Saudi Arabia E-Commerce Logistics Market Size, Share, Trends and Forecast by Service, Business, Destination, Product, and Region, 2026-2034

Saudi Arabia E-Commerce Logistics Market Overview:

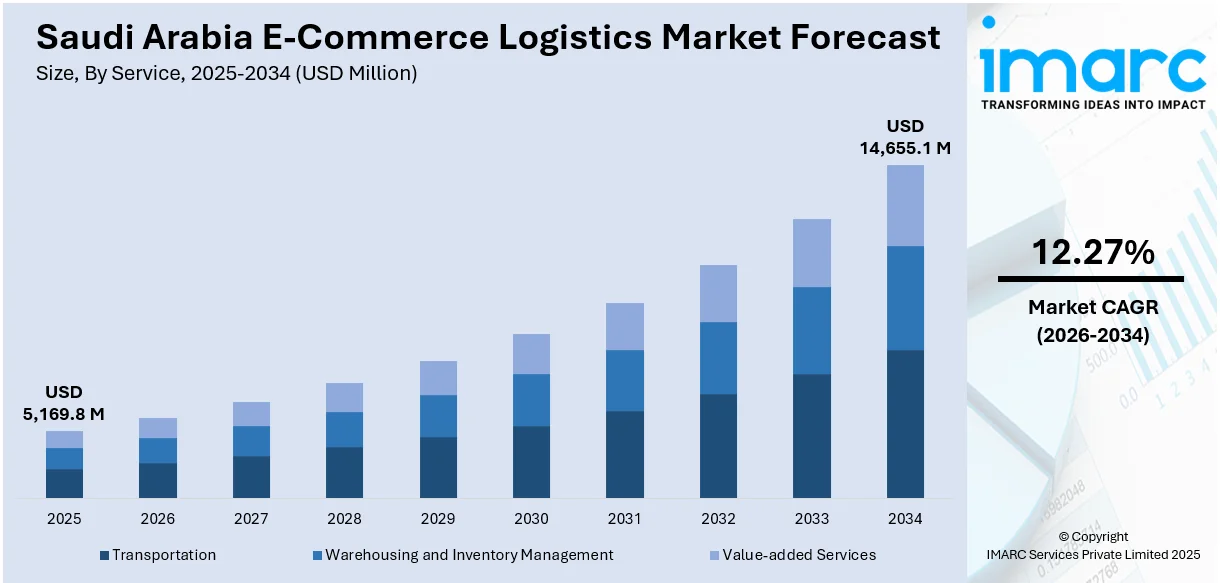

The Saudi Arabia e-commerce logistics market size reached USD 5,169.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,655.1 Million by 2034, exhibiting a growth rate (CAGR) of 12.27% during 2026-2034. The market is expanding rapidly, driven by regional fulfillment hubs, strategic global partnerships, and rising demand for faster deliveries. These developments are helping logistics providers capture a larger Saudi Arabia e-commerce logistics market share by improving service reach and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,169.8 Million |

| Market Forecast in 2034 | USD 14,655.1 Million |

| Market Growth Rate 2026-2034 | 12.27% |

Saudi Arabia E-Commerce Logistics Market Trends:

Growth of Integrated Logistics Partnerships

Saudi Arabia’s e-commerce logistics sector is increasingly shaped by large-scale strategic partnerships that blend local knowledge with international logistics capabilities. These partnerships are addressing the rising complexity of supply chains driven by the country’s booming online retail sector. As e-commerce players seek to provide faster, more reliable deliveries, integrated logistics providers are becoming essential. These alliances are helping overcome operational bottlenecks, enabling access to scalable infrastructure, streamlined warehousing, real-time tracking, and efficient last-mile execution all under a single ecosystem. For instance, in July 2024, CEVA Logistics formed a joint venture with Almajdouie Logistics, one of the leading Saudi providers, to expand its footprint in the Kingdom. The joint venture brought together CEVA’s global expertise and Almajdouie’s regional strength, creating a workforce of 2,000 and a local fleet of over 2,000 assets. The initiative was designed to serve multiple sectors, including e-commerce, while directly supporting the Kingdom’s Vision 2030 logistics goals. This model of integrated partnerships allows for deeper service penetration, improved delivery reliability, and enhanced responsiveness to customer needs. As more global logistics firms seek entry into Saudi Arabia, such joint ventures are likely to multiply, reinforcing a market landscape built on synergy, efficiency, and strategic geographic coverage.

To get more information on this market Request Sample

Expansion of Regional Fulfillment Hubs

The Saudi e-commerce logistics landscape is evolving with a strong focus on regional infrastructure, particularly fulfillment hubs and gateway facilities. As customer expectations around delivery timelines tighten, logistics providers are expanding their footprint across key geographies to support faster, more reliable service. This trend is being driven by the need to shorten delivery cycles, reduce congestion in central hubs, and meet the logistical demands of both domestic consumers and international merchants entering the Saudi market. For instance, in October 2024, Shipa Delivery launched a new e-commerce gateway in Jeddah to complement its existing hubs in Riyadh and Dammam. This western hub reduced delivery times by up to 24 hours and expanded capacity by 15%, particularly benefiting shipments to the Red Sea region. The development helped decentralize operations, allowing faster movement of goods across regions and greater route flexibility. This shift toward region-specific fulfillment solutions is optimizing delivery logistics during peak periods and improving end-user satisfaction. Companies with multiple gateways and localized hubs are now better positioned to absorb volume spikes and provide consistent service levels across the Kingdom. As online retail continues its rapid growth, regional distribution models are expected to play a defining role in Saudi Arabia’s future e-commerce logistics infrastructure.

