Uses Covered | Commercial, Military, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia aviation fuel market size was valued at USD 3,461.09 Million in 2025.

The Saudi Arabia aviation fuel market is expected to grow at a compound annual growth rate of 12.19% from 2026-2034 to reach USD 9,746.99 Million by 2034.

Aviation turbine fuel (ATF) dominated the market with a share of 83%, driven by its widespread utilization across commercial passenger and cargo operations throughout the Kingdom's airport network.

Key factors driving the Saudi Arabia aviation fuel market include Vision 2030 aviation sector investments, national carrier fleet expansion programs, growing religious tourism and pilgrimage traffic, and strategic infrastructure development across the Kingdom's airport network.

Major challenges include crude oil price volatility affecting production costs, limited SAF infrastructure and high SAF production costs, supply chain vulnerabilities arising from regional geopolitical factors, and the substantial capital requirements for expanding fuel storage and distribution networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)