Saudi Arabia Commercial Insurance Market Size, Share, Trends and Forecast by on Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2026-2034

Saudi Arabia Commercial Insurance Market Overview:

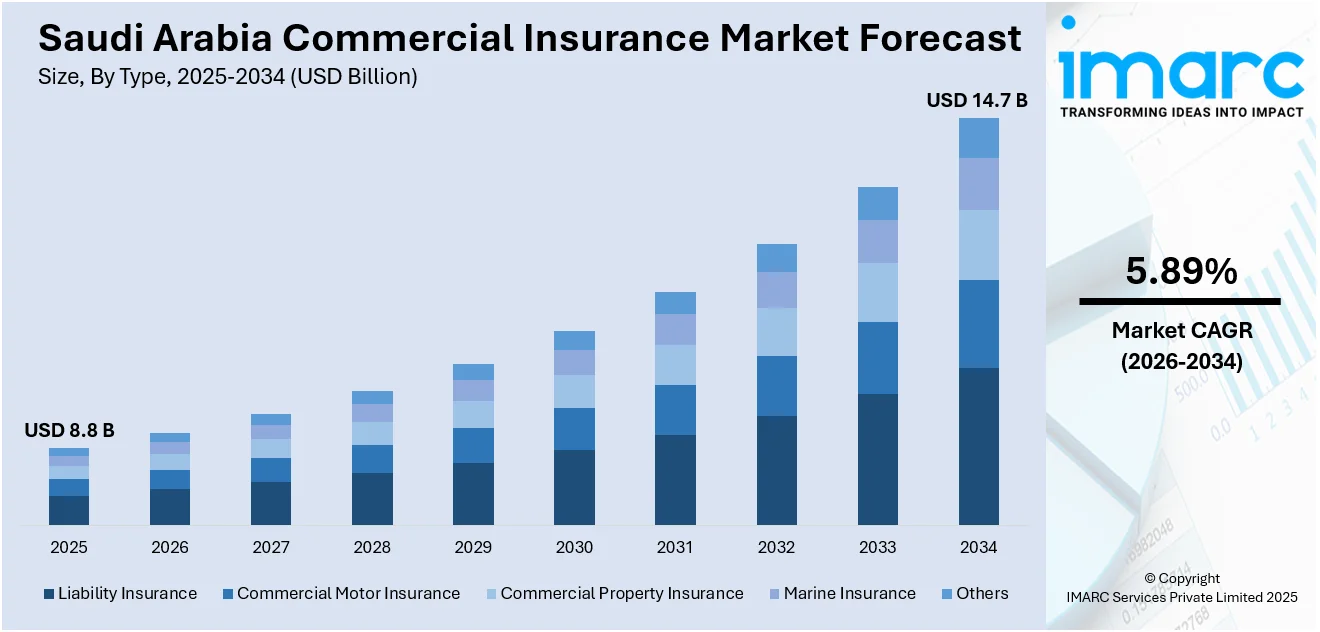

The Saudi Arabia commercial insurance market size reached USD 8.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 14.7 Billion by 2034, exhibiting a growth rate (CAGR) of 5.89% during 2026-2034. The market is experiencing significant growth mainly driven by regulatory reforms, infrastructure growth, and rising SME participation. In line with this, demand for liability, property, and motor coverage is increasing, with digitalization and economic diversification driving market growth and resilience in Saudi Arabia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.8 Billion |

| Market Forecast in 2034 | USD 14.7 Billion |

| Market Growth Rate 2026-2034 | 5.89% |

Saudi Arabia Commercial Insurance Market Trends:

Growth of Construction and Infrastructure Projects

Saudi Arabia’s booming construction sector, fueled by Vision 2030, is significantly influencing demand for commercial insurance. Mega-projects such as NEOM, The Line, Qiddiya, and the Red Sea Development are key drivers of Saudi Arabia commercial insurance market growth, creating a surge in demand for specialized coverage like engineering insurance, contractor’s all-risk, and liability policies. According to the data published by ITA, the Saudi construction market is valued at USD 70.33 billion in 2024 and is projected to grow to USD 91.36 billion by 2029, largely driven by the Vision 2030 initiative. Key projects contributing to this growth include Neom (USD USD 500 billion), Red Sea Global (USD 23.6 billion), and Qiddiya (USD 9.8 billion). These massive developments involve high-value contracts, complex risks, and multi-stakeholder environments, prompting contractors and developers to secure comprehensive protection. Insurance coverage is being sought not only for physical damage but also for third-party liabilities, project delays, and workforce safety. Insurers are tailoring solutions to meet the scale and complexity of these ventures, often involving reinsurance and global underwriting expertise. As infrastructure activity intensifies, this segment is expected to contribute substantially to Saudi Arabia commercial insurance market share, particularly in the medium to long term.

