Saudi Arabia Cosmetic Surgery Market Size, Share, Trends and Forecast by Procedure, Gender, Age Group, End User, and Region, 2026-2034

Saudi Arabia Cosmetic Surgery Market Overview:

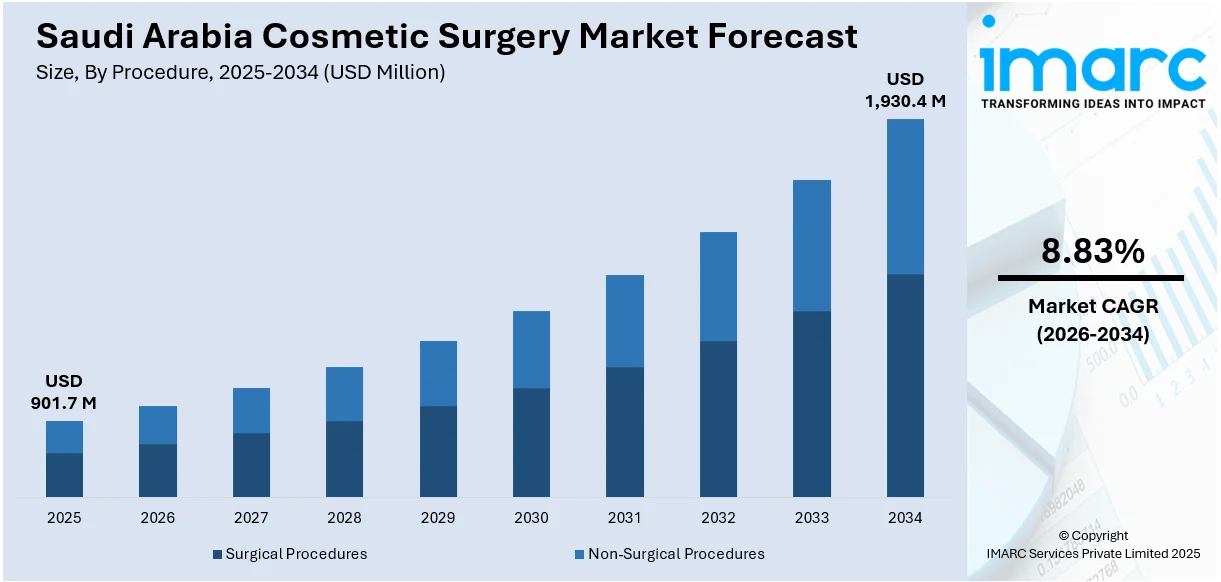

The Saudi Arabia Cosmetic Surgery Market size reached USD 901.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,930.4 Million by 2034, exhibiting a growth rate (CAGR) of 8.83% during 2026-2034. The market is driven by rising disposable incomes, evolving beauty standards influenced by social media, increased acceptance of aesthetic procedures, technological advancements in minimally invasive techniques, and a growing demand for personalized, non-surgical treatments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 901.7 Million |

| Market Forecast in 2034 | USD 1,930.4 Million |

| Market Growth Rate 2026-2034 | 8.83% |

Saudi Arabia Cosmetic Surgery Market Trends:

Rising Disposable Income and Economic Empowerment

Saudi Arabia’s growing economy and the government's Vision 2030 reforms have significantly increased disposable income, especially among women. As more women join the workforce and gain financial independence, they are more willing to invest in cosmetic procedures. The perception of beauty and personal care as part of self-confidence and social status is on the rise. With enhanced purchasing power, consumers are no longer restricted to basic treatments but are exploring advanced and elective cosmetic enhancements, creating a positive Saudi Arabia cosmetic surgery market outlook. Clinics are also tailoring services to this financially empowered demographic, offering flexible payment options and luxury service experiences, further fueling demand in the cosmetic surgery sector.

To get more information on this market Request Sample

Influence of Social Media and Western Beauty Standards

Social media platforms such as Instagram, Snapchat, and TikTok have become powerful tools shaping beauty standards in Saudi Arabia. Influencers and celebrities often promote cosmetic enhancements, making procedures more mainstream and aspirational. Young adults are influenced by edited and filtered images that promote idealized appearances. This constant exposure creates pressure to conform to global beauty norms, increasing the demand for facial and body enhancements. Clinics have also embraced social media to showcase before-and-after results, customer testimonials, and influencer partnerships, which normalize and promote aesthetic procedures. This digital influence is a major factor fueling the Saudi Arabia cosmetic surgery market share.

Cultural Shift Toward Aesthetic Acceptance

Cultural attitudes toward cosmetic surgery in Saudi Arabia have shifted significantly in recent years. What was once seen as taboo is now embraced by a larger segment of the population, especially among younger generations and urban dwellers. Cosmetic enhancements are increasingly viewed as a form of self-care and personal expression rather than vanity. Social reforms, increased openness, and the visibility of public figures who have undergone procedures have helped reduce stigma. Clinics have adapted to this cultural evolution by offering discreet, gender-sensitive services that respect local norms while delivering global-standard results. This growing social acceptance is a key factor driving the Saudi Arabia cosmetic surgery market growth.

