Saudi Arabia CBD Products Market Size, Share, Trends and Forecast by Source, Distribution Channel, Application, and Region, 2026-2034

Saudi Arabia CBD Products Market Overview:

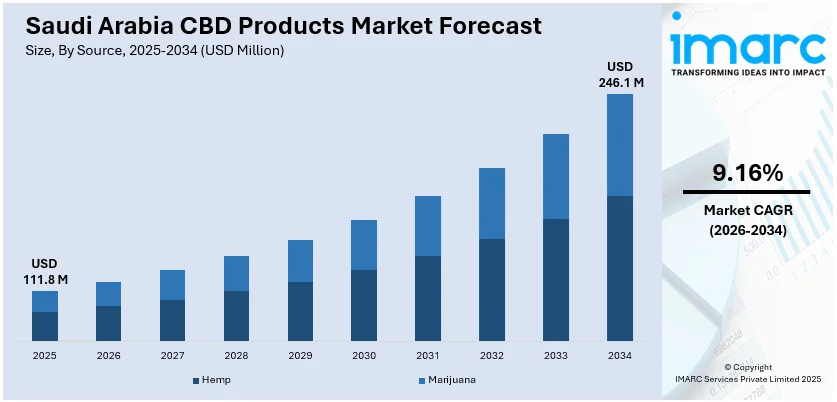

The Saudi Arabia CBD products market size reached USD 111.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 246.1 Million by 2034, exhibiting a growth rate (CAGR) of 9.16% during 2026-2034. The rising consumer awareness of wellness, easing regulatory restrictions, increasing investments in cannabis research, supportive government initiatives for diversification beyond oil, growing acceptance of alternative therapies, expanding retail distribution channels, and shifting preferences toward plant-based health products are driving the growth of the market in Saudi Arabia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 111.8 Million |

| Market Forecast in 2034 | USD 246.1 Million |

| Market Growth Rate 2026-2034 | 9.16% |

Saudi Arabia CBD Products Market Trends:

Rising Mental Health Awareness and Stress Management Needs

The growing recognition of mental health challenges, such as anxiety, stress, and sleep disorders, is driving the demand for alternative wellness solutions in Saudi Arabia. CBD products are marketed for their calming and stress-relieving properties, making them attractive for individuals seeking natural mental health support. In Saudi Arabia, the younger population is facing increasing lifestyle pressures due to urbanization, work demands, and fast-paced living, which is boosting the interest in solutions that promote relaxation and better sleep. International awareness campaigns and access to information via social media are also shaping consumer perceptions about CBD as a safe, non-addictive wellness option. As Saudi society is becoming more open about discussing mental health, the demand for CBD products that are associated with stress management and emotional well-being is set to rise. As per the IMARC Group, the Saudi Arabia mental health market is set to attain USD 8.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033.

To get more information on this market Request Sample

Increasing Shift Towards Organic and Herbal Alternatives

People in Saudi Arabia are showing a notable shift towards organic, herbal, and plant-based alternatives in personal wellness and health care. This trend is closely aligned with the demand for CBD products, which are naturally derived and often perceived as safer than synthetic pharmaceuticals. The preferences for organic remedies are reinforced by rising awareness about the side effects of conventional medicine, encouraging people to explore natural supplements. The Kingdom’s increasing young generation, influenced by global wellness trends, is particularly receptive to herbal-based health solutions. A 2024 GASTAT report indicated that 71% of Saudi citizens were below 35, with a median age of 23.5, showcasing a young demographic. The presence of herbal medicine traditions in the Middle East is further supporting the acceptance of plant-based remedies like CBD.

Expansion of E-commerce and Digital Access to CBD Products

The rapid growth of e-commerce portals in Saudi Arabia is creating opportunities for CBD products to reach people more conveniently. As per the IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024. While traditional retail exposure for CBD products may be limited due to evolving regulations, online platforms allow international brands to market and distribute products directly to consumers. The Kingdom’s digitally savvy young population frequently explores online health and wellness products, creating a receptive audience for CBD. In addition, e-commerce enables discreet purchases, which appeals to people who may be cautious about trying new wellness solutions. As online retail continues to grow, especially in lifestyle category, CBD brands are benefiting from a direct channel to consumers, helping expand adoption across Saudi Arabia.

