Saudi Arabia Data Center Colocation Market Size, Share, Trends and Forecast by Type, Organization Size, End Use Industry, and Region, 2026-2034

Saudi Arabia Data Center Colocation Market Size and Share:

The Saudi Arabia data center colocation market size was valued at USD 674.8 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,769.2 Million by 2034, exhibiting a CAGR of 11.31% from 2026-2034. The market is expanding rapidly, driven by increasing digital transformation, rising cloud adoption, and government investments in IT infrastructure. Additionally, demand for scalable, cost-effective solutions continues to attract enterprises seeking reliable data storage and management services, resultantly supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 674.8 Million |

| Market Forecast in 2034 | USD 1,769.2 Million |

| Market Growth Rate (2026-2034) | 11.31% |

Saudi Arabia's data center colocation market is principally driven by the rapid digital transformation across industries and the government's push for diversification under Vision 2030. The growing adoption of cloud computing, fueled by increased demand for scalable IT infrastructure, has significantly boosted the need for colocation facilities. For instance, as per industry reports, Saudi Arabia is rapidly embracing cloud computing, with annual public cloud service spending expected to reach USD 2.5 billion by 2026, reflecting a 25% CAGR. Furthermore, enterprises are increasingly outsourcing data center colocation operations to reduce costs and focus on core activities. Additionally, the country's strategic location as a digital hub for the Middle East positions it as a key player in attracting global data center investments.

The Saudi Arabia data center colocation market is further supported by rising investments in advanced technologies, including artificial intelligence (AI) and Internet of things (IoT), which demand high-performance computing capabilities. In addition, the increasing penetration of e-commerce and fintech sectors has heightened the need for secure and reliable colocation services, thereby facilitating the market expansion. For instance, according to the International Trade Administration, by 2024, the number of internet users in Saudi Arabia engaging in e-commerce activities is projected to reach 33.6 million. Moreover, the government's initiatives to enhance connectivity through submarine cables and fiber-optic networks are strengthening the overall digital infrastructure. Such developments make Saudi Arabia a growing hub for data center colocation services in the region.

Saudi Arabia Data Center Colocation Market Trends:

Rapid Digital Transformation and Cloud Adoption

Saudi Arabia's rapid digital transformation is being fueled by enterprise modernization plans and government efforts. There is an increasing need for dependable, scalable, and reasonably priced data hosting, as companies in the banking, healthcare, retail, and telecommunications sectors are moving towards cloud-based services and solutions. As per the IMARC Group, the Saudi Arabia cloud services market size reached USD 4.0 Billion in 2024. Without the significant financial outlay required to construct own facilities, data center colocation gives businesses the infrastructure they need to implement cloud apps. The Vision 2030 program of Saudi Arabia, which prioritizes innovations and smart technologies to diversify the economy, is in line with this transformation. As digital platforms are expanding, companies require robust colocation facilities to handle massive data workloads, enable smooth communication, and ensure reliable disaster recovery solutions. Due to this heightened reliance on digital services, colocation is increasingly seen as an attractive option.

Rising Internet Penetration and Data Consumption

Saudi Arabia possesses one of the highest internet penetration rates in the Middle East, with millions of citizens using digital services daily for communication, entertainment, banking, and e-commerce. As per the DataReportal, at the beginning of 2024, Saudi Arabia had 36.84 Million internet users. This increase in internet usage has led to a significant rise in data consumption, heightening the demand for strong data storage and processing systems. Colocation centers offer companies expandable capacity to handle increasing traffic while guaranteeing minimal latency and optimal performance for users. Additionally, the increasing adoption of video streaming, social media, and online gaming platforms is putting pressure on digital infrastructure, further accelerating the need for colocation services. Telecom providers and technology companies are expanding partnerships with colocation providers to ensure seamless delivery of digital experiences.

