Saudi Arabia Facility Management Market Report by Type of Facility Management (In-house Facility Management, Outsourced Facility Management), Offering Type (Hard FM, Soft FM), End Use Industry (Commercial and Retail, Manufacturing and Industrial, Government, Infrastructure, and Public Entities, Institutional, and Others), and Region 2025-2033

Market Overview:

Saudi Arabia facility management market size reached USD 730 Million in 2024. Looking forward, the market is expected to reach USD 1,540 Million by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. The increasing preference for outsourcing facility management tasks to specialized service providers by numerous organizations, is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 730 Million |

|

Market Forecast in 2033

|

USD 1,540 Million |

| Market Growth Rate 2025-2033 | 8.60% |

Facility management (FM) is a comprehensive discipline focused on the effective and efficient management of physical spaces and assets within an organization. It encompasses a wide variety of activities aimed at ensuring that a facility operates smoothly and optimally to support the core business objectives. FM professionals are responsible for tasks such as maintenance, security, space planning, and energy management. Key aspects of FM include maintaining the safety and functionality of buildings, optimizing space utilization, reducing operational costs, and enhancing the overall user experience. This field is crucial in various industries, including commercial real estate, healthcare, education, and hospitality. FM professionals employ strategic planning, technology, and sustainability practices to maximize the value of a facility while minimizing its environmental impact. Their role has evolved in response to changing workplace dynamics, technology advancements, and a growing focus on sustainability and wellness in the built environment. Effective facility management plays a pivotal role in promoting productivity, safety, and sustainability within organizations.

Saudi Arabia Facility Management Market Trends:

Increasing Construction and Infrastructure Expansion

The Saudi Arabia facility management market is being substantially influenced by the continuous growth of the construction and infrastructure industries. Large-scale projects like residential, commercial, and industrial developments, in addition to massive-scale infrastructure projects like airports, highways, and sports facilities, are driving the demand for effective facility management services. These developments are constantly demanding special maintenance, cleaning, security, and operation services in order to keep them functional and viable. As the Vision 2030 of the Kingdom continues to prioritize urban development and modernization, the need for comprehensive facility management services is consistently rising to allow the optimum utilization of these assets. As a result, facility management firms are thus leaning towards providing innovative and sustainable solutions in order to address changing client needs for property owners, investors, and tenants. Moreover, the IMARC Group predicts that the Saudi Arabia construction market is expected to attain USD 135.6 Billion by 2033. This will further increase the need for facility management services in the region.

Technological Advancements and Smart Building Integration

Technological innovation is mainly propelling fundamental transformation within the market with its growing emphasis on smart building integration. The implementation of artificial intelligence (AI), Internet of Things (IoT), and automated systems is augmenting operational efficiencies, optimizing energy usage, and enhancing maintenance cycles. Organizations are continuously investing in smart technology solutions in order to provide real-time monitoring, predictive maintenance, and automated reporting, which enhances facility performance overall. The installation of sophisticated building management systems (BMS) is increasing the need for facility managers to embrace new tools and platforms to help building systems run smoothly. With the continuing demand for sustainability and cost-effectiveness, the government is also investing in various smart technologies, thereby driving the market. For instance, in 2024, Saudi Arabia created Alat, a high-tech company owned by the Public Investment Fund (PIF). Saudi decision-makers plan to allocate about $100 billion by 2030 towards it, concentrating on cutting-edge technologies like artificial intelligence (AI), semiconductors, reducing emissions, robotics, and intelligent urban development.

Emphasis on Sustainability and Energy Efficiency

Growing sensitivity towards environmental concerns and sustainable operations are positively influencing the market. Building owners, developers, and occupants are increasingly focusing on energy-efficient systems, waste minimization, and sustainable building operations. This need is driving facility management firms to incorporate green technologies like energy-efficient lighting and renewable energy solutions into their service portfolio. Moreover, in 2025, Saudi Arabia introduced a green financing program valued at SR1 billion (US$266.6 million), designed to boost private sector investments in eco-friendly initiatives, in line with Vision 2030. Government rules and international environmental regulations are also urging facility management firms to adopt sustainability practices. Firms are constantly refining their service portfolios by including environment friendly solutions to lower the carbon footprint and ensure sustainability. This emphasis on energy efficiency is also catalyzing the demand for facility managers with the skills to operate LEED-certified and other environmentally green buildings.

