Saudi Arabia Cookware Market Size, Share, Trends and Forecast by Type, Product, Material, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Cookware Market Overview:

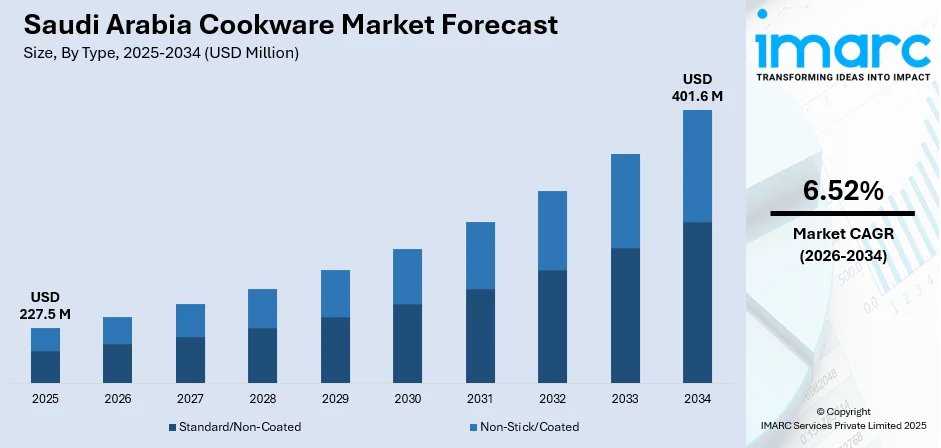

The Saudi Arabia cookware market size reached USD 227.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 401.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.52% during 2026-2034. The market is growing because of higher disposable income, evolving user preferences for innovative, durable, and aesthetically appealing products, and increased digital and retail access. The growing demand in hospitality, government support for local manufacturing, and heightened awareness about sustainability and material safety is further contributing to the Saudi Arabia cookware market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 227.5 Million |

| Market Forecast in 2034 | USD 401.6 Million |

| Market Growth Rate 2026-2034 | 6.52% |

Saudi Arabia Cookware Market Trends:

Rising Disposable Income and Lifestyle Enhancement

Households are allocating larger portions of their budgets to home improvement, kitchen aesthetics, and premium cookware, reflecting an enhanced focus on quality, durability, and design sophistication. According to the Mid-Year Economic and Fiscal Performance Report FY 2024, private consumption expenditures recorded a real increase of 2.4% in the first half of FY2024 compared with the same period in the previous year, underscoring the growing household purchasing power. This rise in expenditure supports the shift toward premium and innovative cookware solutions that align with modern culinary habits and international design preferences. Expanding middle and upper-middle-income groups are particularly drawn to cookware that balances performance with visual refinement, signaling a transition from basic utility to aspirational ownership. The combination of higher income levels, digital retail access, and design-conscious individuals is cultivating a market trend centered on comfort, elegance, and enduring product value.

To get more information on this market, Request Sample

Evolving User Preferences and Product Innovation

The cookware market in Saudi Arabia is growing because of the increasing preference for more efficient and technologically advanced kitchen options. The rising awareness about nutrition, hygiene, and food safety is driving the need for cookware with non-toxic coatings, consistent heat distribution, and energy-saving capabilities. Manufacturers are proactively creating new products that combine convenience, durability, and eco-friendliness to satisfy changing user demands. Sophisticated design differentiation, encompassing ergonomics, aesthetics, and versatile functionality, is influencing buying choices, as people look for tools that combine utility with style. The incorporation of intelligent technologies, featuring accurate temperature management and heat retention systems, is establishing high-end cookware as a practical and desirable home investment. This change indicates a cultural evolution where cooking is more frequently perceived as an experience instead of a chore. With the growing recognition of quality certification and international standards, technologically advanced and health-focused cookware is increasingly establishing its foothold in both residential and professional culinary arenas in Saudi Arabia.

Expansion of Retail Infrastructure and E-Commerce Penetration

Hypermarkets, department stores, and specialty kitchen retailers are progressively emphasizing branded product showcases, engaging shopping experiences, and high-end cookware selections, boosting buyer interaction and visibility for recognized brands. The International Trade Administration (ITA) forecasted that by 2024, the number of internet users engaging in e-commerce in Saudi Arabia will hit 33.6 million, highlighting the Kingdom’s swift digital transformation. The increase in online engagement is transforming buying habits, allowing shoppers to reach broader product selections with enhanced ease, clear pricing, and reliable delivery options. The rising combination of online and offline retail approaches enables cookware producers to enhance market presence and ensure steady client interaction. Combined with digital marketing, influencer collaborations, and data-driven targeting, these retail developments are expanding cookware accessibility and driving long-term growth across both urban and semi-urban consumer segments.

Saudi Arabia Cookware Market Growth Drivers:

Growth of Hospitality and Foodservice Sector

The rise in hotels, restaurants, and catering services, backed by tourism efforts and significant national events, is catalyzing the demand for resilient, high-quality cookware appropriate for heavy commercial use. Professional kitchens need items that offer consistent quality, high heat resistance, and operational efficiency, encouraging manufacturers to innovate using advanced materials and precision production techniques. The increasing appeal of food culture in both domestic tourism and international visitor groups encouraging the use of technologically advanced cookware in the commercial sector. Culinary education facilities and major catering businesses also enhance institutional need for dependable, safety-approved products. The IMARC Group reported that the foodservice market in Saudi Arabia was valued at USD 28,669 Million in 2024, indicating robust growth in the sector. This expansion strengthens long-term prospects for cookware producers who are serving the changing professional culinary landscape and the Kingdom’s growing hospitality framework.

