Saudi Arabia Cigarette Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Cigarette Market Overview:

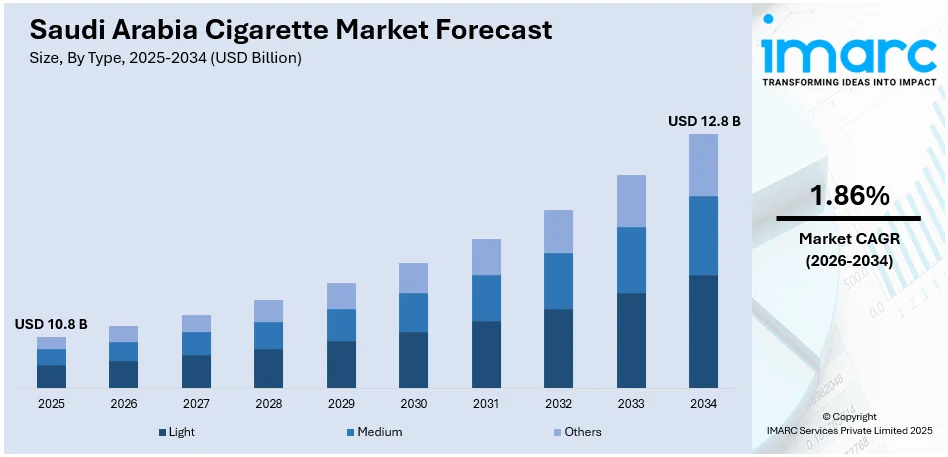

The Saudi Arabia cigarette market size reached USD 10.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 12.8 Billion by 2034, exhibiting a growth rate (CAGR) of 1.86% during 2026-2034. The inflating disposable incomes, a growing young adult population, expanding retail distribution channels, increased social acceptance of smoking, the introduction of premium and flavored cigarette, and aggressive marketing strategies are some of the factors driving market expansion in Saudi Arabia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.8 Billion |

| Market Forecast in 2034 | USD 12.8 Billion |

| Market Growth Rate 2026-2034 | 1.86% |

Saudi Arabia Cigarette Market Trends:

Rising Disposable Income

Economic growth in Saudi Arabia is leading to higher disposable incomes, particularly among the younger population, fostering increased spending on lifestyle and leisure-oriented products, including cigarettes. The rise in purchasing power is encouraging people to prioritize personal preferences and brand choices, contributing to steady demand across different product categories within the tobacco market. With greater financial flexibility, young adults are more willing to allocate part of their income toward discretionary goods that align with social activities and contemporary consumption trends. This shift is reinforced by national economic indicators that reflect stronger household spending. According to the Mid-Year Economic and Fiscal Performance Report FY 2024, private consumption expenditures recorded a real increase of 2.4% in the first half of FY2024 compared to the same period in the previous year. This growth in individual expenditure highlights the expanding capacity of individuals to support consistent market demand, positioning rising incomes as a key driver of cigarette adoption.

To get more information on this market Request Sample

Brand Loyalty and Premiumization Trends

Brand loyalty plays a crucial role in the Saudi Arabia cigarette market, with people frequently favoring consistency and dependability in their selections. This commitment is reinforced by prolonged exposure to well-known global brands that have developed strong reputations for quality. As disposable incomes rise, premiumization trends also gain traction, with individuals seeking products that align with lifestyle aspirations. The growing demand for premium offerings enhances profitability for manufacturers while reinforcing the importance of branding in market success. Premium brands are linked to quality, prestige, and contemporary identity, attracting younger audiences seeking uniqueness. These consumer preferences not only create consistent demand but also stimulate innovation in packaging, product variations, and marketing strategies. Thus, brand loyalty and premiumization trends foster a conducive atmosphere for ongoing growth, guaranteeing that the cigarette market remains robust amid evolving consumer expectations in Saudi Arabia.

Influence of Expatriate Population

The expatriate population in Saudi Arabia plays a crucial role in sustaining cigarette demand, as many arrive from countries with high smoking prevalence and maintain established consumption habits. Their presence ensures consistent sales across both low-priced and mid-range segments, with purchasing decisions often aligned to income levels. Government statistics indicate that the count of non-Saudi inhabitants reached around 15.7 million in 2024, increasing from 14.5 million in 2023, accounting for 75.6% of the overall population growth in the kingdom. Non-Saudis constitute 44.4% of the population, and their cultural and economic impact is significant, underscoring their cultural and economic significance. This demographic not only diversifies brand preferences, with some expatriates preferring familiar international labels and others adapting to locally dominant options, but also enhances sales volume through bulk purchases for personal use or community sharing.

