Saudi Arabia Commercial Real Estate Market Size, Share, Trends and Forecast by Type and Region 2026-2034

Saudi Arabia Commercial Real Estate Market Summary:

The Saudi Arabia commercial real estate market size was valued at USD 69.76 Billion in 2025 and is projected to reach USD 92.76 Billion by 2034, growing at a compound annual growth rate of 3.22% from 2026-2034.

The Saudi Arabia commercial real estate market is experiencing growth driven by sustained government investment, economic diversification initiatives, and rising demand for modern office, retail, and industrial spaces. Vision 2030 programs are encouraging private sector participation, foreign investment, and large-scale infrastructure development. Expanding logistics, tourism, and business services sectors are increasing requirements for high-quality commercial properties. Additionally, rapid urban development, population growth in major cities, and improved regulatory transparency are supporting long-term expansion across key commercial real estate segments throughout the Kingdom.

Key Takeaways and Insights:

- By Type: Offices dominate the market with a share of 32% in 2025, driven by the Regional Headquarters program attracting multinational corporations, limited Grade A vacancy rates, and sustained demand for premium workspaces with smart building features and sustainability certifications.

- By Region: Northern and Central Region lead the market with a share of 40% in 2025, owing to Riyadh's position as the primary business hub capturing over half of national office demand, supported by extensive infrastructure investments and giga-project developments.

- Key Players: The Saudi Arabia commercial real estate market exhibits dynamic competitive intensity, with sovereign wealth fund-backed developers leading transformative urban projects while international real estate operators and institutional investors expand their presence across major metropolitan centers.

The Saudi Arabia commercial real estate market growth is driven by rapid expansion of digital commerce, changing user behavior, and rising demand for modern retail and logistics infrastructure. Strong growth in online shopping is increasing requirements for distribution centers, last-mile logistics hubs, data-enabled retail spaces, and mixed-use commercial developments. According to the International Trade Administration, the number of internet users participating in e-commerce in Saudi Arabia is projected to reach 33.6 million by 2024, highlighting the scale of digital retail adoption. This shift is encouraging retailers and logistics providers to invest in strategically located warehouses, fulfillment centers, and technology-enabled commercial assets. In parallel, physical retail spaces are being redesigned to support omnichannel models that integrate online and offline experiences. Together, these trends are reshaping commercial property demand, supporting sustained leasing activity and new development across retail, industrial, and mixed-use segments.

Saudi Arabia Commercial Real Estate Market Trends:

Mega Infrastructure and Urban Development Projects

Large-scale urban and infrastructure projects continue to accelerate commercial real estate development across Saudi Arabia by creating integrated business and lifestyle hubs. Developments. such as New Murabba, Diriyah Gate, and expansions within the King Abdullah Financial District combine office, retail, hospitality, and leisure assets within planned urban environments. This momentum is evident in New Murabba’s 2025 partnership with South Korea’s Naver Cloud Corp, which introduced smart city platforms, automation, and robotics across the 14-square-kilometer development in Riyadh, projected to generate over 300,000 jobs. Such infrastructure investment enhances connectivity, land utilization, and asset attractiveness, catalyzing the demand for high-quality commercial properties across multiple segments.

Growth of Tourism and Entertainment Sectors

Rapid expansion of tourism and entertainment activities is reshaping commercial real estate demand across Saudi Arabia by increasing requirements for hotels, retail destinations, entertainment venues, and food and beverage spaces. The growing international events, cultural attractions, and leisure developments are driving higher footfall in major urban and coastal markets. This trend is supported by government data showing a 9.7% increase in international visitor spending during the first quarter of 2025 compared to the same period in 2024. Rising tourism activity strengthens demand for mixed-use developments and hospitality-linked commercial assets, sustaining strong development pipelines and leasing momentum tied to visitor-oriented services.

