Saudi Arabia Cold Chain Market Size, Share, Trends and Forecast by Type, Temperature Range, Application, and Region, 2026-2034

Saudi Arabia Cold Chain Market Summary:

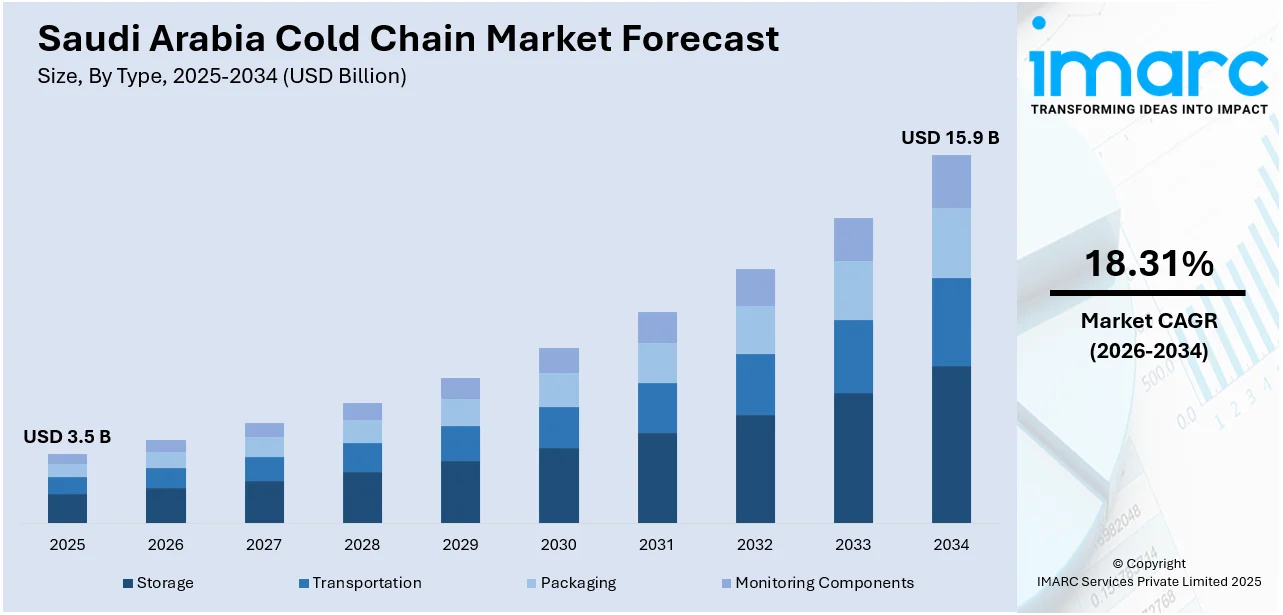

The Saudi Arabia cold chain market size was valued at USD 3.5 Billion in 2025 and is projected to reach USD 15.9 Billion by 2034, growing at a compound annual growth rate of 18.31% from 2026-2034.

The Saudi Arabia cold chain market is expanding rapidly, driven by increasing demand for temperature-sensitive goods across food and pharmaceutical sectors. Growing urbanization, rising consumer preferences for fresh and frozen products, and strategic government investments under Vision 2030 are accelerating infrastructure development. The market benefits from technological advancements in refrigeration systems and real-time monitoring capabilities, strengthening the Kingdom's position as a regional logistics hub for perishable goods handling and distribution.

Key Takeaways and Insights:

- By Type: Storage dominates the market with a share of 38% in 2025, owing to the Kingdom's heavy reliance on warehousing for imported and domestically produced temperature-sensitive goods. Rising demand for refrigerated facilities and blast freezers is supporting market expansion.

- By Temperature Range: Chilled (0°C to 15°C) holds the largest segment with a market share of 40% in 2025, reflecting strong demand for non-frozen perishable goods including fruits, vegetables, dairy products, and beverages requiring consistent refrigeration throughout the supply chain.