To get more information on this market Request Sample

Increased Demand from SMEs and New Businesses

Saudi Arabia's Vision 2030 is speeding up economic diversification through the development of entrepreneurship and less dependence on oil revenues. This change has resulted in an accelerated growth of small and medium enterprises (SMEs) in sectors ranging from technology to logistics, manufacturing, and services According to industry reports, in Q4 2023, Saudi Arabia's SME count rose by 3.1% to exceed 1.3 million, fueled by strong public investment and high venture capital. The distribution includes 571,298 SMEs in Riyadh, 140,132 in Eastern Province, 237,313 in Makkah, and 359,356 in other regions. These businesses require tailored risk coverage for operations, assets, employees, and liabilities, driving steady growth in demand for property insurance, workers’ compensation, cyber coverage, and general liability products. As regulatory frameworks become more structured and awareness of risk management grows, more SMEs are integrating insurance into their business planning. Insurers are responding with simplified, bundled, and tech-enabled policies that cater to the specific needs of smaller enterprises. With the ongoing growth of this segment, SMEs are expected to play a pivotal role in shaping the Saudi Arabia commercial insurance market outlook in the coming years.

Saudi Arabia Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

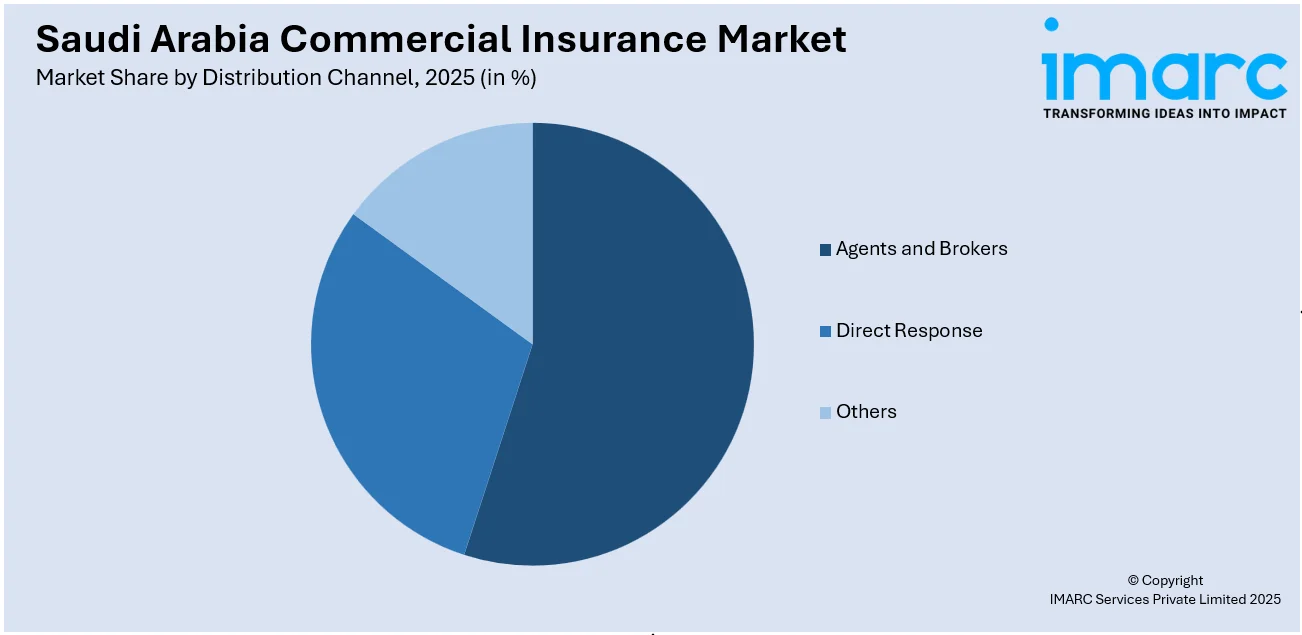

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Agents and Brokers

- Direct Response

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes transportation and logistics, manufacturing, construction, IT and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Commercial Insurance Market News:

- In January 2025, Saudi Arabia’s Public Investment Fund (PIF) acquired a 23.08% stake in Saudi Reinsurance Company to enhance the country’s insurance sector. The investment aims to boost reinsurance capacity, support commercial insurance coverage, and foster market growth, aligning with Saudi Arabia’s strategy to diversify its economy beyond oil revenues.

- In October 2024, Saudi Arabia introduced a compensation insurance scheme for foreign workers in the private sector. This initiative protects expatriates’ rights by compensating for unpaid wages, with coverage up to 17,500 Saudi Riyals. Workers may also claim a return ticket up to 1,000 Saudi Riyals.

Saudi Arabia Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia commercial insurance market on the basis of type?

- What is the breakup of the Saudi Arabia commercial insurance market on the basis of enterprise size?

- What is the breakup of the Saudi Arabia commercial insurance market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia commercial insurance market on the basis of industry vertical?

- What is the breakup of the Saudi Arabia commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia commercial insurance market?

- What are the key driving factors and challenges in the Saudi Arabia commercial insurance market?

- What is the structure of the Saudi Arabia commercial insurance market and who are the key players?

- What is the degree of competition in the Saudi Arabia commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia commercial insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia commercial insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)