Saudi Arabia E-Mobility Market Size, Share, Trends and Forecast by Product, Voltage, Battery, and Region, 2026-2034

Saudi Arabia E-Mobility Market Overview:

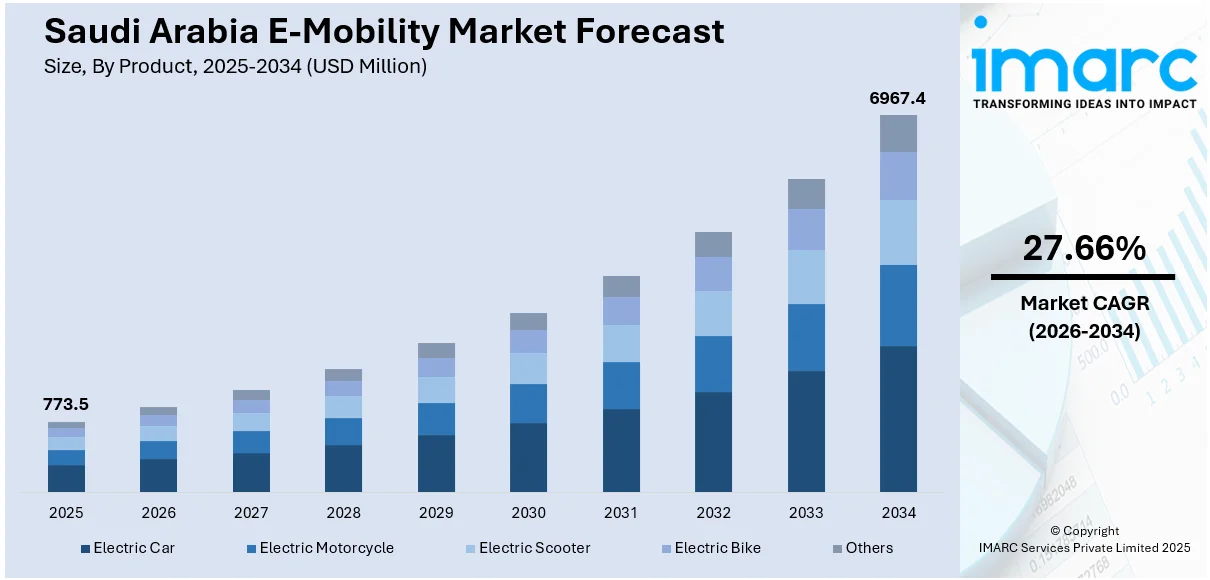

The Saudi Arabia e-mobility market size reached USD 773.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,967.4 Million by 2034, exhibiting a growth rate (CAGR) of 27.66% during 2026-2034. At present, with the growing awareness about climate change, air pollution, and carbon emissions, individuals and policymakers are seeking cleaner and more sustainable transportation options, driving the demand for e-mobility solutions. Besides this, the rising integration of digital technologies in traffic management and public transport is contributing to the expansion of the Saudi Arabia e-mobility market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 773.5 Million |

| Market Forecast in 2034 | USD 6,967.4 Million |

| Market Growth Rate 2026-2034 | 27.66% |

Saudi Arabia E-Mobility Market Trends:

Growing environmental concerns

Rising environmental concerns are positively influencing the market in Saudi Arabia. As awareness about climate change, air pollution, and carbon emissions is increasing, both people and policymakers are actively seeking cleaner and more sustainable transportation alternatives. Electric vehicles (EVs), including electric cars and electric bikes, which produce zero tailpipe emissions, are emerging as a preferred solution to reduce the environmental impact caused by traditional gasoline and diesel-powered vehicles. According to the IMARC Group, the Saudi Arabia electric car market size reached USD 500 Million in 2024. The country is witnessing a growing public interest in protecting natural resources and improving air quality, especially in urban centers where traffic-related pollution is a major issue. This concern is leading to a stronger encouragement for adopting e-mobility solutions. The government is also promoting e-mobility as part of its broader sustainability and diversification goals under Vision 2030. Citizens are seeing EVs not only as modern innovations but also as responsible choices that align with a greener lifestyle. Energy companies and automakers are responding by investing in EV technology and charging infrastructure. Educational campaigns and corporate initiatives are further strengthening public commitment to environmental protection. The rising demand for eco-friendly mobility is encouraging the development of related industries in Saudi Arabia, such as battery production and recycling.

To get more information on this market Request Sample

Increasing expenditure on smart city projects

Rising expenditure on smart city projects are impelling the Saudi Arabia e-mobility market growth. In November 2024, Tilal Real Estates initiated a new endeavor to develop a smart city on the eastern side of the Gulf Kingdom, with an estimated worth of approximately 6 Billion Saudi riyals (USD 1.6 Billion). It covered approximately 268,000 square meters and included residences, workplaces, hotels, parks, streets, shopping centers, cinemas, and various entertainment venues. As the country is focusing on developing technologically advanced and sustainable urban centers like NEOM, there is a growing emphasis on integrating e-mobility solutions. Smart city plans incorporate infrastructure that supports EVs, smart charging stations, dedicated EV lanes, and connected transportation systems. These developments make it easier and more convenient for people to adopt EVs in their daily lives. The integration of digital technologies in traffic management and public transport is also promoting the utilization of e-mobility. These projects aim to reduce carbon emissions and improve air quality, aligning with the broader goals of Vision 2030. As smart cities are expanding, the demand for clean and efficient transportation options is rising. This shift is encouraging automobile manufacturers, technology providers, and energy companies to invest in EV development.