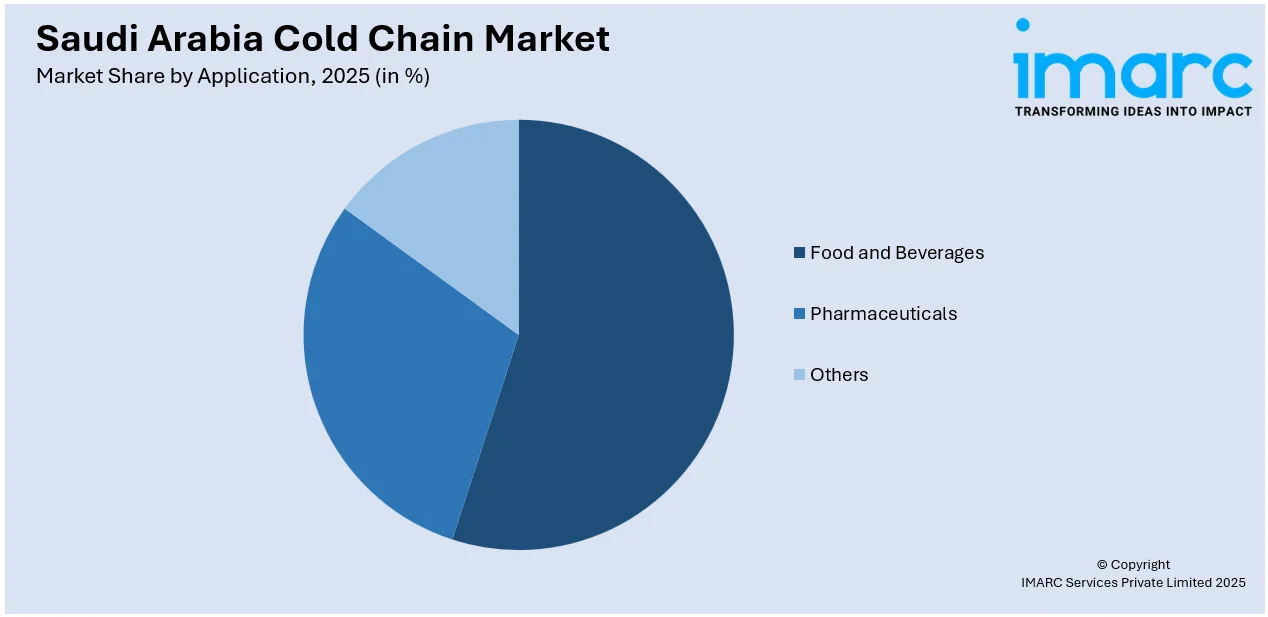

- By Application: Food and beverages lead the market with a share of 64% in 2025. This dominance is driven by increasing consumption of fresh produce, dairy products, and frozen foods, supported by robust retail expansion and consumer preferences for quality perishables.

- By Region: Eastern Region represents the largest region with 30% share in 2025, driven by its strategic location with Dammam Port and industrial zones serving petrochemical and halal-certified food exports across the Gulf region.

- Key Players: Key players drive the Saudi Arabia cold chain market by expanding storage capacities, deploying advanced refrigeration technologies, and strengthening nationwide distribution networks. Their investments in temperature monitoring systems, strategic partnerships, and infrastructure development boost operational efficiency and ensure consistent product quality across diverse temperature-sensitive sectors.

To get more information on this market Request Sample

The Saudi Arabia cold chain market is undergoing significant transformation fueled by Vision 2030 initiatives and rapid economic diversification. The Kingdom's strategic geographic location at the crossroads of Europe, Asia, and Africa positions it as a crucial logistics hub for temperature-controlled supply chains. Consumer expectations for product freshness and extended shelf life are compelling logistics providers to adopt advanced cooling technologies and real-time tracking solutions. The pharmaceutical sector's growth, particularly in vaccine distribution and biologics handling, is driving sophisticated cold chain infrastructure development with GDP-certified facilities. E-commerce expansion is further reshaping logistics requirements, with temperature-sensitive online grocery deliveries demanding efficient last-mile cold chain solutions. Strategic consolidation through joint ventures and partnerships is revolutionizing market capabilities, positioning Saudi Arabia as the regional leader in temperature-controlled logistics services across the Middle East.

Saudi Arabia Cold Chain Market Trends:

Integration of IoT and AI Technologies

The adoption of Internet of Things sensors and artificial intelligence systems is transforming cold chain operations across Saudi Arabia. Real-time temperature monitoring and predictive maintenance capabilities are reducing product spoilage while enhancing supply chain visibility. Advanced algorithms enable route optimization and demand forecasting, improving operational efficiency. In October 2024, CEVA Logistics and Almajdouie Logistics finalized their joint venture headquartered in Dammam with over 2,000 assets, integrating advanced technology solutions to enhance cold chain capabilities throughout the Kingdom.

