Saudi Arabia Buy Now Pay Later Market Size, Share, Trends and Forecast by Channel, Enterprise Size, End Use, and Region, 2026-2034

Saudi Arabia Buy Now Pay Later Market Summary:

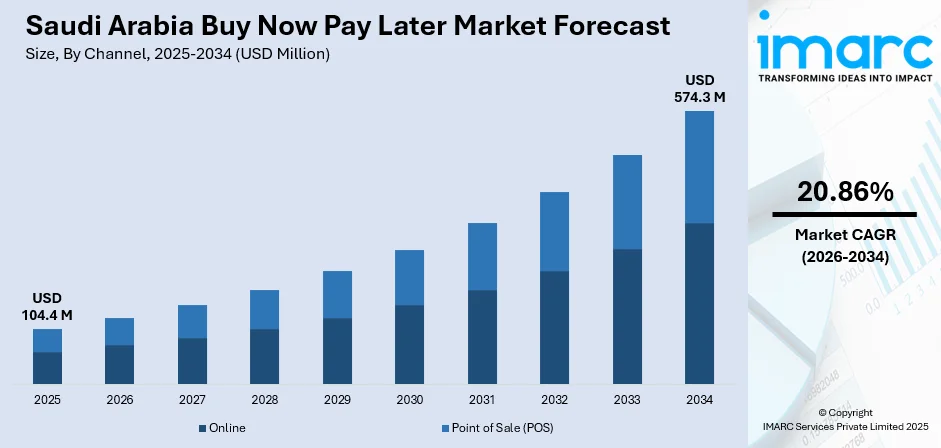

The Saudi Arabia buy now pay later market size was valued at USD 104.4 Million in 2025 and is projected to reach USD 574.3 Million by 2034, growing at a compound annual growth rate of 20.86% from 2026-2034. .

Saudi Arabia's buy now pay later sector represents a transformative shift in consumer payment preferences, driven by digital-first shopping behaviors and increasing smartphone penetration exceeding. Apart from this, the market thrives on flexible installment solutions that align with Islamic finance principles while addressing younger consumers' demand for alternative credit options beyond traditional banking frameworks, thereby expanding the Saudi Arabia buy now pay later market share.

Key Takeaways and Insights:

- By Channel: Online dominates the market with a share of 58% in 2025, reflecting widespread e-commerce adoption and mobile shopping preferences among Saudi consumers seeking seamless digital payment experiences.

- By Enterprise Size: Small and medium enterprises lead the market with a share of 55% in 2025, as these businesses leverage buy now pay later solutions to enhance customer acquisition and compete effectively against larger retailers.

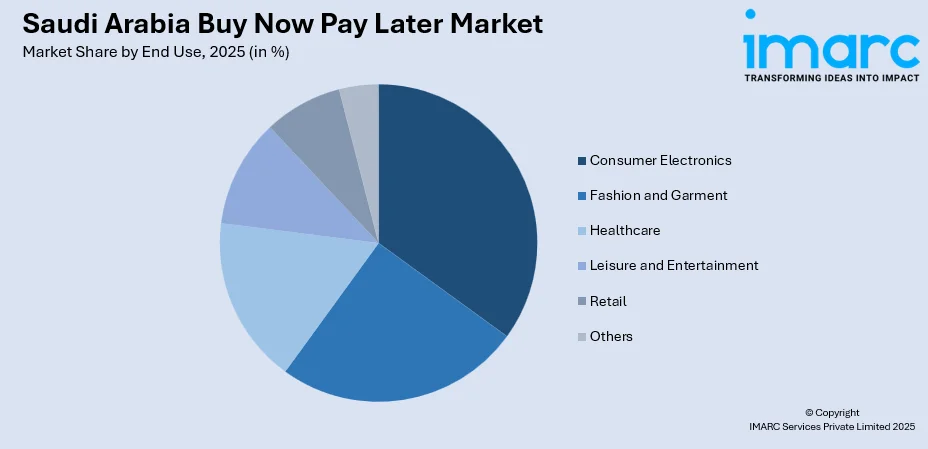

- By End Use: Consumer electronics represent the largest segment with a market share of 24% in 2025, driven by high-value purchases where installment payment options significantly reduce purchase barriers for tech-savvy individuals.

