Saudi Arabia Energy Management Software Market Size, Share, Trends and Forecast by Software, Solution, End Use Industry, and Region, 2026-2034

Saudi Arabia Energy Management Software Market Overview:

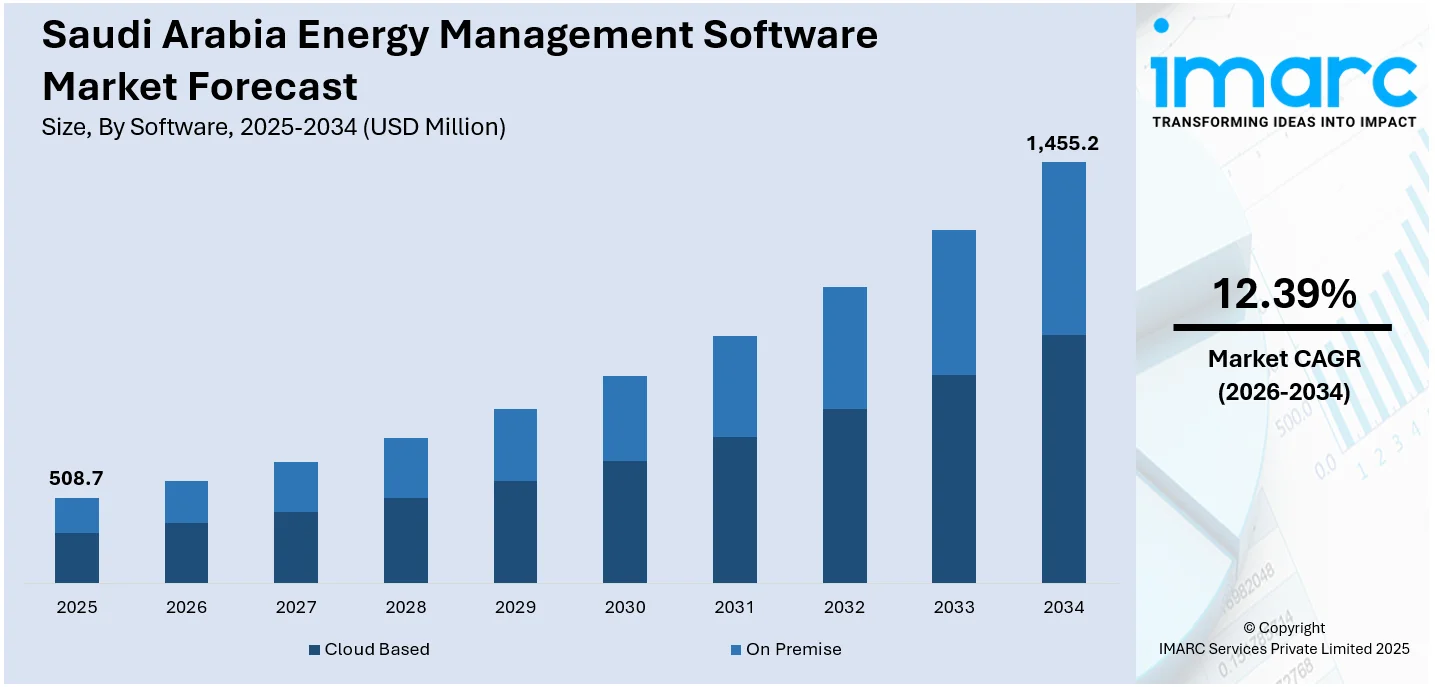

The Saudi Arabia energy management software market size reached USD 508.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,455.2 Million by 2034, exhibiting a growth rate (CAGR) of 12.39% during 2026-2034. The government of Saudi Arabia is promoting energy sustainability and efficiency through various programs, which are increasing the adoption of energy management tools. This, along with the increase in the need for energy efficiency across industries, is impelling the market growth. Moreover, technological innovation in energy management tools is expanding the Saudi Arabia energy management software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 508.7 Million |

| Market Forecast in 2034 | USD 1,455.2 Million |

| Market Growth Rate 2026-2034 | 12.39% |

Saudi Arabia Energy Management Software Market Trends:

Government Initiatives and Regulatory Support

The government of Saudi Arabia is promoting energy sustainability and efficiency through various programs, which are increasing the adoption of energy management software. In 2024, the kingdom focused on automating 40% of its electricity distribution network and planned to complete it by the end of 2025. The Vision 2030 program, which is aimed at diversifying the economy and not being dependent on oil, is also promoting energy efficiency in public and private sectors. These programs are creating strict energy standards and motivating organizations to track and optimize their energy use. Government agencies are offering financial incentives and assistance to companies that adopt energy-saving technologies. Consequently, business organizations are adopting energy management solutions to meet regulatory requirements and adhere to national sustainable development targets. The increasing focus on environmental protection and carbon footprint minimization is creating a favorable climate for the market. Through real-time energy monitoring and management, energy management solutions are finding themselves indispensable for companies working towards these regulatory mandates while saving on operation expenses.

