Saudi Arabia Aviation Market Size, Share, Trends and Forecast by Aircraft Type and Region, 2026-2034

Saudi Arabia Aviation Market Summary:

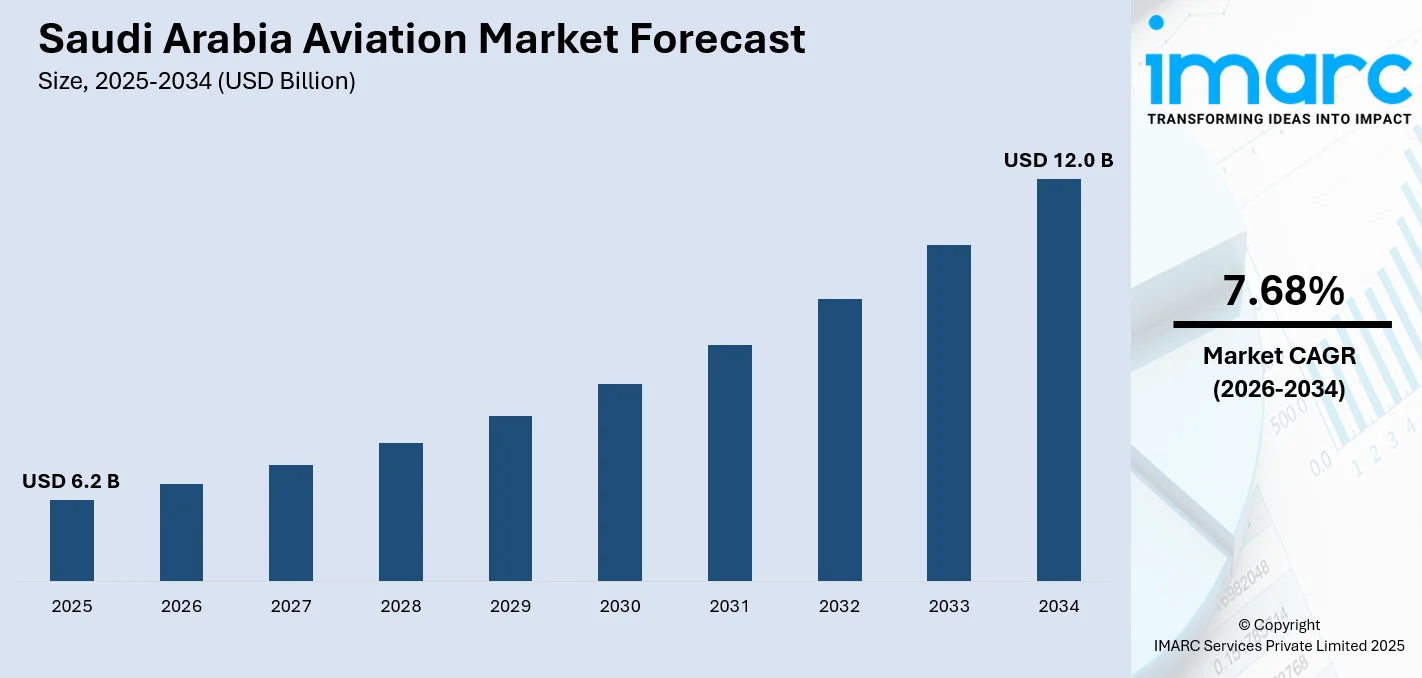

The Saudi Arabia aviation market size was valued at USD 6.2 Billion in 2025 and is projected to reach USD 12.0 Billion by 2034, growing at a compound annual growth rate of 7.68% from 2026-2034.

The Saudi Arabia aviation market is experiencing transformative growth, driven by Vision 2030 strategic initiatives positioning the Kingdom as a global aviation hub. Massive infrastructure investments and ambitious passenger traffic targets are reshaping the sector's trajectory. The launch of new national carriers, expansion of low-cost airlines, and development of mega airport projects are fundamentally altering the competitive landscape. Rising tourism and religious travel demand are creating sustained aviation requirements, while policy-led transformation continues to drive the market share.

