Saudi Arabia Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2026-2034

Saudi Arabia Cement Market Summary:

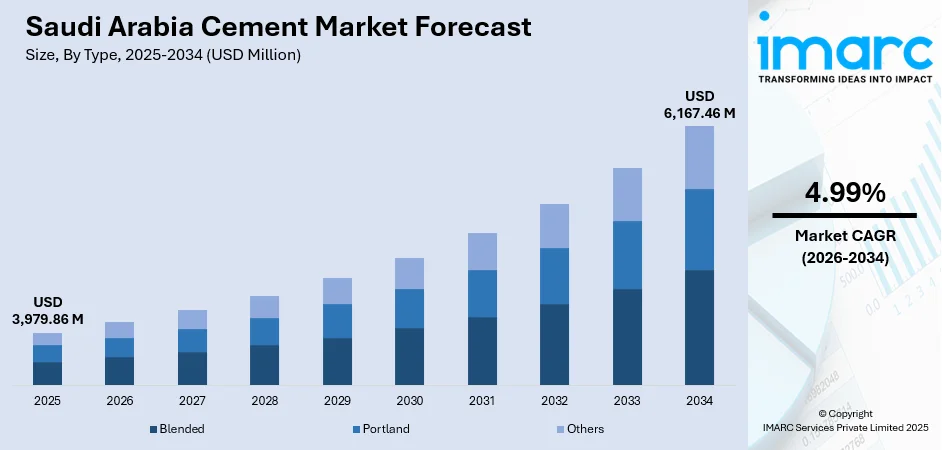

The Saudi Arabia cement market size was valued at USD 3,979.86 Million in 2025 and is projected to reach USD 6,167.46 Million by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

The Saudi Arabia cement market is experiencing robust expansion driven by large-scale infrastructure development under Vision 2030 and accelerating urbanization across major cities. Government-backed mega-projects, expanding housing initiatives, and substantial private sector investments are fueling construction activity nationwide. The growing emphasis on sustainable building practices, advancements in cement production technologies, and rising demand for eco-friendly materials are reshaping manufacturing priorities and strengthening the Saudi Arabia cement market share.

Key Takeaways and Insights:

- By Type: Blended dominates the market with a share of 55.1% in 2025, driven by growing environmental regulations, sustainability mandates, and increasing adoption of supplementary cementitious materials that reduce carbon emissions while enhancing concrete durability.

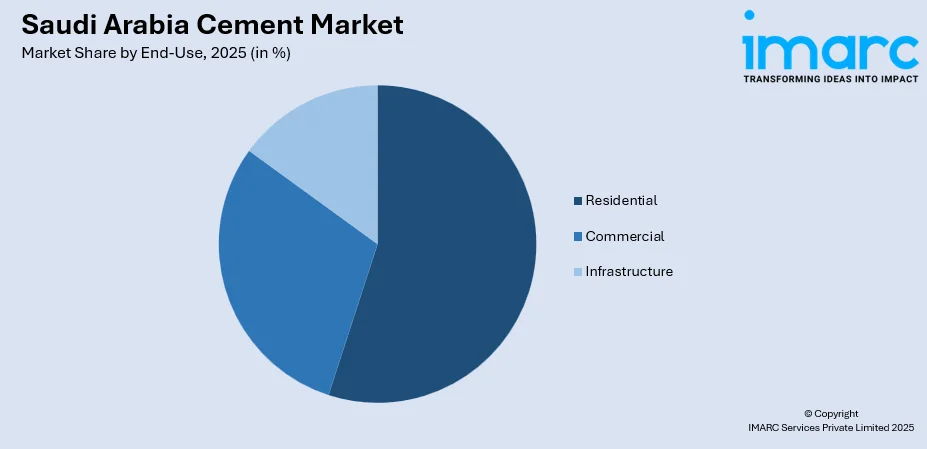

- By End-Use: Residential leads the market with a share of 40.15% in 2025, supported by government housing programs, rapid population growth, and ambitious homeownership targets under the Sakani initiative aimed at reaching 70% homeownership by 2030.

- By Region: Northern and Central region represents the largest segment with a market share of 34% in 2025, owing to concentrated urban development in Riyadh, extensive infrastructure investments, and proximity to major giga-projects requiring substantial cement supplies.

- Key Players: The Saudi Arabia cement market exhibits a moderately consolidated competitive structure, with established manufacturers focusing on capacity optimization, sustainable production methods, strategic partnerships, and logistics enhancements to serve mega-project demands efficiently.

