Saudi Arabia Fast Food Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Saudi Arabia Fast Food Market Summary:

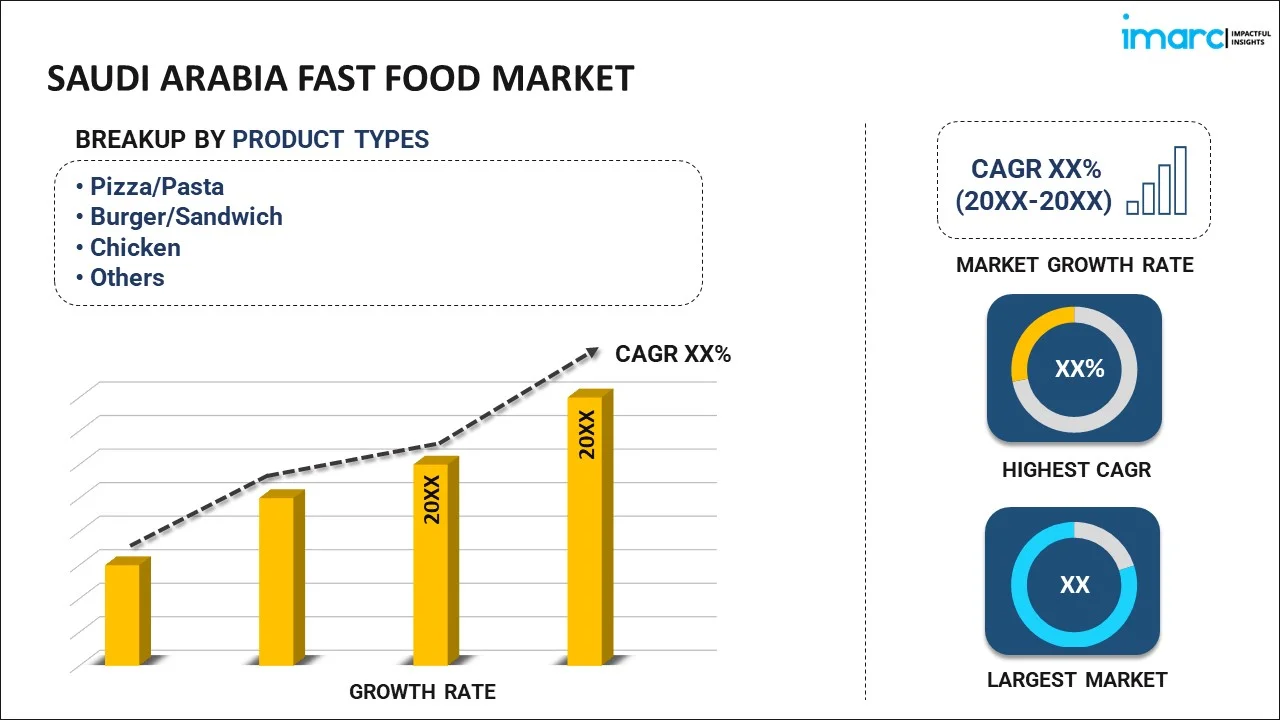

The Saudi Arabia fast food market size was valued at USD 10,067.40 Million in 2025 and is projected to reach USD 18,224.02 Million by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034.

The Saudi Arabia fast food market is experiencing robust expansion on account of evolving consumer preferences, rapid urbanization, and escalating demand for convenient dining solutions. The country's young and dynamic population, combined with rising disposable incomes and busy lifestyles among dual-income households, is accelerating the adoption of quick-service dining options. Additionally, the proliferation of digital ordering platforms and food delivery applications is transforming consumer behavior, making fast food more accessible than ever before. The Vision 2030 initiative of governing agencies that focuses on tourism development and economic diversification, is further catalyzing investments in the foodservice infrastructure, strengthening the Saudi Arabia fast food market share.

Key Takeaways and Insights:

-

By Product Type: Burger/Sandwich dominates the market with a share of 31% in 2025, owing to its widespread appeal among young consumers, quick preparation time, and extensive availability through international chains and local establishments. The segment benefits from continuous menu innovation and customization options that cater to diverse taste preferences.

-

By End User: Quick service restaurants lead the market with a share of 59% in 2025. This dominance is driven by their operational efficiency, standardized menu offerings, strategic locations in high-traffic areas, and strong integration with digital ordering and delivery platforms that align with modern consumer expectations for speed and convenience.

