Saudi Arabia Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2026-2034

Saudi Arabia Debt Collection Software Market Overview:

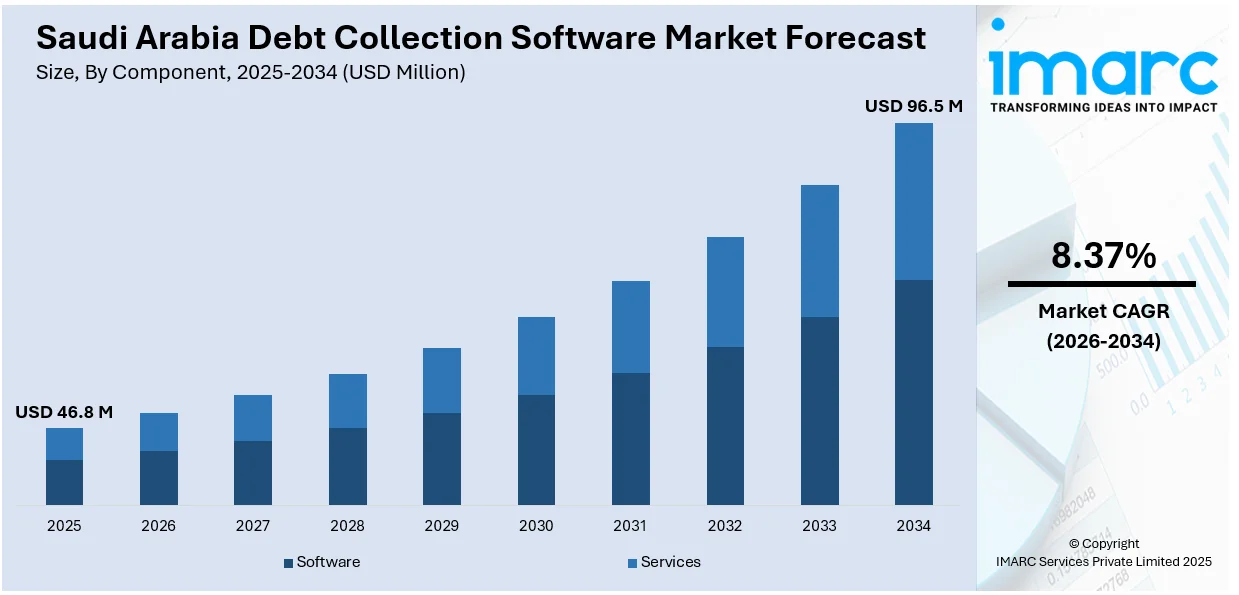

The Saudi Arabia debt collection software market size reached USD 46.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 96.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.37% during 2026-2034. The market is being driven by regulatory reforms enhancing compliance requirements and the rising volumes of consumer credit and non-performing loans, prompting financial institutions to adopt advanced digital solutions for efficient debt recovery, improved transparency, and streamlined communication with borrowers to boost operational performance and mitigate risk.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 46.8 Million |

| Market Forecast in 2034 | USD 96.5 Million |

| Market Growth Rate 2026-2034 | 8.37% |

Saudi Arabia Debt Collection Software Market Trends:

Regulatory Reforms and Increased Oversight by Saudi Central Bank (SAMA)

One of the strongest drivers of the growth in Saudi Arabia's debt collection software market is the forward-thinking regulatory reforms spearheaded by SAMA. Under Vision 2030, the Kingdom has made it a priority to modernize its financial ecosystem with a strong emphasis on transparency, consumer protection, and digitization. For instance, in 2024, SAMA released its regulations on debt collection from retail clients for public comment, which shows that it is committed to standardizing and regulating collection processes across the financial sector. These regulatory steps force organizations to implement software ensuring complete compliance with changing guidelines, such as keeping unambiguous audit trails, automated reports, data protection, and ethical collection behaviors. Current debt collection platforms provide these features out of the box so that businesses can adhere to compliance requirements without increasing legal and reputational exposures. In addition to this, SAMA's requirement for real-time reporting, dispute handling, and communication logs is being increasingly addressed by efficient digital solutions.

To get more information on this market Request Sample

Rising Consumer Credit and Non-Performing Loans (NPLs)

Another key driver of the Saudi debt collection software market is the precipitous increase in consumer credit usage and the concomitant spike in NPLs. Personal finance has seen robust growth in the Kingdom over recent years, spurred by a demographic bulge of youth, expanding middle class, and ubiquitous availability of consumer lending and credit cards. Though this boom indicates rising demand for financial products, it comes with high delinquency risk. While banks are extensively under pressure to deal with increasing portfolios of delinquent loans, debt collection software becomes a necessity to enhance recovery rates. Manual follow-ups and spreadsheets are no longer sufficient in dealing with the size and intricacy of contemporary collections. Powerful platforms with AI-based analytics, automated reminders, segmentation, and predictive modeling enable institutions to determine which accounts are most likely to repay and when to reach out. Besides this, these tools can tailor communication strategies according to behavioral data, enhancing customer response and reducing friction. The growing need for cost effectiveness and increased recovery yields, particularly in a scenario where NPL ratios are under the regulatory microscope, has rendered digital collection systems not only useful but essential.