Expansion of Smart Cities and Internet of Things (IoT) Ecosystems

Saudi Arabia’s smart city initiatives, such as NEOM and the Red Sea Project, are creating massive opportunities for data center colocation. These futuristic developments rely heavily on IoT, artificial intelligence (AI), and cloud-based applications, which generate large volumes of data requiring low-latency storage and processing. In 2024, the Saudi Data and Artificial Intelligence Authority (SDAIA) revealed a USD 14.9 Billion investment aimed at enhancing the Kingdom’s AI capabilities. Colocation facilities are essential to support these smart ecosystems by providing high-speed connectivity, scalability, and energy efficiency. As smart cities continue to expand, they are demanding advanced data infrastructure to handle real-time analytics, traffic monitoring, smart grids, and digital services for residents. Colocation providers are expected to play a central role in enabling this transformation by serving as the backbone for IoT-enabled ecosystems.

Key Growth Drivers of Saudi Arabia Data Center Colocation Market:

Growing Enterprise Outsourcing Trends

Enterprises in Saudi Arabia are outsourcing their IT infrastructure needs to colocation providers rather than investing in costly in-house data centers. Rising operational expenses, complex IT demands, and the need for scalability are encouraging businesses to choose colocation as a cost-efficient alternative. By outsourcing to colocation facilities, companies gain access to state-of-the-art infrastructure, robust connectivity, and disaster recovery solutions without the burden of high capital expenditure. This trend is particularly strong among small and medium-sized enterprises (SMEs) that lack the financial resources to build private facilities. Additionally, multinational corporations entering the Saudi market prefer colocation to ensure faster deployment and compliance with local regulations. This growing preference for outsourcing IT operations allows enterprises to focus on core business activities, thereby catalyzing the demand for colocation services across multiple industry verticals in the Kingdom.

Increasing Demand for Data Security and Compliance

With rising digital adoption, cybersecurity and regulatory compliance are becoming top priorities for enterprises in Saudi Arabia. Sensitive data across finance, healthcare, and government sectors requires secure storage and management that complies with local data protection laws. Colocation providers offer enhanced security features, such as physical access controls, 24/7 monitoring, firewalls, and compliance certifications, making them a trusted choice for businesses. The need for disaster recovery and business continuity solutions is also catalyzing the demand for colocation services. Additionally, global cloud providers entering the Saudi market must adhere to stringent data localization requirements, further fueling the reliance on local colocation facilities. Enterprises recognize that colocation providers can deliver the highest levels of security and compliance without requiring heavy in-house investment.

Rising Focus on Business Continuity and Disaster Recovery

In an increasingly digital economy, businesses cannot afford downtime or data loss. Saudi enterprises are prioritizing business continuity and disaster recovery solutions, which colocation facilities are well-equipped to provide. Colocation centers offer redundant power supply, advanced cooling systems, and multiple network connections, ensuring uninterrupted operations even during outages. They also support disaster recovery strategies by providing secure backup and failover systems across multiple sites. This is especially critical for industries, such as finance, healthcare, and telecom, where service disruptions can result in financial losses or reputational damage. Moreover, colocation providers often integrate managed services, including monitoring and backup, to further strengthen resilience. With the growing natural risks and regulatory demands for business continuity, colocation facilities are becoming a trusted solution that ensures organizations can maintain stability and reliability in a rapidly evolving digital environment.

Saudi Arabia Data Center Colocation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia data center colocation market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on type, organization size, and end use industry.

Analysis by Type:

To get more information on this market, Request Sample

- Retail Colocation

- Wholesale Colocation

The retail colocation segment in Saudi Arabia’s data center market is expanding consistently, mainly boosted by small and medium enterprises (SMEs) preferring comprehensive and cost-efficient solutions. This type of colocation provides clients dedicated cabinets or racks, offering scalability for enterprises with bounded IT demands. Retail colocation is especially compelling to businesses demanding access to resilient IT infrastructure without the capital investment of developing their own facilities. In addition, with magnifying digitalization across major sectors, retail colocation remains an ideal option for enterprises seeking to manage their IT operations effectively while emphasizing on key business functions.

Wholesale colocation is gaining traction in Saudi Arabia, catering to large enterprises and hyperscale cloud providers requiring substantial space and resources. This segment involves leasing entire data halls or substantial portions of a facility, making it ideal for organizations with extensive IT infrastructure needs. Moreover, wholesale colocation offers economies of scale, enhanced customization, and greater control over infrastructure. Additionally, the increasing demand for cloud services and digital transformation initiatives in Saudi Arabia has amplified interest in wholesale colocation, positioning it as a critical component of the market’s growth trajectory.