Saudi Arabia E-Commerce Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on service, business, destination, and product.

Service Insights:

- Transportation

- Warehousing and Inventory Management

- Value-added Services

- Labeling

- Packaging

The report has provided a detailed breakup and analysis of the market based on the service. This includes transportation, warehousing and inventory management, and value-added services (labeling and packaging).

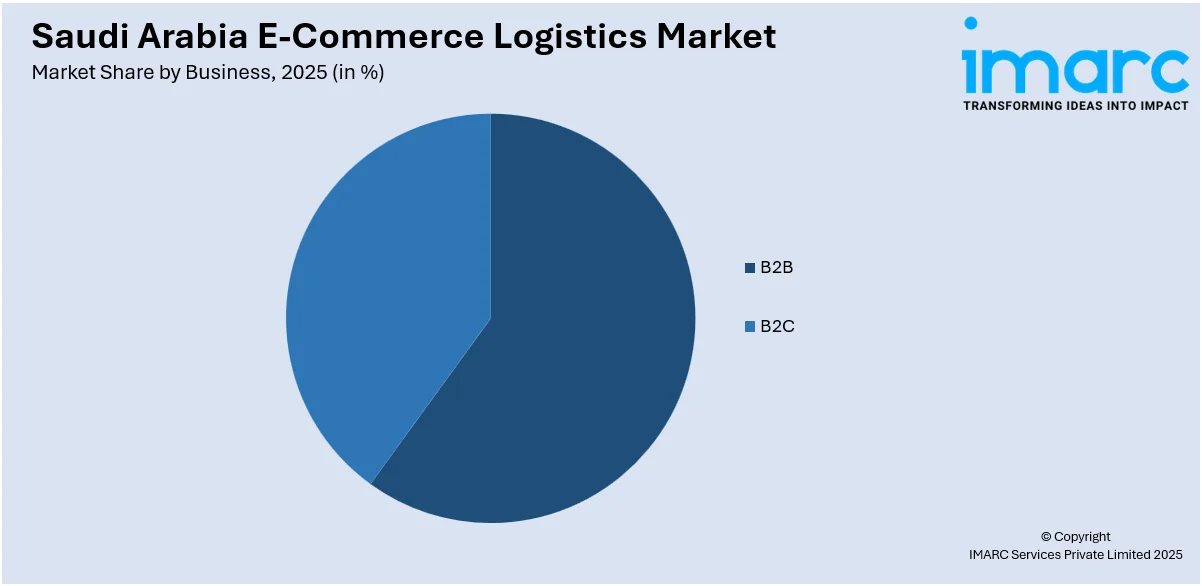

Business Insights:

Access the comprehensive market breakdown Request Sample

- B2B

- B2C

The report has provided a detailed breakup and analysis of the market based on the business. This includes B2B and B2C.

Destination Insights:

- Domestic

- International/Cross Border

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international/cross border.

Product Insights:

- Fashion and Apparel

- Consumer Electronics

- Home Appliances

- Furniture

- Beauty and Personal Care Products

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes fashion and apparel, consumer electronics, home appliances, furniture, beauty and personal care products, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia E-Commerce Logistics Market News:

- April 2025: Quiqup expanded its core e-commerce logistics operations to Saudi Arabia with support from the Mohammed bin Rashid Innovation Fund. The launch enhanced cross-border fulfillment capabilities, improved service access for SMEs, and strengthened the Kingdom’s last-mile logistics infrastructure across the growing e-commerce ecosystem.

- February 2025: DHL eCommerce acquired a minority stake in Saudi logistics firm AJEX, backed by Ajlan & Bros Holding. This entry expanded DHL’s reach into the Kingdom’s fast-growing e-commerce logistics sector, enhancing last-mile delivery capabilities and integrating global expertise into Saudi Arabia.

Saudi Arabia E-Commerce Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Businesses Covered | B2B, B2C |

| Destinations Covered | Domestic, International/Cross Border |

| Product Covered | Fashion and Apparel, Consumer Electronics, Home Appliances, Furniture, Beauty and Personal Care Products, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia e-commerce logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia e-commerce logistics market on the basis of service?

- What is the breakup of the Saudi Arabia e-commerce logistics market on the basis of business?

- What is the breakup of the Saudi Arabia e-commerce logistics market on the basis of destination?

- What is the breakup of the Saudi Arabia e-commerce logistics market on the basis of product?

- What is the breakup of the Saudi Arabia e-commerce logistics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia e-commerce logistics market?

- What are the key driving factors and challenges in the Saudi Arabia e-commerce logistics market?

- What is the structure of the Saudi Arabia e-commerce logistics market and who are the key players?

- What is the degree of competition in the Saudi Arabia e-commerce logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia e-commerce logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia e-commerce logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia e-commerce logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)