Saudi Arabia Facility Management Growth Drivers:

Government Policies and Regulatory Support

Government policies and regulatory frameworks are playing a pivotal role in contributing to the market growth. As part of its economic diversification plans under Vision 2030, the Saudi government is actively promoting the adoption of modern facility management practices. Legislation is being introduced that mandates better standards for energy efficiency, safety, and environmental sustainability in building operations. Facility management service providers are aligning their offerings with these regulatory requirements to meet the growing demands for sustainable building operations. They are consistently improving their processes to ensure compliance with energy-saving initiatives, waste management guidelines, and other green building practices, which are becoming increasingly essential for both public and private sector projects.

Outsourcing of Facility Management Services

The trend of outsourcing facility management services is shaping the market dynamics in Saudi Arabia. Many businesses, particularly those in the private sector, are choosing to outsource their facility management operations to specialized service providers rather than managing these functions in-house. This is primarily driven by the need for cost efficiency, access to expert knowledge, and the ability to focus on core business operations. Outsourcing allows companies to leverage advanced facility management practices, such as predictive maintenance and energy management, without the need for significant upfront investment in infrastructure or training. As more organizations recognize the benefits of outsourcing, there is an increasing demand for professional facility management services, which is propelling market growth and attracting more service providers to the sector.

Increased Focus on Health and Safety Standards

Health and safety concerns are continuously influencing the demand for facility management services in Saudi Arabia. Moreover, there is an intensified focus on maintaining cleanliness, hygiene, and safety standards within public and private facilities. Facility management providers are adapting by offering services that ensure proper sanitation, waste disposal, and air quality management, particularly in high-traffic areas like schools, hospitals, and commercial buildings. Additionally, there is a rise in the need for services related to building compliance with health regulations and the enforcement of safety protocols. As businesses and institutions prioritize the well-being of their employees and visitors, facility management companies are focusing on delivering enhanced services to meet these heightened expectations.

Saudi Arabia Facility Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type of facility management, offering type, and end use industry.

Type of Facility Management Insights:

- In-house Facility Management

- Outsourced Facility Management

- Single FM

- Bundled FM

- Integrated FM

A detailed breakup and analysis of the market based on the type of facility management have also been provided in the report. This includes in-house facility management, outsourced facility management (single FM, bundled FM, and integrated FM).

Offering Type Insights:

- Hard FM

- Soft FM

The report has provided a detailed breakup and analysis of the market based on the offering type. This includes hard FM and soft FM.

End Use Industry Insights:

- Commercial and Retail

- Manufacturing and Industrial

- Government, Infrastructure, and Public Entities

- Institutional

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes commercial and retail, manufacturing and industrial, government, infrastructure, and public entities, institutional, and others.