-

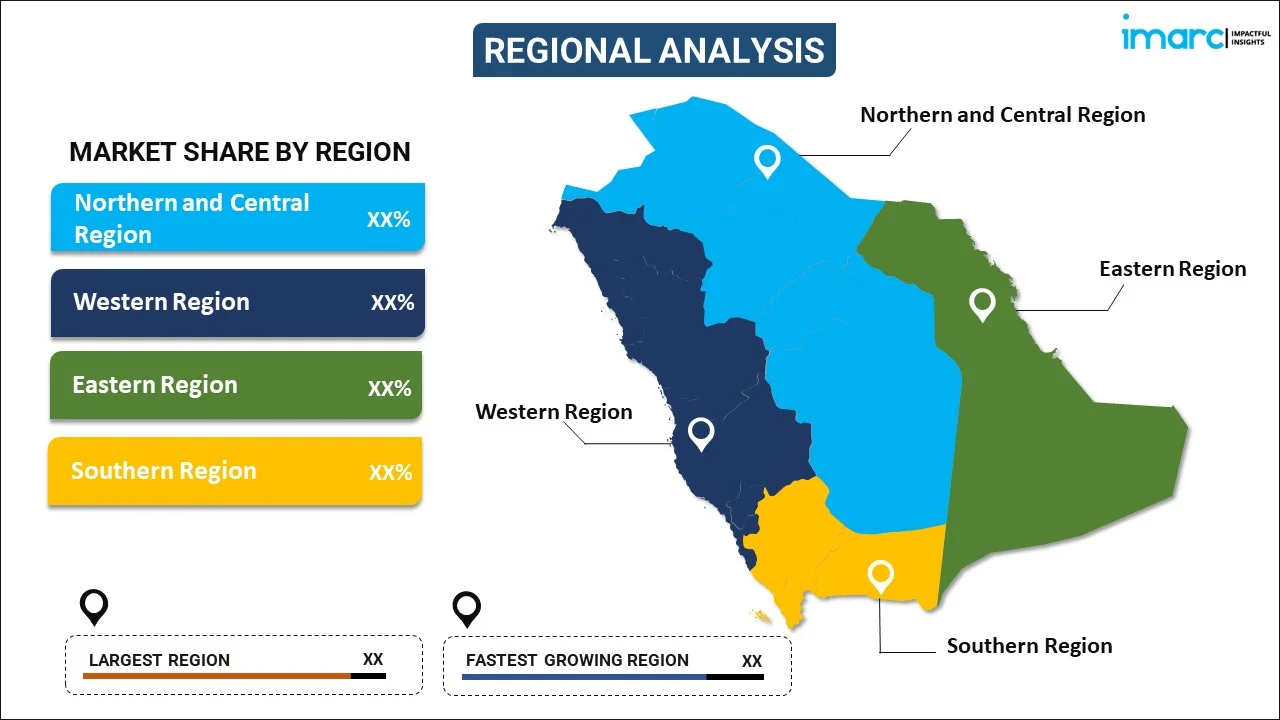

By Region: Northern and Central Region is the largest region with 33% share in 2025, driven by Riyadh's status as the capital city and largest urban center with a cosmopolitan population, extensive commercial infrastructure, and the highest concentration of international food brands and entertainment destinations.

-

Key Players: Key players drive the Saudi Arabia fast food market by expanding franchise networks, investing in digital transformation, and adapting menu offerings to local preferences while maintaining international quality standards. Their strategic partnerships with delivery platforms and investments in sustainable practices are enhancing brand visibility and customer loyalty.

The Saudi Arabia fast food market is propelled by a confluence of demographic, economic, and technological factors that are reshaping the country's foodservice landscape. The kingdom's youthful population structure, with around 71% of citizens that are below the age of 35 according to the 2024 Saudi Family Statistics Report published by the General Authority for Statistics (GASTAT), creates unprecedented demand for trendy, affordable, and convenient dining options. Rapid urbanization has transformed consumer behavior in major cities like Riyadh, Jeddah, and Dammam, where busy work schedules and dual-income households have reduced time for home cooking, making quick-service meals increasingly attractive. The growing influence of Western food culture, particularly among younger demographics who are highly active on social media platforms, is driving experimentation with diverse international cuisines and menu items. Furthermore, the expansion of digital infrastructure, with internet penetration reaching 99% across the kingdom, has facilitated the widespread adoption of mobile ordering applications and food delivery services, fundamentally changing how consumers access and enjoy fast food.