Expansion of Pharmaceutical Cold Chain Infrastructure

Growing healthcare investments and expanding pharmaceutical imports are driving development of specialized temperature-controlled logistics infrastructure. The demand for vaccines, biologics, and specialty medications requiring stringent temperature control is accelerating construction of GDP-compliant warehouses and ultra-low temperature storage facilities. In February 2025, National Unified Procurement Co. (NUPCO) obtained SAR 2.5 Billion in funding to enhance healthcare logistics, expanding partnerships with pharmaceutical companies to localize insulin provision and strengthen cold chain capabilities for temperature-sensitive medications.

E-Commerce Driven Cold Chain Modernization

The rapid expansion of online grocery shopping is reshaping cold chain requirements across Saudi Arabia. Rising consumer demand for home delivery of perishable goods is driving investments in last-mile refrigerated logistics and temperature-controlled micro-fulfilment centers. Multi-temperature delivery vehicles capable of segregating different product categories within single trips are becoming increasingly prevalent. The Saudi Arabia e-commerce market size is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033, with online shopping penetration exceeding substantial percent of the population, necessitating robust cold chain solutions for fresh produce and dairy deliveries.

How Vision 2030 is Transforming the Saudi Arabia Cold Chain Market:

Saudi Arabia's Vision 2030 is reshaping the cold chain market by prioritizing logistics infrastructure development and positioning the Kingdom as a global trade and logistics hub connecting Europe, Asia, and Africa. Top-down strategic initiatives aimed at accelerating economic diversification away from overdependence on oil revenues have quickened the pace of investments in temperature-controlled warehousing, refrigerated transportation, and advanced monitoring systems, with significantly high demand currently witnessed for sophisticated cold chain solutions across food and pharmaceutical sectors. The mega-projects currently ongoing—NEOM's futuristic smart city developments, Red Sea Global's luxury tourism destinations, and Qiddiya's entertainment infrastructure—are creating substantial demand for high-quality international standard cold chain capabilities to support hospitality, retail, and healthcare operations.

Market Outlook 2026-2034:

The Saudi Arabia cold chain market outlook remains highly positive, driven by sustained government investments in logistics infrastructure and growing demand for temperature-sensitive products across food, pharmaceutical, and chemical sectors. Strategic initiatives under Vision 2030 continue accelerating infrastructure development, with significant budget allocations for upgrading cold chain facilities and integrating advanced technology. Technological advancements in refrigeration systems, increasing adoption of energy-efficient solutions, and expansion of port and railway networks will further strengthen market capabilities, positioning Saudi Arabia as the Middle East's premier cold chain logistics hub. The market generated a revenue of USD 3.5 Billion in 2025 and is projected to reach a revenue of USD 15.9 Billion by 2034, growing at a compound annual growth rate of 18.31% from 2026-2034.

Saudi Arabia Cold Chain Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Storage |

38% |

|

Temperature Range |

Chilled (0°C to 15°C) |

40% |

|

Application |

Food and Beverages |

64% |

|

Region |

Eastern Region |

30% |

Type Insights:

- Storage

- Facilities/Services

- Refrigerated Warehouse

- Cold Room

- Equipment

- Blast Freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Transportation

By Mode- Road

- Sea

- Rail

- Air

- By Offering

- Refrigerated Vehicles

- Refrigerated Containers

- Packaging

- Crates

- Insulated Containers and Boxes

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

- Cold Chain Bags/Vaccine Bags

- Ice Packs

- Others

- Monitoring Components

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-premises

- Cloud-based

- Hardware

Storage dominates with a market share of 38% of the total Saudi Arabia cold chain market in 2025.

The storage segment maintains its dominant position in the Saudi Arabia cold chain market, driven by the Kingdom's substantial reliance on warehousing for both imported and domestically produced temperature-sensitive goods. Refrigerated warehouses and cold rooms serve as critical infrastructure for maintaining product integrity across the extensive food import network. Public warehouses attract smaller shippers seeking economies of scale, while private facilities operated by major food manufacturers ensure quality control across vertically integrated supply chains. The segment benefits from increasing investments in automated temperature monitoring systems and energy-efficient refrigeration technologies that enhance operational reliability.

The expansion of cold storage infrastructure continues accelerating across major urban centers, supported by strategic government initiatives and private sector investments. Modern facilities increasingly incorporate advanced technologies including IoT-enabled sensors, automated inventory management systems, and solar-powered refrigeration solutions. In October 2024, MEDLOG announced its partnership with Port Development Company (PDC) to establish a 60,000 square meter cold storage facility at King Abdullah Port, with an investment of 300 Million Saudi Riyals. This development demonstrates the ongoing commitment to expanding storage capabilities and enhancing operational efficiency for perishable goods handling throughout the Kingdom.

