Saudi Arabia Baby Food and Infant Formula Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Baby Food and Infant Formula Market Overview:

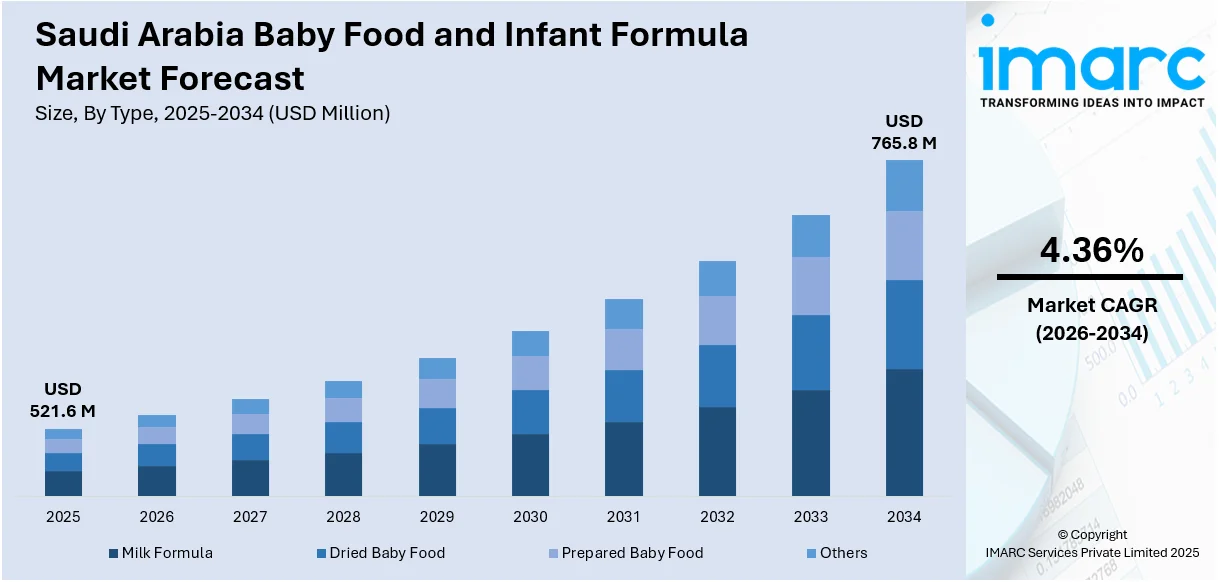

The Saudi Arabia baby food and infant formula market size reached USD 521.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 765.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.36% during 2026-2034. Rising health concerns amongst parents, heightened demand for organic and specialty products, increasing number of working mothers, and government regulations about product safety and advancement of e-commerce platforms with enhanced ease of access and convenience for consumers are some of the factors driving the market within the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 521.6 Million |

| Market Forecast in 2034 | USD 765.8 Million |

| Market Growth Rate 2026-2034 | 4.36% |

Saudi Arabia Baby Food and Infant Formula Market Trends:

Movement Toward Organic and Specialized Formulas

The demand for organic and clean-label baby food and infant formula products is gradually increasing in Saudi Arabia. Parents are more concerned about what goes into the food their children consume; hence, formulas that contain natural, non-GMO, and preservative-free ingredients are growing in popularity. The trend is being echoed among the manufacturers to extend their product line with plant-based and clean-label offerings. In addition, there is a growing need for special formulas targeted to babies with certain dietary requirements including lactose intolerance, allergies, and sensitive digestion. Hypoallergenic formulas, soy-based formulas, and probiotic-enhanced formulas are also becoming increasingly popular as parents demand personalized nutrition for their babies. This in turn is further contributing to the Saudi Arabia infant formula and baby food market growth.

To get more information on this market Request Sample

Convenience and E-Commerce Growth

The increasing number of working mothers and their fast-paced lifestyles creates a greater demand for portable and ready-to-feed infant formula and baby food. Manufacturers are now countering this requirement by developing innovative packaging formats and formulas to meet the convenience and needs of modern-day parents. Moreover, the booming e-commerce is changing the purchasing pattern of baby food and infant formula in Saudi Arabia. Parents tend to consider the ease of reaching online channels to buy their baby food because of the wide selection or price competitiveness. According to industry reports, consumer retail spending in Saudi Arabia is going to increase significantly during the next few years, with a projection that e-commerce would account for 46% of the whole retail industry by the year 2030. Currently, Saudi Arabia contributes to 44% of the entire retail spending in the Gulf Cooperation Council area. Subscription services for baby foods and AI recommendations also make it easier for parents to choose the right diet based on age and nutrition requirements. The growth of retail and e-commerce is hence also fueling the expansion of the Saudi Arabia baby food and instant formula market share.

