Saudi Arabia Electric Vehicle Aftermarket Size, Share, Trends and Forecast by Replacement Part, Propulsion Type, Vehicle Type, Certification, Distribution Channel, and Region, 2026-2034

Saudi Arabia Electric Vehicle Aftermarket Overview:

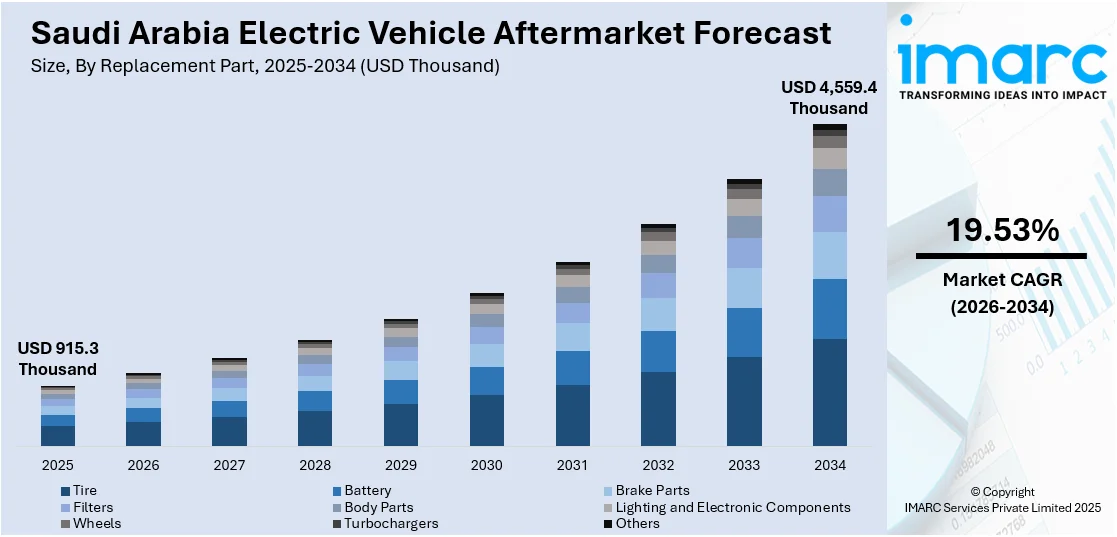

The Saudi Arabia electric vehicle aftermarket size reached USD 915.3 Thousand in 2025. Looking forward, IMARC Group expects the market to reach USD 4,559.4 Thousand by 2034, exhibiting a growth rate (CAGR) of 19.53% during 2026-2034. The rising EV adoption due to government incentives, expanding charging infrastructure, increasing consumer awareness of sustainable mobility, supportive regulatory policies are some of the factors augmenting the Saudi Arabia electric vehicle aftermarket share. Also, growing investments in EV maintenance and battery replacement services are increasing the demand for specialized parts, diagnostics, and skilled technicians across the Kingdom.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 915.3 Thousand |

| Market Forecast in 2034 | USD 4,559.4 Thousand |

| Market Growth Rate 2026-2034 | 19.53% |

Saudi Arabia Electric Vehicle Aftermarket Trends:

Rising Adoption of Electric Vehicles Driving Aftermarket Diversification

The steady increase in electric vehicle (EV) adoption across Saudi Arabia is playing a significant role in reshaping the automotive aftermarket. As per industry reports, as part of its Vision 2030 framework, the Kingdom has set an ambitious target for 30% of all vehicles in Riyadh to be electric, signaling a firm national commitment to sustainable mobility. This policy direction is not only accelerating EV sales but is also prompting a fundamental shift in aftermarket requirements and service delivery models. This rising penetration of EVs results in a fundamental transformation in aftermarket demand, which is positively impacting the Saudi Arabia electric vehicle aftermarket outlook. Additionally, the introduction of financial incentives reduced import duties, and growing awareness surrounding environmental concerns are accelerating EV sales in both the private and commercial sectors. Moreover, conventional services associated with internal combustion engine (ICE) vehicles, such as engine oil replacement, exhaust system repairs, and fuel injector maintenance, are gradually replaced by services tailored to the unique requirements of EVs. This evolving vehicle parc is compelling traditional service centers to upgrade infrastructure, while also encouraging the emergence of specialized workshops and mobile servicing units focused exclusively on electric mobility.

To get more information on this market Request Sample

Expanding Spare Parts Distribution and EV-Centric Supply Networks

The continued growth of electric vehicle usage in Saudi Arabia is necessitating the expansion and refinement of spare parts distribution networks tailored to the specific requirements of EV platforms. Unlike traditional ICE vehicles, EVs incorporate a distinct array of components, including electric drive units, battery management systems, high-efficiency cooling mechanisms, inverters, and onboard charging equipment. This shift in component demand is prompting aftermarket suppliers to recalibrate their inventory strategies and sourcing models. The major distributors across the Kingdom are launching dedicated EV parts portfolios, enhancing warehousing capabilities, and entering into supply agreements with global and regional component manufacturers. Moreover, digital transformation is playing a pivotal role in optimizing supply chain efficiency, which is supporting Saudi Arabia electric vehicle market growth. Integrated platforms now enable real-time tracking of inventory, demand forecasting, and order fulfillment directly to service centers and fleet operators, which is strengthening the market.