To get more information on this market Request Sample

The Saudi Arabia cement market is undergoing significant transformation as the Kingdom accelerates its Vision 2030 objectives and positions itself as a regional construction powerhouse. Domestic cement consumption has strengthened considerably, with production capacity exceeding 80 million tons annually across approximately 20 integrated plants. Major giga-projects including NEOM, the Red Sea Project, Qiddiya, and Diriyah Gate are generating sustained demand for various cement grades. For instance, in January 2025, King Abdullah University of Science and Technology launched the Future Cement Initiative in collaboration with the Ministry of Industry and the National Cement Committee, focusing on developing sustainable production strategies to reduce carbon emissions in cement manufacturing and support Saudi Arabia's carbon neutrality goal by 2060. This initiative underscores the industry's commitment to balancing growth with environmental responsibility.

Saudi Arabia Cement Market Trends:

Rising Demand from Vision 2030 Mega-Projects

The Saudi Arabia cement market is experiencing significant growth driven by the Kingdom's ambitious mega-construction projects under Vision 2030. Large-scale developments including NEOM, the Red Sea Project, and Qiddiya are generating unprecedented demand for cement across multiple grades and applications. These projects require vast quantities of construction materials for foundations, structural frameworks, and civil works. In July 2024, Al Jouf Cement Company signed a 41-month agreement with Italy's Webuild SpA to supply cement valued at SAR 104 million (USD 27.7 million) to NEOM projects, demonstrating the substantial procurement volumes associated with these developments.

Sustainability Initiatives Reshaping Production Practices

Sustainability is fundamentally supporting the Saudi Arabia cement market growth as manufacturers increasingly adopt eco-friendly practices aligned with the Saudi Green Initiative. Cement producers are implementing alternative fuels, supplementary cementitious materials, and carbon capture technologies to reduce emissions. The Saudi Arabia green building materials market size reached USD 239.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 711.01 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033, driving demand for sustainable construction materials. In June 2024, Hoffmann Green Cement Technologies commenced construction of Saudi Arabia's first clinker-free cement production facility in Rabigh under a 22-year exclusive contract with Shurfah Group, signaling a long-term commitment to sustainable cement alternatives.

Digital Transformation Enhancing Operational Efficiency

The cement sector in Saudi Arabia is increasingly adopting digitalization and Industry 4.0 solutions to improve production efficiency, optimize operations, and strengthen overall competitiveness within the market. Manufacturers are implementing predictive maintenance systems, digital fuel mix optimization, automated emissions tracking, and advanced process control mechanisms. In 2024, Mastek secured a multi-tower deal with Yanbu Cement Company to enhance production line efficiency, continuing their partnership initiated in 2022 for digital and cloud transformation aligned with Vision 2030 and Industry 4.0 initiatives. These technological advancements are streamlining production processes and reducing operational costs across the sector.

How Vision 2030 is Transforming the Saudi Arabia Cement Market:

Saudi Arabia’s Vision 2030 is driving transformative growth in the cement market by promoting infrastructure development, urban expansion, and economic diversification. Mega projects across residential, commercial, and industrial sectors are boosting demand for high-quality cement, while government initiatives to modernize cities and enhance transportation networks are stimulating large-scale construction activities. Sustainability goals under Vision 2030 are encouraging the adoption of eco-friendly cement products and energy-efficient production technologies, aligning with global environmental standards. Additionally, industrial localization policies and strategic investments are strengthening domestic manufacturing capabilities, fostering competition among local and international players, and positioning the cement sector as a critical enabler of the Kingdom’s long-term infrastructure and economic objectives.

Market Outlook 2026-2034:

The outlook for Saudi Arabia’s cement market remains highly positive as Vision 2030 drives extensive infrastructure development. Strong demand from mega-projects, housing initiatives, and transport networks is set to support market growth over the forecast period. Cement manufacturers are adapting production capacities to match project needs while investing in sustainable and energy-efficient technologies to comply with evolving environmental standards, positioning the sector to play a key role in the Kingdom’s long-term urbanization and industrialization objectives. The market generated a revenue of USD 3,979.86 Million in 2025 and is projected to reach a revenue of USD 6,167.46 Million by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

Saudi Arabia Cement Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Blended | 55.1% |

| End-Use | Residential | 40.15% |

| Region | Northern and Central Region | 34% |

Type Insights:

- Blended

- Portland

- Others

Blended dominates the market with a share of 55.1% of the total Saudi Arabia cement market in 2025.

