Saudi Arabia Carton Packaging Market Size, Share, Trends and Forecast by Material Type, Product Type, End User, and Region, 2026-2034

Saudi Arabia Carton Packaging Market Overview:

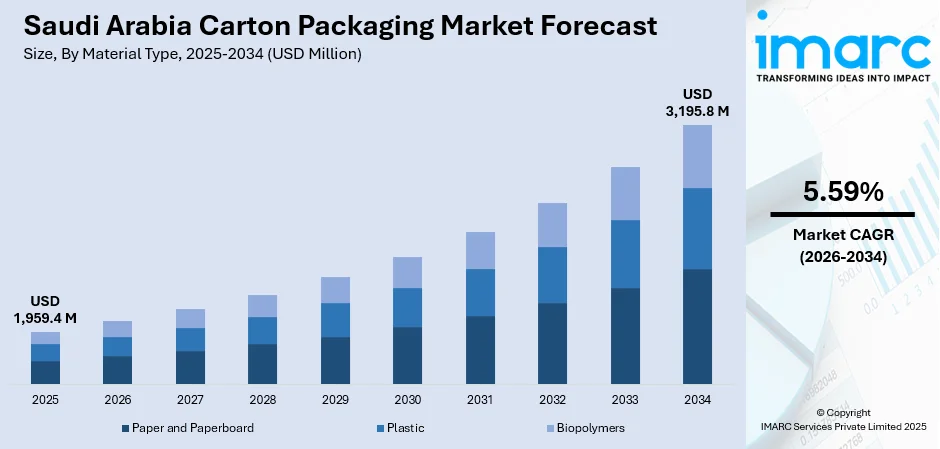

The Saudi Arabia carton packaging market size reached USD 1,959.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,195.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.59% during 2026-2034. The market is witnessing significant growth driven by increasing demand from industries such as food and beverages, e-commerce, and consumer goods. The preference for sustainable and recyclable packaging solutions and technological advancements in production techniques and packaging designs are also improving efficiency and cost-effectiveness, contributing to the Saudi Arabia carton packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,959.4 Million |

| Market Forecast in 2034 | USD 3,195.8 Million |

| Market Growth Rate 2026-2034 | 5.59% |

Saudi Arabia Carton Packaging Market Trends:

Increased Emphasis on Sustainability

Sustainability is emerging as one of the major drivers in the Saudi Arabia carton packaging market as consumer and business demand for eco-friendly, recyclable, and biodegradable materials continues to grow. Paperboard is one of the most common used materials since it is recyclable and contributes little to the environment, hence it is a preferred material to be used in food and beverage packaging. Bioplastics, manufactured from renewable plant feedstocks, are also gaining acceptance as a biodegradable alternative to traditional plastics. Similar in performance to plastics, they will biodegrade naturally, reducing long-term landfill disposal. Companies are increasingly utilizing these environment friendly materials to capitalize on consumers' desire for greener products and laws requiring environmental stewardship. In addition, the growing need for sustainable packaging is also compelling producers to innovate so that sustainability is included in their packaging. For example, in October 2024, Tetra Pak revealed the launch of the "Made, Consumed and Recycled in Saudi Arabia" campaign, marking 44 years in the Kingdom. The campaign features Tetra Pak's contribution to economic development, food security, and sustainability. The business also put in $3 million into recycling carton package solutions, aiding local businesses and the environment. As a result, businesses in Saudi Arabia are preferring these materials, a factor that is propelling the carton packaging market growth.

To get more information on this market, Request Sample

E-Commerce Growth

The geometric rise of e-commerce in Saudi Arabia is significantly propelling demand for cost-effective and protective carton packaging solutions. Based on the statistics released by the International Trade Administration (ITA), the e-commerce industry in Saudi Arabia was projected to develop strongly by 2024 with 33.6 million internet users expected. Internet sales grew by almost 60% since 2020, with the average spend per user increasing more than 50%. The government is strengthening regulations to increase confidence in e-commerce to promote a healthy digital marketplace. As shopping online continues to expand, businesses are increasingly worried about how products get delivered safely and securely to their destinations. Carton packaging is ideal to secure different kinds of goods from electronic items to fragile ones like glassware and transport them safely to their destinations. There is an increased need for durable but light packaging in a bid to conserve shipping cost and provide adequate protection. In addition to this, requirements of fast deliveries and safety-packaging expectations among the masses are driving companies to invest in quality material as well as design-driven innovations.