Key Takeaways and Insights:

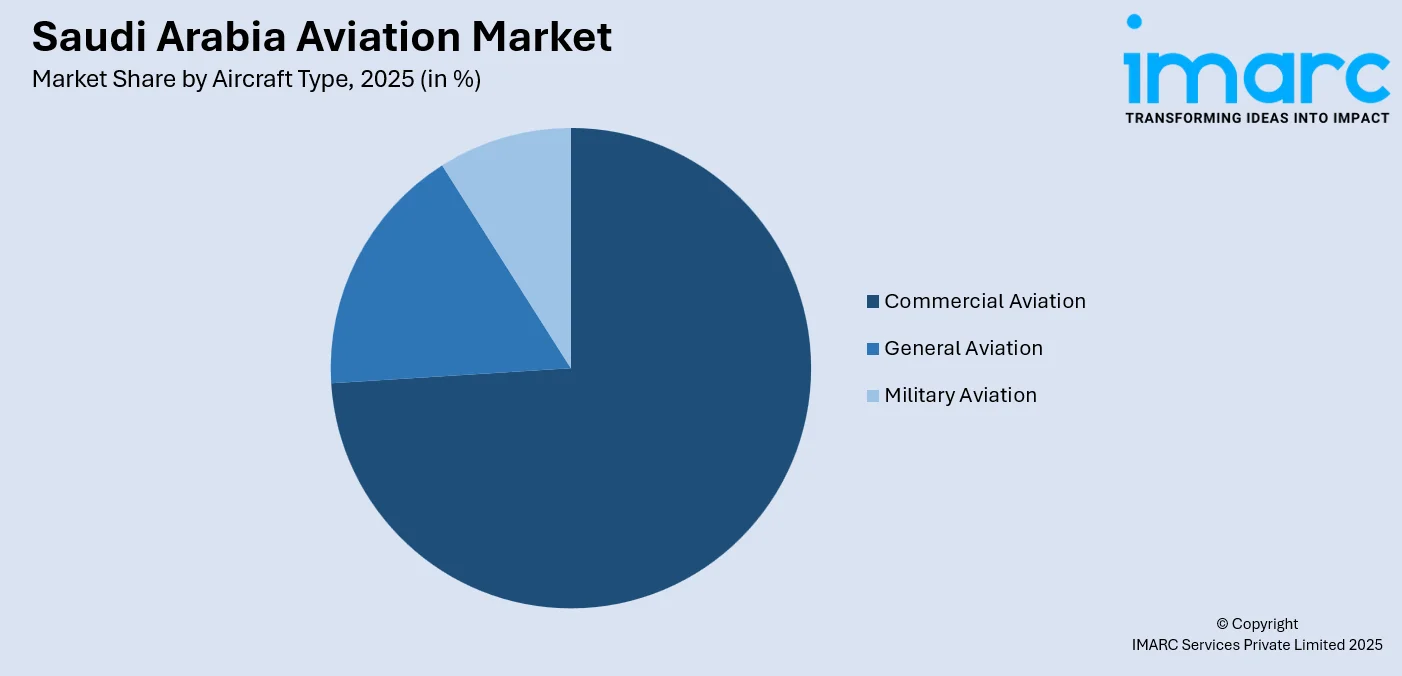

- By Aircraft Type: Commercial aviation dominates the market with a share of 74% in 2025, driven by expanding scheduled airline operations, low-cost carrier growth, and dedicated cargo services. Rising international passenger traffic and fleet modernization initiatives are propelling this segment forward.

- By Region: Northern and Central Region leads the market with a share of 35% in 2025, anchored by the strategic importance of Riyadh as the national capital and primary aviation hub. Ongoing development of airports is reinforcing regional dominance.

- Key Players: Key players drive the Saudi Arabia aviation market by expanding fleet portfolios, enhancing service offerings, and strengthening domestic and international connectivity. Their investments in modern aircraft, technology adoption, and strategic partnerships boost operational efficiency and passenger experience across diverse market segments.

