Saudi Arabia Casting and Forging Market Size, Share, Trends and Forecast by Component Type, Material Type, Manufacturing Process, Sales Channel, and Region, 2026-2034

Saudi Arabia Casting and Forging Market Overview:

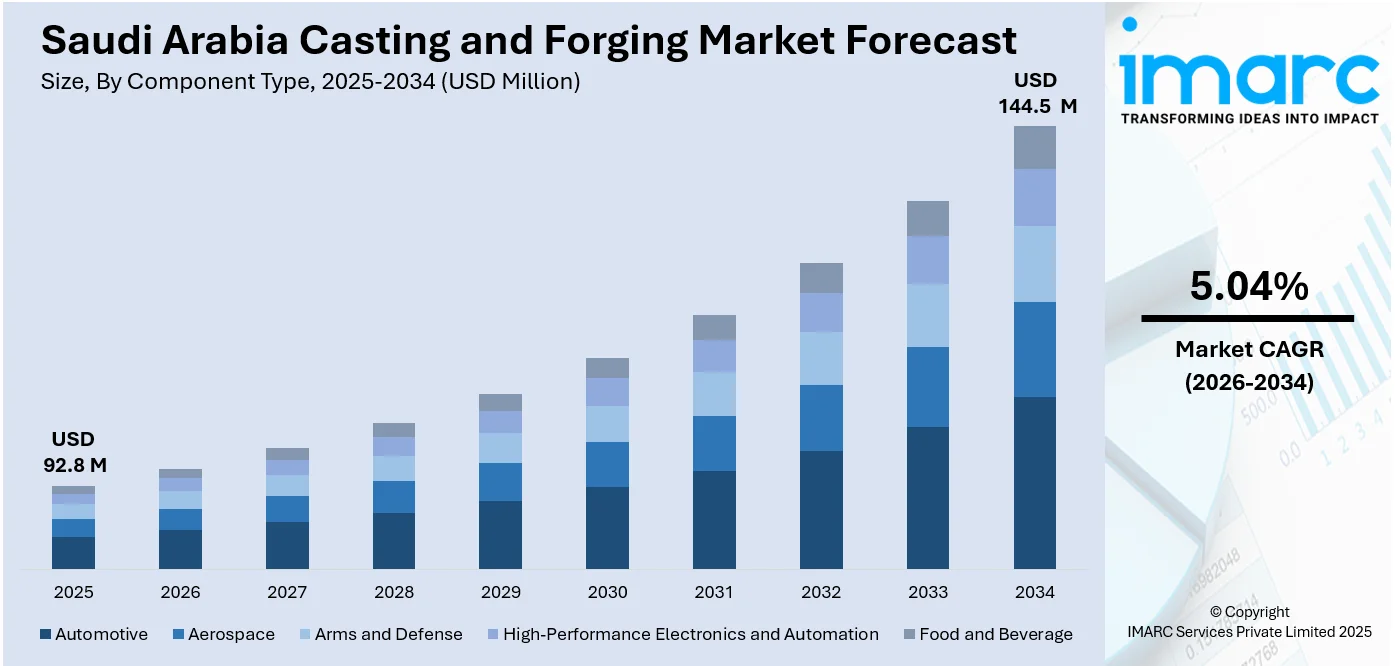

The Saudi Arabia casting and forging market size reached USD 92.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 144.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.04% during 2026-2034. Industrial expansion in oil and gas, infrastructure development under Vision 2030, rising automotive and defense manufacturing, and increasing investments in localized metal component production to reduce import dependence and support domestic heavy machinery industries are some of the factors contributing to Saudi Arabia casting and forging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 92.8 Million |

| Market Forecast in 2034 | USD 144.5 Million |

| Market Growth Rate 2026-2034 | 5.04% |

Saudi Arabia Casting and Forging Market Trends:

Expansion of Domestic Heavy Industrial Capabilities

Saudi Arabia is ramping up its local manufacturing capacity for high-stress industrial components, with a new facility near Jubail equipped with advanced open-die forging presses from Germany. This development enhances the domestic supply base for sectors like petrochemicals, shipbuilding, and wind energy. By reducing dependence on imports and investing in specialized equipment, the country is reinforcing its position as a regional manufacturing hub for critical forged components. The strategic backing from major players in energy and manufacturing further underlines the push toward industrial localization. This move not only supports national supply chain resilience but also strengthens capabilities in precision casting and forging, especially for applications requiring structural integrity and material durability under extreme conditions. These factors are intensifying the Saudi Arabia casting and forging market growth. For example, in May 2023, Tuwaiq Casting & Forging’s new facility near Jubail was equipped with two advanced open-die forging presses from Germany’s SMS group. Backed by Doosan, Dussur, and Saudi Aramco, the plant supported domestic production of high-stress components for petrochemicals, shipbuilding, and wind energy, marking a key step in localizing Saudi Arabia’s heavy industrial supply chain and strengthening its casting and forging market.

To get more information on this market Request Sample

Localization of High-Performance Component Manufacturing

Saudi Arabia’s casting and forging sector is undergoing a shift driven by the establishment of a new large-scale facility near Jubail. Outfitted with state-of-the-art open-die forging presses sourced from Germany, the plant has been designed to produce critical components used in high-load applications. This includes parts for petrochemical equipment, marine vessels, and wind turbines—areas that demand both precision and strength. The initiative is closely aligned with the broader goal of reducing reliance on imported heavy industrial parts by developing in-country manufacturing expertise. Backed by prominent local and international industrial stakeholders, the project reflects growing confidence in Saudi Arabia’s ability to support technically demanding production at home. It also introduces modern forging capabilities that had been previously limited in the region. By anchoring supply closer to end-use sectors, the facility enhances lead times, reduces costs, and builds a foundation for export-ready production in the future. This signals a larger shift toward building a more self-sufficient and technologically advanced manufacturing base capable of supporting the Kingdom’s evolving industrial ambitions.