Government Initiatives Supporting Domestic Manufacturing

The cookware market in Saudi Arabia is benefiting from government-led efforts that encourage domestic production and industrial independence. Through national development strategies, policies that promote investment, technology transfer, and skill enhancement are bolstering the domestic production foundation. Incentives like industrial funding and simplified regulatory systems are enabling small and medium-sized businesses to grow their operations while preserving quality competitiveness. This is enhancing product accessibility, decreasing dependency on imports, and stabilizing pricing frameworks within the cookware sector. Localized manufacturing closely aligns with the Kingdom’s economic diversification objectives, aiding in job creation and fostering sustainable industrial development. Additionally, adherence to local and international quality standards is boosting investor trust, encouraging innovation and technological progress in material development and design effectiveness. The combination of contemporary manufacturing methods with innovation aimed at users is establishing Saudi Arabia as a developing hub for cookware production, enhancing its global competitiveness and enduring industrial strength in the non-oil manufacturing sector.

Increasing Awareness of Sustainability and Material Safety

Eco-aware individuals are focusing on cookware made from recyclable, sustainable, and non-toxic materials that reduce environmental impact and encourage healthier living. Producers are adjusting by implementing manufacturing methods that focus on energy efficiency, minimizing waste, and sustainably sourcing raw materials. Clear product labeling, compliance with international safety standards, and the use of ethically sourced materials are crucial for establishing user trust. This focus on environmental accountability is becoming a crucial factor for brands aiming for enduring loyalty. Firms that implement resource-saving packaging and longer product life cycles are experiencing increasing approval from both urban and semi-urban individuals. The emphasis on sustainability now signifies not just a user trend but also a wider societal dedication to responsible living. As a result, cookware purchases symbolize ethical awareness, material integrity, and alignment with international sustainability objectives within the Saudi Arabia households.

Saudi Arabia Cookware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, product, material, application, and distribution channel.

Type Insights:

- Standard/Non-Coated

- Non-Stick/Coated

- Teflon (PTFE) Coated

- Ceramic Coated

- Enamel Coated

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes standard/non-coated and non-stick/coated (Teflon (PTFE) coated, ceramic coated, enamel coated, and others).

Product Insights:

- Pots and Pans

- Pressure Cooker

- Cooking Racks

- Cooking Tools

- Bakeware

- Microware Cookware

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes pots and pans, pressure cookers, cooking racks, cooking tools, bakeware, and microware cookware.

Material Insights:

- Stainless Steel

- Carbon Steel

- Cast Iron

- Aluminum

- Glass

- Stoneware

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes stainless steel, carbon steel, cast iron, aluminum, glass, stoneware, and others.

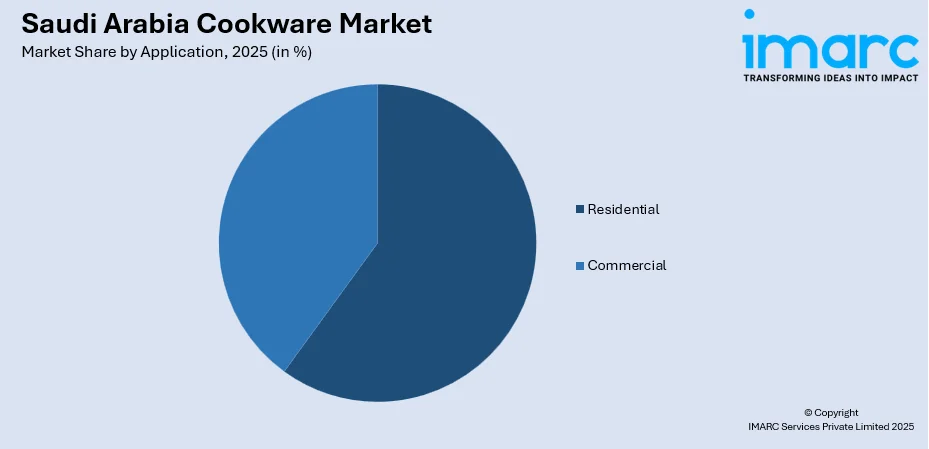

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Supermarket/Hypermarket

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket/hypermarket, specialty stores, online, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cookware Market News:

- June 2025: Vinod Intelligent Cookware officially launched its products in the Middle East, including the UAE, Saudi Arabia, and Bahrain. The expansion features partnerships with Bright Line Trading LLC, listings on Amazon and Noon, and placements in Carrefour stores. The brand aims to meet regional cooking needs with its high-performance, Indian-engineered cookware.

Saudi Arabia Cookware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Products Covered | Pots and Pans, Pressure Cookers, Cooking Racks, Cooking Tools, Bakeware, Microware Cookware |

| Materials Covered | Stainless Steel, Carbon Steel, Cast Iron, Aluminum, Glass, Stoneware, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarket/Hypermarket, Specialty Stores, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cookware market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cookware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cookware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cookware market in Saudi Arabia was valued at USD 227.5 Million in 2025.

The Saudi Arabia cookware market is projected to exhibit a CAGR of 6.52%during 2026-2034, reaching a value of USD 401.6 Million by 2034.

The Saudi Arabia cookware market is growing due to rising disposable incomes, increasing interest in home cooking, premium product adoption, and expanding retail and online distribution. Demand for durable, non-toxic, and energy-efficient cookware is also strengthening the market growth as individuals prioritize quality and convenience. Brand innovation and design advancements continue to enhance overall market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)