Expansion of Logistics, Trade, and Industrial Activity

Saudi Arabia’s ambition to establish itself as a regional logistics and trade hub is catalyzing the demand for commercial and industrial real estate. Expansion of ports, free zones, warehouses, and logistics corridors is increasing requirements for office space, distribution centers, and supporting commercial facilities. This momentum is reinforced by rapid e-commerce growth, with the Ministry of Commerce reporting 40,953 registered e-commerce companies by the fourth quarter of 2024, reflecting a 10 percent annual increase. Rising digital trade activity and supply chain localization continue to support development of strategically located commercial assets and specialized logistics-focused commercial clusters across key regions.

How Vision 2030 is Transforming the Saudi Arabia Commercial Real Estate Market:

Vision 2030 is transforming the Saudi Arabia commercial real estate market by accelerating economic diversification, attracting foreign investment, and reshaping urban development priorities. Large-scale initiatives focused on tourism, entertainment, logistics, and business services are generating demand for modern office spaces, mixed-use developments, retail centers, and industrial facilities. Regulatory reforms, improved transparency, and eased ownership rules are strengthening investor confidence. Government-backed megaprojects and smart city developments are redefining commercial hubs across major cities. Additionally, increased private sector participation and infrastructure spending are supporting long-term growth, positioning commercial real estate as a key pillar in the Kingdom’s broader economic transformation agenda.

Market Outlook 2026-2034:

The Saudi Arabia commercial real estate market demonstrates substantial revenue growth potential throughout the forecast period, underpinned by irreversible economic diversification trajectories, mega-infrastructure investments, and expanding tourism activities. Strong demand for office, retail, hospitality, and logistics assets is supported by urban expansion, foreign direct investment, and private sector participation. Regulatory reforms and improved market transparency are also strengthening investor confidence across major cities. The market generated a revenue of USD 69.76 Billion in 2025 and is projected to reach a revenue of USD 92.76 Billion by 2034, growing at a compound annual growth rate of 3.22% from 2026-2034.

Saudi Arabia Commercial Real Estate Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Offices |

32% |

|

Region |

Northern and Central Region |

40% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Offices

- Retail

- Industrial

- Logistics

- Multi-family

- Hospitality

Offices dominate with a market share of 32% of the total Saudi Arabia commercial real estate market in 2025.

Offices represent the largest segment due to the rising demand from government entities, multinational corporations, and expanding private sector firms. For instance, in 2026, KPMG opened its fourth office in Saudi Arabia, located in Madinah, to strengthen client engagement and support the Kingdom’s growing economic regions. The expansion enhances professional services in accounting, advisory, and tax while fostering local talent, digital innovation, and entrepreneurship.

The segment also benefits from the rise in professional services, finance, technology, and consulting sectors. Economic diversification initiatives are increasing requirements for modern, well-located office spaces across major cities, supporting steady occupancy levels and long-term leasing activity.