Saudi Arabia Debt Collection Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component, deployment mode, organization size, and end user.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

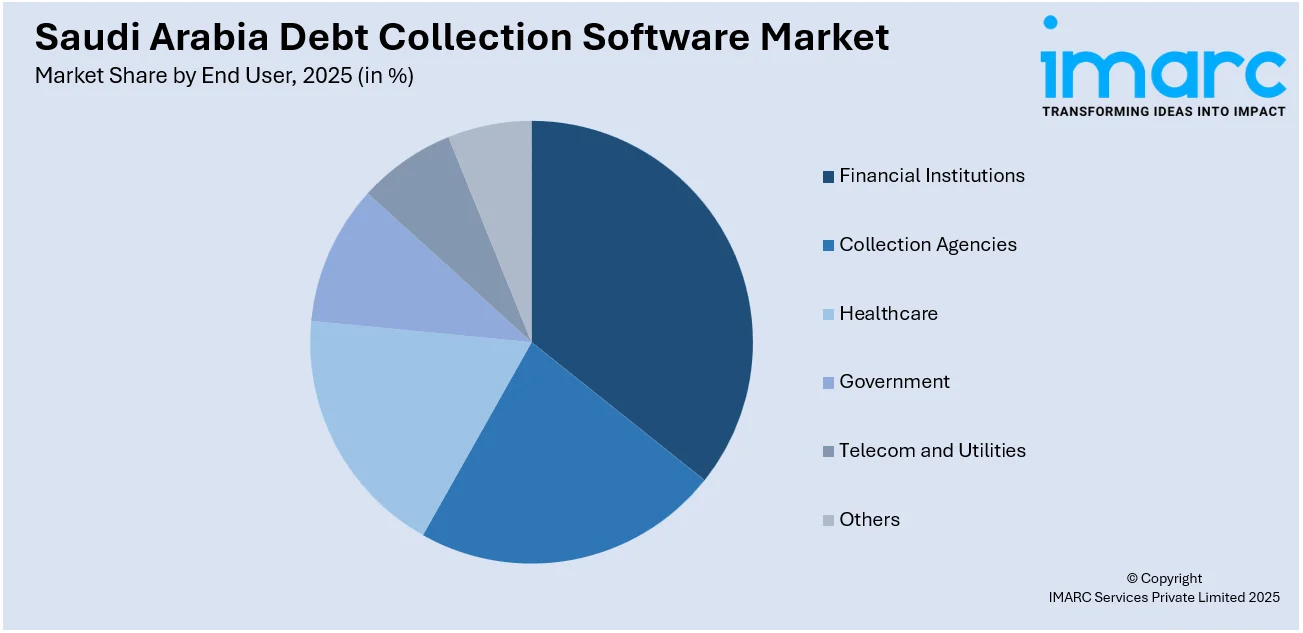

End User Insights:

Access the comprehensive market breakdown Request Sample

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom and Utilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes financial institutions, collection agencies, healthcare, government, telecom and utilities, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Debt Collection Software Market News:

- February 2025: Saudi fintech startup Ebra secured USD 2 million in seed funding led by Seen Holding, with participation from Raz Holding and other investors. Ebra's AI-powered debt collection platform emphasized regulatory-compliant debt recovery processes, offering real-time data insights and secure digital payment solutions.

- July 2024: Saudi Arabia expanded its debt market by appointing five additional financial institutions as primary distributors of government debt instruments. This move diversified the investor base and provided more channels for participation in the local debt market. Consequently, the demand for advanced debt collection software was expected to rise, driving progress and innovation in Saudi Arabia's financial technology sector.

Saudi Arabia Debt Collection Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Users Covered | Financial Institutions, Collection Agencies, Healthcare, Government, Telecom and Utilities, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia debt collection software market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia debt collection software market on the basis of component?

- What is the breakup of the Saudi Arabia debt collection software market on the basis of deployment mode?

- What is the breakup of the Saudi Arabia debt collection software market on the basis of organization size?

- What is the breakup of the Saudi Arabia debt collection software market on the basis of end user?

- What are the various stages in the value chain of the Saudi Arabia debt collection software market?

- What are the key driving factors and challenges in the Saudi Arabia debt collection software market?

- What is the structure of the Saudi Arabia debt collection software market and who are the key players?

- What is the degree of competition in the Saudi Arabia debt collection software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia debt collection software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia debt collection software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia debt collection software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)