Saudi Arabia Circuit Breaker Market Size, Share, Trends and Forecast by Product Type, Voltage, Technology, End-Use, and Region, 2026-2034

Saudi Arabia Circuit Breaker Market Overview:

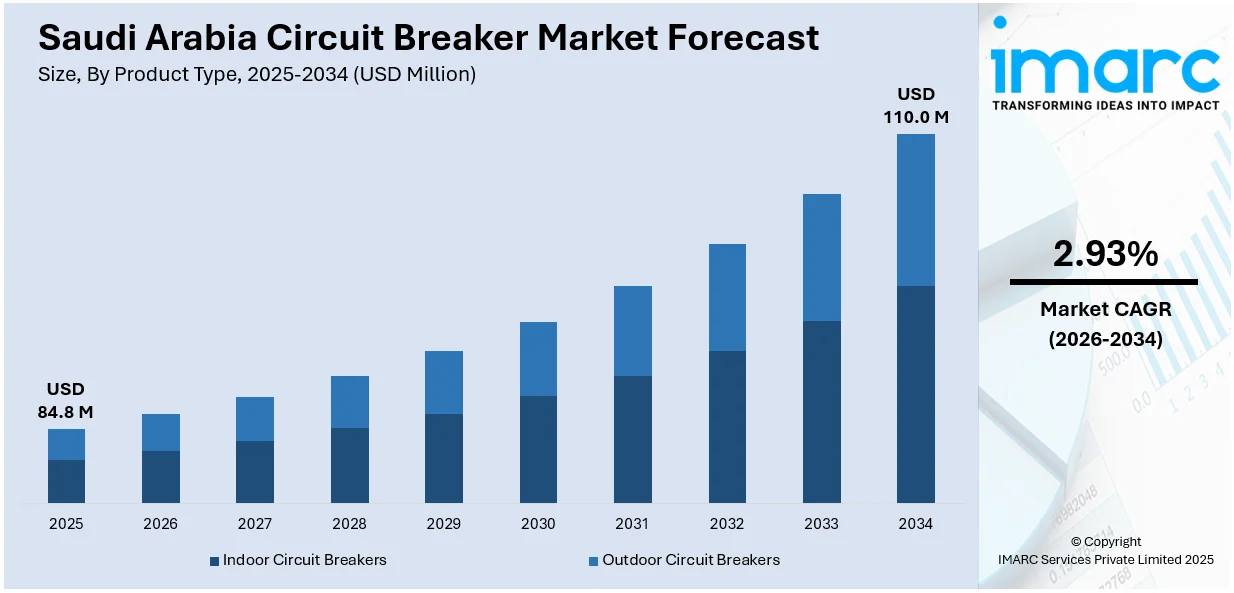

The Saudi Arabia circuit breaker market size reached USD 84.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 110.0 Million by 2034, exhibiting a growth rate (CAGR) of 2.93% during 2026-2034. The market share in Saudi Arabia is expanding, driven by the growing number of residential and commercial structures under Vision 2030, increasing installation of photovoltaic solar panels, battery energy storage systems, and wind farms, and installation of automation and digital monitoring systems in industrial configurations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 84.8 Million |

| Market Forecast in 2034 | USD 110.0 Million |

| Market Growth Rate 2026-2034 | 2.93% |

Saudi Arabia Circuit Breaker Market Trends:

Vision 2030 and Infrastructure Expansion

Saudi Arabia's Vision 2030 program is one of the major drivers behind the infrastructure development in the country. The government is spending heavily on smart cities, public transport, and industrial parks like NEOM, the Red Sea Project, and Qiddiya. In November 2024, the government of Saudi approved a solid 2025 budget of SR1.3tn ($342.7bn) that targets boosting the building sector. Fresh figures from the Investment Ministry show that 3,800 construction licenses were given out in 2024, reflecting a marked upward trend in sector activity. All these developments call for extremely reliable and efficient distribution networks for electricity to meet sophisticated energy requirements. Circuit breakers play a crucial part in guarding electrical circuits in these infrastructure configurations by eliminating overloads and short circuits. In addition, the increasing number of residential and commercial structures under Vision 2030 requires the integration of advanced electrical safety systems, thus driving the use of circuit breakers. International electrical standards and energy efficiency regulations also encourage the use of sophisticated circuit breaker technologies, including vacuum and SF6 breakers, to provide operational safety and performance in diversified applications.

To get more information on this market Request Sample

Growing Demand for Renewable Energy Integration

Saudi Arabia's shift to renewable energy sources, as per its National Renewable Energy Program (NREP), is offering a favorable Saudi Arabia circuit breaker market outlook. Aiming to generate 50% of its power from renewables by 2030 the country is expanding its capacity to 130 gigawatts, 58.7 GW of which will come from solar and 40 GW from wind. The interlinking of solar and wind energy systems requires high-capacity grid infrastructure to support variable loads and avoid system breakdowns. Circuit breakers play a critical role in this context by isolating faults and ensuring grid stability. Renewable energy systems are subject to varying load conditions, which necessitate circuit protection devices with high fault current interruption levels and fast response times. The increasing installation of photovoltaic solar panels, battery energy storage systems, and wind farms therefore drives the demand for medium and high-voltage circuit breakers. With grid modernization projects ongoing, such as the formation of microgrids and distributed energy resources (DERs), the importance of sophisticated circuit breakers in making energy transmission smooth and secure increases by the day.