Temperature Range Insights:

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

Chilled (0°C to 15°C) exhibits a clear dominance with a 40% share of the total Saudi Arabia cold chain market in 2025.

The chilled temperature range segment maintains the largest market share, driven by substantial demand for non-frozen perishable goods including fresh fruits, vegetables, dairy products, and beverages. Consumer preferences for fresh food products over frozen alternatives continue supporting strong growth in chilled storage and transportation requirements. The segment benefits from national food-waste reduction campaigns that create new demand for produce and dairy cold chains capable of extending product shelf life while maintaining optimal quality and nutritional value throughout distribution networks.

The chilled segment's growth is closely linked to expanding retail infrastructure and rising consumer expectations for product freshness. Modern supermarkets and hypermarkets increasingly demand sophisticated chilled logistics capabilities to maintain product quality from supplier to shelf. The refrigeration industry across Saudi Arabia continues advancing, with operators adopting latest UNEP guidelines favoring low-GWP refrigerants including carbon dioxide and propane systems that improve energy efficiency. Multi-temperature vehicles capable of segregating different temperature zones within single trips are becoming standard equipment, reducing transportation costs while maintaining chilled product integrity across the supply chain.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Fruits and Vegetables

- Fruit Pulp and Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery and Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

Food and beverages lead with a share of 64% of the total Saudi Arabia cold chain market in 2025.

The food and beverages sector maintains overwhelming dominance in the Saudi Arabia cold chain market, reflecting the critical importance of temperature-controlled logistics for perishable food products. Rising urbanization with over eighty-four percent of the population residing in urban areas creates substantial demand for fresh produce, dairy products, and frozen foods. Consumer preferences continue shifting toward healthier eating patterns and quality-conscious food choices, driving investments in cold chain logistics that ensure product safety and freshness throughout the supply chain from port to retail shelf.

The segment's growth is further supported by the Kingdom's significant reliance on food imports, with approximately eighty percent of food products being imported to meet domestic consumption needs. This import dependency creates sustained demand for sophisticated cold chain infrastructure capable of maintaining product quality across extended supply chains. Major food retailers and quick-service restaurant chains are expanding their temperature-controlled distribution networks to serve growing consumer demand across urban and suburban areas.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Eastern Region represents the leading segment with a 30% share of the total Saudi Arabia cold chain market in 2025.

The Eastern Region leverages its strategic positioning with Dammam Port and extensive industrial zones to serve petrochemical and halal-certified food exports throughout the Gulf region. The area's proximity to major industrial cities and oil refineries creates sustained demand for temperature-controlled logistics services supporting diverse manufacturing operations. Cold chain infrastructure development continues expanding to meet growing regional distribution requirements.

Strategic investments are strengthening the Eastern Region's cold chain capabilities and reinforcing its position as a major logistics hub serving the Gulf region. The area's proximity to industrial zones and petrochemical facilities creates sustained demand for temperature-controlled logistics services supporting diverse manufacturing and export operations. Modern cold storage facilities are expanding rapidly to accommodate growing volumes of perishable imports and halal-certified food exports. The Saudi Ports Authority's SAR 1 Billion logistics park at King Abdulaziz Port, spanning over one million square meters, is establishing Dammam as a regional logistics anchor.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cold Chain Market Growing?

Government Investments Under Vision 2030 Initiatives

The Saudi Arabian government's commitment to economic diversification under Vision 2030 is driving unprecedented investments in cold chain infrastructure development. The National Transport and Logistics Strategy and National Industrial Development and Logistics Program have allocated substantial funding specifically for upgrading cold chain facilities and integrating advanced technology across the Kingdom. These strategic investments aim to position Saudi Arabia among the world's leading logistics markets, with cold chain infrastructure playing a central role in achieving food security objectives and supporting economic transformation goals. Government-backed initiatives are encouraging private sector participation through public-private partnership models that accelerate infrastructure development while ensuring world-class operational standards.

