Saudi Arabia Diagnostic Labs Market Size, Share, Trends and Forecast by Provider Type, Test Type, Sector, End User, and Region, 2026-2034

Saudi Arabia Diagnostic Labs Market Overview:

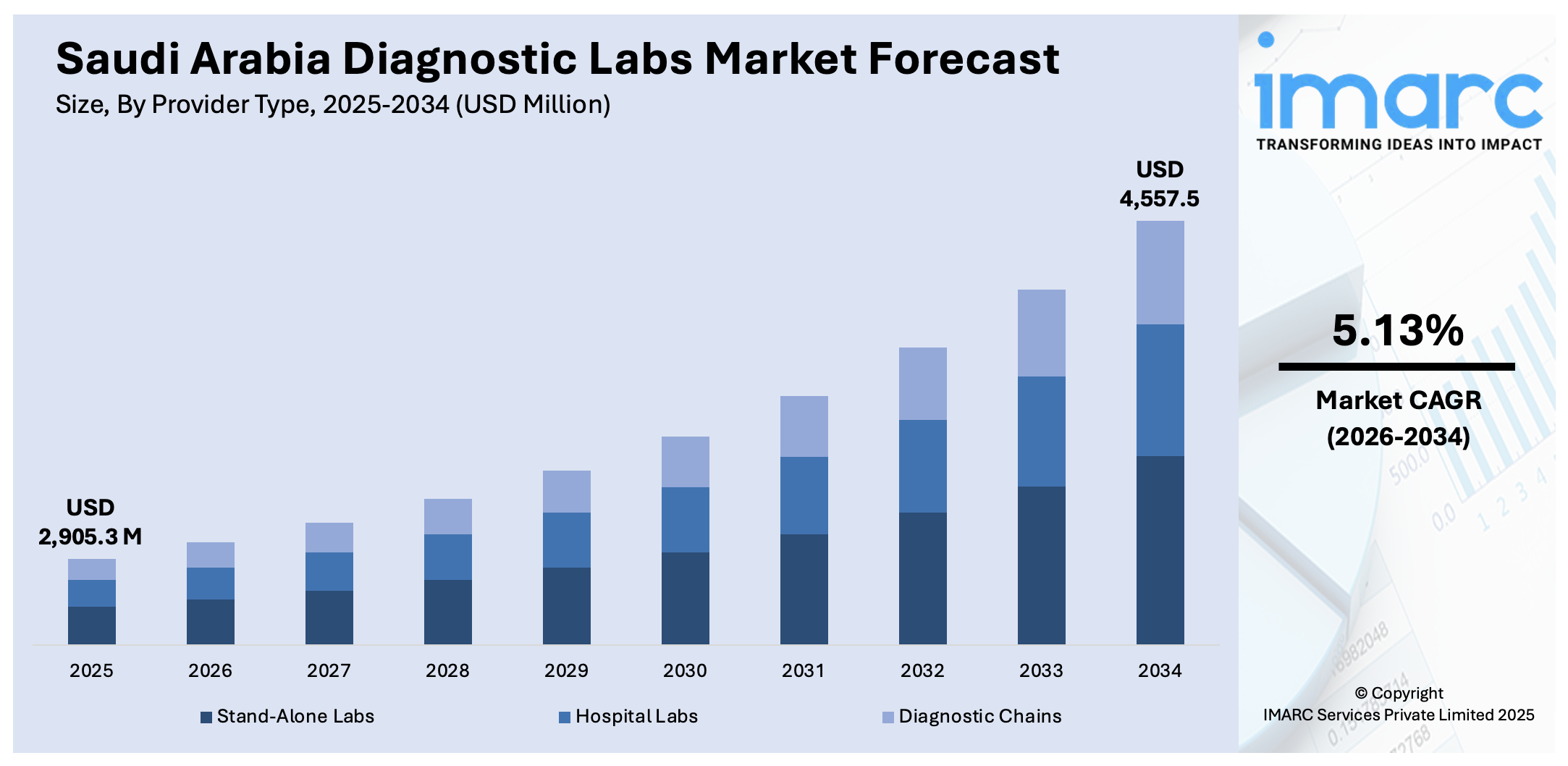

The Saudi Arabia diagnostic labs market size reached USD 2,905.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,557.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.13% during 2026-2034. The increasing demand for advanced healthcare services, the growing aging population, and the rising prevalence of chronic diseases are supporting the market growth. In line with this, Saudi Arabia's Vision 2030, burgeoning health awareness, growing emphasis on preventive care, and technological advancements in diagnostic tools are stimulating the market growth. Furthermore, the expansion of private healthcare centers, increasing medical tourism, investments in research, and the rise of digital health solutions are boosting the Saudi Arabia diagnostic labs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,905.3 Million |

| Market Forecast in 2034 | USD 4,557.5 Million |

| Market Growth Rate 2026-2034 | 5.13% |

Saudi Arabia Diagnostic Labs Market Trends:

Increasing Demand for Advanced Healthcare Services

The growing demand for advanced healthcare services is one of the major factor driving the Saudi Arabia diagnostic labs market growth. The burgeoning population and rising life expectancy have increased the demand for healthcare services, including diagnostic testing, which is providing a thrust to the market growth. Additionally, the prevalence of chronic diseases such as diabetes, cardiovascular diseases (CVDs), and obesity is increasing, necessitating regular diagnostic tests for early diagnosis and treatment. In 2024, a national study showed that 1.6% of Saudis aged 15 years and older suffer from CVD, with a higher rate in men (1.9%) compared to women (1.4%). This number rises considerably with age, reaching 11% among those over 65 years old. The Saudi healthcare system is going through immense growth with increased focus being given on specialty care, preventative care, and lifestyle diseases. The role of diagnostic labs is also central to the task of providing up-to-date, precise reports facilitating the appropriate diagnosis of diseases, monitoring, and management. With greater focus on early intervention and customized care, the demand for diagnostic services is likely to grow, reflecting a trend toward more advanced, technology-driven healthcare practices in the region.

To get more information on this market Request Sample

Saudi Arabia’s Vision 2030 and Healthcare Modernization

Saudi Arabian Vision 2030 is an important factor contributing to the expansion of the diagnostic labs market. Diversifying the economy, moving away from oil-based revenues, and heavy investment in areas such as healthcare are the primary aims of the plan. As part of this vision, the government is overhauling its healthcare infrastructure, such as hospitals, clinics and diagnostic centers, at par with international level across the nation. One of the main goals of the Vision 2030 is to improve the quality of health care system which includes upgrade and expansion of diagnostics laboratories. It aims to boost the access to healthcare, particularly in underserved areas, through the creation of new diagnostic centers and the introduction of latest diagnostic systems, which is providing a positive market outlook.

Rise in Health Awareness and Preventive Care

Health awareness among the Saudi population has grown significantly in recent years, contributing to a stronger demand for diagnostic services. As the population becomes more health-conscious, there is an increased emphasis on preventive care, early detection, and health monitoring. This shift is driven by factors such as the rising prevalence of lifestyle diseases, increasing access to health education, and government initiatives to promote healthy living. As individuals become more proactive about their health, diagnostic labs are playing a critical role in providing essential tests for routine check-ups, screening for diseases, and monitoring chronic conditions. The government has also launched numerous health campaigns aimed at educating the public about the importance of regular health screenings and preventive measures.

Saudi Arabia Diagnostic Labs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on provider type, test type, sector, and end user.

Provider Type Insights:

- Stand-Alone Labs

- Hospital Labs

- Diagnostic Chains

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes stand-alone labs, hospital labs, and diagnostic chains.

Test Type Insights:

- Pathology

- Radiology

A detailed breakup and analysis of the market based on the test type have also been provided in the report. This includes pathology and radiology.

Sector Insights:

- Urban

- Rural

The report has provided a detailed breakup and analysis of the market based on the sector. This includes urban and rural.