Key Growth Drivers of Saudi Arabia CBD Products Market:

Growing Fitness and Lifestyle-Oriented User Base

The growing fitness culture and lifestyle-oriented user base in Saudi Arabia is contributing to the demand for CBD products. Fitness enthusiasts and athletes are seeking supplements like CBD products that aid recovery, reduce muscle soreness, and improve sleep. The Kingdom’s Vision 2030 is prioritizing sports and wellness, encouraging more citizens to adopt active lifestyles, which aligns with greater interest in supportive wellness products. CBD-based beverages, oils, and supplements fit well into the routines of individuals looking for natural recovery aids. Social media influencers and fitness trainers are further amplifying the awareness about CBD as part of holistic fitness regimens. As the active lifestyle movement is gaining momentum, CBD products are positioned to benefit from rising user adoption in Saudi Arabia.

Influence of International Travel

Saudi Arabia’s population, particularly the youth and affluent classes, is widely exposed to international wellness trends through frequent travel, study abroad, and digital platforms. Many people encounter CBD products in countries where they are legally sold and associated with wellness routines, sparking curiosity and interest back home. This exposure plays a vital role in shaping perceptions of CBD as a global wellness standard rather than a niche product. Additionally, Saudi Arabia is becoming more integrated into global retail markets, with international brands increasingly targeting the Middle East. Returning travelers who have experienced CBD abroad often influence peer groups and generate local awareness, supporting the domestic market. As wellness products continue to gain recognition, this exposure effect is expected to significantly contribute to the growing acceptance of CBD products in Saudi Arabia.

Rising Chronic Illnesses and Demand for Alternative Therapies

The growing incidence of chronic health ailments, such as pain disorders and arthritis, in Saudi Arabia is fueling interest in alternative therapies, including CBD. Patients dealing with long-term illnesses often seek solutions beyond conventional medicine, looking for natural options with fewer side effects. CBD products are widely promoted for pain relief, inflammation reduction, and improved quality of life, which resonate strongly with individuals managing chronic health issues. Additionally, the Kingdom’s aging population is adding to the need for natural supplements that can support healthier living. With rising healthcare costs and greater emphasis on preventive health, CBD is gaining attention as a complementary option. While regulatory frameworks are evolving, the awareness about CBD as a potential wellness tool continues to rise among consumers seeking relief from chronic conditions.

Saudi Arabia CBD Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on source, distribution channel, and application.

Source Insights:

- Hemp

- Marijuana

The report has provided a detailed breakup and analysis of the market based on the source. This includes hemp and marijuana.

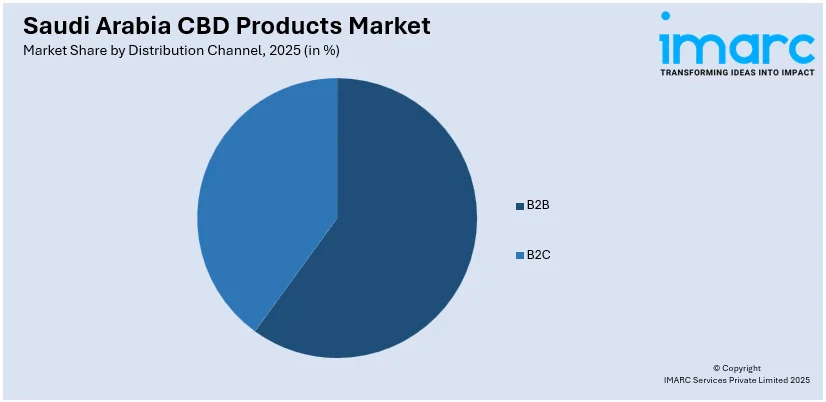

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- B2B

- B2C

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes B2B and B2C.

Application Insights:

- Pharmaceutical

- Wellness

The report has provided a detailed breakup and analysis of the market based on the application. This includes pharmaceutical and wellness.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia CBD Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Hemp, Marijuana |

| Distribution Channels Covered | B2B, B2C |

| Applications Covered | Pharmaceutical, Wellness |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia CBD products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia CBD products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia CBD products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The CBD products market in Saudi Arabia was valued at USD 111.8 Million in 2025.

The Saudi Arabia CBD products market is projected to exhibit a CAGR of 9.16% during 2026-2034, reaching a value of USD 246.1 Million by 2034.

People in Saudi Arabia are becoming more health-conscious and are seeking alternatives to traditional pharmaceutical products, aligning with global wellness trends. The growing demand for herbal and organic-based supplements is further supporting CBD adoption, particularly among younger generations exposed to international health movements through travel and social media. Additionally, the thriving e-commerce sector provides discreet and convenient access to CBD products, enhancing availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)