Saudi Arabia Commercial Drones Market Report by System (Hardware, Software), Product (Fixed Wing, Rotary Blade, Hybrid), Mode of Operation (Remotely Operated, Semi-Autonomous, Autonomous), Weight (<2 Kg, 2 Kg-25 Kg, 25 Kg-150 Kg), Application (Filming and Photography, Inspection and Maintenance, Mapping and Surveying, Precision Agriculture, Surveillance and Monitoring, and Others), End User (Agriculture, Delivery and Logistics, Energy, Media and Entertainment, Real Estate and Construction, Security and Law Enforcement, and Others), and Region 2025-2033

Market Overview:

Saudi Arabia commercial drones market size reached USD 297.0 Million in 2024. Looking forward, the market is expected to reach USD 3,334.1 Million by 2033, exhibiting a growth rate (CAGR) of 30.83% during 2025-2033. The ongoing advancements in drone technology, such as improved battery life, enhanced sensors, better data processing capabilities, and increased payload capacities, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 297.0 Million |

| Market Forecast in 2033 | USD 3,334.1 Million |

| Market Growth Rate 2025-2033 | 30.83% |

Commercial drones are unmanned aerial vehicles (UAVs) designed for various business and industrial applications. These versatile devices have gained popularity across sectors such as agriculture, construction, logistics, and surveillance. Equipped with advanced technologies like GPS, cameras, and sensors, commercial drones offer cost-effective solutions for tasks like crop monitoring, aerial mapping, infrastructure inspection, and package delivery. They enhance efficiency, safety, and data collection capabilities, reducing operational costs and human risks. Regulations and standards govern their usage, ensuring responsible and safe integration into the airspace. As technology advances, commercial drones continue to evolve, providing businesses with innovative tools to streamline operations and gather valuable insights from aerial perspectives.

Saudi Arabia Commercial Drones Market Trends:

Scaling Up Government Plans in Vision 2030

Saudi Arabia's government is championing drone technology through its Vision 2030 program, which is sparking digital transformation and economic diversification. Governments are introducing programs that facilitate research and development of unmanned aerial systems (UAS), creating a favorable environment for commercial adoption of drones. The General Authority of Civil Aviation (GACA) is continually adapting regulations to include drones, and commercial organizations are finding it progressively easier to use them legally and securely. Public sector organizations are more and more cooperating with private drone businesses in surveillance, infrastructure inspection, and environment monitoring, reflecting an increasing institutional use of drone capabilities. As a part of Vision 2030, investments in smart cities, especially NEOM, are also leveraging the use of drones in construction, logistics, and security. The government is also arranging various exhibitions for driving the usage of drones in various industries. For instance, the Saudi drone exhibition is scheduled for September 1 to 3 2025 at the Riyadh front exhibitions and Conference Center in the Kingdom of Saudi Arabia. This event plans to present the advancements in drone manufacturing and its applications in various sectors.

Growing Adoption in Oil and Gas Sector

Saudi Arabia is increasingly using commercial drones in the oil and gas industry for surveillance, inspection, and monitoring of distant infrastructure. For instance, in 2025, Saudi Aramco discovered 14 new oil reserves in the Eastern Province and the Empty Quarter. Drones are used in various oil and gas sites to inspect pipelines, offshore rigs, storage tanks, and refineries, thereby minimizing the exposure of personnel to harmful environments. This is greatly enhancing operational safety, minimizing downtime, and maximizing efficiency. Energy firms are employing thermal imaging enabled drones to find gas leaks and corrosion in real time. Being one of the world's largest producers of crude oil, the demand for such solutions is steadily on the rise. The oil and gas sector is also working with drone service providers to create specialized airborne platforms capable of operating in the extreme desert conditions.

