Saudi Arabia Broom and Mop Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Broom and Mop Market Summary:

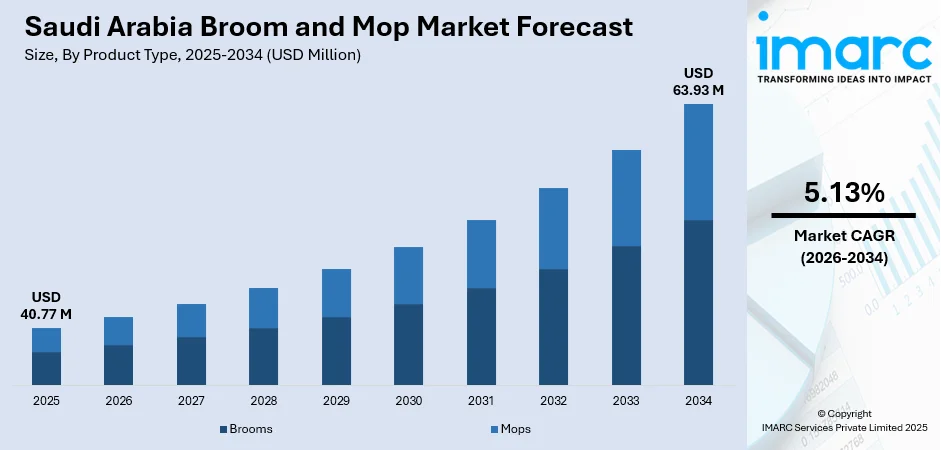

The Saudi Arabia broom and mop market size was valued at USD 40.77 Million in 2025 and is projected to reach USD 63.93 Million by 2034, growing at a compound annual growth rate of 5.13% from 2026-2034.

The Saudi Arabia broom and mop market is experiencing robust expansion driven by rapid urbanization, heightened hygiene awareness following the pandemic era, and increasing demand for convenient and efficient cleaning solutions. The Kingdom's Vision 2030 initiative has catalyzed infrastructure development across hospitality, healthcare, and commercial real estate sectors, creating substantial demand for professional-grade cleaning equipment. Rising disposable incomes among the growing middle-class population, coupled with evolving lifestyle preferences that prioritize time-saving household solutions, are further propelling market growth. The introduction of technologically advanced products such as steam mops and robotic mopping systems has enhanced consumer interest, while the growth of contemporary retail channels and online marketplaces has significantly enhanced the availability of products throughout both urban and semi-urban areas, strengthening the Saudi Arabia broom and mop market share.

Key Takeaways and Insights:

- By Product Type: Mops dominate the market with a share of 55% in 2025, driven by consumer preference for versatile wet cleaning solutions and the increasing adoption of advanced mopping technologies including steam and robotic mops.

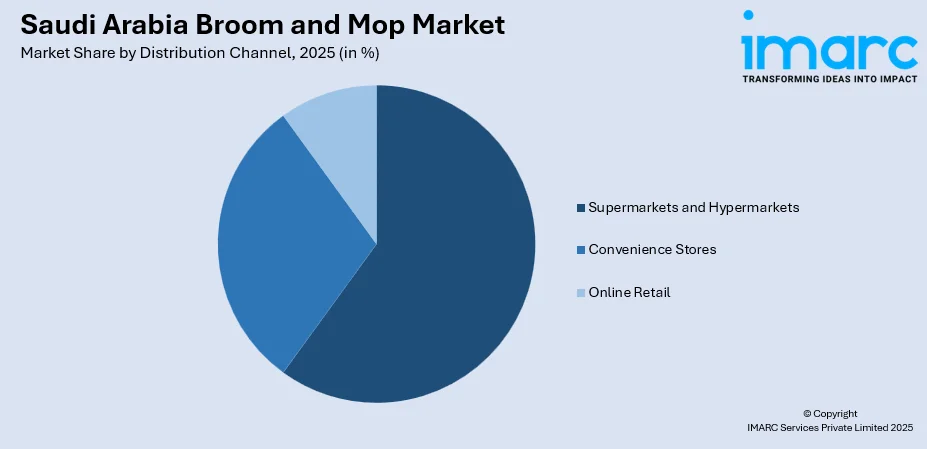

- By Distribution Channel: Supermarkets and Hypermarkets lead the market with a share of 60% in 2025, attributed to their extensive product assortments, competitive pricing strategies, and the convenience of one-stop shopping experiences for household cleaning supplies.