Blended cement has emerged as the preferred choice among Saudi Arabia's construction sector due to its environmental advantages and enhanced performance characteristics. This segment incorporates supplementary materials such as fly ash, slag, and silica fume, which reduce clinker content and consequently lower carbon emissions during production. The growing adoption of blended cement aligns with the Kingdom's commitment to environmental stewardship under the Saudi Green Initiative and supports green building certification requirements increasingly mandated in public procurement.

Cement manufacturers are increasing blended cement production to meet growing demand from sustainability-focused developers and government projects that prioritize low-emission materials. New production facilities are being established to incorporate eco-friendly technologies, such as calcined clay and other supplementary cementitious materials, enabling significant reductions in carbon emissions while maintaining product performance. These initiatives reflect the industry’s commitment to sustainable manufacturing practices and its alignment with the Kingdom’s environmental and Vision 2030 goals, supporting the transition toward greener construction materials.

End-Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

Residential leads the market with a share of 40.15% of the total Saudi Arabia cement market in 2025.

The residential segment maintains its dominant position driven by the Kingdom's ambitious housing programs and rising homeownership aspirations among the population. Government initiatives including Sakani and Wafi are accelerating residential construction to address housing demand, with Saudi Arabia's housing supply expected to expand from 3.5 million to 3.9 million units by 2028. The national homeownership rate reached 65.4% by the end of 2024, surpassing interim targets and progressing toward the 70% goal by 2030.

Major urban centers are experiencing particularly strong residential construction activity as population growth and urbanization drive demand for housing solutions. Riyadh continues to experience strong housing demand, driving significant construction activity and cement consumption. Thousands of new residential units are being launched through government programs, while many families are moving into their first homes. Large-scale community developments and ongoing housing projects are sustaining demand for building materials, highlighting the critical role of residential construction in supporting the growth of the Kingdom’s cement sector and advancing Vision 2030’s urbanization and homeownership objectives.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region represents the largest share with 34% of the total Saudi Arabia cement market in 2025.

The Northern and Central region leads the cement market due to concentrated urban growth in Riyadh and its proximity to major infrastructure developments. As the Kingdom’s capital and key economic center, Riyadh drives high cement demand through residential, commercial, and public construction projects. The city is undergoing rapid transformation with large-scale initiatives, including mixed-use developments and landmark urban projects, which are supporting sustained construction activity and reinforcing the region’s role as a primary contributor to Saudi Arabia’s cement consumption.

Government investment priorities further strengthen the region's cement demand fundamentals as central authorities allocate significant resources to urban modernization and connectivity improvements. Public housing initiatives and major transportation projects continue to create steady demand for cement in the region. Long-term supply agreements linked to road, sewage, and utility infrastructure upgrades support consistent consumption. The northern areas benefit from strategic proximity to large-scale developments, facilitating efficient logistics and cement supply for transformative infrastructure projects, further strengthening the region’s position as a key driver of market growth.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cement Market Growing?

Vision 2030 Infrastructure Development Initiatives

The primary driver of the Saudi Arabia cement market is the scale and continuity of construction activity under the Vision 2030 national development framework. The Kingdom's commitment to economic diversification has unlocked substantial multi-year investments in housing, transportation, tourism, and industrial infrastructure, all of which are cement-intensive applications. Mega-projects, including NEOM, the Red Sea Project, Qiddiya, and Diriyah Gate, require enormous volumes of cement for foundations, structural frameworks, tunnels, bridges, and civil works. The Public Investment Fund's infrastructure portfolio continues expanding with projects valued in the hundreds of billions of dollars. In January 2025, the NovusCrete Consortium was established through a memorandum of understanding among SIKA AG, ClimateCrete Inc., NEOM, the Saudi Investment Recycling Company, and the Public Investment Fund, focusing on developing sustainable concrete production methods to support these massive developments.

Expanding Residential Construction and Housing Programs

Residential construction is a key driver of cement demand as the Kingdom works to meet growing housing needs through extensive government programs. Expanding homeownership targets under Vision 2030 are fueling the construction of new housing projects, which in turn requires substantial volumes of cement. This sustained focus on residential development is supporting the growth of the cement sector and reinforcing its role in enabling the Kingdom’s broader urbanization and infrastructure goals. Urban population growth, particularly in major cities like Riyadh and Jeddah, creates continuous demand for apartment complexes, villa developments, and integrated residential communities. In August 2025, the Saudi government formalized a tripartite agreement between the Real Estate Development Fund, National Housing Company, and Saudi National Bank to deliver over 40,000 housing units across 24 residential projects nationwide, demonstrating sustained commitment to housing expansion.