Saudi Arabia Casting and Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component type, material type, manufacturing process, and sales channel.

Component Type Insights:

- Automotive

- Engine Components

- Transmission Components

- Structural Components

- Suspension Components

- Exhaust System Components

- Powertrain Components

- Interior Components

- Exterior Components

- Others

- Aerospace

- Safety Critical Structural Parts

- Non-Safety Critical Parts

- Arms and Defense

- Mobility

- Arms and Gear

- High-Performance Electronics and Automation

- Heat Management

- Electronic-Housings

- Automation Structural Parts

- Food and Beverage

- Structural Components

- Functional Components

The report has provided a detailed breakup and analysis of the market based on the component type. This includes automotive (engine components, transmission components, structural components, suspension components, exhaust system components, powertrain components, interior components, exterior components, and others), aerospace (safety critical structural parts, and non-safety critical parts), arms and defense (mobility and arms and gear), high-performance electronics (heat management, electronic-housings, and automation structural parts) and food and beverage (structural components and functional components).

Material Type Insights:

- Aluminum Alloy 2xxx Series

- Aluminum Alloy 3xxx Series

- Aluminum Alloy 5xxx Series

- Aluminum Alloy 6xxx Series

- Aluminum Alloy 7xxx Series

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes aluminum alloy 2xxx series, aluminum alloy 3xxx series, aluminum alloy 5xxx series, aluminum alloy 6xxx series, and aluminum alloy 7xxx series.

Manufacturing Process Insights:

- Casting Process

- Sand Casting

- Die Casting

- High Pressure Die Casting

- Others

- Forging Process

- Open Die Forging

- Closed Die Forging

- Upset Forging

- Precision Forging

- Rheocasting Process

- Others

The report has provided a detailed breakup and analysis of the market based on the manufacturing process. This includes casting process (sand casting, die casting, high pressure die casting, and others), forging process (open die forging, closed die forging, upset forging, and precision forging), rheocasting process, and others.

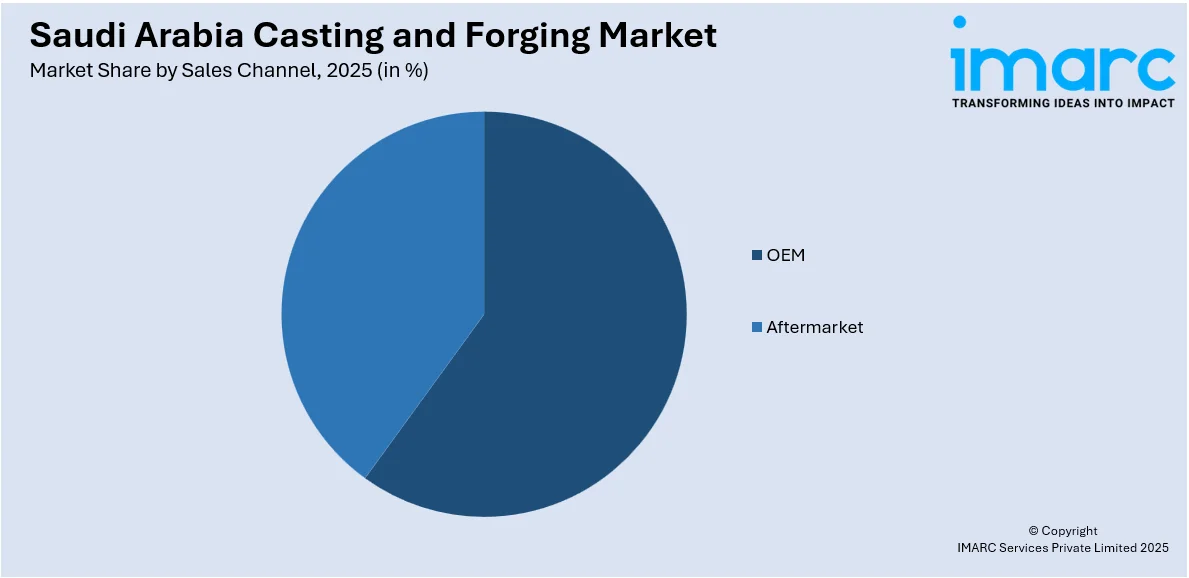

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Casting and Forging Market News:

- In February 2025, Saudi EV maker Ceer signed SAR 5.5 Billion worth of deals, including agreements with Saudi Aluminum Casting Co. and CTR to localize aluminum casting and forging. These initiatives support Vision 2030 by enhancing domestic automotive manufacturing and supply chains, creating demand for locally produced metal components and advanced fabrication capabilities in the casting and forging market in Saudi Arabia.

Saudi Arabia Casting and Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Aluminum Alloy 2xxx Series, Aluminum Alloy 3xxx Series, Aluminum Alloy 5xxx Series, Aluminum Alloy 6xxx Series, Aluminum Alloy 7xxx Series |

| Manufacturing Processes Covered |

|

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia casting and forging market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia casting and forging market on the basis of component type?

- What is the breakup of the Saudi Arabia casting and forging market on the basis of material type?

- What is the breakup of the Saudi Arabia casting and forging market on the basis of manufacturing process?

- What is the breakup of the Saudi Arabia casting and forging market on the basis of sales channel?

- What is the breakup of the Saudi Arabia casting and forging market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia casting and forging market?

- What are the key driving factors and challenges in the Saudi Arabia casting and forging?

- What is the structure of the Saudi Arabia casting and forging market and who are the key players?

- What is the degree of competition in the Saudi Arabia casting and forging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia casting and forging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia casting and forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia casting and forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)