To get more information on this market Request Sample

The Saudi Arabia aviation market is witnessing unprecedented expansion, as the Kingdom implements comprehensive reforms under its national transformation agenda. Government commitment to developing aviation infrastructure has catalyzed significant investments across airports, airlines, and support services. The sector benefits from strategic geographic positioning that enables connectivity between major global markets across Asia, Europe, and Africa. Expanding tourism initiatives encompassing leisure, cultural, and religious travel segments are generating sustained demand for air transport services. Travel and tourism are projected to account for over 10% of Saudi Arabia's GDP by 2025. The introduction of new carriers alongside fleet expansion by established airlines is intensifying competition while improving service accessibility. Digital transformation across booking platforms, passenger processing, and operational management is enhancing efficiency throughout the aviation ecosystem. Workforce development programs are addressing specialized skill requirements while attracting international expertise.

Saudi Arabia Aviation Market Trends:

Digital Transformation and Artificial Intelligence (AI) Integration

The Saudi Arabia aviation market is embracing advanced digital technologies to enhance operational efficiency and passenger experience. Airlines are implementing AI-powered systems for personalized services, real-time decision making, and predictive maintenance. In December 2025, Riyadh Air partnered with IBM to launch as the world's first AI-native airline, embedding intelligent automation across operations from day one. Additionally, airports are adopting smart infrastructure, biometric screening, and integrated digital platforms to streamline check-in, security, and boarding processes while reducing congestion and turnaround times.

Sustainable Aviation Initiatives

Environmental sustainability is gaining prominence within the Saudi Arabia aviation sector as carriers pursue carbon reduction targets aligned with global commitments. Airlines and airports are integrating sustainable aviation fuel (SAF) and advanced efficiency technologies into operations. In February 2025, Red Sea International Airport introduced 35% SAF blends in partnership with Red Sea Global and Arabian Petroleum Supply Company, reducing aircraft emissions by up to 35% per flight.

Tourism-Driven Network Expansion

Growing tourism demand is catalyzing significant route network development as airlines expand connectivity to serve emerging destinations. New mega-projects, including NEOM, AlUla, and the Red Sea development, are generating dedicated aviation infrastructure requirements. International tourist arrivals reached 29.7 Million in 2024, surging from 18.04 Million recorded in 2016, while domestic travelers nearly doubled to 86.2 Million during the same period. Airlines are launching direct services from Europe, Asia, and Africa to capitalize on the Kingdom's rising profile as a leisure and cultural tourism destination.

How Vision 2030 is Transforming the Saudi Arabia Aviation Market:

Vision 2030 is transforming the Saudi Arabia aviation market by positioning the Kingdom as a global connectivity and tourism hub. The strategy prioritizes airport expansion, new airline development, and fleet modernization to support rising passenger volumes and international traffic. Liberalized air policies and private sector participation are attracting foreign airlines, investors, and airport operators. Massive tourism, entertainment, and business travel initiatives are creating sustained demand for domestic and international routes. Cargo aviation is also gaining importance as logistics, e-commerce, and industrial exports expand. Vision 2030 encourages digitalization, smart airports, and sustainability practices to enhance efficiency and passenger experience. Workforce localization programs are building aviation skills across pilots, maintenance, and ground services. Together, these measures are accelerating capacity growth, improving service quality, and strengthening Saudi Arabia’s role as a key gateway.

Market Outlook 2026-2034:

The Saudi Arabia aviation market outlook remains highly positive, as strategic investments and policy initiatives continue to drive sectoral transformation. Airport expansion projects, fleet modernization programs, and new carrier launches are collectively enhancing capacity to accommodate projected passenger growth. The market generated a revenue of USD 6.2 Billion in 2025 and is projected to reach a revenue of USD 12.0 Billion by 2034, growing at a compound annual growth rate of 7.68% from 2026-2034. Growing religious and leisure tourism segments, combined with improving international connectivity, are creating sustained demand drivers. Continued government support, regulatory modernization, and private sector participation are expected to maintain strong growth momentum throughout the forecast period.

Saudi Arabia Aviation Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Aircraft Type |

Commercial Aviation |

74% |

|

Region |

Northern and Central Region |

35% |

Aircraft Type Insights:

Access the comprehensive market breakdown Request Sample

- Commercial Aviation

- General Aviation

- Military Aviation

Commercial aviation dominates with a market share of 74% of the total Saudi Arabia aviation market in 2025.

