Saudi Arabia Bio Agriculture Market Size, Share, Trends and Forecast by Segment and Region, 2026-2034

Saudi Arabia Bio Agriculture Market Overview:

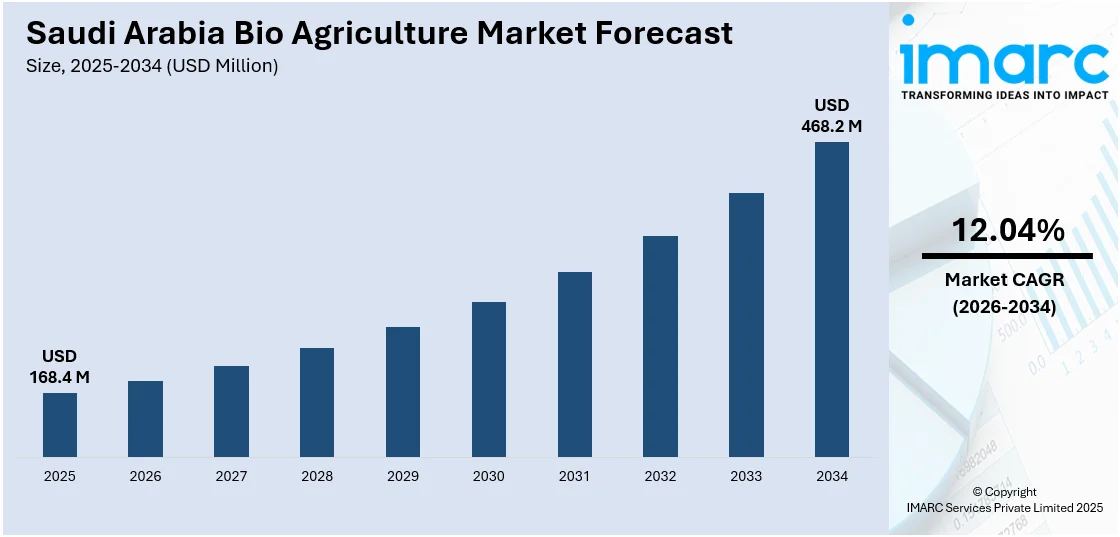

The Saudi Arabia bio agriculture market size reached USD 168.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 468.2 Million by 2034, exhibiting a growth rate (CAGR) of 12.04% during 2026-2034. The market is growing due to rising consumer demand for organic food, government initiatives promoting sustainable farming, and Vision 2030's focus on food security. Water scarcity drives the adoption of efficient bio-farming techniques, while increasing awareness of chemical-free agriculture accelerates the use of biofertilizers and biopesticides. International partnerships further support market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 168.4 Million |

| Market Forecast in 2034 | USD 468.2 Million |

| Market Growth Rate 2026-2034 | 12.04% |

Saudi Arabia Bio Agriculture Market Trends:

Increasing Adoption of Organic Farming Practices

The significant shift toward organic farming due to rising health consciousness and government support is propelling the Saudi Arabia bio agriculture market growth. A research report from the IMARC group indicates that the organic food market in Saudi Arabia was valued at USD 2.1 Billion in 2024. It is projected to grow to USD 5.1 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 9.4% from 2025 to 2033. Consumers are increasingly demanding pesticide-free, nutrient-rich produce, driving farmers to adopt sustainable practices. The Saudi Ministry of Environment, Water, and Agriculture (MEWA) has launched initiatives such as the Organic Farming Program to encourage eco-friendly agriculture, offering subsidies and training to farmers. Additionally, the country’s Vision 2030 emphasizes food security and sustainability, further expanding the Saudi Arabia bio agriculture market share. While local supermarkets and web-based retailers are expanding their lines of organic food, the market for organic food in the locality is growing. Foreign exchange and international credibility are enhanced through partnerships with global organizations such as with European certifying bodies of organic products. The scarcity of water is a big issue, which is the reason farming, such as drip irrigation or hydroponics, is becoming more popular. They require as much water as possible in order for it to be the quality of harvest. Several farmers are coming to realize that organic farming is a long-term economic and environmental trend, and this trend is going to increase.