- By Region: Western Region exhibits dominance with a 30% share in 2025, benefiting from concentrated urban populations in Jeddah and Mecca alongside higher digital payment infrastructure and tourist-driven retail activity serving pilgrims.

- Key Players: The Saudi Arabia buy now pay later market demonstrates dynamic competitive intensity, with fintech innovators competing alongside traditional financial institutions to capture market share across diverse merchant categories and consumer segments.

To get more information on this market Request Sample

The Saudi Arabia buy now pay later market has emerged as a cornerstone of the Kingdom's financial technology revolution, fundamentally reshaping how consumers approach purchasing decisions. Young demographics seeking interest-free payment flexibility have accelerated adoption across retail categories, while merchants recognize these solutions as powerful tools for basket size expansion and customer loyalty enhancement. The regulatory environment continues evolving to balance consumer protection with innovation, creating frameworks that encourage responsible lending practices while supporting Vision 2030's digital economy objectives. In Saudi Arabia, the proportion of the digital economy in the gross domestic product (GDP) rose by 0.4 percent, reaching 16 percent in 2024, up from 15.6 percent in 2023. This was disclosed in the findings of the Digital Economy Survey report for the year 2024. The core digital economy contributed 2.7 percent, whereas the narrow digital economy represented 2.4 percent. The expansive digital economy accounted for the highest portion at 10.9 percent of GDP. The report indicated that the operating revenues for the information and communications technology (ICT) sector hit SR249.8 billion in 2024, driven by wired and wireless telecommunications, which generated SR133.9 billion, and computer programming activities, which earned SR31.1 billion.

Saudi Arabia Buy Now Pay Later Market Trends:

Integration with Islamic Finance Principles

Buy now pay later providers are increasingly developing Shariah-compliant structures that eliminate interest charges while maintaining commercial viability through merchant discount fees and transparent service charges. This alignment with Islamic finance principles has unlocked consumer segments previously hesitant to engage with conventional credit products, particularly among religiously observant populations seeking ethical payment alternatives. Fintech platforms are collaborating with Shariah advisory boards to ensure product structures meet religious requirements while delivering the convenience modern consumers expect from digital payment solutions. In 2025, Saudi fintech Tamara has obtained a $2.4 billion Shariah-compliant financing deal from Goldman Sachs, Citi, and Apollo to enhance its buy-now-pay-later and credit offerings throughout the Gulf region.

Expansion into Experiential and Service Sectors

Beyond traditional retail applications, buy now pay later solutions are penetrating travel bookings, healthcare payments, educational services, and entertainment purchases. Consumers are utilizing installment payment options for hotel reservations during Hajj and Umrah pilgrimages, dental procedures, professional certification courses, and theme park admissions. This range of options shows increasing acknowledgment by merchants that payment flexibility boosts conversion rates by 20-35% for high-involvement purchases, as consumers value the chance to control cash flow for experiences and services that deliver value over extended timeframes. In 2025, Arabian Pay, the top national fintech platform, revealed the signing of a contract to obtain funding during its Pre-Seed investment round from Al Bassami Holding Group, a prominent player in the logistics and transportation industry both in the Kingdom and worldwide. The signing event was graced by the Founder and CEO of Arabian Pay, alongside CEO of Al Bassami Holding Group. Arabian Pay is continually growing and enhancing its innovation in financial solutions, centering on the Buy Now, Pay Later (BNPL) approach to assist small and medium-sized enterprises (SMEs).

Artificial Intelligence-Driven Credit Assessment

Providers are deploying sophisticated machine learning algorithms that evaluate creditworthiness using alternative data sources beyond traditional credit bureaus, including mobile phone usage patterns, e-commerce transaction histories, and social media engagement metrics. These advanced assessment models enable approval decisions in under 60 seconds while expanding access to underbanked populations (estimated at 18% of adults) with limited formal credit histories. The technology simultaneously reduces default risk (maintaining rates below 3% industry-wide) through behavioral pattern recognition that identifies potentially problematic borrowing behaviors before extending credit facilities to new customers. IMARC Group predicts that the Saudi Arabia artificial intelligence market is projected to attain USD 4,374.5 Million by 2034.