Changing Consumer Attitudes Towards Convenience and Portability

The growing demand for convenience and portability among the masses is driving the carton packaging market. With the fast pace of life, particularly in the city, people are looking for packaging solutions that simplify their daily lives. Carton packaging has several benefits in this respect as it is light, convenient to open, and extremely portable. This is particularly relevant in the case of products that have a constantly on-the-move nature, like readymade food products, snacks, drinks, and health products. Cartons also offer convenient storage for consumers because they can be stacked and stored tightly within kitchens, grocery stores, and warehouses. These consumer needs are being answered by manufacturers who are creating packaging that is not only convenient but also convenient to use. Convenient-to-carry cartons with handles or resealable functions are increasingly prevalent, especially in food and beverage (F&B) industries. Furthermore, the potential of carton packaging to support easy-to-read product information and branding contributes immensely to its growing popularity. The Saudi Arabia foodservice market is projected to attain USD 58,310 Million by 2033.

Saudi Arabia Carton Packaging Market Growth Drivers:

Technological Innovations in Packaging Manufacturing and Design

The Saudi Arabian carton packaging industry is being aided by ongoing technological innovations in packaging manufacturing and design. As manufacturers make investments in advanced technologies like digital printing, automation, and intelligent packaging, the industry is growing more dynamic and streamlined. Digital printing technology is enabling high-quality, low-cost customization of carton packaging. Brands are now able to print complex designs, logos, and product details more accurately and quickly, and carton packaging becomes a viable option for branding and marketing. Carton manufacturing processes are being automated to enhance efficiency by minimizing human errors and maximizing output. Fully automated production lines enable manufacturers to respond to increasing demand in a timely manner with consistent quality and less waste. Machine learning and artificial intelligence are also being used to optimize packaging designs, with manufacturers using them to design cartons that make the most of space, minimize material use, and improve overall performance. These technological innovations are creating more cost-effective and sustainable packaging options, with carton packaging becoming a more attractive choice for companies. Additionally, intelligent packaging technologies that incorporate QR codes or augmented reality (AR) are improving consumer interaction and adding value to companies. With advances in technology, carton packaging is likely to be at the center of the packaging sector, providing innovative solutions that cater to the requirements of today's companies and consumers.

Government Regulations Encouraging Domestic Production

The expansion of the carton packaging industry in Saudi Arabia is directly related to the nation's governmental policies and laws that support domestic manufacturing and economic diversification. In the context of Saudi Arabia's Vision 2030, its government has been aggressively pushing for the growth of the non-oil economy, such as the packaging sector. Policies intended to minimize the dependence on imported products and stimulate local production are creating a good atmosphere for local carton packing manufacturers. Some of the policies include financial incentives in the form of tax relief, subsidies, and access to government finance for the local manufacturers. With the encouragement of local production, the government is not just facilitating the development of the carton packaging industry but also making the nation more independent in terms of packaging manufacturing. At the same time, policies promoting the use of local materials are raising the demand for carton packaging. These incentives are helping local producers increase their producing capacities, invest in new technologies, and improve the range of products they offer. Consequently, the local carton packaging industry is expanding, with local businesses being more equipped to take advantage of the growing demand for packaging solutions within most industries. The integration of government incentives and increased demand for eco-friendly packaging is speeding up the growth of the carton packaging industry.

Increased Demand in the F&B Industry

The growth of Saudi Arabia's F&B sector is at the forefront of the drive for the carton packaging market. As the population of the country rises, with more demand for convenience foods, safe and efficient packaging solutions become ever more in demand. Carton packaging, as it is cost-effective, protective, and easy to deal with, is especially suited to the food and drink market. Cartons find widespread application in the packaging of most food products including snacks, frozen foods, dairy products, and ready-to-eat foods. With the increasing need for packaged food and beverages, especially in metropolitan cities, reliance on carton packaging has increased because cartons help maintain the freshness of products as well as the durability during transportation. In addition, eco-conscious consumers prefer products that are packaged in eco-friendly cartons, and hence the demand for eco-friendliness carton solutions is increasing. As the F&B sector keeps on growing, particularly due to urbanization and shifting end user attitudes, carton packaging is being widely used as a solution that is both functional and eco-friendly.

Saudi Arabia Carton Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on material type, product type, and end user.

Material Type Insights:

- Paper and Paperboard

- Plastic

- Biopolymers

The report has provided a detailed breakup and analysis of the market based on the material type. This includes paper and paperboard, plastic, and biopolymers.