Technological Advancements and AI Integration

Rapid advancements in technologies, most notably automation, artificial intelligence (AI), and integration of sensors, are driving the market in Saudi Arabia. AI algorithms are now being integrated into drones to make autonomous flight, object identification, and real-time decision-making possible, which are redefining the usage of aerial information for industries. Smart drones are being deployed in agriculture, construction, and security industries for enhanced precision and productivity in mapping, surveying, and surveillance activities. Image recognition based on AI is assisting in recognizing changes in terrains, illegal behavior, or infrastructure deterioration. Firms are continuously investing in drones with longer flight duration, more payload capacity, and multi-spectral sensors. While local and foreign producers concentrate on research and development (R&D), the Saudi drone industry is experiencing innovation in product offerings. Moreover, the Saudi Arabia AI market is projected to attain USD 4,018 Million by 2033, as per the predictions of the IMARC Group.

Saudi Arabia Commercial Drones Market Growth Drivers:

Increased Demand for Infrastructure Development and Monitoring

With Saudi Arabia embarking on mega infrastructure projects such as NEOM, The Red Sea Project, and Qiddiya, the need for drones to be used in construction planning, monitoring of progress, and safety inspections is ever increasing. Drones are being utilized by construction companies to produce real-time aerial mapping, 3D models, and volumetric analysis, thus optimizing project efficiency and cutting costs. Drones are being utilized to track big and usually far-flung building sites, facilitating quicker decision-making and enhanced coordination among parties. Geospatial data collection and surveying are getting more precise and efficient with the aid of drone technologies. Drones are also supporting the causation of environmental and safety regulatory compliance by carrying out periodic aerial audits. This technological adoption is playing a significant part in enabling developers to achieve stringent project timelines. As construction and real estate sectors have come to realize cost and time benefits, drone use is growing very fast, and infrastructure monitoring is one of the pillars of the most robust growth in the commercial drone industry.

Increasing Use in Agricultural Precision Farming

Saudi Arabia's agriculture industry is progressively embracing drone technology to overcome the conventional constraints in terms of water usage, land yield, and monitoring difficulties. Farmers are increasingly employing drones to spray crops, map out irrigation, and manage pests, which are greatly enhancing resource use efficiency and production. Under conditions of drought and scarce arable land, precision agriculture is becoming critical, and drones are providing immediate information on crop health, soil health, and hydration levels. Multispectral imaging and AI-based analytics are being deployed to identify diseases or nutritional deficiencies early on, thereby allowing targeted intervention. Agritech companies are also joining hands with drone operators to provide end-to-end packages, including data analysis and drone fleet management. Government departments are also facilitating the shift to smart agricultural methods, as per the national food security strategy. With agriculture modernization emerging as a priority, drones are also emerging as key players, and their application is increasingly being used across agricultural lands in Saudi Arabia.

Expansion of E-commerce and Logistics Channels

At present, logistics operators are testing drone deliveries to bypass traffic congestion limitations, access remote locations, and reduce high delivery expenses. Pilot campaigns and collaborations are being formed to pilot and deploy aerial delivery solutions in urban and rural areas. Drones are now used not just for package delivery but also for supply chain monitoring and warehouse inventory management. As consumer expectations move toward same-day delivery, drones are proving to be a potential technological solution. Regulatory authorities are incrementally enabling the infrastructure to allow for delivery drone operations at scale, with compliance and safety. With the growth in the digital economy and the retail giants expanding online, the logistics sector is adopting drones as part of its strategy for change.

Saudi Arabia Commercial Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on system, product, mode of operation, weight, application, and end user.

System Insights:

- Hardware

- Airframe

- Propulsion System

- Payloads

- Others

- Software

The report has provided a detailed breakup and analysis of the market based on the system. This includes hardware (airframe, propulsion system, payloads, and others) and software.

Product Insights:

- Fixed Wing

- Rotary Blade

- Hybrid

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes fixed wing, rotary blade, and hybrid.

Mode of Operation Insights:

- Remotely Operated

- Semi-Autonomous

- Autonomous

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes remotely operated, semi-autonomous, and autonomous.