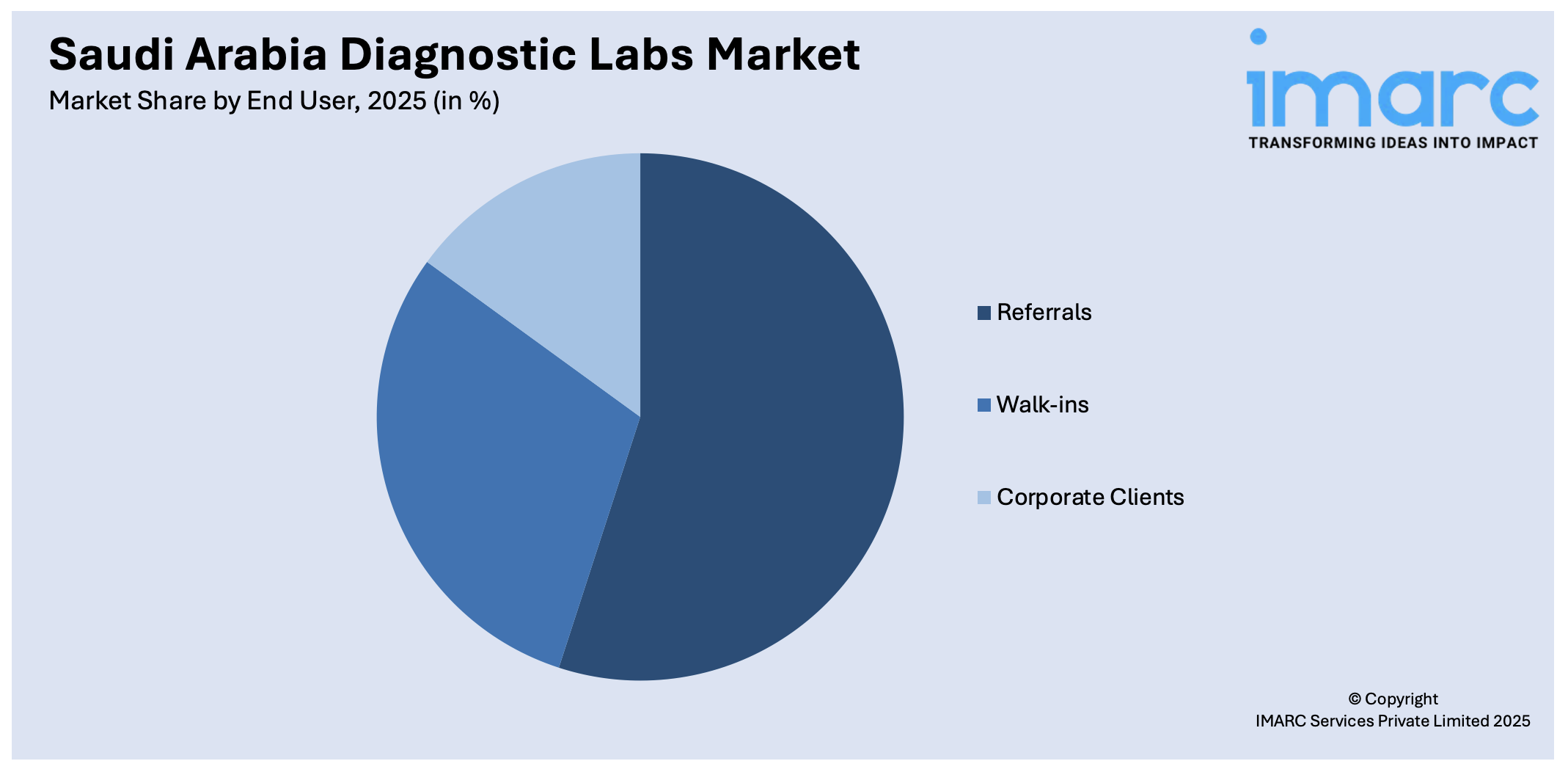

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Referrals

- Walk-ins

- Corporate Clients

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes referrals, walk-ins, and corporate clients.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Diagnostic Labs Market News:

- In 2024, the Saudi Food and Drug Authority (SFDA) launched an initiative to develop medical diagnostic laboratory devices and integrate three-dimensional (3D) printing within hospitals and medical laboratories.

- In 2023, Cerba HealthCare partnered with Nexus Gulf Healthcare to enhance clinical pathology services in Saudi Arabia. This collaboration aims to improve diagnostic solutions and aligns with the country's Vision 2030 healthcare objectives.

Saudi Arabia Diagnostic Labs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Provider Types Covered | Stand-Alone Labs, Hospital Labs, Diagnostic Chains |

| Test Types Covered | Pathology, Radiology |

| Sectors Covered | Urban, Rural |

| End Users Covered | Referrals, Walk-ins, Corporate Clients |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia diagnostic labs market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia diagnostic labs market on the basis of provider type?

- What is the breakup of the Saudi Arabia diagnostic labs market on the basis of test type?

- What is the breakup of the Saudi Arabia diagnostic labs market on the basis of sector?

- What is the breakup of the Saudi Arabia diagnostic labs market on the basis of end user?

- What is the breakup of the Saudi Arabia diagnostic labs market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia diagnostic labs market?

- What are the key driving factors and challenges in the Saudi Arabia diagnostic labs market?

- What is the structure of the Saudi Arabia diagnostic labs market and who are the key players?

- What is the degree of competition in the Saudi Arabia diagnostic labs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia diagnostic labs market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia diagnostic labs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia diagnostic labs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)