Saudi Arabia Cigarette Market Growth Drivers:

Youth Demographics

The expanding youth population in Saudi Arabia represents a crucial factor influencing cigarette usage, as their lifestyle choices and social behaviors increasingly shape market demand. Young adults are highly influenced by peer groups, social gatherings, and a desire to embrace contemporary and global consumption patterns, which positions them as an attractive user base for tobacco companies. According to GASTAT's 2024 report, 71% of Saudi citizens are below the age of 35, with an average age of 26.6 years and a median age of 23.5 years, underscoring the demographic advantage that amplifies this trend. Exposure to international media and digital platforms further reinforces their preference for well-known brands and fosters interest in new product offerings. The continuous entry of individuals into the legal smoking age ensures a steady number of users, while social and cultural factors associate smoking with leisure and identity, making it a socially reinforced behavior among this demographic.

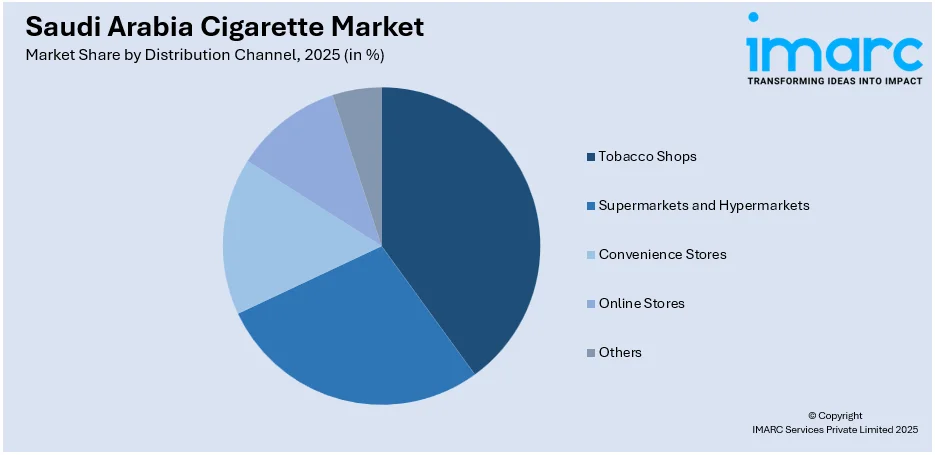

Retail Modernization and Market Expansion

The retail sector in Saudi Arabia is rapidly modernizing, greatly driving cigarette sales and overall market growth. The emergence of large-format supermarkets, structured retail chains, and convenience stores are improving user access and generated new growth opportunities. Additionally, e-commerce platforms are emerging as an essential part of this change, providing enhanced convenience and widening product access beyond conventional retail environments. According to the International Trade Administration (ITA), it is projected that the number of internet users participating in e-commerce in Saudi Arabia will hit 33.6 million by 2024, highlighting the increasing trend of online retail. Besides this, contemporary retailers enhance brand visibility with organized displays and advertising initiatives, while loyalty programs, targeted pricing incentives, and in-store promotional techniques further increase demand. The growth of these structured retail outlets in urban and semi-urban areas is improving market reach, connecting with individuals who previously had restricted access.

Influence of International Tobacco Companies

The involvement of major global tobacco firms significantly influences the cigarette market in Saudi Arabia. These companies have vast experience, well-established brand portfolios, and considerable investments in marketing and distribution. Their capability to launch new products, uphold quality standards, and enhance brand awareness provides them with an advantage in attracting user interest. International corporations also establish industry standards that local retailers and distributors adhere to, fostering an organized and competitive market. Their financial power enables them to handle regulatory challenges while ensuring robust product availability and visibility. Through aggressive branding and consistent supply, these companies solidify individual trust and expand market reach. The influence of international entities also promotes continuous product innovation, maintaining a market that is dynamic and adaptable to evolving preferences. This global presence is a vital factor for growth, enhancing the market's robustness and placing it competitively on an international level.

Saudi Arabia Cigarette Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Light

- Medium

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes light, medium, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Tobacco Shops

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes tobacco shops, supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cigarette Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light, Medium, Others |

| Distribution Channels Covered | Tobacco Shops, Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cigarette market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cigarette market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cigarette industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cigarette market in Saudi Arabia was valued at USD 10.8 Billion in 2025.

The Saudi Arabia cigarette market is projected to exhibit a CAGR of 1.86% during 2026-2034, reaching a value of USD 12.8 Billion by 2034.

The cigarette market in Saudi Arabia is growing attributed to higher disposable incomes, a large and increasing young population, and rising urbanization that encourages lifestyle-driven consumption. In addition, strong distribution networks, availability of global brands, and effective marketing strategies are strengthening the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)