Commercial aviation leads the Saudi Arabia aviation market due to strong growth in passenger travel driven by tourism, business mobility, and population expansion. Government-backed tourism initiatives, religious travel to Makkah and Madinah, and rising domestic connectivity requirements generate consistent demand for scheduled airline services. Expansion of major airports and the launch of new national and regional carriers support higher flight frequencies and broader route networks. The introduction of Riyadh Air as the Kingdom's new national carrier, which commenced commercial operations in October 2025, is adding significant capacity targeting 100 international destinations by 2030.

The segment also benefits from substantial investments in fleet expansion, airport infrastructure, and aviation services aligned with long-term economic diversification goals. Commercial airlines play a central role in connecting Saudi Arabia with global markets, supporting trade, foreign investment, and workforce mobility. High aircraft utilization rates, established regulatory frameworks, and strong government support enhance operational stability. Compared to private or general aviation, commercial aviation achieves greater economies of scale, higher passenger volumes, and predictable revenue streams, securing its leading position in the Saudi Arabia aviation market.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads the market with a 35% share of the total Saudi Arabia aviation market in 2025.

Northern and Central Region's leadership position is anchored by Riyadh's strategic importance as the national capital, primary business center, and emerging tourism destination. King Khalid International Airport in Riyadh handled 37.6 Million passengers in 2024, establishing it as a critical aviation gateway supporting domestic connectivity and international services. The region benefits from concentrated corporate activity, government operations, and growing entertainment sector development that generates sustained air travel demand across business and leisure segments.

Additionally, major infrastructure investments in airport expansion, digitalization, and passenger handling capacity are strengthening the region’s aviation dominance. Riyadh’s role as a hub for new national carriers and international airlines is expanding route density and frequency, improving connectivity across Asia, Europe, and Africa. The growth of conferences, exhibitions, and mega-events further supports year-round travel demand. Strong road and rail linkages with surrounding cities enhance feeder traffic to Riyadh airports, while rising population and income levels sustain domestic travel, reinforcing the Northern and Central Region’s leadership in the market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Aviation Market Growing?

Vision 2030 Strategic Transformation and Government Support

Vision 2030 is driving a strategic transformation of the Saudi Arabia aviation market by positioning air transport as a core engine of economic diversification and global integration. The national aviation vision focuses on expanding airline capacity, modernizing airports, and strengthening supporting services to enable seamless domestic and international connectivity. Strong government support is evident through consistent policies, regulatory reforms, and long-term planning that reduce investment risk and accelerate project execution. State-backed institutions and sovereign entities are playing an active role in airline development, infrastructure expansion, and ecosystem building. The strategy prioritizes competitiveness, service quality, and operational efficiency while encouraging private sector participation and foreign partnerships. Emphasis is also placed on developing Saudi talent, adopting digital technologies, and improving passenger experience. Collectively, these measures are reshaping the aviation landscape, shifting the Kingdom towards a hub-based model that enhances connectivity, stimulates tourism, supports trade, and strengthens Saudi Arabia’s aviation networks nationwide connectivity.

Rising Tourism and Religious Travel Demand

Tourism expansion is generating substantial aviation demand, as the Kingdom pursues ambitious visitor targets under its national development strategy. Growth in leisure tourism, entertainment destinations, and cultural attractions is increasing inbound and outbound air travel, encouraging airlines to expand route networks and flight frequencies. Religious tourism remains a cornerstone, with 18.5 Million pilgrims performing Hajj and Umrah during 2024, including 16.92 Million international Umrah visitors, representing a 101% increase compared to 2022. Airlines deploy wide-body and narrow-body fleets to manage peak pilgrim flows, while airports invest in dedicated terminals and streamlined processes. Improved visa policies, tourism promotion, and better connectivity are attracting first-time and repeat visitors. This sustained travel demand strengthens revenues for airlines, boosts airport throughput, and justifies ongoing investments in fleet expansion, infrastructure upgrades, and passenger services.

Mega Airport Infrastructure Development

Massive airport expansion projects are significantly strengthening the aviation capacity of Saudi Arabia and reinforcing its position in global air connectivity. Large-scale developments are focused on creating next-generation aviation hubs that integrate passenger terminals with logistics, commercial, and lifestyle infrastructure. The flagship airport development in Riyadh reflects a long-term vision to accommodate future traffic growth while supporting tourism, business travel, and cargo movement. Its master plan emphasizes smart design, operational efficiency, and seamless multimodal connectivity. Parallel investments are underway at major regional airports to expand terminals, upgrade runways, and enhance passenger services. These upgrades aim to reduce congestion, improve turnaround times, and attract more international airlines. New airports serving tourism-focused regions highlight the Kingdom’s commitment to sustainable and innovative infrastructure, incorporating energy-efficient designs and environmentally responsible operations.

