Saudi Arabia Enzymes Market Size, Share, Trends and Forecast by Type, Source, Reaction Type, Application, and Region, 2026-2034

Saudi Arabia Enzymes Market Overview:

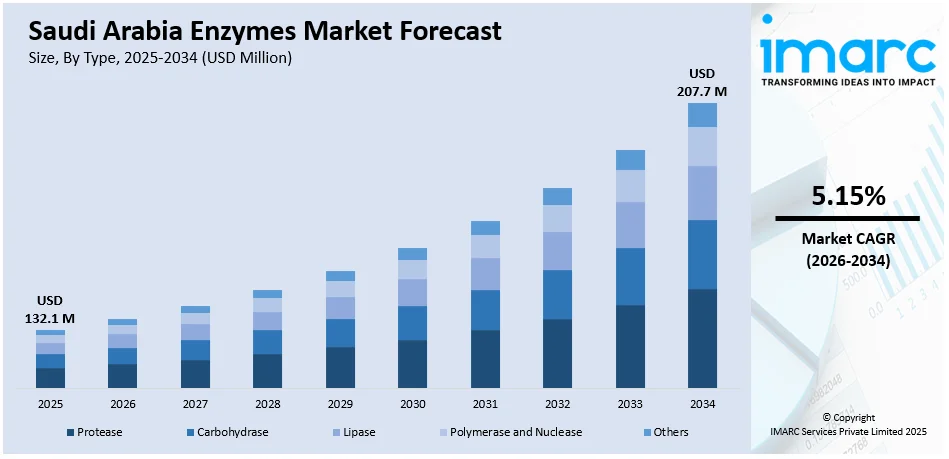

The Saudi Arabia enzymes market size reached USD 132.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 207.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.15% during 2026-2034. The growing focus on improving sustainability and reducing chemical usage is offering a favorable market outlook. This trend, along with the heightened innovations in the food and beverage (F&B) industry, is impelling the growth of the market. Apart from this, the rapid development of pharmaceutical and nutraceutical sectors is expanding the Saudi Arabia enzymes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 132.1 Million |

| Market Forecast in 2034 | USD 207.7 Million |

| Market Growth Rate 2026-2034 | 5.15% |

Saudi Arabia Enzymes Market Trends:

Expanding Food and Beverage Processing Demand

The Saudi food and beverage (F&B) industry is innovating, with companies more frequently applying enzymes to increase shelf life, texture, and production efficiency. Bakery, dairy, and juice-processing industries are using enzymes to substitute synthetic additives as consumers demand cleaner-label products. Enzymes like amylases, proteases, and lipases are increasingly contributing to ingredient modification for specific functionality, such as improved dough conditioning or flavor improvement. Domestic players are also collaborating with global enzyme manufacturers to have a consistent supply and technological support. The government's initiative for food security, according to Vision 2030, is encouraging investments in local food manufacturing plants, which, in turn, is generating a steady demand for enzyme-based processing aids. The Vision 2030 initiative seeks to provide food supply availability and price stability throughout the Kingdom, minimizing food loss and waste by approximately 50% by 2030. In 2024 food wastage in the country was estimated at over 33% of the total food, amounting to approximately SAR 40 billion per year. National initiatives planned to reduce this percentage to around 15% through awareness campaigns and supply chain optimization.

To get more information on this market Request Sample

Rapid Development of Pharmaceutical and Nutraceutical Sectors

Pharmaceutical and nutraceutical industries are adopting enzymes to formulate drugs, diagnostics, and therapeutic purposes, thereby impelling the Saudi Arabia enzymes market growth. Enzymes are facilitating streamlined manufacturing of drugs by allowing targeted chemical transformations, enhancing bioavailability, and providing increased product purity. As chronic diseases like diabetes, obesity, and cardiovascular diseases are increasing, there is a rise in the interest in enzyme-based treatments such as digestive enzymes and anti-inflammatory supplements. Government initiatives for localizing the production of pharma manufacturing, like collaborations with international pharma giants under Vision 2030, are driving the demand for enzyme technologies that help improve formulation capacities. In the nutraceuticals arena, enzymes are being incorporated into dietary supplements that are attributing benefits from gut well-being to immune system support. Individuals are becoming increasingly aware about enzyme-based products, particularly proteolytic and digestive enzymes, due to higher health education and promotion. As biologic and personalized medicine innovation grows, the need for customized enzyme solutions is increasing. The IMARC Group predicts that the Saudi Arabia pharmaceuticals market size is projected to attain USD 11.7 Billion by 2033.

