Saudi Arabia E-Cigarette Market Size, Share, Trends and Forecast by Product, Flavor, Mode of Operation, Distribution Channel, and Region, 2026-2034

Saudi Arabia E-Cigarette Market Overview:

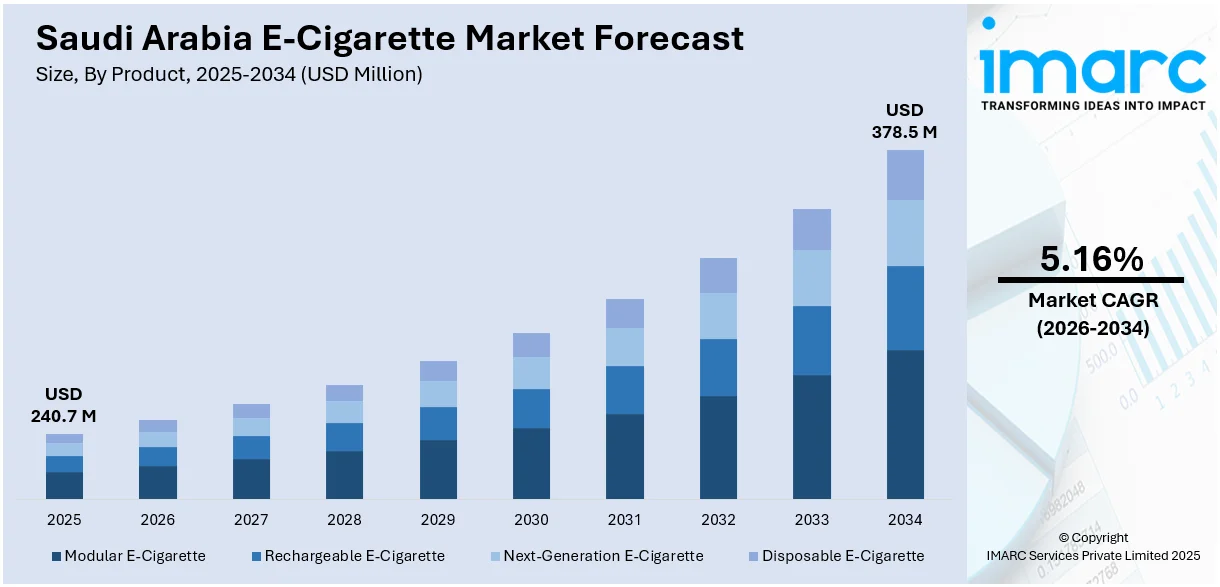

The Saudi Arabia e-cigarette market size reached USD 240.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 378.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.16% during 2026-2034. Inflating disposable incomes and evolving lifestyle preferences, combined with the removal of the e-cigarette ban and the establishment of a formal regulatory framework, are driving the widespread adoption and creating a more structured, growth-oriented environment for the e-cigarette market in Saudi Arabia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 240.7 Million |

| Market Forecast in 2034 | USD 378.5 Million |

| Market Growth Rate 2026-2034 | 5.16% |

Saudi Arabia E-Cigarette Market Trends:

Growing Health Awareness

In Saudi Arabia, rising health awareness among the population is strongly propelling the e-cigarette industry. As people become increasingly aware of the health risks posed by conventional cigarettes, including lung cancer, cardiovascular disease, and respiratory disease, many are looking for healthier options. As per Global Cancer Observatory, in 2024, lung cancer was considered as one of the top leading cancers affecting people in Saudi Arabia. The effect of smoking on general health is also being increasingly understood around the globe, leading people to shift away from regular tobacco in favor of products that are seen as safer. E-cigarettes, which involve no combustion and contain fewer chemicals that are generally toxic than traditional cigarettes, are being seen as a healthier alternative. Health campaigns and access to more information regarding the negative effects of smoking have heightened this movement. Many ex-smokers are switching to e-cigarettes as a way to decrease their exposure to smoking-related ailments. Also, growing awareness of the impact of secondhand smoke is prompting non-smokers to think about switching to e-cigarettes as a healthier alternative. As health-conscious behavior gains importance in Saudi society, e-cigarettes are becoming a working alternative to traditional smoking, thus fueling demand in the market. This emphasis on health and wellness will continue to drive consumer habits, cementing the role of e-cigarettes in the market for years to come.