Market Restraints:

What Challenges the Saudi Arabia Aviation Market is Facing?

Skilled Workforce and Pilot Shortage

The Saudi Arabia aviation sector is increasingly facing pressures related to lack of qualified personnel, especially in aircrew, technical, and engineering categories, owing to accelerated expansion plans. The growth rate is outpacing training programs, besides which an average workforce is nearing retirement, further pressuring replacement requirements. Worker retention is also a challenge, as international competition for qualified aviation manpower is leading to escalating salary demands.

Aircraft Delivery Delays and Supply Chain Constraints

Delays in delivery of aircraft are limiting the expansion of the fleets operated by carriers in Saudi Arabia. Delays in deliveries have been attributed to global disruption in the aviation supply chain and production backlogs. As a result, airlines are operating older fleets longer, thereby posing higher costs and complexities with regard to their maintenance. Other carriers are opting for leasing services as they await an expansion in capacities.

High Infrastructure and Operational Investment Requirements

Long-term aviation aspirations are costly, creating pressures for operators and developers alike in the capital investment needed for airports, airlines, and supporting infrastructure. Mega airport projects entail extended construction periods with considerable time before returns can be realized, while airlines must engage in very expensive fleet acquisition, technology upgrades, and sustainability initiatives. Increased labor, fuel, and digital systems operation costs add even more challenges to profitability. Capital planning and phase investment are key strategies that balance growth and financial sustainability.

Competitive Landscape:

Key players play a vital role in driving the market by expanding capacity, improving connectivity, and strengthening service quality. National and low-cost airlines are adding new routes, modernizing fleets, and enhancing passenger experience to meet rising travel demand. Airport operators are investing in infrastructure expansion, smart technologies, and operational efficiency to support higher traffic volumes. Government entities and sovereign-backed institutions provide strategic direction, funding support, and regulatory stability that encourage long-term investment. Aviation service providers, including maintenance, ground handling, and training organizations, are strengthening the supporting ecosystem. Partnerships with global aircraft manufacturers, technology firms, and international airlines enable knowledge transfer and innovation adoption.

Recent Developments:

- In January 2026, Flyadeal introduced five new routes from Madinah, representing a major expansion from its latest operational base and increasing weekly capacity by 40% at the airport in the holy city. The New Year expansion added new services to Istanbul Sabiha Gökçen along with four domestic routes to Abha, Al Hofuf, Jazan, and Tabuk.

- In December 2025, Saudi Arabia was set to introduce three new airlines to cater to its ‘giga-project’ locations, including NEOM and Qiddiya, as part of its Vision 2030 initiative aimed at drawing 150 Million visitors each year. One will be a low-cost airline headquartered in Dammam, a coastal city on the Arabian Gulf. Based at King Fahd International Airport (DMM), the currently unnamed airline plans to operate flights to 24 domestic and 57 international locations by 2030, transporting 10 Million passengers with a fleet of 45 aircraft.

Saudi Arabia Aviation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Commercial Aviation, General Aviation, Military Aviation |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia aviation market size was valued at USD 6.2 Billion in 2025.

The Saudi Arabia aviation market is expected to grow at a compound annual growth rate of 7.68% from 2026-2034 to reach USD 12.0 Billion by 2034.

Commercial aviation dominated the market with a share of 74%, driven by expanding scheduled airline operations, low-cost carrier growth, fleet modernization initiatives, and rising domestic and international passenger traffic.

Key factors driving the Saudi Arabia aviation market include Vision 2030 strategic initiatives positioning the Kingdom as a global aviation hub, massive infrastructure investments in airport expansion, rising tourism and religious travel demand, and new carrier launches enhancing connectivity.

Major challenges include skilled workforce and pilot shortages affecting operational expansion, aircraft delivery delays due to global manufacturing bottlenecks, high infrastructure investment requirements, supply chain constraints, and competitive pressure from established regional aviation hubs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)