- Key Players: The Saudi Arabia broom and mop market exhibits moderate competitive intensity, characterized by the presence of international manufacturers competing alongside regional distributors. Companies are increasingly differentiating through product innovation, eco-friendly materials, and technology integration to capture consumer interest in premium cleaning solutions.

To get more information on this market Request Sample

The ongoing technological innovation and changing consumer demands are driving a steady transformation in Saudi Arabia’s broom and mop market. Health consciousness has become a permanent fixture in purchasing decisions, with consumers seeking cleaning tools that offer superior sanitization capabilities without reliance on harsh chemicals. The commercial sector represents a significant growth engine, particularly as the hospitality industry undergoes unprecedented expansion under Vision 2030. Saudi Arabia added over 443,200 licensed hotel rooms in 2024 alone, representing a 107% increase from the previous year, creating substantial institutional demand for professional cleaning equipment. Furthermore, the retail landscape is transforming rapidly, with e-commerce platforms capturing growing market share among younger, digitally savvy consumers who value product reviews, price comparisons, and doorstep delivery convenience. Together, these elements create favorable conditions that support consistent market expansion over the projected timeframe.

Saudi Arabia Broom and Mop Market Trends:

Rising Adoption of Smart and Automated Cleaning Technologies

The integration of artificial intelligence and automation into floor cleaning equipment represents a transformative trend in the Saudi market. Robotic mops equipped with LiDAR navigation, smartphone app controls, and self-cleaning base stations are gaining traction among urban households seeking hands-free cleaning solutions. In June 2023, Kyvol launched its Cybovac S60, a fully automatic 5-in-1 robot vacuum and mop, at Extra stores across Saudi Arabia, featuring integrated vacuuming, mopping, mop-washing, mop-drying, and dust-emptying capabilities. This technological progression reflects broader consumer demand for efficiency and convenience in household maintenance.

Growing Preference for Eco-Friendly and Chemical-Free Cleaning Solutions

Environmental consciousness and health awareness are driving significant consumer interest in sustainable cleaning products throughout Saudi Arabia. Steam mops, which utilize high-temperature steam for chemical-free disinfection, have emerged as popular alternatives to traditional mopping methods. The growing preference for steam-based cleaners across the GCC highlights Saudi Arabia as a key demand center. This trend aligns with the Kingdom's broader sustainability objectives under Vision 2030 and responds to consumer preferences for products that minimize environmental impact while maintaining effective sanitization performance.

Expansion of Premium and Multi-Functional Product Offerings

Manufacturers are increasingly introducing premium, multi-functional cleaning products designed to meet a wide range of household requirements through single-device solutions. Recently, leading brands have expanded their offerings in Saudi Arabia with advanced robot cleaners featuring powerful suction, adaptable mechanisms for different floor types, and automated base stations that handle maintenance tasks. This shift toward versatile, high-performance equipment reflects growing consumer willingness to invest in quality solutions that deliver superior results across varied cleaning needs.

Market Outlook 2026-2034:

The Saudi Arabia broom and mop market demonstrates strong growth potential supported by favorable demographic trends, infrastructure development initiatives, and evolving consumer preferences toward modern cleaning solutions. The Kingdom's expanding hospitality sector, targeting 150 million annual visitors by 2030, combined with substantial investment in residential and commercial real estate, ensures sustained institutional and consumer demand for cleaning equipment. Technological innovation, particularly in smart cleaning devices and sustainable product formulations, will continue driving premiumization across product categories. The market generated a revenue of USD 40.77 Million in 2024 and is projected to reach a revenue of USD 63.93 Million by 2034, growing at a compound annual growth rate of 5.13% from 2026-2034.

Saudi Arabia Broom and Mop Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Mops | 55% |

| Distribution Channel | Supermarkets and Hypermarkets | 60% |

Product Type Insights:

- Brooms

- Mops

The mops segment leads the market with a 55% share of the total Saudi Arabia broom and mop market in 2025.

The dominance of mops in the Saudi market reflects fundamental consumer preferences for wet cleaning methods that effectively address dust accumulation in the region's arid climate. Traditional flat mops and spin mops remain popular for routine floor maintenance, while technological advancements have expanded the category to include steam mops and robotic mopping systems that appeal to premium-seeking consumers. The introduction of mops with replaceable microfiber pads, self-wringing mechanisms, and spray functionality has enhanced product utility and consumer convenience, contributing to sustained category growth across residential and commercial applications.