To get more information on this market Request Sample

Growing Interest in Energy Efficiency Across Industries

There is an increase in the need for energy efficiency across industries in Saudi Arabia, which is crucially helping the energy management software market grow. Some of these industries include manufacturing, construction, oil and gas, and commercial industries, which are all putting emphasis on minimizing energy usage to reduce operating expenses and increase overall productivity. Businesses are implementing energy management software to improve visibility into their energy consumption patterns and to spot the possibilities for cost reduction through optimization. Increased emphasis on energy efficiency is largely prompted by the rising costs of energy and increased apprehension over environmental sustainability. As companies invest more in energy-saving measures, they are also adopting cutting-edge energy management systems that support predictive analytics, real-time monitoring, and automated energy system control. This is also being driven by the global movement towards green and sustainable practices.

Technological innovations in Energy Management Systems

Technological innovation in energy management tools is propelling the Saudi Arabia energy management software market growth. The creation of advanced software solutions with features such as machine learning (ML), predictive analytics, and the Internet of Things (IoT) is revolutionizing the monitoring and management of energy consumption. Energy management platforms are becoming increasingly user-friendly and accessible, allowing companies to collect extensive data and insights on their energy consumption. These technologies are giving companies actionable intelligence to maximize energy use, eliminate waste, and enhance overall system efficiency. Moreover, advances in cloud computing are allowing firms to monitor their energy data remotely, providing flexibility and scalability. With these successive developments, energy management solutions are increasingly becoming part of energy management strategies, enabling companies to automate energy savings and integrate with overall environmental sustainability goals. These advances in technology are spurring both adoption and demand for EMS solutions nationwide. In 2024, the Saudi Electricity Company introduced its latest app, "Al Kahraba," during a ceremony in Riyadh, with the goal of boosting customer experience, enhancing operational efficiency, and ensuring dependable performance. This advanced digital platform provides unified features for effortless account management, delivering users a smooth and improved digital experience.

Saudi Arabia Energy Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on software, solution, and end use industry.

Software Insights:

- Cloud Based

- On Premise

The report has provided a detailed breakup and analysis of the market based on the software. This includes cloud based and on premise.

Solution Insights:

- Carbon Management System

- Utility Billing System

- Customer Information System

- Demand Response Management

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes carbon management system, utility billing system, customer information system, demand response management, and others.

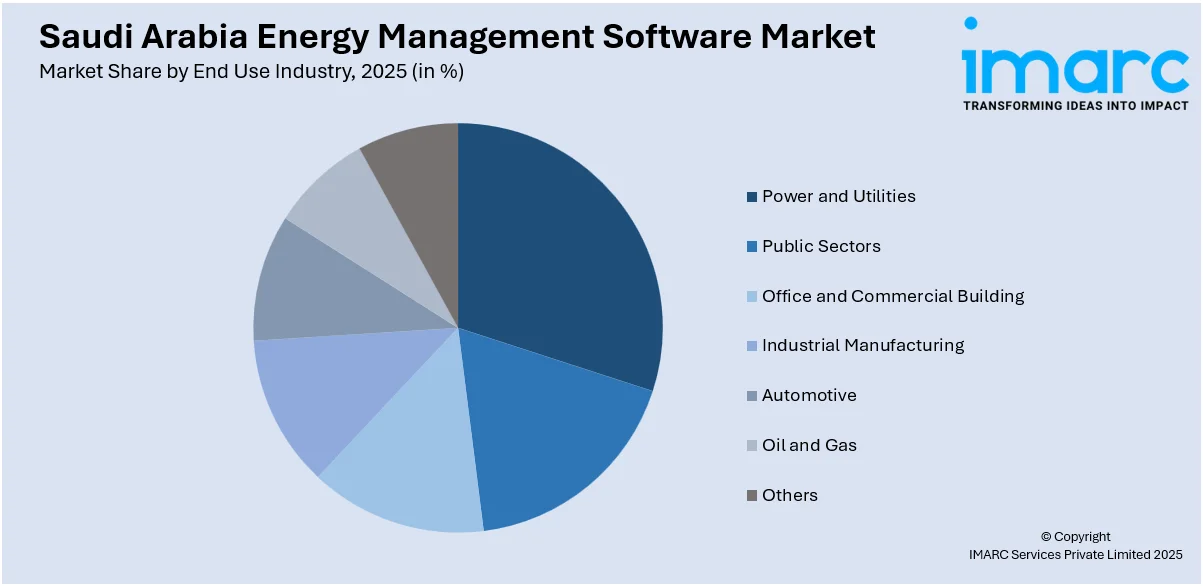

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Power and Utilities

- Public Sectors

- Office and Commercial Building

- Industrial Manufacturing

- Automotive

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes power and utilities, public sectors, office and commercial building, industrial manufacturing, automotive, oil and gas, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Energy Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Softwares Covered | Cloud Based, On Premise |

| Solutions Covered | Carbon Management System, Utility Billing System, Customer Information System, Demand Response Management, Others |

| End Use Industries Covered | Power and Utilities, Public Sectors, Office and Commercial Building, Industrial Manufacturing, Automotive, Oil and Gas, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia energy management software market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia energy management software market on the basis of software?

- What is the breakup of the Saudi Arabia energy management software market on the basis of solution?

- What is the breakup of the Saudi Arabia energy management software market on the basis of end use industry?

- What is the breakup of the Saudi Arabia energy management software market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia energy management software market?

- What are the key driving factors and challenges in the Saudi Arabia energy management software market?

- What is the structure of the Saudi Arabia energy management software market and who are the key players?

- What is the degree of competition in the Saudi Arabia energy management software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia energy management software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia energy management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia energy management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)