Saudi Arabia Baby Apparel Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Application, End User, and Region, 2026-2034

Saudi Arabia Baby Apparel Market Summary:

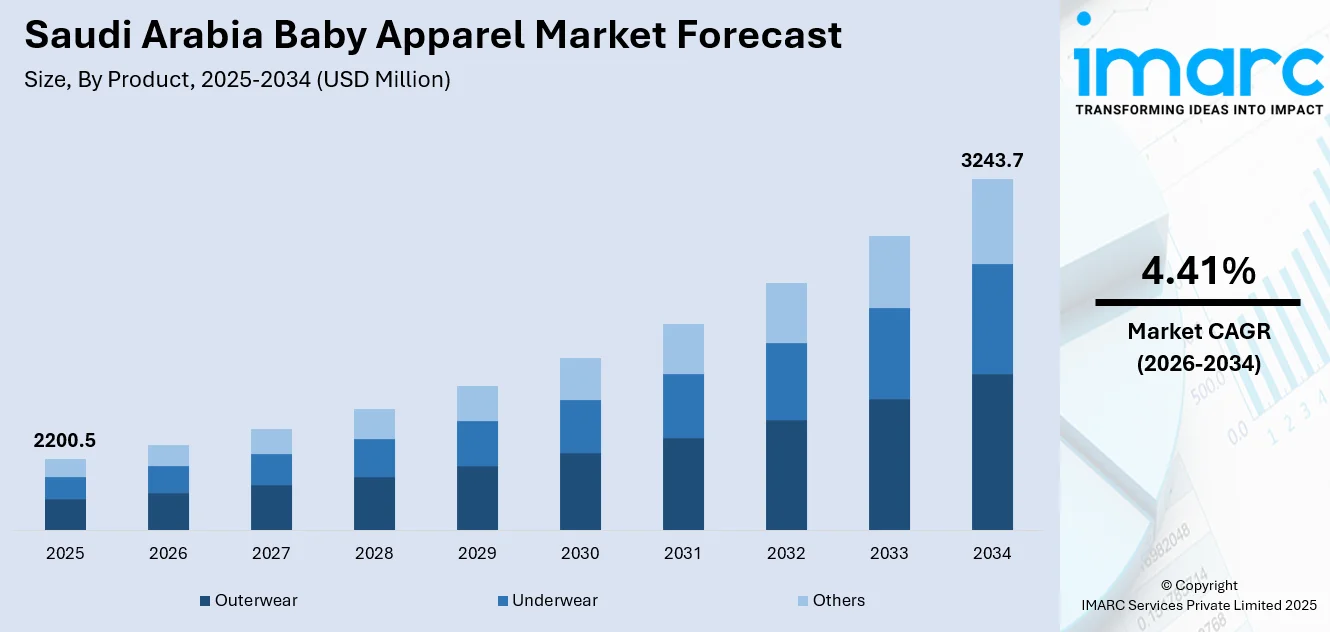

The Saudi Arabia baby apparel market size was valued at USD 2,200.5 Million in 2025 and is projected to reach USD 3,243.7 Million by 2034, growing at a compound annual growth rate of 4.41% from 2026-2034.

The Saudi Arabia baby apparel market is experiencing stable growth driven by favorable demographic patterns, rising household incomes, and evolving consumer preferences toward premium baby clothing. The market benefits from a youthful population structure and cultural emphasis on children's appearance that encourages spending on quality infant attire. Increasing urbanization across major cities has fostered greater exposure to international fashion trends, prompting parents to seek stylish and comfortable options for their children. The expanding retail infrastructure, including modern shopping malls and specialty stores, has improved product accessibility while e-commerce platforms have enhanced convenience for time-constrained families navigating the Saudi Arabia baby apparel market share.

Key Takeaways and Insights:

- By Product: Outerwear dominates the market with a share of 42% in 2025, owing to its versatility for protecting infants from varying climate conditions, suitability for both casual and formal occasions, and parental preference for layered dressing options that ensure comfort and style.

- By Material: Cotton leads the market with a share of 60% in 2025. This dominance is driven by cotton's natural breathability, hypoallergenic properties, and softness that suits sensitive baby skin, alongside increasing parental awareness regarding fabric safety and comfort.