To get more information on this market, Request Sample

Government Regulations and Harm Reduction Support

The government of Saudi Arabia has implemented a regulatory system that supports harm reduction while also providing assurance for the safe consumption of e-cigarettes, which is having a major impact on the market. In 2025, The sale of tobacco products in kiosks and grocery stores throughout the Kingdom has been prohibited by the Saudi Ministry of Municipalities and Housing. This forms a section of an update to the criteria for grocery stores, supermarkets, and hypermarkets, established by the ministry to enhance the business climate and elevate food safety standards for consumer protection. Saudi authorities have recognized the significance of harm reduction strategies in public health, and thus they have implemented a controlled sale and use of e-cigarettes. By permitting e-cigarettes to be sold with certain regulations in place like age controls and product safety standards, the government is allowing the expansion of the market while providing for consumer safety. Furthermore, the government is interested in decreasing the incidence of smoking-related illnesses, which have been a major public health issue in the nation for quite a while. By providing e-cigarettes as a less dangerous substitute, the government is producing a platform for transition from conventional smoking. This regulatory environment is making smokers shift to e-cigarettes as a safer alternative, which is driving the growth of the market.

Growing Vaping Culture

The growing popularity of vaping culture in Saudi Arabia is a critical driver of the growth of the e-cigarette market. Vaping has soon turned out to be a lifestyle and social option, particularly among the new generation. This transformation is propelled by a change in attitude towards smoking and a growing urge to embrace trendy and contemporary habits. Social media, influencers, and online forums are also helping shape the culture of vaping. With influencers presenting their vaping experiences and endorsing products of e-cigarettes, the habit has picked up pace, especially among the youth. The popularity of vaping as a fashionable, socially palatable trend has caused an upsurge in its uptake. In city towns, where young people and youth are more inclined to embrace new fads, e-cigarettes are becoming a popular option to conventional cigarettes. Vaping is also seen to be less invasive than smoking, with more stigmas being removed from it. Since more individuals are being exposed to vaping culture online and from social networks, the need for e-cigarettes is increasing. Waker had its pre-launch in Dubai in January 2025 and will progressively become accessible in the other emirates too. The official launch of the revolutionary system occurred in Germany in April 2025, with intentions to eventually broaden its reach to additional EU markets. A launch in the UK occurred soon after the Germany release, and around June, Waker is anticipated to make its debut in Saudi Arabia. The Waker system includes a USB-C quick-rechargeable base device (30 min.) featuring a durable 4,800mAh battery and prefilled pods available in various flavors that easily fit into the device's slot.

Saudi Arabia E-Cigarette Market Growth Drivers:

Product Innovation and Variety

E-cigarette makers are constantly updating their products to meet consumers' differing tastes in Saudi Arabia, which is strongly propelling the market forward. The rich variety and customization of present-day e-cigarette products are drawing many different categories of consumers. Technology upgrades in e-cigarettes, including more effective vaporization systems, longer battery life, and better flavors, are inducing new consumers and former smokers alike to use the products. Manufacturers are releasing a range of flavors—like fruit, mint, and dessert tastes—to attract a wider consumer market. And as the option of varying nicotine strengths enables users to customize their vaping experience, e-cigarettes become more attractive to consumers who wish to taper down nicotine use. The innovation of disposable e-cigarettes, and even more streamlined and smaller forms, is also appealing to users who want convenience and mobility. With advancements in technology, e-cigarettes are becoming increasingly user-friendly, with improvements like leak-proof technology and refillable designs.

Growing Disposable Income and Altered Lifestyles

The increased disposable income in Saudi Arabia is pushing more individuals to seek out premium lifestyle goods, such as e-cigarettes. With increased incomes, consumers are prepared to spend money on goods that complement their changing health-oriented lifestyles. As disposable incomes rise, many consumers are changing their consumption patterns and opting for e-cigarettes as a substitute for conventional tobacco products. E-cigarettes are viewed as a newer, more sophisticated, and socially acceptable alternative, especially by the younger, more affluent group. This group is more apt to spend money on goods that correlate with their changing lifestyle, with e-cigarettes being perceived as a desirable and trendy alternative. Also, with changing societal values, there is an increasing shift towards healthier and more responsible lifestyles, which has helped fuel the growth of the market.

Presence of International Brands

The entry of foreign e-cigarette brands into the Saudi Arabian market is one of the major drivers of its growth. Due to the growth of globalization, international businesses are seeing the potential of the Saudi market and bringing their e-cigarette products to fulfill the local demand. These international brands introduce with them vast experience, new product designs, and proven marketing strategies that expose e-cigarettes to a wider audience in Saudi Arabia. Foreign brands are also capable of producing a variety of products with varying tastes and flavors, ranging from simple e-cigarettes to sophisticated vaping machines. Their availability in the Saudi market enhances competition, which is advantageous to consumers as it leads to improved prices, diversity, and product quality. In addition, these brands tend to have a certain credibility that benefits consumers who may be e-cigarette novices. The presence of international brands, along with local adaptation and promotion, is driving growth in the e-cigarette market. With Saudi consumers becoming more familiar with international trends and products, they are increasingly turning towards the use of e-cigarettes, further driving the market.