Weight Insights:

- <2 Kg

- 2 Kg-25 Kg

- 25 Kg-150 Kg

A detailed breakup and analysis of the market based on the weight have also been provided in the report. This includes <2 kg, 2 kg-25 kg, and 25 kg-150 kg.

Application Insights:

- Filming and Photography

- Inspection and Maintenance

- Mapping and Surveying

- Precision Agriculture

- Surveillance and Monitoring

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes filming and photography, inspection and maintenance, mapping and surveying, precision agriculture, surveillance and monitoring, and others.

End User Insights:

- Agriculture

- Delivery and Logistics

- Energy

- Media and Entertainment

- Real Estate and Construction

- Security and Law Enforcement

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes agriculture, delivery and logistics, energy, media and entertainment, real estate and construction, security and law enforcement, and others.

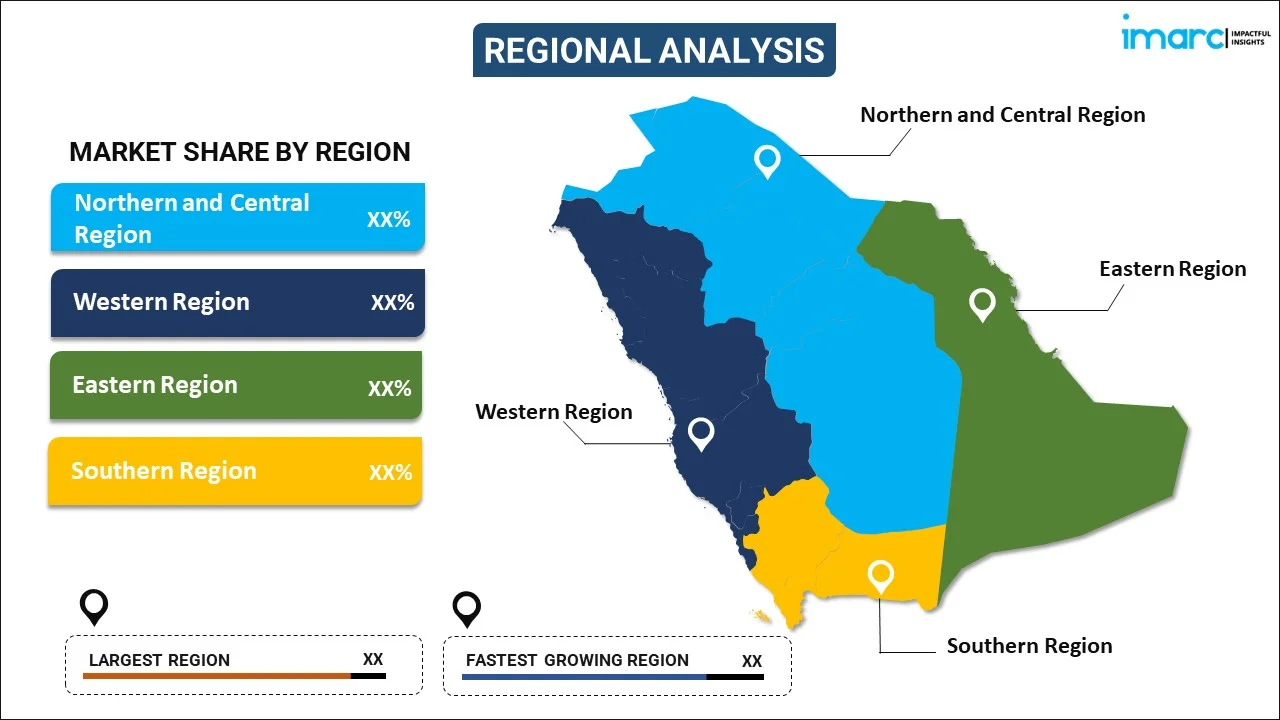

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Commercial Drones Market News:

- February 2025: Skyports Drone Services (Skyports) is entering the Saudi Arabian market for the first time in a strategic partnership with iot squared, a joint venture between Saudi Arabia's Public Investment Fund (PIF) and the country's national telecoms company stc group. The agreement will be used to build on Skyports' beyond visual line of sight (BVLOS) experience for a proof-of-concept investigating the application of drone technology into Saudi Arabia's giga-scale infrastructure and real estate projects, referred to as giga-projects.