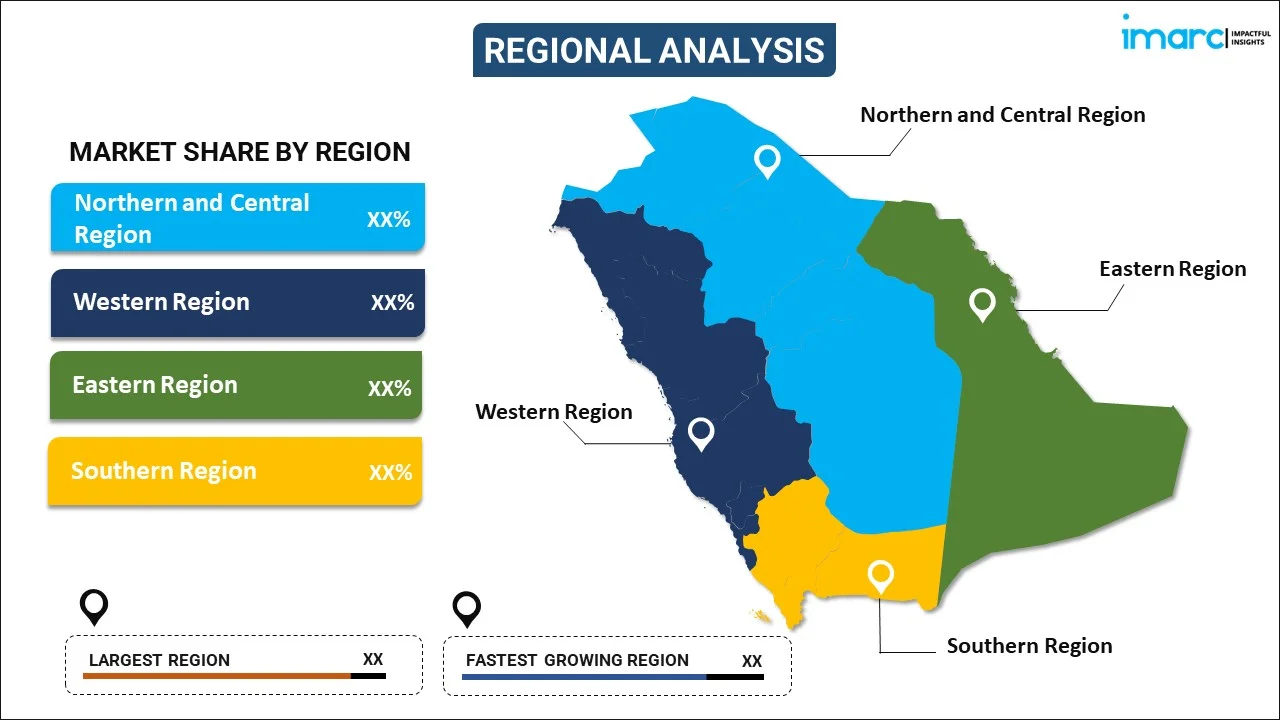

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region lead with a market share of 40% of the total Saudi Arabia commercial real estate market in 2025.

Northern and Central Region hold the biggest market share owing to concentration of government institutions, corporate headquarters, and business districts. Strong infrastructure, connectivity, and ongoing urban development projects continue to attract large-scale office and mixed-use investments.

These regions also benefit from population growth, expanding professional services, and strong demand for premium spaces. Strategic economic initiatives sustain leasing momentum. In 2025, Ericsson inaugurated its regional headquarters in Riyadh, supporting digital transformation, 5G and future 6G development, talent growth, and cross-sector innovation aligned with Vision 2030.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Commercial Real Estate Market Growing?

Digital Transformation and Tokenization of Real Estate Assets

Digital innovation is a significant factor influencing the Saudi Arabia commercial real estate market by enhancing accessibility, liquidity, and investor participation. Technology-led models are reshaping traditional property transactions by enabling transparent, secure, and efficient ownership structures. This shift is reflected in the planned launch of Saudi Arabia’s first tokenized real estate transaction in 2025 by droppRWA and RAFAL Real Estate, allowing fractional ownership starting from just one riyal. Aligned with Vision 2030 objectives, such initiatives promote blockchain adoption, citizen participation, and foreign investment. Tokenization is expected to broaden the investor base, improve market efficiency, and support long-term commercial real estate growth.

Rising Demand for Mixed-Use Developments

Integrated developments that combine office, retail, hospitality, and residential components are increasingly preferred within Saudi Arabia’s commercial real estate market due to their efficient land utilization, strong footfall generation, and diversified income streams. These mixed-use environments support higher occupancy rates and improve long-term asset resilience by attracting a broad tenant base. This development approach is exemplified by the resumption of Jeddah Tower construction in 2025, a landmark mixed-use project within the USD 20 billion Jeddah Economic City initiative, incorporating hotels, offices, and branded residences. Such large-scale projects reinforce investor confidence and accelerate mixed-use commercial development across major Saudi cities.