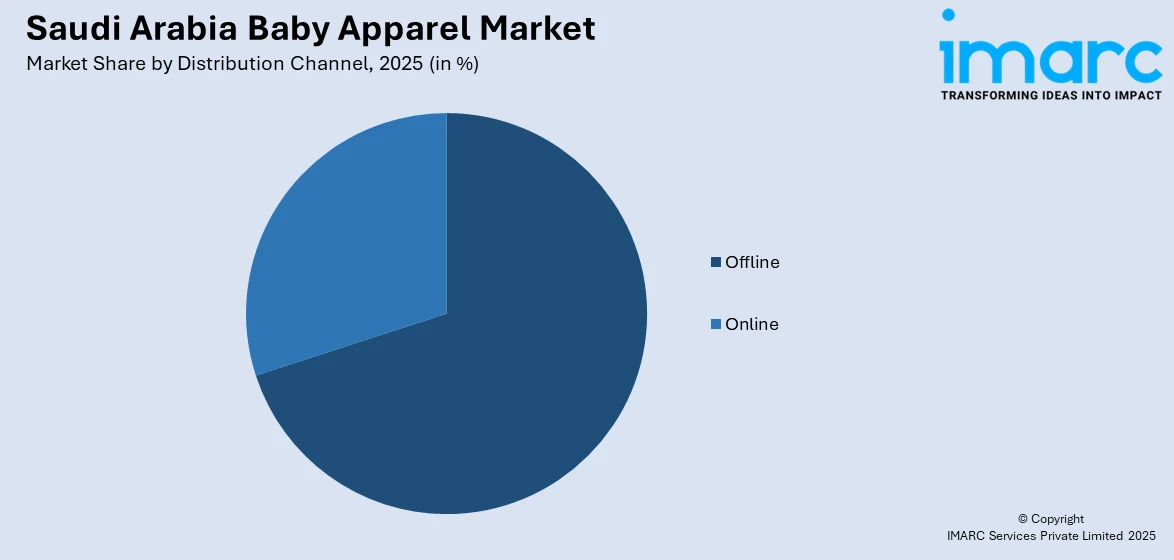

- By Distribution Channel: Offline exhibits a clear dominance in the market with 73% share in 2025, reflecting strong consumer preference for physical examination of baby clothing quality, sizing accuracy, and fabric feel before purchase across Saudi Arabia's expanding retail infrastructure.

- By Application: 0-12 months represents the biggest segment with a market share of 48% in 2025, driven by the higher frequency of clothing purchases required for rapidly growing newborns and infants, alongside the extensive range of specialized garments designed for this developmental stage.

- By End User: Girls dominate the market with a share of 51% in 2025, owing to broader variety and design options available in girls' apparel, cultural preferences for decorative clothing, and parental inclination toward purchasing diverse wardrobe selections for female infants.

- By Region: Northern and Central Region is the largest region with 30% share in 2025, driven by the concentration of Saudi Arabia's population in Riyadh and surrounding urban centers, higher disposable incomes, and extensive retail infrastructure supporting premium baby apparel purchases.

- Key Players: Key players drive the Saudi Arabia baby apparel market by expanding product portfolios, improving fabric quality and design innovation, and strengthening nationwide distribution networks. Their investments in marketing, affordability initiatives, and partnerships with healthcare providers boost awareness and accelerate adoption.

To get more information on this market Request Sample

The Saudi Arabia baby apparel market is experiencing transformative growth propelled by a confluence of socioeconomic and demographic factors that are reshaping consumer purchasing behaviors across the Kingdom. Rising disposable incomes among young Saudi families, bolstered by economic diversification initiatives and expanding employment opportunities, have elevated consumer spending on premium infant clothing that combines functionality with aesthetic appeal. The expanding influence of social media platforms and digital content creators has exposed parents to global fashion trends, driving demand for stylish and brand-conscious baby apparel choices. International retailers and e-commerce platforms are increasingly recognizing the market's potential, expanding their physical and digital presence to capture growing consumer demand. This heightened investment activity reflects the market's attractiveness and growing opportunities for both domestic and international players seeking to capitalize on the Kingdom's expanding baby apparel demand. Parents are demonstrating willingness to invest in high-quality garments that meet modern expectations for comfort, safety, and contemporary styling, creating favorable conditions for sustained market expansion across diverse product categories and distribution channels.

