Saudi Arabia Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End Use Industry, and Region, 2026-2034

Saudi Arabia Drones Market Overview:

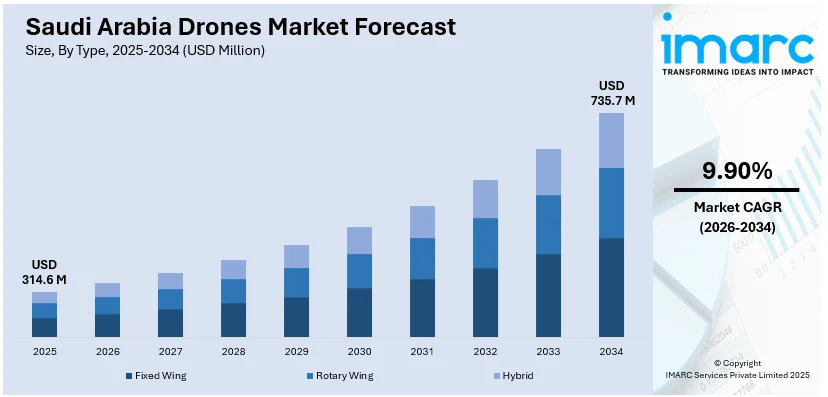

The Saudi Arabia drones market size reached USD 314.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 735.7 Million by 2034, exhibiting a growth rate (CAGR) of 9.90% during 2026-2034. The rising demand for e-commerce and delivery services, coupled with advancements in military and security technologies, is driving Saudi Arabia drone market, as drones offer efficient logistics solutions, enhance defense capabilities, and reduce reliance on traditional infrastructure and military assets through innovation and regulatory support.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 314.6 Million |

| Market Forecast in 2034 | USD 735.7 Million |

| Market Growth Rate 2026-2034 | 9.90% |

Saudi Arabia Drones Market Trends:

Rising Demand for E-commerce and Delivery Services

The increasing need for e-commerce and effective delivery services in Saudi Arabia is speeding up the adoption of drone technology. With the growth of online shopping, drones are being acknowledged as a viable option for rapidly and affordably delivering packages. They provide the capability to transport products to isolated or crowded locations with less dependence on conventional infrastructure such as roadways or delivery trucks. In cities such as Riyadh and Jeddah, where heavy traffic can greatly postpone deliveries, drones offer a means to avoid congestion and guarantee quicker service. The governing body is actively backing this transition to drone-driven logistics by creating regulatory frameworks to facilitate drone delivery services. For instance, in January 2025, Matternet announced that it received approval from Saudi Arabia’s General Authority of Civil Aviation (GACA) to operate its M2 drone. The approval follows the drone’s FAA Type Certification, which met GACA’s airworthiness standards. This marks the first time a drone delivery operator has received such approval in Saudi Arabia. This regulatory achievement highlights the dedication of the governing authority to promoting innovation in drone logistics, improving the buyer experience, and generating new business prospects. These efforts collectively contribute to the rapid expansion of the drone market in Saudi Arabia.

To get more information on this market, Request Sample

Advancements in Military and Security Technologies

The drone market in Saudi Arabia is largely propelled by swift progress in military and security technologies. Drones are emerging as crucial assets in contemporary defense strategies, providing unmatched abilities in monitoring, reconnaissance, and precision-targeted missions. As Saudi Arabia concentrates on updating its defense systems and fortifying its borders, it is progressively relied on drones to achieve these objectives. These unmanned systems offer benefits like enhanced accuracy, reduced operational risks, and cost efficiency in comparison to conventional military assets. This change in defense approach is especially noticeable in 2024 when the Royal Saudi Air Force (RSAF) chose China's Wing Loong-10B drone for procurement. This unmanned combat aerial vehicle (UCAV) enhanced Saudi Arabia's ability to conduct surveillance and strike missions, establishing it as an essential component of Saudi Arabia’s defense efforts. The Wing Loong-10B was displayed at the World Defense Show, highlighting its increasing significance in Saudi Arabia’s military inventory amid changing regional conflicts. As security issues evolve, the governing authority is prioritizing the use of drone technology for defense, counterterrorism, and intelligence-gathering operations. This strategic integration of drones is further supported by collaborations with international defense firms and the aim to lessen reliance on conventional military equipment, which frequently involves greater expenses and prolonged deployment periods.

Saudi Arabia Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, component, payload, point of sale, and end use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

The report has provided a detailed breakup and analysis of the market based on the payload. This includes <25 kilograms, 25-170 kilograms, and >170 kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

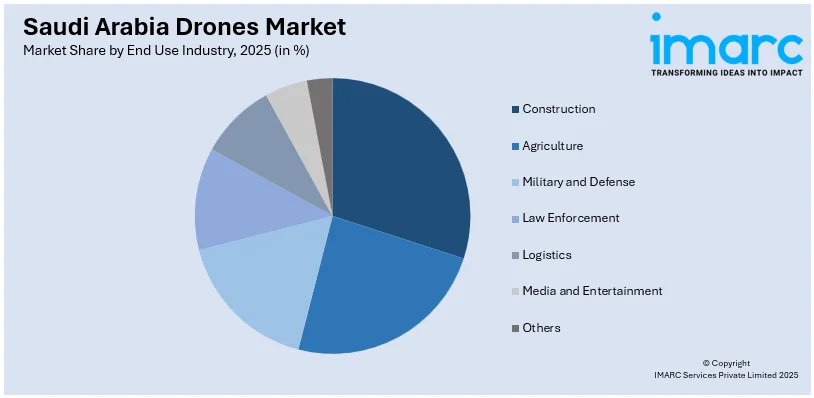

End Use Industry Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Drones Market News:

- In April 2025, Terra Drone signed a memorandum of understanding (MOU) with Saudi Aramco to enhance innovation in drone, robotics, and AI-driven solutions for the energy sector. The collaboration aims to support Saudi Arabia's localization efforts, workforce development, and economic diversification goals. Terra Drone's Saudi branch, Terra Drone Arabia, will play a key role in advancing these initiatives.

- In February 2025, Skyports Drone Services announced its entry into the Saudi Arabian market through a partnership with iot squared. The collaboration aims to demonstrate drone operations in Saudi Arabia’s giga-projects, focusing on beyond visual line of sight (BVLOS) services. This initiative seeks to enhance sustainability and efficiency in the large-scale infrastructure developments.

Saudi Arabia Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia drones market on the basis of type?

- What is the breakup of the Saudi Arabia drones market on the basis of component?

- What is the breakup of the Saudi Arabia drones market on the basis of payload?

- What is the breakup of the Saudi Arabia drones market on the basis of point of sale?

- What is the breakup of the Saudi Arabia drones market on the basis of end use industry?

- What is the breakup of the Saudi Arabia drones market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia drones market?

- What are the key driving factors and challenges in the Saudi Arabia drones market?

- What is the structure of the Saudi Arabia drones market and who are the key players?

- What is the degree of competition in the Saudi Arabia drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia drones market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)