Analysis by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

In Saudi Arabia, small and medium enterprises (SMEs) are increasingly adopting data center colocation services to enhance their IT infrastructure without incurring significant capital expenditures. These businesses benefit from scalable solutions, improved operational efficiency, and robust security offered by colocation facilities. Moreover, the growing digital transformation among SMEs, supported by government initiatives encouraging technological adoption, has further boosted demand. Furthermore, colocation services enable SMEs to focus on core business activities while leveraging advanced data center infrastructure to support their growth and competitiveness in an evolving market.

Large enterprises in Saudi Arabia rely heavily on data center colocation services to manage extensive data requirements and ensure business continuity. These organizations prioritize high-performance infrastructure, advanced security protocols, and reliability, which colocation providers deliver through state-of-the-art facilities. With increasing reliance on cloud computing and data analytics, large enterprises are investing in colocation to achieve scalability and efficiency. In addition, strategic partnerships with colocation providers also enable these enterprises to meet growing operational demands, reduce energy consumption, and align with sustainability goals, strengthening their market presence.

Analysis by End Use Industry:

- BFSI

- Manufacturing

- IT and Telecom

- Energy

- Healthcare

- Government

- Retail

- Education

- Entertainment and Media

- Others

The BFSI sector in Saudi Arabia is increasingly leveraging data center colocation services to enhance operational efficiency and ensure regulatory compliance. By outsourcing data center needs, financial institutions can focus on core activities while benefiting from secure, scalable, and cost-effective infrastructure. Furthermore, colocation facilities offer robust disaster recovery solutions and high availability, which are critical for maintaining uninterrupted financial services. This strategic approach enables BFSI entities to adapt to evolving technological demands and customer expectations.

Saudi Arabia's manufacturing industry is adopting data center colocation to support digital transformation initiatives, including automation and smart manufacturing. Colocation services provide the necessary IT infrastructure to handle large-scale data processing and storage, facilitating real-time analytics and decision-making. This approach allows manufacturers to optimize production processes, improve supply chain management, and enhance product quality, thereby increasing competitiveness in both domestic and international markets.

The IT and telecom sector is a significant consumer of data center colocation services in Saudi Arabia. Telecom operators and IT service providers utilize colocation facilities to expand network reach, improve service delivery, and manage the growing demand for data services. Moreover, colocation offers scalable solutions that support rapid deployment of new technologies, such as 5G and IoT, enabling these companies to maintain a competitive edge and meet customer expectations for high-speed, reliable connectivity.

In Saudi Arabia's energy sector, data center colocation services are essential for managing vast amounts of data generated from exploration, production, and distribution activities. Colocation facilities provide the computational power and storage capacity required for advanced analytics, predictive maintenance, and real-time monitoring. As a result, this enables energy companies to optimize operations, reduce costs, and enhance safety measures, contributing to more efficient resource management and sustainability efforts.

The healthcare industry in Saudi Arabia is increasingly relying on data center colocation to support electronic health records, telemedicine, and other digital health initiatives. Colocation services offer secure and compliant environments for sensitive patient data, ensuring privacy and facilitating seamless information exchange among healthcare providers. Furthermore, this infrastructure supports improved patient care, operational efficiency, and the integration of emerging technologies such as AI and machine learning in medical diagnostics and treatment.

Saudi Arabian government agencies are utilizing data center colocation to support e-government services, enhance public sector efficiency, and ensure data sovereignty. Colocation facilities provide secure, scalable, and reliable infrastructure that enables the deployment of digital services to citizens and businesses. This approach aligns with national initiatives aimed at digital transformation, improving service delivery, and fostering transparency and accountability within government operations.

The retail sector in Saudi Arabia is adopting data center colocation to support e-commerce platforms, customer relationship management systems, and supply chain operations. Colocation services offer the necessary IT infrastructure to handle high transaction volumes, data analytics, and personalized marketing strategies. Additionally, this enables retailers to enhance customer experiences, streamline operations, and adapt to changing consumer behaviors, thereby driving growth and competitiveness in the market.

