Saudi Arabia Excavators Market Size, Share, Trends and Forecast by Product, Mechanism Type, Power Range, Application, and Region, 2026-2034

Saudi Arabia Excavators Market Overview:

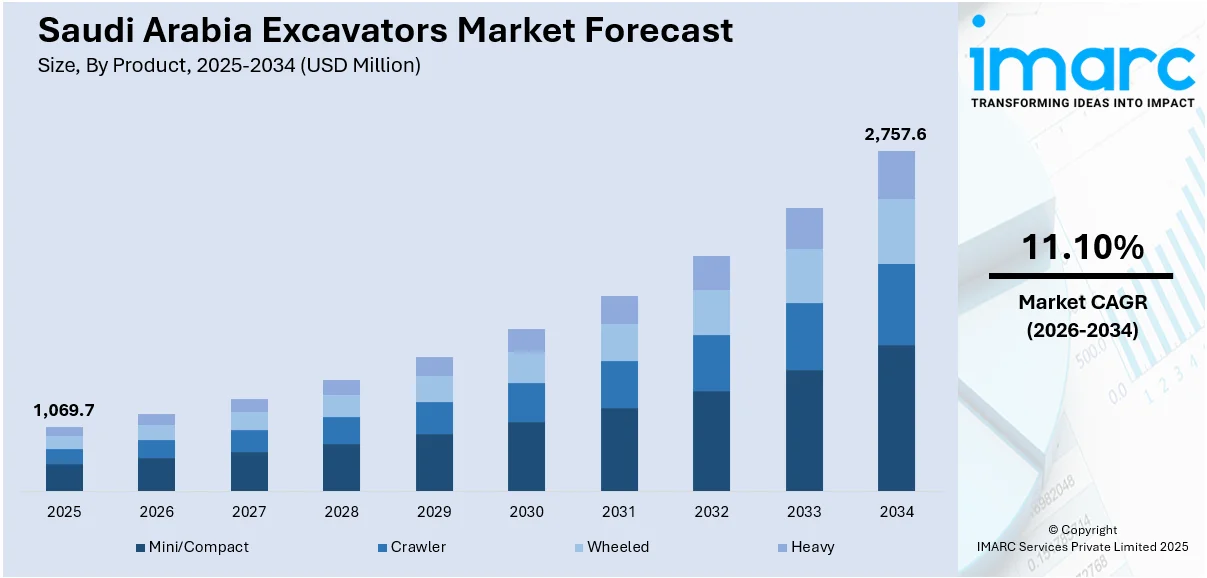

The Saudi Arabia excavators market size reached USD 1,069.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,757.6 Million by 2034, exhibiting a growth rate (CAGR) of 11.10% during 2026-2034. The market is driven by the rising execution of mega infrastructure projects under Vision 2030, necessitating durable and efficient excavation machinery across sectors. The increasing adoption of automation and telematics in construction equipment is enhancing operational control, maintenance planning, and productivity, thereby fueling the market. Meanwhile, mineral exploration supported by favorable regulatory reforms is generating continuous demand for heavy-duty excavators, further augmenting the Saudi Arabia excavators market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,069.7 Million |

| Market Forecast in 2034 | USD 2,757.6 Million |

| Market Growth Rate 2026-2034 | 11.10% |

Saudi Arabia Excavators Market Trends:

Infrastructure Investments and Mega Projects

The rapid acceleration of construction and infrastructure activities under Saudi Arabia’s Vision 2030 framework has significantly influenced the demand for advanced excavation machinery. The government’s long-term urban planning initiatives require large-scale earthmoving operations that necessitate high-performance excavators across varied terrains. This uptick in infrastructure contracts across transport, tourism, housing, and energy sectors has created a sustained need for technically advanced and durable equipment. Moreover, strategic partnerships between public agencies and international contractors have encouraged the deployment of specialized machinery to meet tight deadlines and regulatory standards. The incorporation of smart technologies into these developments, including underground utilities and geospatial mapping, also favors the use of modern excavators with digital integration capabilities. Rental companies are expanding fleets to meet temporary demand spikes driven by overlapping project timelines. Equipment suppliers and OEMs are simultaneously scaling up local support services and parts distribution to ensure machine uptime. On October 15, 2024, New Murabba announced it had excavated over 10 million cubic meters of earth, marking 86% completion of excavation at the Mukaab and podium sites in Riyadh, while logging over 3 million safe work hours. The massive effort involved around 250 excavators and 400 equipment units operating daily, supported by approximately 900 on-site workers. As capital expenditures on infrastructure remain high and execution timelines shorten, machinery that delivers performance and reliability is prioritized—thereby directly reinforcing Saudi Arabia excavators market growth.

