Saudi Arabia Breakfast Foods Market Size, Share, Trends and Forecast by Source, Packaging Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Breakfast Foods Market Overview:

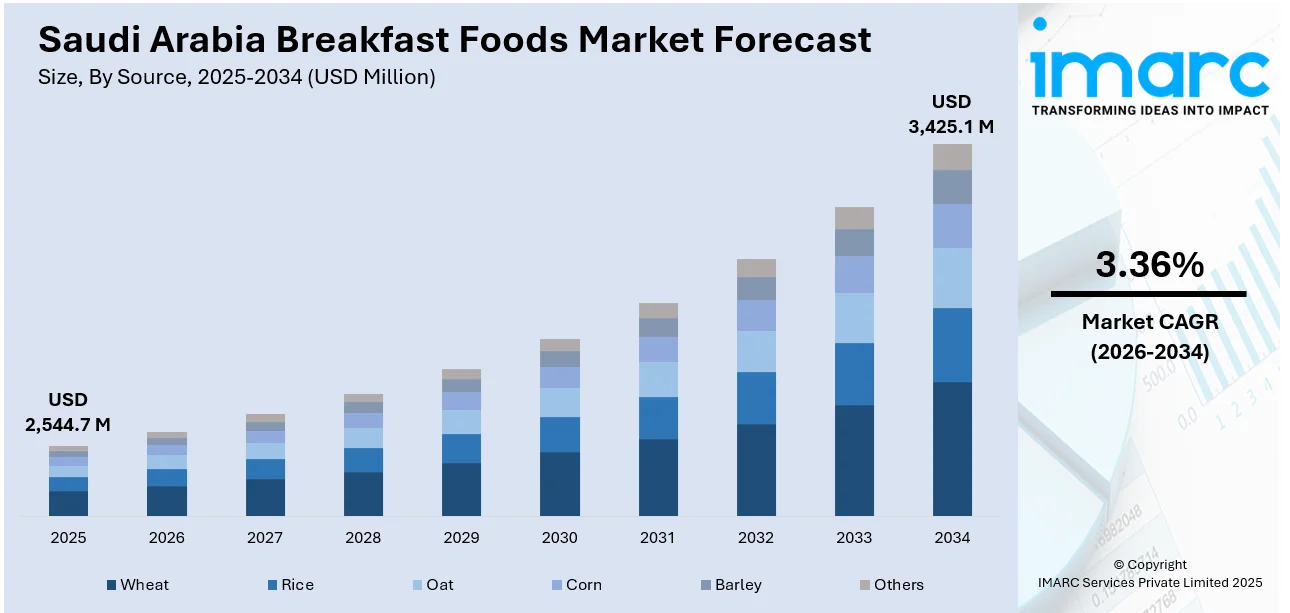

The Saudi Arabia breakfast foods market size reached USD 2,544.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,425.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.36% during 2026-2034. Presently, as the number of social media users is increasing, businesses are utilizing digital platforms to engage in influencer partnerships and interactive promotions that attract a younger audience. Besides this, the broadening of retail channels is contributing to the expansion of the Saudi Arabia breakfast foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,544.7 Million |

| Market Forecast in 2034 | USD 3,425.1 Million |

| Market Growth Rate 2026-2034 | 3.36% |

Saudi Arabia Breakfast Foods Market Trends:

Growing marketing efforts

Increasing funding on marketing campaigns are fueling the market growth in Saudi Arabia. Food manufacturers and brands are actively using various channels, including television, billboards, online platforms, and in-store promotions, to highlight the nutritional benefits, convenience, and taste of their breakfast offerings. These campaigns often target health-conscious consumers and busy professionals who seek quick and wholesome breakfast solutions. With rising social media users, companies are leveraging digital platforms to run influencer collaborations and interactive promotions that engage a younger demographic. According to the DataReportal, in January 2024, Saudi Arabia had 35.10 Million people using social media, representing 94.3% of its entire population. Social media campaigns aid in creating brand awareness and fostering trust through relatable content and customer reviews. Brands are also sponsoring events, offering discounts, and providing free samples to build stronger customer connections. Marketing strategies are increasingly tailored for local tastes and dietary preferences, which helps companies connect more deeply with Saudi consumers. The focus on engaging storytelling, health trends, and product innovations is further spiking overall interest. As marketing is becoming more personalized and data-oriented, it assists brands in identifying customer needs and positioning their items effectively. This continuous engagement is influencing purchasing behavior and strengthening brand loyalty.