Mops remain vital for routine household cleaning, especially for maintaining indoor floors and handling both light and heavy messes. The category has evolved with advancements such as ergonomic handles, adjustable extensions, and specialized mop heads suited for different flooring types. Commercial environments, including retail facilities and warehouses, also generate steady demand for durable, high-capacity mopping solutions designed to cover large areas efficiently and withstand frequent use.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

Supermarkets and hypermarkets dominate the distribution landscape with a 60% market share in 2025.

Supermarkets and hypermarkets have established commanding market presence through extensive product assortments, competitive pricing, and convenient shopping environments that enable consumers to evaluate and compare cleaning products alongside regular grocery purchases. Major retail chains including Panda Retail Company, Abdullah Al-Othaim Markets, and Carrefour have expanded store networks across the Kingdom, with Panda alone earmarking 20 new stores for 2025. These retailers leverage purchasing power advantages to secure favorable supplier terms, translating into attractive consumer pricing while maintaining substantial shelf space for diverse broom and mop product ranges.

Online retail represents the fastest-growing distribution channel, propelled by Saudi Arabia's exceptional digital infrastructure featuring 99% internet penetration and 77% 5G coverage. E-commerce platforms, including Amazon.sa, Noon, and specialty retailers offer consumers extensive product selections, detailed specifications, customer reviews, and doorstep delivery convenience. The channel particularly excels in premium product categories, where consumers benefit from comprehensive research capabilities before investing in higher-priced robotic mops and steam cleaning equipment. Convenience stores maintain relevance for immediate-need purchases and serve price-conscious consumers in residential neighborhoods.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The demand in the Northern and Central region is largely driven by rapid urban development, rising residential construction, and increased consumer spending on home care products. The presence of major cities like Riyadh accelerates the adoption of modern cleaning tools as households prioritize convenience and hygiene. Growth in commercial spaces, educational institutions, and government facilities further supports steady market expansion for durable and efficient cleaning solutions.

The Western region benefits from strong hospitality, tourism, and retail activity, especially in cities such as Jeddah, Makkah, and Madinah. High footfall in hotels, malls, and public facilities boosts demand for reliable cleaning tools to maintain hygiene standards. Rising apartment living, lifestyle upgrades, and renovation activities also contribute to growing household adoption of advanced broom and mop products tailored for diverse floor types and heavy cleaning needs.

In the Eastern region, industrial expansion, oil sector operations, and large-scale commercial developments are key demand drivers. Workplaces, warehouses, and manufacturing sites require durable cleaning tools capable of handling frequent and intensive use. Residential growth in cities like Dammam and Al Khobar further supports sales, driven by rising housekeeping needs and consumer preference for ergonomic, efficient products that simplify everyday cleaning tasks while meeting hygiene expectations.

The Southern region’s market is supported by increasing urbanization, infrastructure development, and growing residential communities. Consumers are gradually shifting toward improved cleaning tools as awareness of hygiene and modern home care solutions rises. Retail expansion and public facility upgrades also stimulate demand for durable products suited to varied surfaces. Additionally, tourism in select areas encourages adoption of effective cleaning equipment across hospitality and service establishments.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Broom and Mop Market Growing?

Accelerating Urbanization and Infrastructure Development Under Vision 2030

Saudi Arabia's ambitious Vision 2030 initiative is catalyzing unprecedented infrastructure development across residential, commercial, and hospitality sectors, directly stimulating demand for cleaning equipment throughout the Kingdom. The country is expanding its cities with extensive infrastructure projects and new residential developments, creating sustained demand for home care solutions, including brooms and mops. Urban population growth intensifies requirements for convenient and efficient cleaning products suited to apartment living and busy household schedules. As of 2024, about 85.17% of Saudi Arabia’s population lives in urban areas.

Heightened Hygiene Awareness and Health-Conscious Consumer Behavior

The pandemic era fundamentally transformed consumer attitudes toward household cleanliness, establishing hygiene maintenance as a permanent priority in purchasing decisions. Saudi consumers increasingly seek cleaning tools offering superior sanitization capabilities, driving demand for steam mops, antibacterial-treated bristles, and products designed for effective germ elimination. Healthcare facilities across the Kingdom, supported by approximately USD 6.47 billion in sector expansion investment between 2020 and 2024, require specialized cleaning equipment meeting stringent sanitation standards to prevent infections and ensure patient safety. This institutional demand complements residential market growth as consumers prioritize family health protection through regular, thorough cleaning practices. The convergence of health awareness with cultural emphasis on cleanliness creates a supportive environment for premium product adoption and increased purchase frequency.