To get more information on this market Request Sample

Mining and Natural Resource Exploration Activities

Saudi Arabia’s mining sector is undergoing significant transformation as part of its strategy to diversify the economy beyond hydrocarbons. The government has introduced investor-friendly regulations and licensing procedures aimed at unlocking vast reserves of phosphate, bauxite, gold, and rare earth elements. These initiatives require robust excavation solutions capable of operating in harsh desert environments and over extensive mine sites. Excavators are essential in clearing overburden, breaking surface rock, and loading material for transport, making them a cornerstone of upstream mineral development activities. The scale of exploration efforts has increased following the launch of the National Industrial Development and Logistics Program (NIDLP), which includes infrastructure development for mining zones. International and regional mining operators are collaborating with local equipment suppliers to deploy heavy-duty machinery tailored to geological conditions. For instance, the Volvo EC550E excavators have proven to be high-performance machines in Saudi Arabia, offering up to 35% higher productivity and 22% better fuel efficiency than their predecessors. Deployed by Ashab Alrowad International since 2022, the EC550E units have demonstrated exceptional power, operator comfort, and durability on large-scale earthmoving projects in harsh desert conditions. Additionally, the growing need for energy transition minerals aligns with global trends and intensifies domestic excavation activities. Machine versatility, hydraulic efficiency, and durability are top criteria for procurement as mining projects become more technically complex and capital intensive. This sectoral momentum continues to solidify demand for high-capacity excavation machinery in the kingdom’s mineral value chain.

Saudi Arabia Excavators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, mechanism type, power range, and application.

Product Insights:

- Mini/Compact

- Crawler

- Wheeled

- Heavy

The report has provided a detailed breakup and analysis of the market based on the product. This includes mini/compact, crawler, wheeled, and heavy.

Mechanism Type Insights:

- Electric

- Hydraulic

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the mechanism type. This includes electric, hydraulic, and hybrid.

Power Range Insights:

- Up to 300 HP

- 301-500 HP

- 501 HP and Above

The report has provided a detailed breakup and analysis of the market based on the power range. This includes up to 300 HP, 301-500 HP, and 501 HP and above.

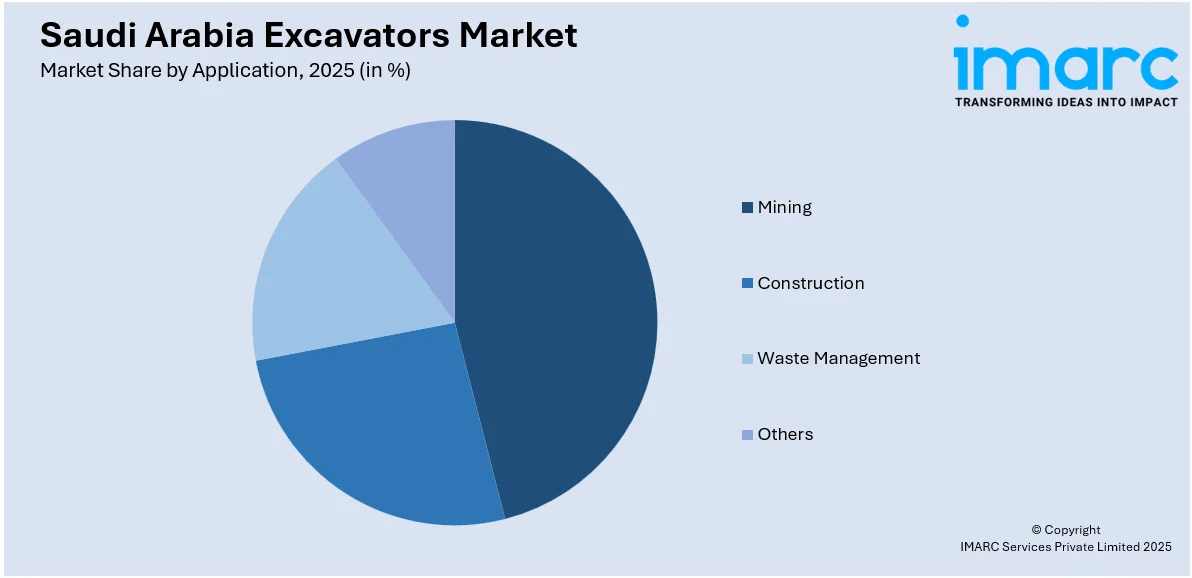

Application Insights:

Access the comprehensive market breakdown Request Sample

- Mining

- Construction

- Waste Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes mining, construction, waste management, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Excavators Market News:

- On May 24, 2025, Zoomlion delivered dozens of ZE215E excavators in Riyadh to a major local leasing company for use in a large-scale pipeline project in Kasim Province, Saudi Arabia. The ZE215E model, featuring components from globally recognized brands and customized for Saudi conditions like high temperatures and sand resistance, reflects growing customer confidence following its prior use in the King Salman Park project. Zoomlion also recently delivered over a dozen ZE370E excavators for the NEOM City project and now operates a localized network across Saudi Arabia.

Saudi Arabia Excavators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Mini/Compact, Crawler, Wheeled, Heavy |

| Mechanism Types Covered | Electric, Hydraulic, Hybrid |

| Power Ranges Covered | Up to 300 HP, 301-500 HP, 501 HP and Above |

| Applications Covered | Mining, Construction, Waste Management, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia excavators market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia excavators market on the basis of product?

- What is the breakup of the Saudi Arabia excavators market on the basis of mechanism type?

- What is the breakup of the Saudi Arabia excavators market on the basis of power range?

- What is the breakup of the Saudi Arabia excavators market on the basis of application?

- What is the breakup of the Saudi Arabia excavators market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia excavators market?

- What are the key driving factors and challenges in the Saudi Arabia excavators market?

- What is the structure of the Saudi Arabia excavators market and who are the key players?

- What is the degree of competition in the Saudi Arabia excavators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia excavators market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia excavators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia excavators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)