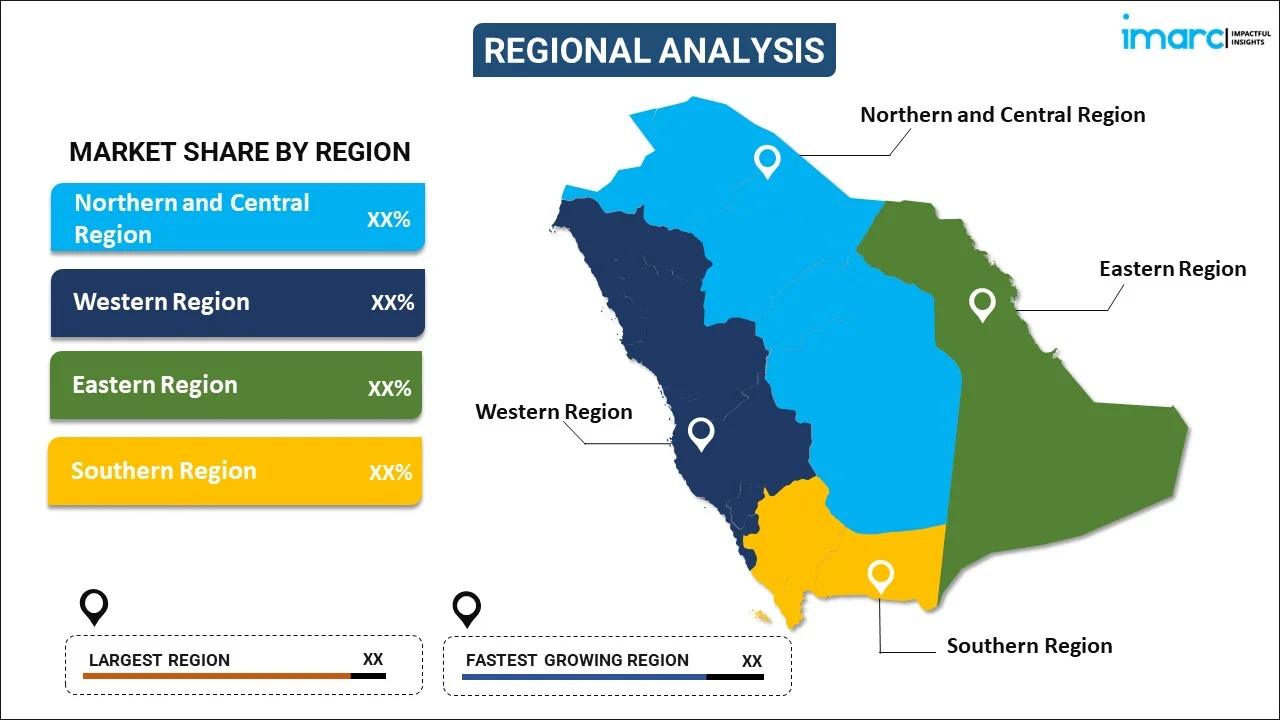

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Facility Management Market News:

- June 2025: The National Fire Protection Association® (NFPA®) has entered into a Memorandum of Understanding (MoU) with the Saudi Facility Management Association (SFMA), a leading organization committed to promoting vocational training for facility managers within the Kingdom of Saudi Arabia. Signed in Riyadh, the MoU provides the platform for a strategic partnership aimed at raising fire safety standards throughout the Kingdom. The MoU was signed by Olga Caledonia, director for International Business Development at NFPA, and Aiyd A. Alqahtani, board chairman at SFMA.

- May 2025: Prince Mohammed bin Salman bin Abdulaziz Al Saud, Crown Prince, Prime Minister and Board Chairman of Directors at PIF, announced the establishment of HUMAIN, a PIF-owned operating company. HUMAIN will invest and operate along the artificial intelligence (AI) value chain as a single operating company. Led by Crown Prince, HUMAIN will deliver an end-to-end set of AI solutions, products, and tools, such as next-generation data centers, AI infrastructure and cloud capabilities, and sophisticated AI models and solutions. One of the world's most capable multimodal Arabic large language models (LLMs) will also be offered by the company. The firm will serve a major hub for AI for industries like healthcare, manufacturing, and energy.

- March 2025: CBRE Middle East recently held its Vision 2030 Focus Forum in the Kingdom of Saudi Arabia, during which it introduced the Kingdom's first-ever package of intelligent and sustainable Facilities Management (FM) solutions to the KSA market. Gathering some of the region's most prominent corporate and government institutions Kingdom-wide, CBRE Middle East leveraged the Focus Forum to introduce its groundbreaking portfolio of FM services intended to make clients more efficient in operation, workplace experience and sustainability.

- March 2025: AlMajal AlArabi Group (MAG), Saudi Arabia's top integrated facility management service provider, participated in high-profile FM Expo Saudi. The industry-leading facilities management solutions exhibition is co-located alongside Big 5 Construct Saudi, the largest construction show in the Kingdom, at Riyadh Front Exhibition & Conference Center at ROSHN Front.

- February 2024: John Crane, a major firm in mission-critical technologies and services for the energy and process sectors, and a business of Smiths Group plc, won three asset management contracts with large petrochemical entities in Saudi Arabia. This further supports the brand’s pledge to assist industrial and energy development within the Kingdom, in accordance with the Saudi Vision 2030. The agreements are a landmark for John Crane, which won 3 significant asset management deals in the Kingdom of Saudi Arabia in the last year with a spectrum of petrochemical customers.

- October 2024: Trascent, the worldwide facilities management advisory services leader, and Gulaid Holding, a well-established Saudi Arabia-based investor in the facilities management sector, partnered to establish Trascent Arabia, a joint venture to deliver value added and differentiated services dedicated to the Kingdom's facilities management (FM) sector. The new company will bring innovative solutions in line with Saudi Vision 2030 that will concentrate on revolutionizing the delivery of FM services in the country and Gulf region.

Saudi Arabia Facility Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Facility Managements Covered |

|

| Offering Types Covered | Hard FM, Soft FM |

| End Use Industries Covered | Commercial and Retail, Manufacturing and Industrial, Government, Infrastructure, and Public Entities, Institutional, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Regionn |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia facility management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia facility management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia facility management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Facility management is a discipline focused on ensuring the efficient operation of physical spaces, including tasks like maintenance, security, energy management, and space planning, to optimize building functionality and support an organization's core objectives.

The Saudi Arabia facility management market reached USD 730 Million in 2024.

The market is expected to grow at a CAGR of 8.60% from 2025-2033, reaching USD 1,540 Million in 2033.

Key factors include growing construction and infrastructure expansion, technological advancements, smart building integration, and a strong focus on sustainability and energy efficiency in response to Vision 2030 and environmental concerns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)