Expansion of Modern Retail Formats and E-Commerce Platforms

The transformation of Saudi Arabia's retail landscape significantly enhances product accessibility and consumer choice in the broom and mop category. Supermarkets and hypermarkets continue expanding store networks, with major retailers investing in new locations across established urban centers and emerging residential communities. The Saudi Arabia E-commerce market size reached USD 222.9 Billion in 2024. The market is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. This digital commerce expansion enables manufacturers to reach consumers directly, bypassing traditional distribution constraints while providing detailed product information, user reviews, and competitive pricing. The synergy between physical retail expansion and e-commerce growth ensures consumers across geographic regions and demographic segments can access diverse product offerings, supporting overall market expansion.

Market Restraints:

What Challenges the Saudi Arabia Broom and Mop Market is Facing?

Price Sensitivity Among Cost-Conscious Consumer Segments

Despite growing middle-class affluence, significant consumer segments remain price-sensitive, preferring economical basic products over premium alternatives. Low-cost conventional cleaning tools from local and regional manufacturers compete effectively on price, limiting market penetration for higher-margin innovative products. This price sensitivity constrains manufacturer ability to recoup research and development investments through premium positioning strategies.

Competition from Alternative Cleaning Methods and Services

The expanding professional cleaning services sector presents competitive pressure on consumer product demand, particularly among affluent households and commercial establishments. Cleaning service companies offer comprehensive maintenance solutions that reduce client requirements for in-house equipment investment. Additionally, vacuum cleaner adoption for dry debris removal may partially substitute broom usage in certain household applications.

Import Dependency and Supply Chain Considerations

The Saudi market relies substantially on imported cleaning equipment, creating exposure to international supply chain disruptions, currency fluctuations, and transportation cost variations. Limited domestic manufacturing capacity for advanced cleaning products necessitates ongoing import dependence, potentially affecting product availability and pricing stability during periods of global supply chain stress.

Competitive Landscape:

The Saudi Arabia broom and mop market exhibits a moderately fragmented competitive structure featuring international consumer goods corporations, specialized cleaning equipment manufacturers, and regional distributors serving diverse consumer segments. Global players leverage brand recognition, product innovation capabilities, and extensive distribution networks to capture premium market segments, while local competitors maintain relevance through competitive pricing and established retailer relationships. Companies increasingly differentiate through technological innovation, with smart cleaning devices and eco-friendly formulations representing key competitive battlegrounds. Strategic partnerships with major retail chains and e-commerce platforms have become critical for market access and consumer visibility. The market environment encourages continuous product development and marketing investment as competitors seek sustainable competitive advantages in an expanding opportunity landscape.

Recent Developments:

- November 2024: Dreame Technology introduced three innovative vacuum cleaners with mop functionality in Saudi Arabia, including the Z30 premium stick vacuum, H14 wet and dry vacuum with 60°C hot water cleaning, and X40 Ultra Complete robot vacuum featuring 12,000 Pa suction power and 70°C hot water mop cleaning through a 7-in-1 automatic care base station.

Saudi Arabia Broom and Mop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Brooms, Mops |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia broom and mop market size was valued at USD 40.77 Million in 2025.

The Saudi Arabia broom and mop market is expected to grow at a compound annual growth rate of 5.13% from 2026-2034 to reach USD 63.93 Million by 2034.

Mops dominated the product type segment with a 55% market share in 2025, driven by consumer preference for versatile wet cleaning solutions and the increasing adoption of advanced mopping technologies including steam mops and robotic systems.

Key factors driving the Saudi Arabia broom and mop market include accelerating urbanization and infrastructure development under Vision 2030, heightened hygiene awareness and health-conscious consumer behavior, expansion of modern retail formats and e-commerce platforms, and growing adoption of technologically advanced cleaning solutions.

Major challenges include price sensitivity among cost-conscious consumer segments limiting premium product adoption, competition from professional cleaning services reducing household equipment demand, import dependency creating supply chain vulnerabilities, and the need for continuous product innovation to maintain consumer interest in a competitive market environment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)