- January 2025: Matternet, the world's top urban drone delivery system developer, announced that The Kingdom of Saudi Arabia has approved the company to fly its M2 drone within the country, the first to receive this approval. Approval was granted by Saudi Arabia's General Authority of Civil Aviation ("GACA") following a determination by the agency that the FAA Type Certification of the M2 awarded by the U.S. satisfied GACA airworthiness requirements.

- April 2025: Terra Drone Corporation has entered into a Memorandum of Understanding (MOU) with Aramco, Saudi Arabia's one of the world's top integrated energy and chemicals players. This agreement represents a strategic alliance to venture into innovation in drones, robotics, and AI-based solutions specific to the oil and gas industry to aid in localization.

- June 2025: In a historic bid to enhance healthcare efficiency during the Hajj period, Saudi Arabia has successfully tested a drone-based system for medicine delivery among the primary healthcare centers and hospitals in the holy places. The program, presented by the Kingdom's health system, represents the first-of-its-kind deployment that aims to enhance medical response among the pilgrims throughout the 1446 Hajj season.

- May 2024: Front End, a Saudi Arabian smart solutions leader, announced its plans to launch electric passenger drones no later than the end of 2024, CEO and Chairman Majid Alghaslan confirmed. The service will be introduced through a partnership with EHang, the Chinese developer of electric vertical take-off and landing vehicles, Alghaslan.

- April 2025: Toru Tokushige, CEO and founder of Terra Drone Corporation, discussed setting up a new local unit in Saudi Arabia and USD 15-million investment by Aramco in the company to localize drone technologies. Terra Drone produces cutting-edge air mobility devices and offers drone services for surveying, inspections, agriculture and other sectors.

Saudi Arabia Commercial Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Systems Covered |

|

| Products Covered | Fixed Wing, Rotary Blade, Hybrid |

| Mode of Operations Covered | Remotely Operated, Semi-Autonomous, Autonomous |

| Weights Covered | <2 Kg, 2 Kg-25 Kg, 25 Kg-150 Kg |

| Applications Covered | Filming and Photography, Inspection and Maintenance, Mapping and Surveying, Precision Agriculture, Surveillance and Monitoring, Others |

| End Users Covered | Agriculture, Delivery and Logistics, Energy, Media and Entertainment, Real Estate and Construction, Security and Law Enforcement, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia commercial drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia commercial drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia commercial drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A commercial drone is an unmanned aerial vehicle (UAV) designed for business and industrial use across various sectors such as agriculture, construction, logistics, surveillance, and more. These drones are equipped with advanced technologies including GPS, high-resolution cameras, sensors, and software for data analysis. They are used to perform tasks like aerial mapping, infrastructure inspection, crop monitoring, and package delivery. Commercial drones offer advantages such as enhanced efficiency, reduced operational costs, minimized human risk, and improved data collection capabilities. They are integrated responsibly into airspace operations under regulatory frameworks to ensure safety and compliance.

The Saudi Arabia commercial drones market size reached USD 297.0 Million in 2024.

The expected growth rate (CAGR) of the Saudi Arabia commercial drones market during 2025-2033 is 30.83%, with the market projected to grow to USD 3,334.1 Million by 2033.

Key factors driving the Saudi Arabia commercial drones market include Vision 2030 initiatives, growing adoption in oil and gas, technological advancements, infrastructure development, precision agriculture, and expanding e-commerce and logistics applications, enhancing efficiency, safety, and data-driven operations across sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)