Product Type Insights:

- Folding Cartons

- Rigid Cartons

- Liquid Cartons

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes folding cartons, rigid cartons, and liquid cartons.

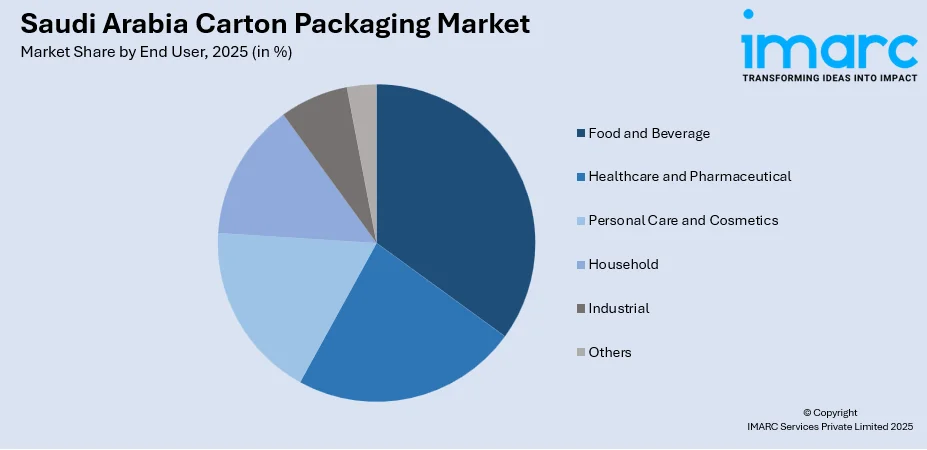

End User Insights:

- Food and Beverage

- Healthcare and Pharmaceutical

- Personal Care and Cosmetics

- Household

- Industrial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverage, healthcare and pharmaceutical, personal care and cosmetics, household, industrial, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Carton Packaging Market News:

- In April 2025, Crown Paper Mill (CPM) has launched a new tissue paper facility in Saudi Arabia, equipped with a high-speed Valmet tissue paper machine, the fastest globally, capable of manufacturing 2,200 meters of tissue paper every minute. Starting with a capacity of 60,000 metric tonnes each year, the facility will enhance CPM’s overall manufacturing abilities to 160,000 metric tonnes per year. In an exclusive interview with Paper Mart, Mr. Abdullah Al Khateeb, Managing Director of CPM and Ittihad Paper Mill (IPM), discusses the mill's expansion in Saudi Arabia and ambitions to extend their presence throughout the MENA region. The company aims to create new innovative tissue paper products and invest in next-generation sustainable technologies to lessen its environmental impact.

- In March 2025, Tetra Pak and Al Rabie announced a groundbreaking partnership at Gulfood Consumer to modernize Al Rabie’s juice and dairy production facilities in Saudi Arabia. The three-year project will digitize operations and enhance sustainability, significantly improving resource efficiency while reducing water and electricity usage, all while focusing on carton packaging innovations.

- In October 2024, Al-Medan Project Factory for Carton announced the launch of its Rams Al-Tatour folding carton factory in Saudi Arabia. Utilizing advanced Koenig & Bauer technology, the facility aims to revolutionize folding carton packaging with enhanced efficiency and flexibility, addressing the industry's demands for shorter delivery times and smaller print runs.

- In August 2024, Alesayi Beverage Corporation announced its partnership with SIG to enhance its product range, introducing bag-in-box packaging. Utilizing the SIG SureFill 42 Aseptic system, Alesayi will launch new beverages in the HoReCa sector. This aligns with Alesayi's commitment to innovative packaging solutions, including carton, and sustainability in the MEA region.

Saudi Arabia Carton Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Paper and Paperboard, Plastic, Biopolymers |

| Product Types Covered | Folding Cartons, Rigid Cartons, Liquid Cartons |

| End Users Covered | Food and Beverage, Healthcare and Pharmaceutical, Personal Care and Cosmetics, Household, Industrial, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, and Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia carton packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia carton packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia carton packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carton packaging market in Saudi Arabia was valued at USD 1,959.4 Million in 2025.

The Saudi Arabia carton packaging market is projected to exhibit a CAGR of 5.59% during 2026-2034, reaching a value of USD 3,195.8 Million by 2034.

Key factors driving the Saudi Arabia carton packaging market include heightened demand for sustainable and eco-friendly packaging, rapid growth in the e-commerce industry, shifting consumer preferences for convenience, technological advancements in packaging design, government support for local manufacturing, and the expansion of the food and beverage (F&B) sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)