Saudi Arabia E-Cigarette Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product, flavor, mode of operation, and distribution channel.

Product Insights:

- Modular E-Cigarette

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the product. This includes modular e-cigarette, rechargeable e-cigarette, next-generation e-cigarette, and disposable e-cigarette.

Flavor Insights:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes tobacco, botanical, fruit, sweet, beverage, and others.

Mode of Operation Insights:

- Automatic E-Cigarette

- Manual E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes automatic e-cigarette and manual e-cigarette.

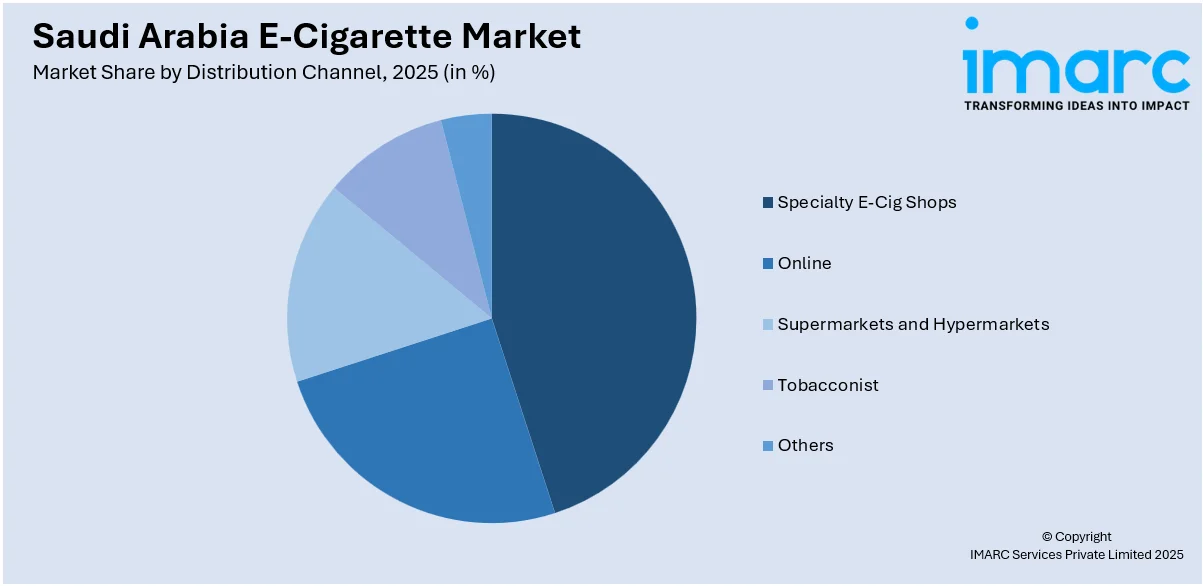

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Slow Charging

- Specialty E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty e-cig shops, online, supermarkets and hypermarkets, tobacconist, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia E-Cigarette Market News:

- In November 2023, ELFBAR introduced its BC10000 disposable vape in Saudi Arabia, delivering as many as 10,000 puffs with improved flavor and superior features. The product utilized QUAQ MESH technology to ensure uniform vaping satisfaction and a Bionic Honeycomb Structure for enhanced flavor transmission. Offered in two versions with multiple flavors, it merged elegant design with intelligent features, such as real-time displays for power and e-liquid levels.

Saudi Arabia E-Cigarette Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette |

| Flavors Covered | Tobacco, Botanical, Fruit, Sweet, Beverage, Others |

| Mode of Operations Covered | Automatic E-Cigarette, Manual E-Cigarette |

| Distribution Channels Covered | Specialty E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia e-cigarette market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia e-cigarette market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia e-cigarette industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-cigarette market in Saudi Arabia was valued at USD 240.7 Million in 2025.

The Saudi Arabia e-cigarette market is projected to exhibit a CAGR of 5.16% during 2026-2034, reaching a value of USD 378.5 Million by 2034.

Key factors driving the Saudi Arabia e-cigarette market include increasing health consciousness, government support for harm reduction, the rising popularity of vaping culture, product innovation and variety, higher disposable income, and the influence of international e-cigarette brands. These elements are contributing to growing demand and adoption of e-cigarettes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)