How Vision 2030 is Transforming the Saudi Arabia Buy Now Pay Later Market:

Vision 2030 is playing a direct role in shaping the buy now pay later market in Saudi Arabia by accelerating digital payments and fintech adoption. The program’s emphasis on a cashless economy and financial inclusion has reduced reliance on credit cards and encouraged alternative consumer financing models. Regulatory support from the Saudi Central Bank, including fintech sandbox initiatives and clearer licensing pathways, has allowed BNPL providers to scale with greater confidence. Growth in e-commerce, driven by higher internet penetration and changing retail habits, has further strengthened BNPL adoption, particularly in fashion, electronics, and lifestyle segments. Merchants are increasingly using BNPL to improve checkout completion rates and attract younger consumers. Vision 2030’s support for SMEs has also widened merchant participation, expanding BNPL beyond large retailers. A young population, high smartphone usage, and preference for short-term, transparent payment plans continue to drive the demand. With tighter oversight and growing partnerships between banks, fintech firms, and merchants, BNPL is becoming a standard payment option within Saudi Arabia’s modern retail and digital commerce environment.

Market Outlook 2026-2034:

The Saudi Arabia buy now pay later market is positioned for substantial expansion as digital payment infrastructure matures and regulatory frameworks solidify around consumer financing models. Government initiatives promoting cashless transactions, including the Vision 2030 target of increased digital payment penetration, and fintech development create favorable conditions for sustained growth. The market generated a revenue of USD 104.4 Million in 2025 and is projected to reach a revenue of USD 574.3 Million by 2034, growing at a compound annual growth rate of 20.86% from 2026-2034. Increasing merchant adoption across diverse retail categories, with merchants already integrated by late 2025, combined with rising consumer comfort with digital-first financial services, will drive market penetration beyond early-adopter segments into mainstream purchasing behaviors throughout the forecast period.

Saudi Arabia Buy Now Pay Later Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Channel |

Online |

58% |

|

Enterprise Size |

Small and Medium Enterprises |

55% |

|

End Use |

Consumer Electronics |

24% |

|

Region |

Western Region |

30% |

Channel Insights:

- Online

- Point of Sale (POS)

Online dominates with a market share of 58% of the total Saudi Arabia buy now pay later market in 2025.

The online channel's commanding position reflects fundamental shifts in Saudi consumer shopping behaviors, with e-commerce platforms experiencing growth and serving as primary discovery and purchase environments for products ranging from fashion to home furnishings. Digital-native buy now pay later integrations offer frictionless checkout experiences where payment plans are presented automatically at transaction completion, eliminating the psychological barriers associated with credit applications. Mobile commerce particularly drives online segment growth, accounting for a major portion of e-commerce transactions, as smartphone-optimized payment flows enable impulse purchases through social media shopping features and influencer-driven product promotions.

The online channel benefits from superior data collection capabilities that enable personalized credit limit offerings and targeted promotional campaigns based on browsing histories and past purchase patterns. E-commerce merchants recognize that embedding buy now pay later options directly into product pages increases average order values while reducing cart abandonment rates, creating strong incentives for prominent placement of these payment alternatives. The seamless integration between online retailers and fintech platforms allows real-time inventory synchronization and instant payment confirmation within 3 to 5 seconds, delivering customer experiences that physical retail environments struggle to replicate without dedicated point-of-sale infrastructure investments.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

Small and medium enterprises lead with a share of 55% of the total Saudi Arabia buy now pay later market in 2025.

Small and medium enterprises, employing a large percentage of the private sector workforce, have embraced buy now pay later solutions as competitive equalizers that enable them to offer payment flexibility previously available only through large retailers with established credit programs. These businesses benefit from partnership models where fintech providers assume credit risk and operational complexity, allowing SMEs to focus on core merchandising activities while still delivering modern payment options customers increasingly expect. The relatively lower integration costs and minimal technical requirements make buy now pay later accessible to businesses lacking dedicated IT departments or complex payment infrastructure.

SME adoption is particularly pronounced in fashion boutiques, specialty electronics retailers, wellness centers, and local furniture stores where purchase decisions involve moderate to high price points that benefit from installment options. These businesses report measurable improvements in conversion rates and customer retention when buy now pay later alternatives are prominently displayed alongside traditional payment methods. The segment's growth is further accelerated by fintech providers actively targeting SME merchants through simplified onboarding processes, revenue-sharing models where merchants pay per transaction that align incentives, and marketing support that helps smaller businesses communicate payment flexibility to their customer bases through digital and physical channels.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Fashion and Garment

- Healthcare

- Leisure and Entertainment

- Retail

- Others

Consumer electronics exhibit a clear dominance with a 24% share of the total Saudi Arabia buy now pay later market in 2025.