To get more information on this market Request Sample

Growth of Biofertilizers and Biopesticides for Sustainable Crop Production

Another key trend in the market is the rising demand for biofertilizers and biopesticides as alternatives to chemical inputs. Farmers are increasingly adopting these biological solutions to enhance soil fertility and protect crops without harming the environment. The Saudi government is promoting bio-inputs through policies that restrict harmful agrochemicals and incentivize sustainable alternatives. Research institutions and agri-tech startups are also developing locally tailored biofertilizers to suit the region’s arid conditions. The shift toward bio-inputs aligns with global sustainability trends and meets the growing consumer preference for chemical-free food. Companies are investing in microbial and organic-based products, leveraging Saudi Arabia’s expanding biotech sector. Furthermore, the integration of precision agriculture technologies, such as IoT-enabled soil sensors, is optimizing the application of biofertilizers, improving efficiency. Studies among 229 olive farmers in Saudi Arabia's Al-Jouf region found that users of the Agricultural Guide application showed a 20% to 30% increase in the adoption of sustainable methods. Interestingly, irrigation and soil improvement practices were adopted at rates of 75% and 76%, respectively. The 206,000 farmers nationwide who have adopted the app have seen enhanced olive yields, higher income, and greater digital engagement. Additionally, a machine learning model has shown a 94% accuracy rate in predicting adoption of the app. As Saudi Arabia continues to advance in precision agriculture, these digital technologies are helping drive sustainability in its bio-agriculture industry. As awareness of soil degradation and chemical resistance grows, the biofertilizer and biopesticide market is poised for robust growth, creating a positive Saudi Arabia bio agriculture market outlook.

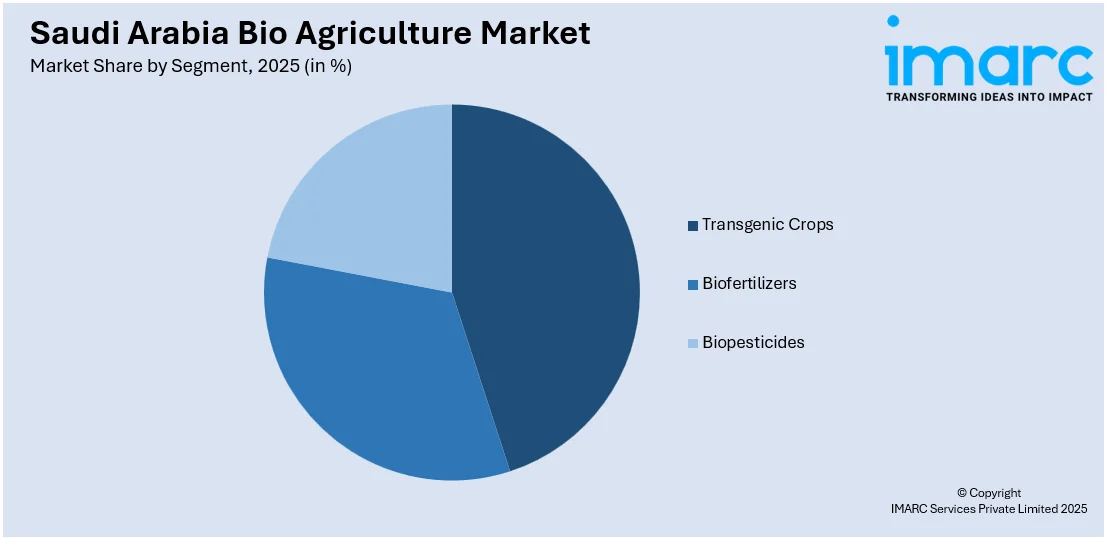

Saudi Arabia Bio Agriculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on segment.

Segment Insights:

Access the comprehensive market breakdown Request Sample

- Transgenic Crops

- Biofertilizers

- Biopesticides

The report has provided a detailed breakup and analysis of the market based on the segment. This includes transgenic crops, biofertilizers, and biopesticides.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Bio Agriculture Market News:

- April 16, 2025: Liberation Labs partnered with the NEOM Investment Fund to build a biomanufacturing plant in Saudi Arabia dedicated to manufacture dairy proteins without animals, egg proteins, and biomaterials. The move supports Saudi Arabia's food security strategy by leveraging precision fermentation to produce high-value ingredients domestically. The plant, modeled after the Richmond, Indiana, site, can expand to 4 million liters and is expected to break ground within two years following the completion of a feasibility study.

- January 21, 2025: Arable, a Saudi agritech firm, managed to raise USD 2.55 Million in seed funding, 90% of which was contributed by foreign investors, to improve its hydroponic farming technologies in the Kingdom. The firm's environmentally friendly strategy, designed to overcome the peculiar climatic issues in Saudi Arabia, aims to raise local vegetable production and contribute to food security projects, as stated in the plans of Vision 2030. Supported by prominent government agencies, Arable's technologies are expected to revolutionize water-saving agriculture in the country.

Saudi Arabia Bio Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Transgenic Crops, Biofertilizers, Biopesticides |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia bio agriculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia bio agriculture market on the basis of segment?

- What is the breakup of the Saudi Arabia bio agriculture market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia bio agriculture market?

- What are the key driving factors and challenges in the Saudi Arabia bio agriculture?

- What is the structure of the Saudi Arabia bio agriculture market and who are the key players?

- What is the degree of competition in the Saudi Arabia bio agriculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia bio agriculture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia bio agriculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia bio agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)