Saudi Arabia Fast Food Market Trends:

Digital Transformation and Mobile Ordering Adoption

The Saudi Arabia fast food market is witnessing a significant digital transformation as operators increasingly adopt mobile ordering platforms, self-service kiosks, and AI-powered customer engagement tools. Consumers, particularly the tech-savvy younger generation, are embracing digital ordering for its convenience and speed, with real-time tracking and personalized recommendations enhancing the overall dining experience. In September 2024, Chinese tech giant Meituan introduced its food delivery platform KeeTa in Riyadh, investing SAR 1 Billion (USD 266.6 Million) with the goal of expanding market presence, demonstrating the growing emphasis on digital infrastructure in the fast food sector.

Health-Conscious Menu Innovation

Fast food operators are responding to increasing consumer awareness about nutrition and wellness by introducing healthier menu alternatives, including grilled options, fresh salads, and reduced-calorie beverages. This trend aligns with the government's efforts to combat obesity through mandatory menu calorie labeling in all food service establishments, encouraging consumers to make informed dietary choices. The integration of locally sourced ingredients and the introduction of plant-based protein alternatives are gaining traction among health-conscious consumers seeking balanced meal options without compromising on taste or convenience.

Expansion of Cloud Kitchen Operations

Because cloud kitchens allow operators to manage several virtual brands from a single location, they are revolutionizing the Saudi Arabian fast food industry's operating landscape. This model significantly reduces real estate costs while maximizing delivery efficiency and menu experimentation capabilities. Regulatory frameworks have been established to provide clarity and foster investment in this emerging segment, ensuring food safety standards remain consistent with conventional restaurant operations. These delivery-only facilities are particularly beneficial in high-rent urban areas where traditional brick-and-mortar establishments face substantial operational costs. Innovation in the fast food industry is fueled by virtual brand strategies, which enable existing restaurants to investigate and test new culinary concepts without the financial and logistical concerns associated with physical expansion.

How Vision 2030 is Transforming the Saudi Arabia Fast Food Market:

Saudi Arabia's Vision 2030 initiative is fundamentally reshaping the fast food landscape by driving unprecedented investments in entertainment, tourism, and commercial infrastructure that create new consumption opportunities. The development of giga-projects including NEOM, Qiddiya, and the Red Sea Project is establishing entirely new urban centers with integrated foodservice requirements, while the relaxation of social and entertainment regulations has expanded dining occasions and extended operating hours. The initiative's focus on attracting international tourists and hosting global events is increasing footfall in commercial districts, benefiting quick-service operators with enhanced visibility and customer traffic. Government support for franchising and foreign direct investment in the food sector is accelerating the entry of international brands, while simultaneously nurturing local entrepreneurship and culinary innovation.

Market Outlook 2026-2034:

The Saudi Arabia fast food market is poised for sustained growth during the forecast period, driven by continued urbanization, rising tourism, and ongoing investments in foodservice infrastructure aligned with Vision 2030 objectives. The development of mega-projects such as NEOM, the Red Sea Project, and Qiddiya entertainment city is creating significant opportunities for quick-service restaurant expansion in emerging commercial zones. The market generated a revenue of USD 10,067.40 Million in 2025 and is projected to reach a revenue of USD 18,224.02 Million by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034.

Saudi Arabia Fast Food Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Burger/Sandwich | 31% |

| End User | Quick Service Restaurants | 59% |

| Region | Northern and Central Region | 33% |

Product Type Insights:

To get more information on this market, Request Sample

- Pizza/Pasta

- Burger/Sandwich

- Chicken

- Asian/Latin American Food

- Seafood

- Others

Burger/Sandwich dominates with a market share of 31% of the total Saudi Arabia fast food market in 2025.

The burger/sandwich segment leads the Saudi Arabia fast food market driven by strong consumer preference for protein-rich, customizable meal options that offer quick preparation and convenient portability. International chains have established extensive networks across the kingdom, while numerous local competitors offer innovative fusion concepts that blend traditional Saudi flavors with international fast food approaches. The segment benefits from continuous product innovation, limited-time offerings, and strategic promotional campaigns that maintain consumer interest and drive repeat visits.