Expansion of Healthcare and Education Infrastructure

Saudi Arabia’s expanding investment in healthcare and education is catalyzing the demand for specialized commercial real estate across multiple regions. Development of hospitals, clinics, universities, and training centers requires purpose-built office, retail, and support infrastructure, creating long-term leasing opportunities. This momentum is evident in 2025, as the Kingdom advances healthcare expansion with five new hospitals, 963 additional beds, advanced medical services, and digital health initiatives under a SR260 billion budget. Growth in private healthcare participation and international education partnerships further strengthens tenancy stability, supporting consistent demand for high-quality commercial properties in both urban and emerging markets.

Market Restraints:

What Challenges the Saudi Arabia Commercial Real Estate Market is Facing?

Rising Construction Costs and Supply Chain Disruptions

The unprecedented scale of concurrent infrastructure and real estate developments across the Kingdom is intensifying pressure on construction resources, materials, and skilled labor availability. Elevated demand for building materials, particularly steel and concrete, combined with global supply chain volatilities is escalating project costs above regional benchmarks and extending delivery timelines.

Potential Oversupply Risk in Specific Office Corridors

Simultaneous delivery of multiple large-scale office developments, including New Murabba phases, expansions within the King Abdullah Financial District, and new private towers, may exceed near-term absorption capacity in select metropolitan areas. In some cases, government-led projects may progress faster than tenant demand, creating temporary oversupply and localized vacancy pressures within specific office submarkets.

Complex Regulatory Frameworks Affecting Investment Flows

Despite meaningful regulatory reforms supporting foreign investment, some administrative procedures and licensing processes remain complex and time-intensive for international developers. Ongoing regulatory adjustments, including real estate transaction tax requirements, add compliance considerations that require careful evaluation. These factors can extend approval timelines and influence investment planning and execution within the Saudi commercial real estate market.

Competitive Landscape:

The Saudi Arabia commercial real estate market demonstrates dynamic competitive intensity characterized by sovereign wealth fund-backed developers leading transformative mega-projects alongside established local developers and expanding international real estate operators. Market dynamics reflect strategic positioning across premium, mid-market, and value segments, with differentiation increasingly driven by sustainability credentials, technology integration, and mixed-use development capabilities. The competitive landscape is evolving toward consolidated platforms capable of delivering integrated communities combining commercial, residential, and entertainment components while addressing sustainability mandates and smart building requirements that increasingly influence tenant and investor preferences.

Recent Developments:

- January 2026: Saudi Arabia launched the “Saudi Properties” platform to support the upcoming Non-Saudi Property Ownership Law, including commercial real estate. The platform centralizes property browsing, eligibility checks, applications, and regulatory oversight for foreign investors. It aims to enhance transparency, simplify transactions, and facilitate controlled foreign participation in the Kingdom’s real estate market.

- January 2026: Medline has opened a new office in Riyadh, Saudi Arabia, strengthening its Middle East presence and enhancing service capabilities for healthcare providers. The Riyadh office will provide localized support across key functions, improving response times, in-person engagement, and coordination for medical-surgical products and solutions.

Saudi Arabia Commercial Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Offices, Retail, Industrial, Logistics, Multi-family, Hospitality |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India hospital market size was valued at USD 193.42 Billion in 2025.

The Saudi Arabia commercial real estate market is expected to grow at a compound annual growth rate of 3.22% from 2026-2034 to reach USD 92.76 Billion by 2034.

Offices dominate the market with 32% revenue share in 2025, driven by the Regional Headquarters program attracting multinational corporations and sustained demand for premium Grade A workspaces.

Key factors driving the Saudi Arabia commercial real estate market include the Kingdom’s ambition to become a regional logistics hub, expansion of ports, free zones, warehouses, and logistics corridors, and rapid e-commerce growth, with 40,953 registered e-commerce companies by Q4 2024, reflecting a 10% annual increase.

Major challenges include rising construction costs and supply chain pressures from concurrent mega-projects, potential oversupply risks in specific office corridors, complex regulatory frameworks affecting foreign investment timelines, and skilled labor shortages impacting project delivery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)