Educational institutions in Saudi Arabia are leveraging data center colocation to support online learning platforms, research initiatives, and administrative systems. Colocation services provide scalable and reliable infrastructure that facilitates the delivery of digital education resources, collaboration tools, and data storage solutions. Moreover, this supports the modernization of educational practices, enhances accessibility to learning materials, and fosters innovation in teaching and research methodologies.

The entertainment and media industry in Saudi Arabia is utilizing data center colocation to manage content delivery networks, streaming services, and digital content production. Colocation facilities offer the bandwidth, storage, and processing power required to deliver high-quality content to diverse audiences. Furthermore, this enables media companies to expand their digital offerings, improve user experiences, and capitalize on the growing demand for online entertainment, thereby increasing market reach and revenue opportunities.

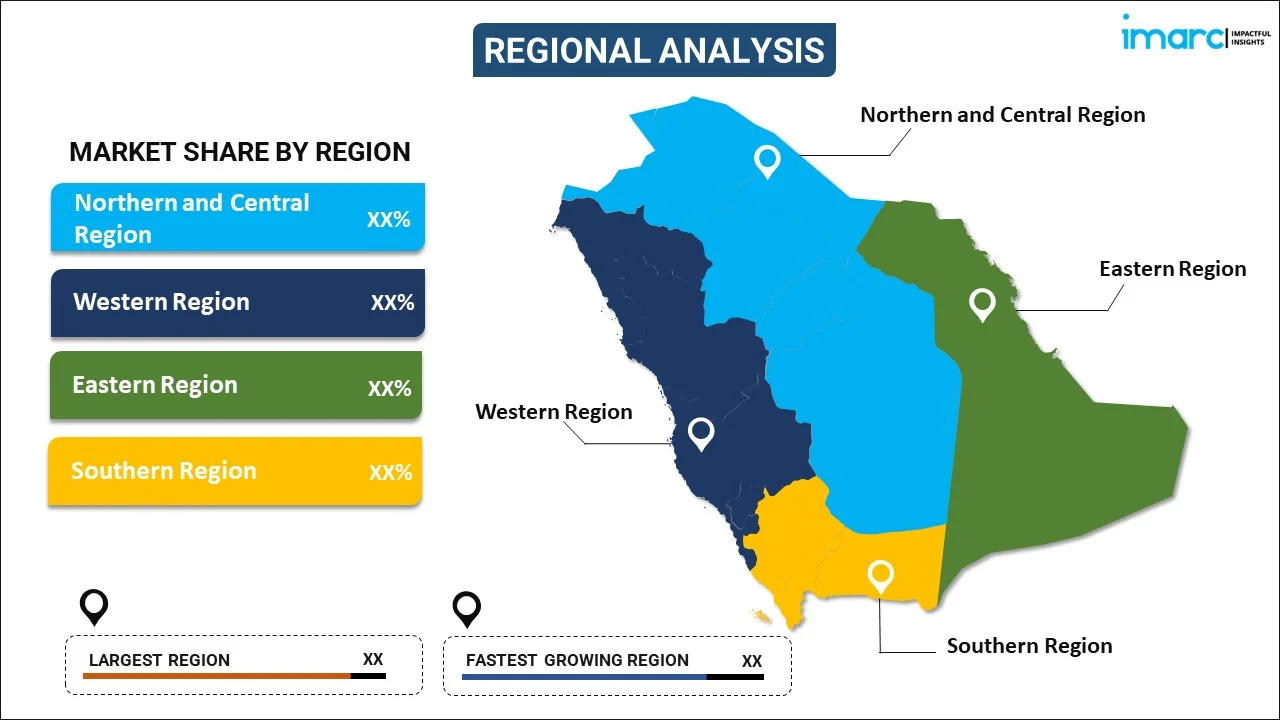

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central regions are currently witnessing elevating need for data center colocation services, chiefly boosted by public sector ventures as well as government programs. Major sectors including defense, finance, and education are actively utilizing colocation facilities to address their magnifying data management and storage requirements. Furthermore, the region benefits from strong digital infrastructure and a concentration of major businesses, creating a robust market for advanced IT services. Strategic investments in cloud computing and AI technologies further enhance the appeal of colocation services in these regions.