To get more information on this market Request Sample

Increasing demand for premium products

Rising demand for premium products is impelling the Saudi Arabia breakfast foods market growth. People are seeking high-quality, nutritious, and gourmet options that offer better taste and health benefits. With inflating disposable incomes, people are willing to spend on value-added breakfast items. According to governing authorities, per capita disposable income in Saudi Arabia is estimated to rise by 8.1% in real terms from 2023 to 2028. Urban lifestyles and busy schedules are encouraging the consumption of ready-to-eat (RTE), organic, and fortified products that align with health-conscious choices. Premium cereals, artisanal breads, protein-rich dairy, and imported spreads are gaining popularity among young professionals and families. These products often carry perceived health benefits, better ingredients, and international appeal, which attract consumers looking for both convenience and quality.

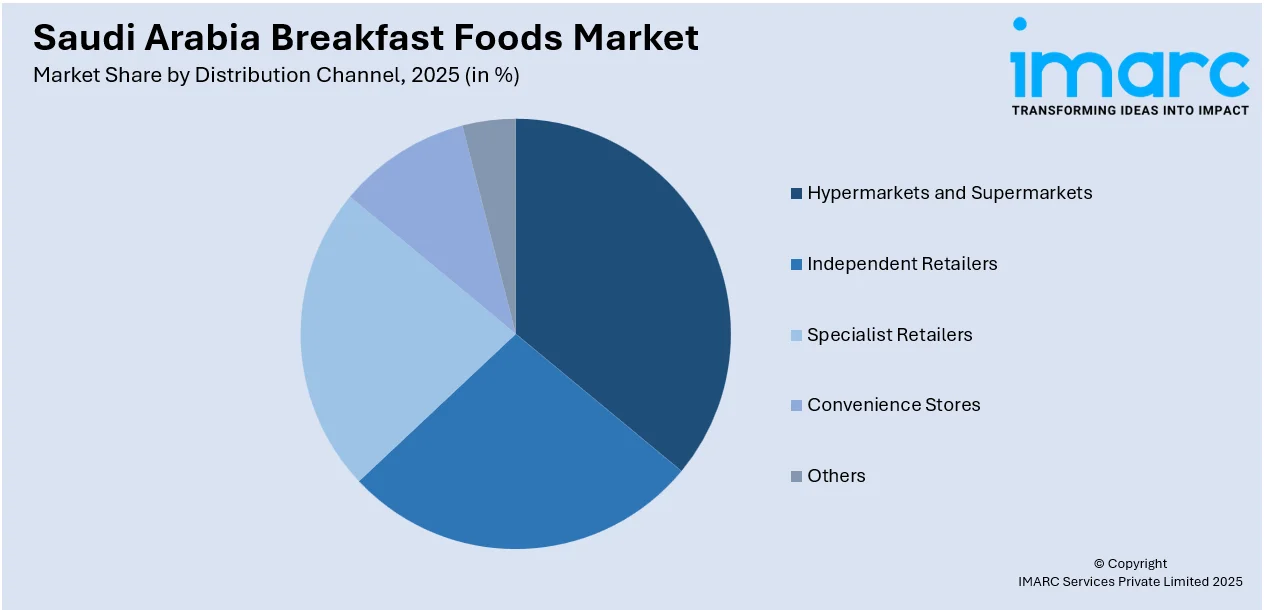

Expansion of retail channels

The expansion of retail channels is positively influencing the market. As per the USDA, in 2024, Saudi Arabia's food retail sales were projected to increase by about 4%. Supermarkets, hypermarkets, and convenience stores offer a wide range of breakfast items, ranging from cereals and dairy to baked goods and RTE meals. Organized retail outlets provide attractive packaging, promotions, and better shopping experiences, which encourage frequent purchases. The presence of both international and local brands in retail spaces is increasing consumer awareness and introducing new varieties. Additionally, modern retail formats ensure better supply chains and cold storage, maintaining the freshness of perishable items. As retail continues to grow in both physical stores and online platforms, individuals find it easier to access a wide assortment of breakfast options.

Saudi Arabia Breakfast Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on source, packaging type, and distribution channel.

Source Insights:

- Wheat

- Rice

- Oat

- Corn

- Barley

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes wheat, rice, oat, corn, barley, and others.

Packaging Type Insights:

- Boxes

- Pouches

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes boxes, pouches, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Independent Retailers

- Specialist Retailers

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, independent retailers, specialist retailers, convenience stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Breakfast Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Wheat, Rice, Oat, Corn, Barley, Others |

| Packaging Types Covered | Boxes, Pouches, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Independent Retailers, Specialist Retailers, Convenience Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia breakfast foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia breakfast foods market on the basis of source?

- What is the breakup of the Saudi Arabia breakfast foods market on the basis of packaging type?

- What is the breakup of the Saudi Arabia breakfast foods market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia breakfast foods market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia breakfast foods market?

- What are the key driving factors and challenges in the Saudi Arabia breakfast foods market?

- What is the structure of the Saudi Arabia breakfast foods market and who are the key players?

- What is the degree of competition in the Saudi Arabia breakfast foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia breakfast foods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia breakfast foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia breakfast foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)