Growing Focus on Sustainable Industrial Processes

Industries across Saudi Arabia are increasingly integrating enzymes into their production processes to improve sustainability and reduce chemical usage. Enzymes are being used in textile processing, leather treatment, paper bleaching, and biofuel production as eco-friendly alternatives to harsh synthetic chemicals. For instance, cellulases and laccases are enabling textile manufacturers to carry out processes like biopolishing with less water and energy. In the detergents sector, manufacturers are formulating enzyme-based cleaners that perform effectively at lower temperatures, thus conserving energy and aligning with environmental goals. The push toward circular economy principles and reduced carbon emissions under Vision 2030 is encouraging industries to adopt greener technologies, with enzymes playing a central role. International companies offering industrial enzyme solutions are entering into partnerships with local entities, ensuring knowledge transfer and technological advancement. By improving process efficiency and reducing environmental footprints, enzymes are becoming vital to Saudi Arabia’s industrial transformation agenda.

Saudi Arabia Enzymes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, source, reaction type, and application.

Type Insights:

- Protease

- Carbohydrase

- Lipase

- Polymerase and Nuclease

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes protease, carbohydrase, lipase, polymerase and nuclease, and others.

Source Insights:

- Microorganisms

- Plants

- Animals

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes microorganisms, plants, and animals.

Reaction Type Insights:

- Hydrolase

- Oxidoreductase

- Transferase

- Lyase

- Others

A detailed breakup and analysis of the market based on the reaction type have also been provided in the report. This includes hydrolase, oxidoreductase, transferase, lyase, and others.

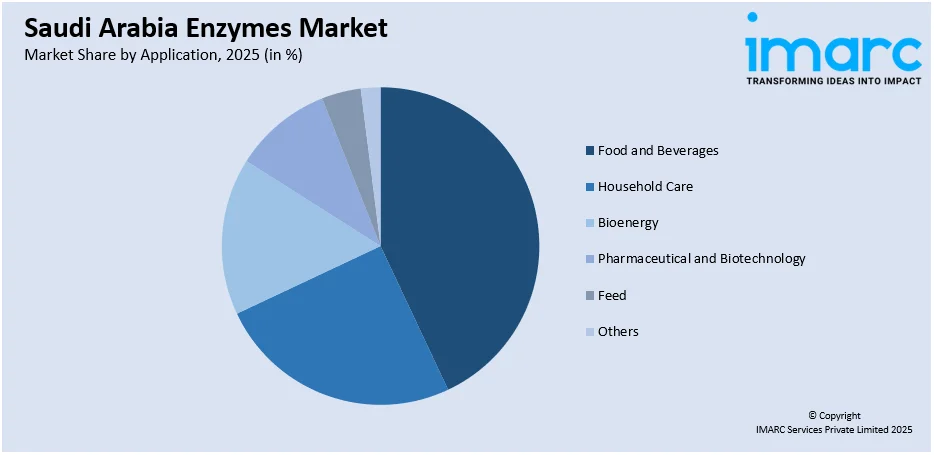

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Household Care

- Bioenergy

- Pharmaceutical and Biotechnology

- Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, household care, bioenergy, pharmaceutical and biotechnology, feed, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Enzymes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Protease, Carbohydrase, Lipase, Polymerase and Nuclease, Others |

| Sources Covered | Microorganisms, Plants, Animals |

| Reaction Types Covered | Hydrolase, Oxidoreductase, Transferase, Lyase, Others |

| Applications Covered | Food and Beverages, Household Care, Bioenergy, Pharmaceutical and Biotechnology, Feed, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia enzymes market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia enzymes market on the basis of type?

- What is the breakup of the Saudi Arabia enzymes market on the basis of source?

- What is the breakup of the Saudi Arabia enzymes market on the basis of reaction type?

- What is the breakup of the Saudi Arabia enzymes market on the basis of application?

- What is the breakup of the Saudi Arabia enzymes market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia enzymes market?

- What are the key driving factors and challenges in the Saudi Arabia enzymes?

- What is the structure of the Saudi Arabia enzymes market and who are the key players?

- What is the degree of competition in the Saudi Arabia enzymes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia enzymes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia enzymes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia enzymes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)