Saudi Arabia Baby Care Products Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Saudi Arabia Baby Care Products Market Overview:

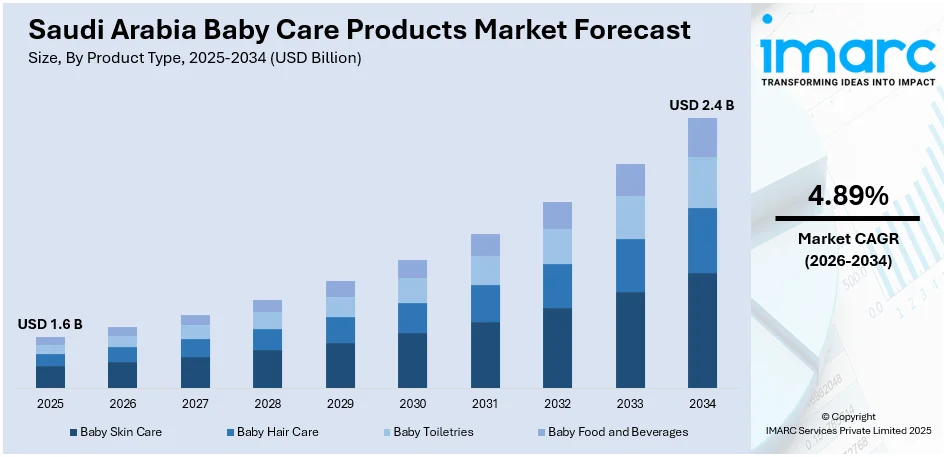

The Saudi Arabia baby care products market size reached USD 1.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2034, exhibiting a growth rate (CAGR) of 4.89% during 2026-2034. The market is witnessing robust growth due to rising demand for organic items, premium brand adoption, and digital retail expansion. Moreover, urbanization, higher per-child spending, and increasing awareness of infant wellness continue to shape consumer preferences and product innovation across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.6 Billion |

| Market Forecast in 2034 | USD 2.4 Billion |

| Market Growth Rate 2026-2034 | 4.89% |

Saudi Arabia Baby Care Products Market Trends:

Rising Demand for Organic and Natural Products

In Saudi Arabia, growing health consciousness among parents is leading to increased preference for organic and natural baby care products. This shift is playing a major role in Saudi Arabia baby care products market growth, especially in urban areas with higher income levels. Parents are seeking plant-based, chemical-free, and hypoallergenic options in categories such as baby lotions, shampoos, diapers, and wipes to minimize the risk of skin irritation and allergic reactions. Influenced by global trends and medical recommendations, there is also a notable rise in demand for products labeled as organic-certified or free from artificial additives. Both international and local brands are expanding their natural product lines, often featuring transparent ingredient lists and sustainable packaging. For instance, in March 2023, Australian plant-based baby formula startup Sprout Organic expanded into Saudi Arabia and Malaysia, targeting high-growth markets. CEO Selasi Berdie highlighted the region’s zero tariffs and robust birth rates as key benefits. The company seeks private funding for further expansion, offering certified organic formulas free from common allergens.As awareness and purchasing power continue to rise, this trend is expected to have a lasting impact on the Saudi Arabia baby care products market outlook.

To get more information on this market Request Sample

Increasing Online and Omnichannel Shopping

The rapid growth of digital infrastructure and mobile commerce in Saudi Arabia is transforming how parents shop for baby care products. According to the report published by the Small and Medium Enterprise General Authority, Saudi Arabia's e-commerce sector is rapidly growing, with 34.5 million users and 42,900 online stores. E-commerce is expected to contribute 12% to GDP, with revenues reaching $69 billion and a 15% CAGR anticipated through 2020-2025. With the convenience of home delivery, easy price comparisons, and access to product reviews, e-commerce platforms are becoming a preferred channel for purchasing diapers, baby wipes, skin care, and feeding essentials. Additionally, hybrid retail models such as click-and-collect or in-store pickup options—are gaining traction, combining physical retail benefits with online efficiency. Online-exclusive promotions, subscription services, and bundled product deals are further encouraging digital adoption, especially among young, tech-savvy parents. This trend has also enabled smaller or premium brands to reach a broader audience without extensive shelf presence in traditional stores. As consumers increasingly embrace digital platforms for convenience and variety, the online and omnichannel segment is playing a growing role in shaping the Saudi Arabia baby care products market share.

Saudi Arabia Baby Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, category, and distribution channel.

Product Type Insights:

- Baby Skin Care

- Baby Hair Care

- Baby Toiletries

- Baby Bath Products and Fragrances

- Baby Diapers and Wipes

- Baby Food and Beverages

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby skin care, baby hair care, baby toiletries (baby bath products and fragrances and baby diapers and wipes), and baby food and beverages.

Category Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes premium and mass.

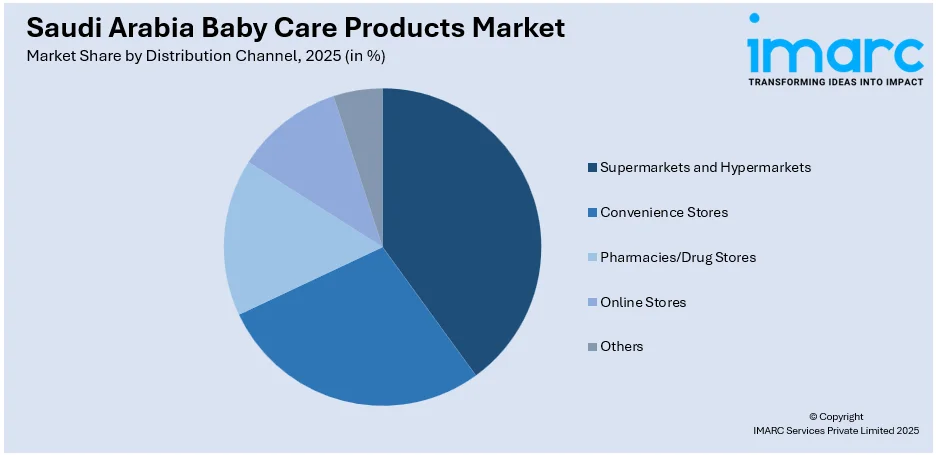

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies/Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies/drug stores, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Baby Care Products Market News:

- In September 2024, Nestlé announced its plans to open its first factory in Saudi Arabia, a $72 million baby food facility in Jeddah's Third Industrial City, by 2025. With an annual capacity of 15,000 tonnes, the factory aligns with the Saudi government's push for local manufacturing and reduced oil dependence while expanding Nestlé's regional presence.

Saudi Arabia Baby Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Categories Covered | Premium, Mass |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia baby care products market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia baby care products market on the basis of product type?

- What is the breakup of the Saudi Arabia baby care products market on the basis of category?

- What is the breakup of the Saudi Arabia baby care products market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia baby care products market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia baby care products market?

- What are the key driving factors and challenges in the Saudi Arabia baby care products market?

- What is the structure of the Saudi Arabia baby care products market and who are the key players?

- What is the degree of competition in the Saudi Arabia baby care products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia baby care products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia baby care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia baby care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)