Sustainability Regulations and Green Building Standards

Policies by governments to ensure environmental sustainability are also contributing to the use of high cement formulations and production technology. The Saudi Green Initiative has set its specific goals in minimizing carbon emissions in the industrial sector, such as cement production. Green building standards and purchasing specifications are gradually shifting towards lower-emission blends of cement, establishing a competitive edge over the companies that invest in production capacities that are environmentally friendly. The Kingdom leads green construction in the Arab world, with approximately 2,000 active sustainable building projects. This endorsement highlights the growing acceptance of eco-friendly cement alternatives in premium construction projects, reflecting the sector’s shift toward more sustainable and environmentally responsible building practices.

Market Restraints:

What Challenges the Saudi Arabia Cement Market is Facing?

Overcapacity and Pricing Pressures

The Saudi Arabia cement market faces persistent overcapacity challenges as installed production capacity continues exceeding national demand levels. Combined capacity across the Kingdom's cement plants surpasses current consumption requirements, leading to intense competition and pricing pressures among producers. Without additional export outlets or industry consolidation, asset underutilization may affect long-term profitability margins and limit investment in production upgrades.

Rising Raw Material and Energy Costs

Volatility in raw material prices, particularly for key inputs including clinker, limestone, and gypsum, creates production cost challenges for cement manufacturers. Fluctuating energy costs further compound operational expenses, affecting profit margins and pricing strategies. Cement production is inherently energy-intensive, making the sector vulnerable to global energy market dynamics and regional fuel price adjustments.

Labor Costs and Regulatory Compliance

Nationalization targets under the Nitaqat program and rising wage expectations are increasing human resource-related operating costs across the cement sector. Skilled labor shortages in engineering and plant operations have delayed efficiency upgrades and project staffing in some facilities. Additionally, environmental compliance requirements including emission limits on particulate matter, nitrogen oxides, and sulfur dioxide necessitate ongoing investments in pollution control equipment.

Competitive Landscape:

The Saudi Arabia cement market features a moderately consolidated competitive structure characterized by established domestic manufacturers with regional production strengths and distribution networks. Companies are pursuing operational excellence through capacity optimization, logistics enhancements, and strategic partnerships to serve mega-project demand efficiently. Sustainability has emerged as a competitive differentiator, with manufacturers investing in alternative fuels, supplementary cementitious materials, and carbon capture technologies. Digital transformation initiatives are enabling improved production efficiency and cost management. Industry consolidation continues as companies explore mergers, joint ventures, and capacity-sharing arrangements to address regional overcapacity and strengthen market positions.

Recent Developments:

- December 2024: Al Jouf Cement Company launched a green cement product exclusively for NEOM projects, developed in partnership with Asas Al Muhailb Company. This product reduces CO₂ emissions by 30%, increases concrete lifespan, and eliminates need for imported materials such as granulated blast furnace slag and fly ash, aligning with Saudi Vision 2030 sustainability objectives.

- October 2024: City Cement partnered with UK-based Next Generation SCM to establish Saudi Arabia's first calcined clay supplementary cementitious material production plant. Located in Riyadh with an initial capacity of 350,000 tonnes annually and plans to double output in the second year, the facility utilizes CemGreen's patented technology to reduce CO₂ emissions in cement production.

Saudi Arabia Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cement market size was valued at USD 3,979.86 Million in 2025.

The Saudi Arabia cement market is expected to grow at a compound annual growth rate of 4.99% from 2026-2034 to reach USD 6,167.46 Million by 2034.

Blended cement, representing the largest share of 55.1%, leads the Saudi Arabia cement market due to growing sustainability regulations, environmental mandates promoting reduced carbon emissions, and increasing adoption of supplementary cementitious materials in construction applications.

Key factors driving the Saudi Arabia cement market include Vision 2030 mega-project investments, expanding residential construction under government housing programs, sustainability regulations promoting green building practices, and substantial private and public sector investments in infrastructure development.

Major challenges include overcapacity leading to pricing pressures, volatility in raw material and energy costs, labor cost increases from Saudization compliance requirements, environmental regulatory compliance expenses, and regional demand imbalances affecting production utilization rates.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)