Saudi Arabia Cosmetic Surgery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on procedure, gender, age group, and end user.

Procedure Insights:

- Surgical Procedures

- Breast Augmentation

- Liposuction

- Eyelid Surgery

- Abdominoplasty

- Rhinoplasty

- Others

- Non-Surgical Procedures

- Botulinum Toxin

- Hyaluronic Acid

- Hair Removal

- Nonsurgical Fat Reduction

- Photo Rejuvenation

- Others

The report has provided a detailed breakup and analysis of the market based on the procedure. This includes surgical procedures (breast augmentation, liposuction, eyelid surgery, abdominoplasty, rhinoplasty, and others) and non-surgical procedures (botulinum toxin, hyaluronic acid, hair removal, nonsurgical fat reduction, photo rejuvenation, and others).

Gender Insights:

- Female

- Male

A detailed breakup and analysis of the market based on gender have also been provided in the report. This includes female and male.

Age Group Insights:

- 13 to 29

- 30 to 54

- 55 and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 13 to 29, 30 to 54, and 55 and above.

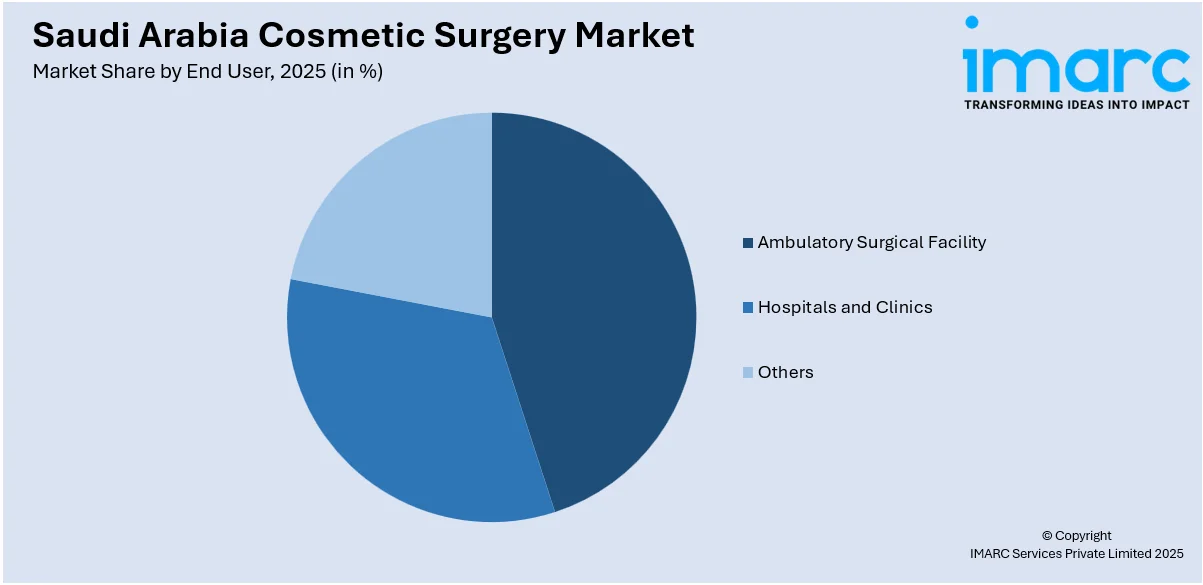

End User Insights:

Access the comprehensive market breakdown Request Sample

- Ambulatory Surgical Facility

- Hospitals and Clinics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes ambulatory surgical facility, hospitals and clinics, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cosmetic Surgery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Procedures Covered |

|

| Genders Covered | Female, Male |

| Age Groups Covered | 13 to 29, 30 to 54, 55 and Above |

| End Users Covered | Ambulatory Surgical Facility, Hospitals and Clinics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cosmetic surgery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cosmetic surgery market on the basis of procedure?

- What is the breakup of the Saudi Arabia cosmetic surgery market on the basis of gender?

- What is the breakup of the Saudi Arabia cosmetic surgery market on the basis of age group?

- What is the breakup of the Saudi Arabia cosmetic surgery market on the basis of end user?

- What is the breakup of the Saudi Arabia cosmetic surgery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cosmetic surgery market?

- What are the key driving factors and challenges in the Saudi Arabia cosmetic surgery market?

- What is the structure of the Saudi Arabia cosmetic surgery market and who are the key players?

- What is the degree of competition in the Saudi Arabia cosmetic surgery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cosmetic surgery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cosmetic surgery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cosmetic surgery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)