The Western Region, home to major urban hubs and economic zones, sees significant demand for colocation services from the tourism, retail, and logistics sectors. These industries rely on data centers to handle extensive customer data and streamline operations. Furthermore, the region’s focus on smart city initiatives and digital transformation, coupled with its growing e-commerce activities, has accelerated the adoption of colocation services. Additionally, with an emphasis on scalability and sustainability, operators in the Western Region are optimizing their offerings to align with industry-specific requirements.

The Eastern Region, known for its robust oil and gas industry, is a key contributor to the Saudi data center colocation market. The energy sector’s demand for secure and scalable IT infrastructure drives the need for advanced colocation solutions. Additionally, the region's growing industrial base and focus on digital innovation make it a hub for technology-driven industries. Moreover, with rising adoption of cloud services and digital analytics, colocation providers are capitalizing on the region’s diverse and expanding end-use industries to drive market growth.

The Southern Region of Saudi Arabia, with its emerging industrial base and growing emphasis on digital connectivity, is seeing increased adoption of colocation services from the agriculture, mining, and small business sectors. These industries rely on efficient data management and IT infrastructure to optimize operations. Furthermore, the region's strategic focus on regional development and digital transformation has created opportunities for colocation providers to expand their presence. In addition, tailored services addressing the unique needs of these industries are fostering steady market growth in this region.

Competitive Landscape:

The competitive landscape is dynamic, with strong participation from established operators and new entrants. The market is mainly driven by increasing demand for digital infrastructure, supported by advancements in technology and strategic partnerships. Moreover, collaborations between data center companies are enhancing innovation, sustainability, and energy efficiency, fostering a competitive and evolving market environment. For instance, in November 2024, Pure Data Centers announced a strategic collaboration with Dune Vaults for the development of hyperscale data center campuses in Saudi Arabia, with IT capacity exceeding 100MW. In addition, several operators are focusing on innovative solutions to meet the growing needs of cloud services, scalable IT infrastructure, and enhanced data management, solidifying Saudi Arabia's position as a regional hub for data center services.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia data center colocation market with detailed profiles of all major companies.

Saudi Arabia Data Center Colocation Market News:

- July 2025: Al Moammar Information Systems Company (MIS) in Saudi Arabia struck a deal to provide an extra 112MW of data center capacity with the Saudi Data Centre Fund 1 of the kingdom. The provider of IT services disclosed the information in a statement to the Saudi stock market.

- October 2024: DataVolt, a Saudi Arabia-based data center developer, signed an MoU with Center3 to provide maintenance as well as operational services for data centers in Saudi Arabia. The companies aim to utilize their expertise to boost dependability, efficacy, and innovation in data center management.

Saudi Arabia Data Center Colocation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Retail Colocation, Wholesale Colocation |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Manufacturing, IT and Telecom, Energy, Healthcare, Government, Retail, Education, Entertainment and Media, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia data center colocation market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia data center colocation market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia data center colocation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Data center colocation in Saudi Arabia refers to the provision of shared, secure infrastructure where businesses lease space, power, and cooling for their IT equipment. It supports applications like cloud computing, disaster recovery, and content delivery, enabling enterprises to enhance scalability, operational efficiency, and data management while reducing infrastructure costs.

The data center colocation market in Saudi Arabia was valued at USD 674.8 Million in 2025.

The Saudi Arabia data center colocation market is projected to exhibit a CAGR of 11.31% during 2026-2034, reaching a value of USD 1,769.2 Million by 2034.

Enterprises and government organizations are seeking cost-efficient solutions to manage rising data volumes, which is driving the preference for colocation services over building in-house data centers. Vision 2030’s focus on digital transformation and smart city development is further boosting the need for advanced data infrastructure. Global cloud providers and local telecom operators are investing in colocation facilities to serve expanding internet usage and digital services in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)