Consumer electronics represents the archetypal use case for buy now pay later adoption, as smartphones, laptops, gaming consoles, and home appliances carry price points that create meaningful purchase hesitation among consumers managing monthly budgets. The ability to distribute payments across several months transforms affordability calculations for products ranging from premium smartphones to home theater systems, enabling consumers to access latest technology releases without depleting savings or relying on traditional credit cards. Electronics retailers report that buy now pay later availability directly influences brand and model selection, with consumers often upgrading to higher-specification products when installment payments make premium options financially accessible.

The consumer electronics segment benefits from the category's natural alignment with digitally-savvy demographics already comfortable with online purchasing and mobile payment technologies. Product replacement cycles for electronics create recurring purchase opportunities where consumers familiar with buy now pay later from previous transactions default to these payment methods for subsequent acquisitions. The segment also experiences seasonal surges during back-to-school periods, Ramadan shopping, and year-end promotions when consumer electronics purchases concentrate, with buy now pay later options helping smooth demand by making premium products accessible to budget-conscious shoppers during high-consideration purchase windows throughout the calendar year.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Western region leads with a share of 30% of the total Saudi Arabia buy now pay later market in 2025.

The Western Region's market leadership stems from Jeddah's position as a commercial hub with sophisticated retail infrastructure and cosmopolitan consumer populations exhibiting high digital payment adoption rates. The region benefits from concentrated economic activity in major urban centers where international retailers and local merchants compete intensively, creating environments where payment innovation serves as competitive differentiation. Additionally, the Western Region's role in serving millions of annual religious pilgrims visiting Mecca generates substantial retail activity across hospitality, transportation, and consumer goods sectors where buy now pay later solutions facilitate purchases for visitors managing travel budgets.

The region's demographic composition skews younger compared to national averages, with tech-savvy populations demonstrating comfort with fintech solutions and mobile-first shopping behaviors that naturally align with buy now pay later adoption patterns. Western Region merchants have invested heavily in omnichannel retail strategies that integrate online and physical shopping experiences, creating seamless environments where buy now pay later options function consistently across touchpoints. The concentration of shopping malls, specialty retail districts, and e-commerce fulfillment infrastructure provides the merchant density necessary for buy now pay later providers to achieve operational efficiency while building brand awareness through prominent merchant partnerships across diverse retail categories.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Buy Now Pay Later Market Growing?

Youthful Demographics Seeking Alternative Credit Solutions

Saudi Arabia's population structure features 71% under age 35 who exhibit preferences for flexible payment options over traditional credit products with their associated approval processes taking 3 to 7 days and interest structures charging annually. This demographic cohort demonstrates comfort with digital financial services having grown up with smartphone technology and social media commerce generating massive revenue annually, creating natural affinity for buy now pay later solutions that integrate seamlessly into their existing shopping behaviors. The younger generation's skepticism toward conventional banking products, combined with desires for financial transparency and control over spending commitments, positions buy now pay later as an attractive alternative that aligns with their values around accessible, straightforward financial services without hidden costs or complex terms requiring extensive documentation.

E-Commerce Acceleration and Digital Payment Infrastructure

The rapid expansion of Saudi Arabia's e-commerce ecosystem has created ideal conditions for buy now pay later proliferation, as online shopping environments provide the technical frameworks necessary for seamless payment plan integration at checkout. Government initiatives promoting digital transformation have accelerated merchant and consumer readiness for innovative payment solutions beyond cash and traditional cards. The widespread availability of high-speed mobile internet with 5G coverage increasing combined with smartphone penetration exceeding enables consumers to access buy now pay later services from anywhere. IMARC Group predicts that the Saudi Arabia 5G infrastructure market is projected to attain USD 4,892.8 Million by 2034.

Vision 2030 Fintech Development Initiatives

Saudi Arabia's Vision 2030 economic diversification strategy explicitly emphasizes fintech sector development as a priority area, with the Saudi Central Bank licensing 23 fintech companies, creating regulatory support and institutional backing for payment innovation that includes buy now pay later models. As per Fintech Saudi’s yearly fintech report, there are currently 261 fintech companies in the country, marking a 21% increase from 216 in 2024 and exceeding the 230 company goal set for the conclusion of 2025 by 13%. Government support extends to initiatives promoting financial inclusion targeting the unbanked population and expanding access to credit alternatives for underbanked populations comprising adults, positioning buy now pay later as a tool aligned with broader policy objectives around economic participation and consumer empowerment through accessible financial services.