The widespread availability of burgers/sandwiches across multiple distribution channels, including quick-service restaurants, food courts, and delivery platforms, ensures maximum consumer accessibility. Both global brands and regional operators continue to invest in expanding their presence across the kingdom, introducing new menu variations and dining concepts to capture evolving consumer preferences. The segment's appeal to the younger demographic, who frequently seek affordable and satisfying meals during busy work or study schedules, continues to sustain its market leadership position across urban and suburban areas.

End User Insights:

- Food-Service Restaurants

- Quick Service Restaurants

- Caterings

- Others

Quick service restaurants lead with a share of 59% of the total Saudi Arabia fast food market in 2025.

Quick service restaurants have emerged as the dominant end-user segment, driven by their ability to meet the demands of Saudi Arabia's fast-paced urban lifestyle and the preferences of its predominantly young, tech-savvy population. The QSR sector thrives through standardized operations, efficient food preparation processes, and strategic positioning in high-traffic locations including shopping malls, commercial districts, and transportation hubs. Early in 2023, the Alshaya Group established a state-of-the-art production facility in Saudi Arabia that could produce 60,000 baked goods daily to provide more than 400 Starbucks locations nationwide, exemplifying the scale and operational sophistication of the sector.

The integration of advanced digital technologies, including mobile ordering platforms, self-service kiosks, and AI-driven customer engagement tools, has significantly enhanced operational efficiency and customer experience within the QSR segment. Government support through Vision 2030 initiatives, which emphasize economic diversification and tourism development, is creating favorable conditions for both international chains and local operators to expand their presence. The fierce competition between global brands and regional players continues to spur innovation in service delivery, menu selection, and sustainable practices, benefiting consumers with improved quality and diverse dining options.

Regional Insights:

To get detailed regional analysis of this marketRequest Sample.

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region exhibits a clear dominance with a 33% share of the total Saudi Arabia fast food market in 2025.

The Northern and Central Region, anchored by Riyadh as the capital city and largest urban center, leads the Saudi Arabia fast food market through its extensive commercial infrastructure, cosmopolitan population, and high concentration of international food brands. The region benefits from robust economic activity, substantial government and private sector investments, and a lifestyle characterized by busy professional schedules that favor convenient dining solutions. Riyadh is home to more branded international food outlets than any other Saudi city, serving as the first choice for global brands expanding their presence in the kingdom, while urban development projects continue to increase restaurant density across new commercial districts.

The region's well-developed transportation infrastructure, including metro-connected food courts and recreational hubs, creates optimal conditions for quick-service restaurant operations and food delivery services. Major food aggregators and delivery service providers have established strong footholds in the Northern and Central region, leveraging strategic partnerships with restaurants and continuous technological innovations to enhance service quality and customer satisfaction. With early-stage QSR operators carefully placing themselves ahead of anticipated population growth and tourism expansion, the Northern Region's NEOM development is generating new demand for food service infrastructure.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Fast Food Market Growing?

Youthful Demographic Profile and Changing Lifestyles

The Saudi Arabia fast food market is fundamentally driven by the country's youthful population structure and evolving lifestyle patterns that increasingly favor convenient, on-the-go dining solutions. Young consumers are more likely to explore international cuisines, experiment with new menu offerings, and utilize fast food outlets as social gathering venues, driving sustained demand across product categories. The expansion of Saudi Arabia's workforce, combined with the rise of dual-income households and longer commute times, has significantly reduced the time available for traditional home cooking, making quick-service restaurants an increasingly attractive meal solution. Digital natives within this demographic readily embrace food delivery applications and mobile ordering platforms, further accelerating the sector's growth trajectory.

Social Media Influence and Evolving Food Culture

The pervasive influence of social media platforms is significantly transforming the Saudi Arabia fast food market by shaping consumer preferences, driving brand awareness, and creating viral food trends that accelerate demand. Fast food companies can highlight their products on digital platforms with eye-catching images, influencer partnerships, and interactive marketing campaigns that appeal to the kingdom's highly connected populace. User-generated content, including food reviews, photographs, and video testimonials, builds trust and interest among potential customers, encouraging experimentation with new menu items and dining experiences. The younger demographic, particularly students and young professionals, frequently discover limited-time offers, new restaurant openings, and trending food items through their social media feeds, translating online engagement into physical store visits and delivery orders. Viral food challenges and trending hashtags create organic marketing opportunities that significantly boost brand visibility and consumer traffic without substantial advertising expenditure. Rapid changes in consumer demand brought about by this social media-driven effect favor operators who can swiftly develop their menus and modify their concepts to conform to changing digital trends.