Saudi Arabia Baby Apparel Market Trends:

Rising Preference for Premium and Branded Babywear

The Saudi Arabia baby apparel market is witnessing a pronounced shift toward premium and branded clothing options as parents increasingly prioritize quality, design, and skin-friendly materials for their infants. This evolving consumer mindset reflects broader lifestyle aspirations among young Saudi families who view their children's attire as an expression of status and personal values. Social media platforms have amplified this trend by showcasing curated infant outfits and brand endorsements, while international retailers expand their baby apparel collections to meet sophisticated consumer expectations. Materials such as organic cotton and hypoallergenic fabrics are gaining traction, positioning premium brands favorably among health-conscious parents.

Growing Demand for Sustainable and Organic Baby Clothing

Sustainability consciousness is emerging as a significant trend shaping the Saudi Arabia baby apparel market as parents become increasingly aware of environmental impacts and fabric safety concerns. Consumers are gravitating toward organic cotton and eco-friendly materials that offer breathability, durability, and freedom from harmful chemicals that could irritate delicate infant skin. The Saudi Arabia retail market recorded revenue growth with expanding shopping mall infrastructure during recent quarters, enhancing accessibility of sustainable baby apparel products through dedicated sections and clear product labeling. This environmental awareness aligns with broader regional initiatives promoting responsible consumption patterns among younger generations of Saudi parents.

Digital Transformation and E-commerce Expansion

The way Saudi parents find and buy baby clothes is changing due to the digital change of retail channels; infant clothing sales on e-commerce platforms have significantly increased. Online marketplaces appeal to time-pressed families with small children because they provide unparalleled convenience, product diversity, competitive pricing, and speedy delivery alternatives. In addition to increasing internet coverage, government expenditures in digital infrastructure have increased customer confidence in online commerce. Social commerce and mobile applications have made it possible for marketers to interact directly with tech-savvy Saudi consumers, resulting in customized purchasing experiences that increase repeat business and customer loyalty.

How Vision 2030 is Transforming the Saudi Arabia Baby Apparel Market:

Through extensive economic diversification and social modernization initiatives, Saudi Arabia's Vision 2030 project is radically changing the Kingdom's baby clothing industry landscape. The framework for national transformation has sped up the growth of the retail industry, drawing in global fashion labels and fostering local manufacture and entrepreneurship. Progressive policy changes have made it possible for more women to enter the workforce, which has raised household earnings and increased demand for quick shopping options that accommodate the hectic schedules of working parents. Shopping centers are now lifestyle destinations where families can get high-end baby clothing along with dining and recreational activities thanks to improved entertainment and leisure infrastructure. Multinational corporations have been attracted to set up manufacturing operations in the Kingdom by the vision's emphasis on localizing supply chains, which might increase product availability and price competitiveness. Digital economy initiatives have strengthened e-commerce infrastructure, enabling seamless online shopping experiences that complement traditional retail channels and expand market reach across diverse consumer segments.

Market Outlook 2026-2034:

The Saudi Arabia baby apparel market presents a positive outlook characterized by sustained demand expansion driven by favorable demographic patterns and evolving consumer preferences toward premium infant clothing options. The market generated a revenue of USD 2,200.5 Million in 2025 and is projected to reach a revenue of USD 3,243.7 Million by 2034, growing at a compound annual growth rate of 4.41% from 2026-2034. Rising disposable incomes and increasing exposure to global fashion trends through social media platforms are encouraging parents to invest in high-quality, stylish baby clothing. The expanding retail infrastructure, including modern shopping centers and e-commerce platforms, enhances product accessibility while international brands continue entering the market with innovative collections designed for Saudi consumer preferences.

Saudi Arabia Baby Apparel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Outerwear |

42% |

|

Material |

Cotton |

60% |

|

Distribution Channel |

Offline |

73% |

|

Application |

0-12 Months |

48% |

|

End User |

Girls |

51% |

|

Region |

Northern and Central Region |

30% |

Product Insights:

- Outerwear

- Underwear

- Others

Outerwear dominates with a market share of 42% of the total Saudi Arabia baby apparel market in 2025.