Saudi Arabia E-Mobility Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, voltage, and battery.

Product Insights:

- Electric Car

- Electric Motorcycle

- Electric Scooter

- Electric Bike

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes electric car, electric motorcycle, electric scooter, electric bike, and others.

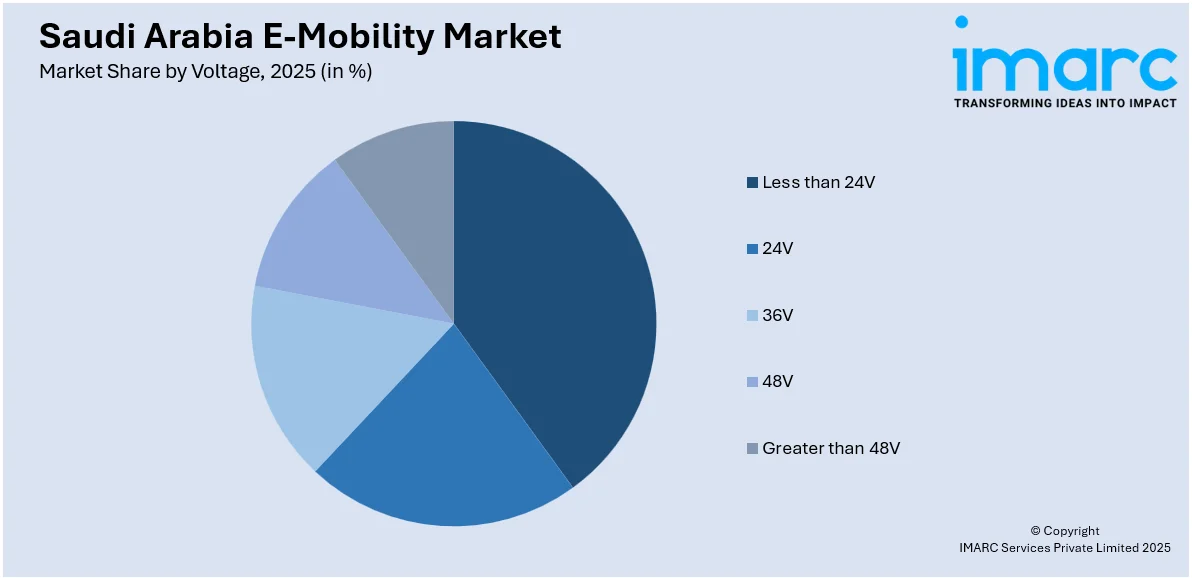

Voltage Insights:

Access the comprehensive market breakdown Request Sample

- Less than 24V

- 24V

- 36V

- 48V

- Greater than 48V

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes less than 24V, 24V, 36V, 48V, and greater than 48V.

Battery Insights:

- Sealed Lead Acid

- Li-ion

- NiMH

The report has provided a detailed breakup and analysis of the market based on the battery. This includes sealed lead acid, Li-ion, and NiMH.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia E-Mobility Market News:

- In December 2024, Al-Futtaim Electric Mobility Company introduced BYD, the prominent energy vehicle (NEV) firm, in Saudi Arabia. The company was set to introduce a comprehensive range of vehicles designed to transform the driving experience in the country, featuring three all-electric models (BYD HAN, BYD ATTO 3, and BYD SEAL) along with two long-range PHEVs (BYD SONG PLUS and BYD QIN PLUS). It guaranteed that car owners would enjoy a smooth and easy switch to e-mobility.

- In May 2024, Saudi Arabia's Aramco teamed up with China's BYD, a prominent player, to develop innovative low-emission vehicles. It aimed to lessen oil reliance, adopt sustainability, and create a cleaner transportation system. Declared amid a pivotal transformation phase for the Kingdom’s automotive industry, the collaboration signified Saudi Arabia’s goal to establish itself as a major center for green mobility within the GCC.

Saudi Arabia E-Mobility Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electric Car, Electric Motorcycle, Electric Scooter, Electric Bike, Others |

| Voltages Covered | Less than 24V, 24V, 36V, 48V, Greater than 48V |

| Batteries Covered | Sealed Lead Acid, Li-ion, NiMH |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia e-mobility market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia e-mobility market on the basis of product?

- What is the breakup of the Saudi Arabia e-mobility market on the basis of voltage?

- What is the breakup of the Saudi Arabia e-mobility market on the basis of battery?

- What is the breakup of the Saudi Arabia e-mobility market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia e-mobility market?

- What are the key driving factors and challenges in the Saudi Arabia e-mobility market?

- What is the structure of the Saudi Arabia e-mobility market and who are the key players?

- What is the degree of competition in the Saudi Arabia e-mobility market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia e-mobility market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia e-mobility market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia e-mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)