Growth in Specialized EV Service Centers and Technician Training

The shift toward the development of specialized EV service centers is acting as a major market driver. Traditional automotive service providers are reconfiguring their facilities to accommodate the unique requirements of electric powertrains, battery systems, and software-based vehicle diagnostics. This transition is largely influenced by the increasing penetration of EVs in the Kingdom, supported by Vision 2030 goals and favorable government incentives promoting green mobility. Automotive aftermarket players are collaborating with international training institutes and OEMs to upskill the workforce in areas such as high-voltage system safety, battery diagnostics, and software calibration. These developments are creating a parallel service ecosystem, distinct from conventional car maintenance. As EVs come with fewer mechanical parts but more electronic and battery components, aftermarket businesses are also adjusting their inventory management strategies to prioritize EV-specific parts like battery modules, thermal management components, and advanced sensor systems. This trend is redefining service models and encouraging the emergence of dedicated EV maintenance brands across Saudi Arabia.

Saudi Arabia Electric Vehicle Aftermarket Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on replacement part, propulsion type, vehicle type, certification, and distribution channel.

Replacement Part Insights:

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Turbochargers

- Others

The report has provided a detailed breakup and analysis of the market based on the replacement part. This includes tire, battery, brake parts, filters, body parts, lighting and electric components, wheels, turbochargers, and others.

Propulsion Type Insights:

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

- Plug-in Hybrid Electric Vehicles

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicles, hybrid electric vehicles, fuel cell electric vehicles, and plug-in hybrid electric vehicles.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Certification Insights:

- Genuine Parts

- Certified Parts

- Uncertified Parts

A detailed breakup and analysis of the market based on the certification have also been provided in the report. This includes genuine parts, certified parts, and uncertified parts.

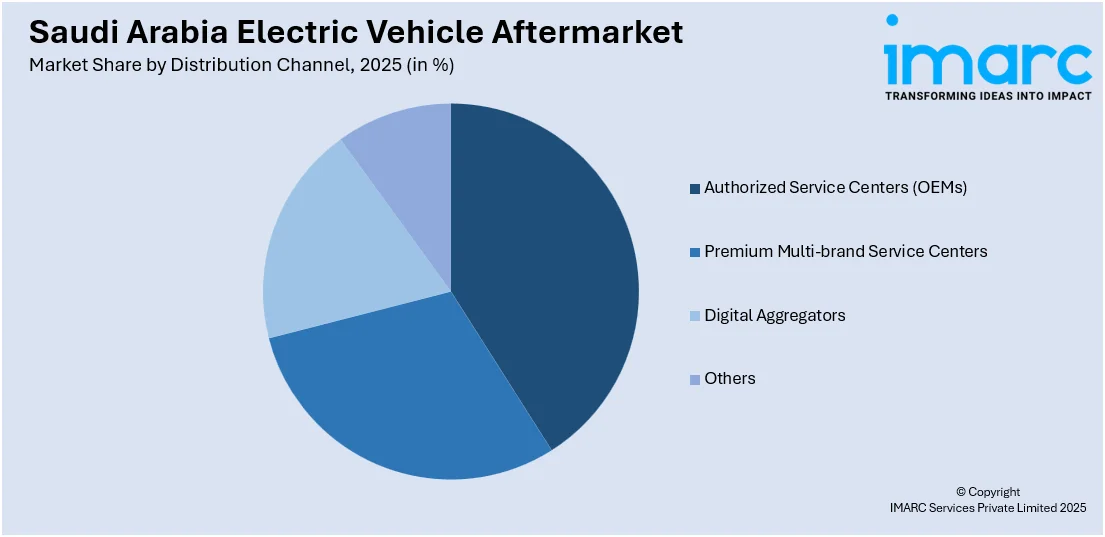

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Authorized Service Centers (OEMs)

- Premium Multi-brand Service Centers

- Digital Aggregators

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes authorized service centers (OEMs), premium multi-brand service center, digital aggregators, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electric Vehicle Aftermarket News:

- On September 2024, Petromin Corporation announced the launch of Saudi Arabia’s first dedicated hybrid and electric vehicle (EV) maintenance center through its National Tire Service Company (NTSC) in Riyadh. This strategic initiative aligns with the Kingdom's Vision 2030 goals to promote sustainable transportation and localize advanced automotive services. The facility is equipped with state-of-the-art diagnostic and repair technologies, offering specialized services for hybrid and EV vehicles.

Saudi Arabia Electric Vehicle Aftermarket Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacement Parts Covered | Tire, Battery, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Turbochargers, Others |

| Propulsion Types Covered | Battery Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, Plug-in Hybrid Electric Vehicles |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Certifications Covered | Genuine Parts, Certified Parts, Uncertified Parts |

| Distribution Channels Covered | Authorized Service Centers (OEMs), Premium Multi-brand Service Centers, Digital Aggregators, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric vehicle aftermarket performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electric vehicle aftermarket on the basis of replacement part?

- What is the breakup of the Saudi Arabia electric vehicle aftermarket on the basis of propulsion type?

- What is the breakup of the Saudi Arabia electric vehicle aftermarket on the basis of vehicle type?

- What is the breakup of the Saudi Arabia electric vehicle aftermarket on the basis of certification?

- What is the breakup of the Saudi Arabia electric vehicle aftermarket on the basis of distribution channel?

- What is the breakup of the Saudi Arabia electric vehicle aftermarket on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electric vehicle aftermarket?

- What are the key driving factors and challenges in the Saudi Arabia electric vehicle aftermarket?

- What is the structure of the Saudi Arabia electric vehicle aftermarket and who are the key players?

- What is the degree of competition in the Saudi Arabia electric vehicle aftermarket?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric vehicle aftermarket from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric vehicle aftermarket.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric vehicle aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)