Digital Infrastructure and Food Delivery Ecosystem

The expansion of digital infrastructure and the maturation of the food delivery ecosystem are transforming the Saudi Arabia fast food market by enhancing consumer accessibility and convenience. The online food ordering and delivery market has experienced exponential growth, enabling fast food operators to extend their reach beyond physical locations and serve customers directly at their homes and workplaces. Major food aggregators have established strong operational networks, leveraging strategic partnerships with restaurants and investments in logistics infrastructure to ensure efficient delivery services. The widespread adoption of digital payment methods, including mobile wallets like Apple Pay and STC Pay, has further streamlined the ordering process, reducing friction and encouraging repeat purchases among tech-savvy consumers.

Market Restraints:

Health Concerns and Rising Obesity Rates

The increasing prevalence of obesity and diet-related non-communicable diseases poses a significant restraint on the Saudi Arabia fast food market. With more than half of the population classified as overweight and rising rates of type 2 diabetes and cardiovascular conditions, consumers are becoming more cautious about their dietary choices. Government initiatives mandating calorie labeling and promoting healthier eating habits are influencing consumer behavior and creating pressure on fast food operators to reformulate their offerings.

Intensifying Competition and Market Saturation

The Saudi Arabia fast food market faces intensifying competition as both international chains and local operators vie for market share in increasingly saturated urban markets. The fierce rivalry is driving aggressive pricing strategies, promotional campaigns, and margin compression, particularly in major cities like Riyadh and Jeddah. Operators must continuously invest in differentiation, innovation, and customer experience enhancements to maintain relevance and profitability in the crowded marketplace.

Supply Chain Complexities and Cost Pressures

Supply chain complexities and operational cost pressures present ongoing challenges for fast food operators in Saudi Arabia. Reliance on both local and international suppliers creates vulnerabilities to global price fluctuations, geopolitical tensions, and logistical disruptions that can impact ingredient availability and quality consistency. The geographical diversity of Saudi Arabia complicates distribution logistics, particularly for operators expanding into rural and emerging markets beyond traditional urban centers.

Competitive Landscape:

The Saudi Arabia fast food market is characterized by intense competition between established international chains and dynamic local operators, each striving to capture consumer loyalty through innovation, quality, and value propositions. Global brands leverage their operational expertise, standardized processes, and brand recognition to maintain strong market positions, while local chains differentiate through menu localization, cultural alignment, and strategic pricing. The competitive landscape is further shaped by aggressive franchise expansion, strategic partnerships with delivery platforms, and investments in digital transformation. Operators are increasingly focusing on sustainable practices, healthier menu options, and enhanced customer experiences to meet evolving consumer expectations. The market structure encourages continuous innovation in service delivery, menu development, and technology adoption, ultimately benefiting consumers with diverse, accessible, and high-quality fast food offerings.

Recent Developments:

-

In April 2025, within the Olaya Towers of Riyadh, Pret A Manger opened its first store in Saudi Arabia. This project represents a significant turning point in the brand's larger plan to expand throughout the Gulf Cooperation Council (GCC)., offering fresh sandwiches, salads, and coffee to Saudi consumers.

Saudi Arabia Fast Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Pizza/Pasta, Burger/Sandwich, Chicken, Asian/Latin American Food, Seafood, Others |

| End Users Covered | Food-Service Restaurants, Quick Service Restaurants, Caterings, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia fast food market size was valued at USD 10,067.40 Million in 2025.

The Saudi Arabia fast food market is expected to grow at a compound annual growth rate of 6.82% from 2026-2034 to reach USD 18,224.02 Million by 2034.

Burger/Sandwich dominated the market with a share of 31%, driven by widespread consumer preference for protein-rich, customizable meal options offered through extensive international chain networks and innovative local establishments across the kingdom.

Key factors driving the Saudi Arabia fast food market include the youthful demographic profile, rapid urbanization, rising disposable incomes, expansion of digital ordering platforms, Vision 2030 infrastructure investments, and growing tourism arrivals.

Major challenges include rising health concerns and obesity rates, intensifying competition among operators, supply chain complexities, regulatory compliance requirements, and the need for continuous menu innovation to meet evolving consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)