Rising Demand for Perishable Food Products

Growing urbanization and changing consumer preferences are creating sustained demand for fresh and frozen food products requiring sophisticated cold chain logistics. Consumer expectations increasingly focus on product freshness, safety, and extended shelf life, compelling retailers and food service operators to invest in temperature-controlled distribution networks. The Kingdom's significant reliance on food imports, with approximately eighty percent of food products imported to meet domestic consumption, creates continuous demand for cold chain infrastructure capable of maintaining product integrity across extended international supply chains. Rising disposable incomes and expanding quick-service restaurant chains further amplify demand for reliable temperature-controlled logistics services across diverse food categories including dairy, meat, seafood, and fresh produce.

Expansion of Pharmaceutical and Healthcare Logistics

The growing pharmaceutical sector is emerging as a significant driver of cold chain market expansion, with increasing demand for vaccines, biologics, and temperature-sensitive medications. As per the IMARC Group, Saudi Arabia represents the largest pharmaceutical market, valued at USD 11.79 Billion by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034, with substantial annual growth. The establishment of vaccine manufacturing facilities and biologics production centers is creating new demand for ultra-low temperature storage capabilities and GDP-compliant distribution networks. E-pharmacy expansion is further accelerating pharmaceutical cold chain requirements, with the Saudi Arabia e-pharmacy market reaching significant scale and driving demand for temperature-controlled last-mile delivery solutions.

Market Restraints:

What Challenges the Saudi Arabia Cold Chain Market is Facing?

High Operational and Energy Costs

Maintaining temperature-controlled environments requires significant investment in infrastructure, energy consumption, and technology deployment. Operational expenses including electricity costs for cold storage facilities account for a substantial portion of total logistics expenditures in Saudi Arabia, creating profitability challenges for smaller market participants. The Kingdom's extreme climate conditions place enormous pressure on cooling systems, increasing energy consumption and operational costs compared to temperate regions."

Shortage of Skilled Workforce

The cold chain logistics sector faces significant challenges due to shortage of skilled professionals specialized in temperature-controlled operations management. Many companies report difficulties finding adequately skilled labor for cold chain operations including refrigeration system management, compliance monitoring, and temperature-sensitive goods handling. Saudization quotas amplify workforce constraints, while vocational training programs have not kept pace with digitalization requirements, leaving skill gaps in emerging technologies.

Infrastructure Gaps in Remote Regions

While major urban centers like Riyadh, Jeddah, and Dammam benefit from advanced cold storage facilities, remote and rural areas face significant infrastructure shortages. Limited access to refrigerated storage and poor last-mile connectivity in outlying regions hampers reliable transport of perishables, restricting market access for agricultural producers and limiting distribution reach for temperature-sensitive products. The high capital investment requirements for establishing cold chain infrastructure in less developed areas, estimated at substantial amounts for comprehensive facility development, create barriers to market expansion beyond primary urban corridors.

Competitive Landscape:

The Saudi Arabia cold chain market features a competitive landscape characterized by both established regional logistics providers and international players expanding their presence in the Kingdom. Major market participants are differentiating through comprehensive service offerings encompassing storage, transportation, and value-added capabilities including packaging, customs clearance, and quality testing tailored to SFDA requirements. Strategic consolidation through joint ventures and partnerships is reshaping competitive dynamics, combining global logistics expertise with local market knowledge to address distribution challenges in harsh climatic conditions. Companies are investing substantially in technology infrastructure including IoT-enabled monitoring systems, automated warehousing solutions, and energy-efficient refrigeration technologies to enhance operational efficiency and service quality. The focus on GDP-certified facilities for pharmaceutical logistics and specialized temperature-controlled solutions is creating premium service segments within the market.

Saudi Arabia Cold Chain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Temperature Ranges Covered | Chilled (0°C to 15°C), Frozen (-18°C to -25°C), Deep-frozen (Below -25°C) |

| Applications Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cold chain market size was valued at USD 3.5 Billion in 2025.

The Saudi Arabia cold chain market is expected to grow at a compound annual growth rate of 18.31% from 2026-2034 to reach USD 15.9 Billion by 2034.

Storage dominated the market with a share of 38%, driven by the Kingdom's heavy reliance on refrigerated warehousing and cold rooms for imported and domestically produced temperature-sensitive goods.

Key factors driving the Saudi Arabia cold chain market include government investments under Vision 2030, rising demand for fresh and frozen food products, expanding pharmaceutical logistics requirements, and technological advancements in refrigeration and monitoring systems.

Major challenges include high operational and energy costs for temperature-controlled facilities, shortage of skilled workforce specialized in cold chain operations, infrastructure gaps in remote regions, complex regulatory compliance requirements, and supply chain disruptions affecting imported equipment availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)