Outerwear maintains dominant positioning within the Saudi Arabia baby apparel market due to its versatility and practical functionality for protecting infants across varying climate conditions. Parents prioritize jackets, coats, rompers, and layered clothing options that ensure adequate warmth during cooler months while providing protection from air conditioning in indoor environments. The segment benefits from diverse design possibilities that enable manufacturers to combine protective functionality with fashionable aesthetics appealing to style-conscious Saudi parents. In January 2025, Giordano Saudi Arabia launched its collaborative Kung Fu Panda collection featuring limited-edition products available both in stores and online, demonstrating brand initiatives to capture market attention through distinctive outerwear offerings.

The outerwear segment continues expanding as cultural norms encourage coordinated family dressing for social gatherings and religious occasions where presentable infant attire holds particular significance. International brands have recognized this opportunity by introducing seasonal collections featuring premium materials and contemporary designs tailored to Saudi consumer preferences. The segment also benefits from gifting culture, as outerwear items frequently serve as preferred choices for baby showers, birth celebrations, and family visits that demand visually appealing and practical clothing options. Parents increasingly seek outerwear combining comfort features with durable construction that withstands frequent washing while maintaining aesthetic appeal throughout extended use periods.

Material Insights:

- Cotton

- Wool

- Silk

Cotton leads with a share of 60% of the total Saudi Arabia baby apparel market in 2025.

Cotton maintains overwhelming dominance within the Saudi Arabia baby apparel market owing to its exceptional breathability, natural softness, and hypoallergenic properties that suit sensitive infant skin across the Kingdom's warm climate conditions. Parents increasingly recognize cotton's superiority for regulating body temperature while minimizing irritation risks associated with synthetic alternatives, driving sustained preference for cotton-based baby clothing. The material's durability enables repeated washing without significant degradation, offering practical value for families navigating frequent laundry cycles required for infant garments. Saudi Arabia's organic cotton market has experienced notable expansion as health-conscious consumers seek certified products free from harmful chemical residues.

The cotton segment further benefits from growing consumer awareness regarding sustainable and ethical manufacturing practices that align with broader environmental consciousness trends among younger Saudi parents. Premium cotton variants including organic and Egyptian cotton are gaining traction as parents demonstrate willingness to invest in superior fabric quality that ensures optimal comfort for their children. Retailers have responded by expanding cotton-based product assortments while providing clear labeling that communicates material composition and safety certifications to informed consumers. The segment's strength reflects fundamental alignment between cotton's inherent properties and the specific requirements of baby apparel in Saudi Arabia's climate and cultural context.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline exhibits a clear dominance with 73% share of the total Saudi Arabia baby apparel market in 2025.

Offline distribution channels maintain commanding market share within Saudi Arabia's baby apparel sector as parents strongly prefer physical examination of clothing quality, fabric texture, and sizing accuracy before purchasing items for their infants. The Kingdom's expanding retail infrastructure featuring modern shopping malls and specialty baby stores provides engaging shopping experiences where families can browse extensive product selections with professional assistance. Saudi Arabia hosts approximately four thousand five hundred shopping centers nationwide, with major urban centers like Riyadh and Jeddah offering premium retail destinations housing international baby apparel brands alongside local retailers catering to diverse consumer preferences.

The offline segment benefits from Saudi cultural norms that position family shopping trips as social activities combining practical purchasing with entertainment and dining experiences. Dedicated baby apparel sections within department stores and specialty retailers offer curated selections that simplify decision-making for parents seeking quality infant clothing options. Store personnel provide valuable guidance regarding sizing, material suitability, and care instructions that enhance consumer confidence in purchasing decisions. Physical retail also facilitates immediate product availability without shipping delays, addressing urgent clothing needs for rapidly growing infants while enabling instant exchange or return processes.

Application Insights:

- 0-12 Months

- 12-24 Months

- 2-3 Years

0-12 months represent the leading segment with 48% share of the total Saudi Arabia baby apparel market in 2025.

The newborn and infant age category dominates market share within Saudi Arabia's baby apparel sector due to the heightened frequency of clothing purchases required during this rapid growth developmental stage. Infants experience significant size changes throughout their first year, necessitating continuous wardrobe replenishment that drives sustained purchasing activity among parents. The segment encompasses specialized garment categories including bodysuits, sleepsuits, onesies, and swaddles designed specifically for newborn comfort and ease of diaper changing. Saudi Arabia's fertility rate and birth statistics support consistent demand generation for infant apparel as young families celebrate new arrivals.