Government Policies and Market Dynamics

The Saudi government has played a consistent role in strengthening the outlook for baby food and infant formula markets, imposing tougher standards for quality and safety to ensure higher quality. Breastfeeding-promoting policies are still very vigorous while the government ensures safety and nutritional standards at par with world-class measures for products. A section of the populace regarding formula usage lies between the promotion and encouragement of breastfeeding by all health authorities. This creates a need for culturally sensitive understanding by companies to market and distribute products effectively in the Saudi Arabian locale, which is bound to shape the Saudi Arabia baby food and instant formula market outlook further.

Saudi Arabia Baby Food and Infant Formula Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes milk formula, dried baby food, prepared baby food, and others.

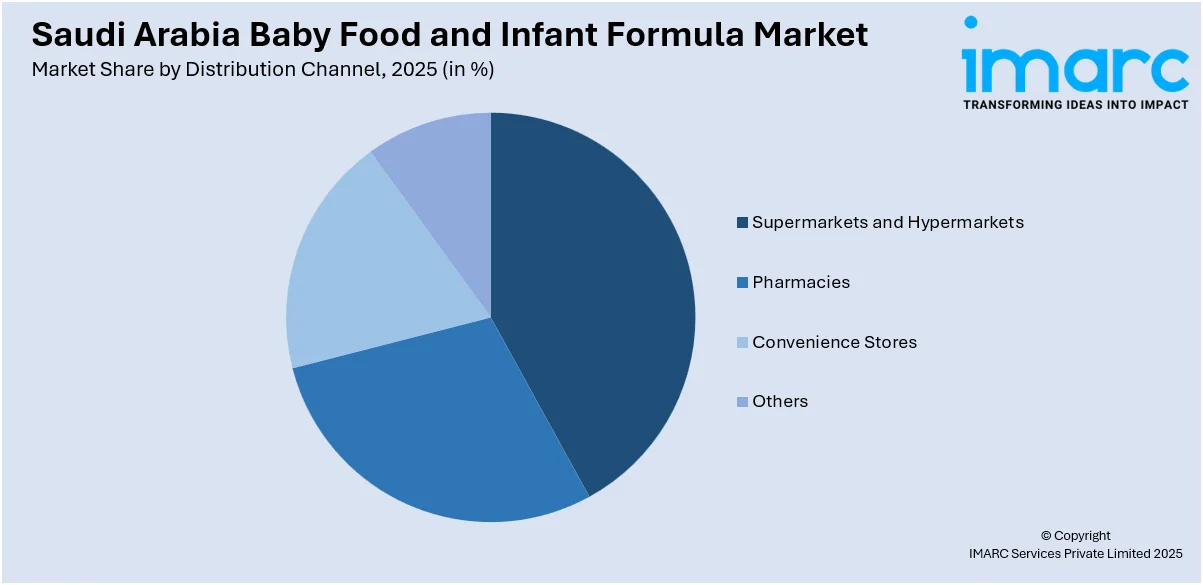

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, pharmacies, convenience stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Baby Food and Infant Formula Market News:

- In September 2024, Nestlé declared its intentions to establish a new $72 million factory in Saudi Arabia, marking its first in the nation. It has entered into a contract with the Saudi Authority for Industrial Cities and Technology Zones (MODON) to develop a 117,000sqm area in the Jeddah Third Industrial City. The upcoming factory will focus on baby food, possess an annual capacity of 15,000 tonnes, and is set to launch in 2025. The government of Saudi Arabia is working to lessen its economy's reliance on the oil industry and is also urging multinational FMCG companies to establish a stronger local presence in the nation, including regional offices and production facilities.

Saudi Arabia Baby Food and Infant Formula Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia baby food and infant formula market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia baby food and infant formula market on the basis of type?

- What is the breakup of the Saudi Arabia baby food and infant formula market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia baby food and infant formula market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia baby food and infant formula market?

- What are the key driving factors and challenges in the Saudi Arabia baby food and infant formula market?

- What is the structure of the Saudi Arabia baby food and infant formula market and who are the key players?

- What is the degree of competition in the Saudi Arabia baby food and infant formula market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia baby food and infant formula market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia baby food and infant formula market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia baby food and infant formula industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)