Market Restraints:

What Challenges the Saudi Arabia Buy Now Pay Later Market is Facing?

Consumer Debt Accumulation and Default Risk Concerns

The ease of accessing buy now pay later credit across multiple merchants simultaneously creates potential for consumers to accumulate payment obligations beyond their repayment capacity, particularly among younger users with limited experience managing installment commitments. Unlike traditional credit products with centralized credit bureau reporting, fragmented buy now pay later usage across platforms may obscure total debt exposure until payment difficulties emerge. Regulatory authorities are increasingly scrutinizing the sector's credit assessment practices and consumer protection mechanisms to prevent over-extension.

Regulatory Uncertainty and Compliance Evolution

The buy now pay later sector operates in a developing regulatory environment where rules governing consumer lending, data privacy, and fintech operations continue evolving as authorities balance innovation encouragement with consumer protection imperatives. Providers face ongoing compliance costs and operational adjustments as regulatory frameworks solidify, creating uncertainty around long-term business model viability and profitability thresholds. The potential for stricter licensing requirements, mandatory credit checks, or interest rate caps could fundamentally alter the sector's economics and accessibility advantages.

Merchant Discount Rate Sustainability and Profitability Pressures

Buy now pay later providers rely on merchant fees as primary revenue sources, creating tension as retailers push back against discount rates that impact already-thin profit margins in competitive retail categories. As the market matures and competition intensifies among providers, merchants gain negotiating leverage to demand lower fees or threaten to consolidate payment partnerships with fewer providers. The sustainability of current merchant economics remains uncertain as providers balance growth investments, credit risk management costs, and pathway to profitability while maintaining merchant relationships.

Competitive Landscape:

The Saudi Arabia buy now pay later market exhibits a dynamic competitive structure characterized by fintech startups leveraging technology advantages alongside established financial institutions seeking to defend payment processing market share. Competition centers on merchant acquisition strategies, with providers differentiating through integration simplicity, approval rates, and marketing support that helps retailers communicate payment flexibility to consumers. The landscape includes both domestic operators with local market understanding and international platforms bringing proven business models from mature markets, creating knowledge transfer that accelerates overall sector development. Competitive intensity is further shaped by partnerships between technology providers and traditional banks seeking to modernize product offerings without building proprietary fintech capabilities internally.

Recent Developments:

- In February 2025, Telr has teamed up with Bank AlJazira to improve digital payment options for its merchants, aiding Saudi Arabia’s transition to a cashless economy. This partnership will optimize transactions, facilitating quicker payments, enhanced fraud protection, and a smooth checkout process for companies and their clients. Combining Telr’s advanced technology with Bank AlJazira’s strong banking system, businesses gain access to a wide range of payment solutions, such as payment links, recurring payments, e-invoicing, Buy Now, Pay Later (BNPL), and additional features. This partnership improves payment options, broadens financial access, and enables e-commerce companies to succeed in Saudi Arabia’s rapidly changing digital marketplace.

Saudi Arabia Buy Now Pay Later Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | Online, Point of Sale (POS) |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Uses Covered | Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia buy now pay later market size was valued at USD 104.4 Million in 2025.

The Saudi Arabia buy now pay later market is expected to grow at a compound annual growth rate of 20.86% from 2026-2034 to reach USD 574.3 Million by 2034.

Online dominated the Saudi Arabian market with a share of 58%, driven by widespread e-commerce adoption and mobile shopping preferences among consumers seeking seamless digital payment experiences that integrate installment options directly into checkout flows.

Key factors driving the Saudi Arabia buy now pay later market include youthful demographics seeking alternative credit solutions, accelerating e-commerce adoption supported by digital payment infrastructure, and Vision 2030 fintech development initiatives that create regulatory support for payment innovation.

Major challenges include consumer debt accumulation risks as users access credit across multiple platforms simultaneously, regulatory uncertainty as compliance frameworks continue evolving, and merchant discount rate sustainability pressures as retailers negotiate for lower fees amid competitive retail margin environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)