The segment further benefits from gifting traditions surrounding births and early childhood milestones that encourage relatives and friends to purchase baby clothing as celebratory presents. Parents demonstrate heightened quality consciousness when selecting garments for newborns, prioritizing soft materials, secure fastenings, and easy dressing features that minimize infant discomfort. The extensive product variety available within this age category enables manufacturers and retailers to offer comprehensive collections addressing diverse occasions from everyday wear to special events. Healthcare provider recommendations regarding appropriate infant clothing further influence purchasing decisions within this dominant market segment.

End User Insights:

- Girls

- Boys

Girls hold the largest share with 51% of the total Saudi Arabia baby apparel market in 2025.

Girls' apparel maintains leading market positioning within Saudi Arabia's baby clothing sector driven by broader design variety and decorative options that encourage more frequent purchases and wardrobe expansion. The segment benefits from extensive color palettes, pattern selections, and embellishment options that enable parents to express creativity through their daughters' attire choices. Cultural preferences for dressing female infants in coordinated outfits for family gatherings and social occasions further stimulate demand within this segment. Manufacturers respond by introducing diverse seasonal collections featuring dresses, rompers, and accessorized ensembles that appeal to fashion-conscious Saudi parents.

The girls' segment additionally benefits from accessory categories including headbands, bows, and matching footwear that expand average basket values beyond core apparel items. Parental inclination toward purchasing multiple outfit options for special occasions and photography sessions contributes to higher purchasing frequency within this demographic. Social media influence has amplified interest in trendy girls' fashion as parents share images of stylishly dressed daughters, creating aspirational content that drives consumer demand. The segment's design flexibility enables brands to differentiate through unique prints, colors, and styling details that establish distinctive market positioning.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads the market with 30% share of the total Saudi Arabia baby apparel market in 2025.

The Northern and Central Region, anchored by the capital city Riyadh, commands dominant market positioning within Saudi Arabia's baby apparel sector due to its substantial population concentration and superior economic indicators. Riyadh functions as the Kingdom's commercial and administrative center, hosting numerous international brand outlets and modern shopping destinations that offer extensive baby apparel selections. The region benefits from higher average household incomes that enable premium purchasing decisions alongside comprehensive retail infrastructure supporting diverse consumer preferences across various price segments.

The region's demographic profile featuring young families and substantial expatriate communities creates sustained demand for quality infant clothing options spanning international and local brand preferences. Urban development projects and new residential communities continue expanding the consumer base while attracting retailers seeking growth opportunities. The Northern and Central Region also serves as a testing ground for new product launches and retail concepts that subsequently expand to other geographic markets. E-commerce penetration rates within this region exceed national averages, providing additional sales channels that complement traditional retail while reaching consumers across diverse neighborhood communities.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Baby Apparel Market Growing?

Rising Disposable Incomes and Evolving Consumer Preferences

The sustained increase in household disposable incomes across Saudi Arabia, propelled by economic diversification initiatives and expanding employment opportunities, is fundamentally transforming consumer spending patterns within the baby apparel market. Families are demonstrating increased willingness to invest in premium, branded, and fashionable clothing options for their infants, reflecting broader lifestyle aspirations and quality consciousness. This shift extends beyond basic functional requirements as parents increasingly view baby apparel as an expression of family identity and social status. Social media platforms and digital content have exposed Saudi consumers to global fashion trends, amplifying demand for stylish infant clothing that aligns with contemporary aesthetic preferences. The modern Saudi parent prioritizes both visual appeal and fabric safety, prompting brands to respond with innovative collections balancing design excellence with material quality that addresses these dual expectations comprehensively.

Expanding Retail Infrastructure and E-commerce Growth

Saudi Arabia's rapidly expanding retail infrastructure is creating enhanced accessibility and product discovery opportunities that stimulate baby apparel market growth across diverse consumer segments. The Kingdom's shopping mall developments and specialty retail formats provide engaging environments where families experience curated baby apparel selections with professional guidance and immediate product availability. Simultaneously, the accelerating growth of e-commerce platforms has revolutionized how Saudi parents discover and purchase infant clothing, offering convenience, variety, and competitive pricing that appeal to time-constrained modern families. Government investments in digital infrastructure have strengthened internet penetration while building consumer trust in online shopping experiences. International retailers and local entrepreneurs are increasingly leveraging omnichannel strategies that integrate physical stores with digital platforms, creating seamless shopping journeys that maximize consumer engagement and conversion across multiple touchpoints.