Expansion of Industrial and Manufacturing Sectors

Saudi Arabia's focus on economic diversification away from oil, and more importantly, industrial sector growth through non-oil industries is benefiting the circuit breaker sector. Finance Minister Mohammed Al-Jadaan indicated that non-oil sectors contributed 52% to Saudi Arabia’s real GDP in the third quarter of 2024, spurred by private sector investments and exports. Projects like the National Industrial Development and Logistics Program (NIDLP) are drawing investments into manufacturing industries, mining, and petrochemicals. These industries use high-powered machinery and need reliable electrical protective systems so that their operations are not disrupted and people are safe. Industrial uses require circuit breakers with high voltage capacity, endurance in tough environmental conditions, and stable performance. These comprise air, vacuum, and gas-insulated circuit breakers specifically designed to satisfy the special requirements of heavy-duty use. Furthermore, the installation of automation and digital monitoring systems in industrial configurations is bolstering the Saudi Arabia circuit breaker market growth.

Saudi Arabia Circuit Breaker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, voltage, technology, and end-use.

Product Type Insights:

- Indoor Circuit Breakers

- Outdoor Circuit Breakers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes indoor circuit breakers and outdoor circuit breakers.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

Technology Insights:

- Air

- Vacuum

- Oil

- SF6

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes air, vacuum, oil, and SF6.

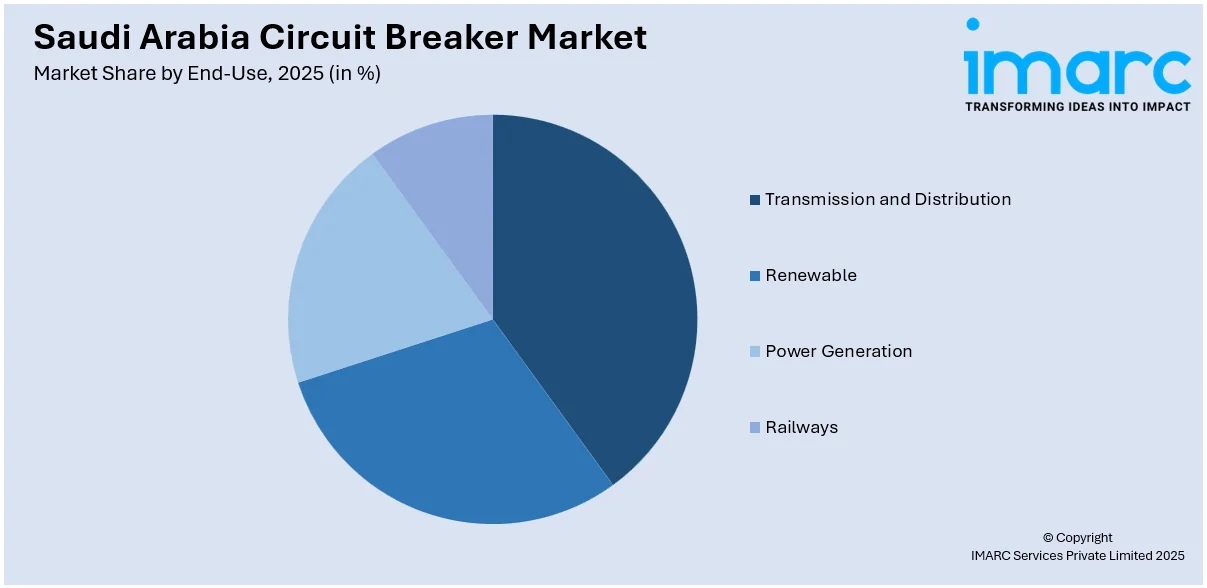

End-Use Insights:

Access the comprehensive market breakdown Request Sample

- Transmission and Distribution

- Renewable

- Power Generation

- Railways

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes transmission and distribution, renewable, power generation, and railways.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Circuit Breaker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Indoor Circuit Breakers, Outdoor Circuit Breakers |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| Technologies Covered | Air, Vacuum, Oil, SF6 |

| End-Uses Covered | Transmission and Distribution, Renewable, Power Generation, Railways |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia circuit breaker market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia circuit breaker market on the basis of product type?

- What is the breakup of the Saudi Arabia circuit breaker market on the basis of voltage?

- What is the breakup of the Saudi Arabia circuit breaker market on the basis of technology?

- What is the breakup of the Saudi Arabia circuit breaker market on the basis of end-use?

- What is the breakup of the Saudi Arabia circuit breaker market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia circuit breaker market?

- What are the key driving factors and challenges in the Saudi Arabia circuit breaker?

- What is the structure of the Saudi Arabia circuit breaker market and who are the key players?

- What is the degree of competition in the Saudi Arabia circuit breaker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Saudi Arabia circuit breaker market forecasts, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia circuit breaker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia circuit breaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)