Demographic Patterns and Cultural Emphasis on Children

Saudi Arabia's favorable demographic structure featuring a youthful population and consistent birth rates provides foundational demand support for sustained baby apparel market expansion. The Kingdom's population exceeds thirty-five million with a median age below thirty years, indicating substantial representation of family-forming demographics that generate continuous infant clothing purchasing activity. Cultural traditions emphasizing children's welfare and appearance encourage generous spending on quality baby attire, particularly for social gatherings, religious celebrations, and family milestones. Gifting customs surrounding births and early childhood events further amplify purchasing volumes as extended family networks participate in clothing the newest family members. The combination of demographic momentum and cultural values creates an enduring market foundation that supports both volume growth and premiumization trends across diverse product categories and price segments.

Market Restraints:

What Challenges the Saudi Arabia Baby Apparel Market is Facing?

Intense Market Competition and Price Sensitivity

The Saudi Arabia baby apparel market faces substantial competitive pressure from numerous international brands and local players vying for consumer attention within an increasingly saturated retail environment. Established global brands maintain significant market presence while new entrants continuously emerge, creating differentiation challenges for individual players seeking sustainable positioning. A considerable consumer segment remains price-conscious, particularly following economic adjustments that have prompted household budget reassessments, creating dual market dynamics where premium demand coexists with value-seeking behavior that pressures brand pricing strategies.

Supply Chain Complexities and Import Dependencies

Saudi Arabia's baby apparel market remains substantially dependent on imported products, creating exposure to international supply chain disruptions, currency fluctuations, and logistics challenges that can affect product availability and pricing stability. Limited domestic manufacturing capacity for infant clothing necessitates reliance on overseas suppliers, potentially extending lead times and complicating inventory management for retailers seeking responsive assortment planning. Import dependencies may result in higher product costs that challenge affordability for price-sensitive consumer segments while creating vulnerability to global trade dynamics affecting textile and apparel supply chains.

Seasonal Demand Fluctuations and Climate Considerations

Saudi Arabia's distinct climate characterized by hot summers and moderate winters creates seasonal demand variations that complicate inventory planning and product assortment decisions for baby apparel retailers. The extended warm season reduces demand for certain outerwear categories while concentrated purchasing periods around cooler months and special occasions create uneven revenue distribution throughout the year. Retailers must efficiently manage inventory allocation across varying seasonal requirements while avoiding overstock situations that necessitate margin-eroding promotional activities to clear excess merchandise.

Competitive Landscape:

The Saudi Arabia baby apparel market exhibits a fragmented competitive structure featuring a diverse mix of international brands, regional players, and local retailers competing across various price segments and distribution channels. Established global companies leverage brand recognition, product quality, and extensive retail partnerships to maintain market positioning while continuously introducing innovative collections tailored to Saudi consumer preferences. Competition intensifies around product differentiation strategies including fabric quality, design innovation, sustainability credentials, and pricing approaches that address diverse consumer expectations. Players are increasingly investing in omnichannel capabilities that integrate physical retail presence with digital commerce platforms, creating seamless shopping experiences that maximize consumer engagement. Marketing strategies emphasize social media engagement, influencer partnerships, and targeted digital campaigns that resonate with young Saudi parents seeking guidance on infant clothing choices.

Saudi Arabia Baby Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Outerwear, Underwear, Others |

| Materials Covered | Cotton, Wool, Silk |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | 0-12 Months, 12-24 Months, 2-3 Years |

| End Users Covered | Girls, Boys |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia baby apparel market size was valued at USD 2,200.5 Million in 2025.

The Saudi Arabia baby apparel market is expected to grow at a compound annual growth rate of 4.41% from 2026-2034 to reach USD 3,243.7 Million by 2034.

Outerwear dominated the market with a share of 42%, driven by its versatility for protecting infants across varying climate conditions and suitability for both casual and formal occasions.

Key factors driving the Saudi Arabia baby apparel market include rising disposable incomes, evolving consumer preferences toward premium branded clothing, expanding retail infrastructure, and favorable demographic patterns.

Major challenges include intense market competition from international and local players, price sensitivity among certain consumer segments, supply chain dependencies on imports, and seasonal demand fluctuations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)